Yousef47

1-2年

Which deposit and withdrawal options are available with Pictet—do they accept methods like credit cards, PayPal, Skrill, or cryptocurrencies?

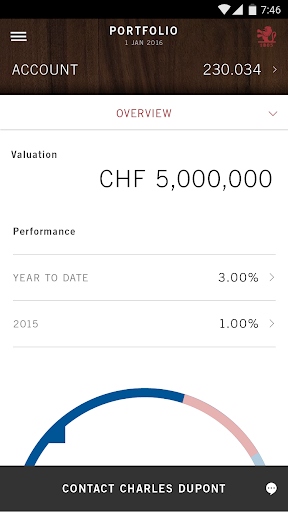

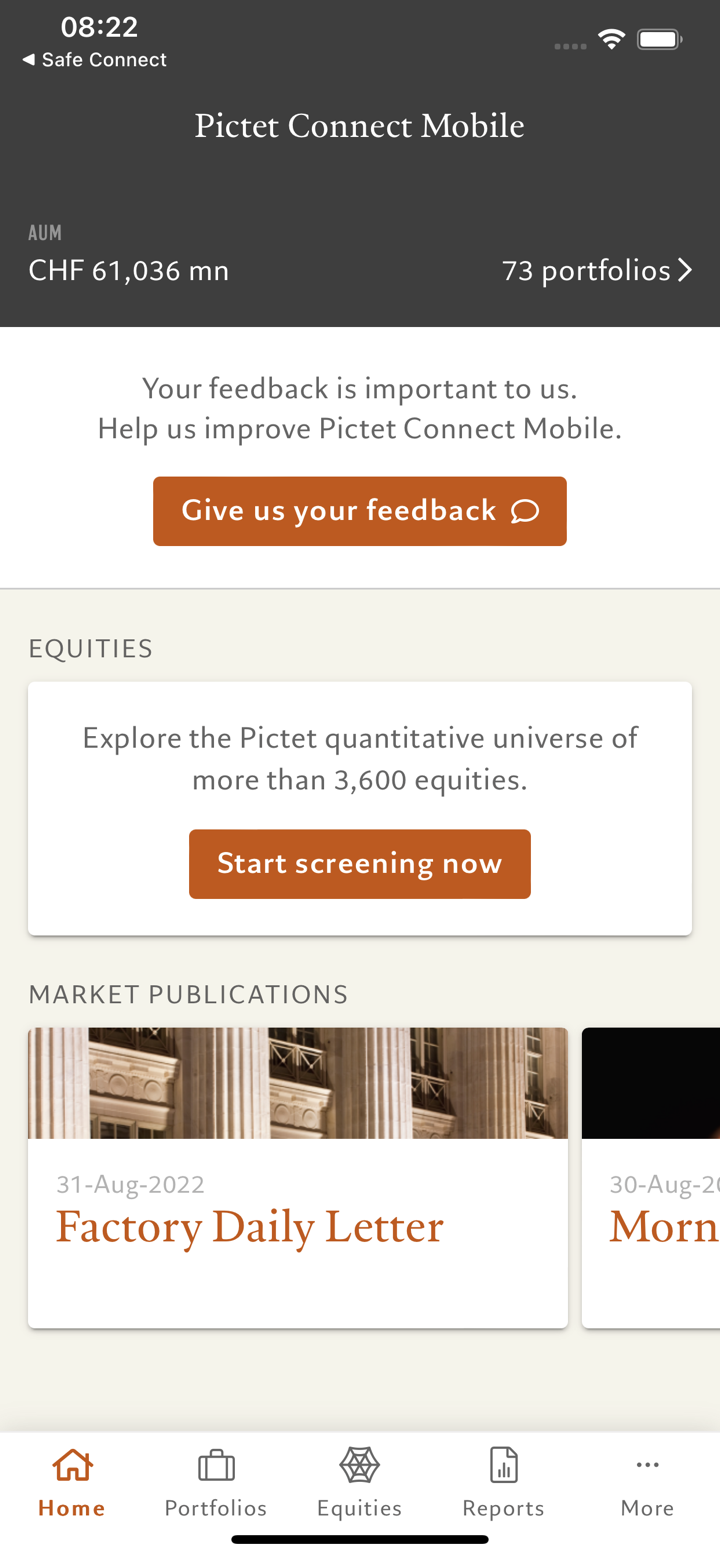

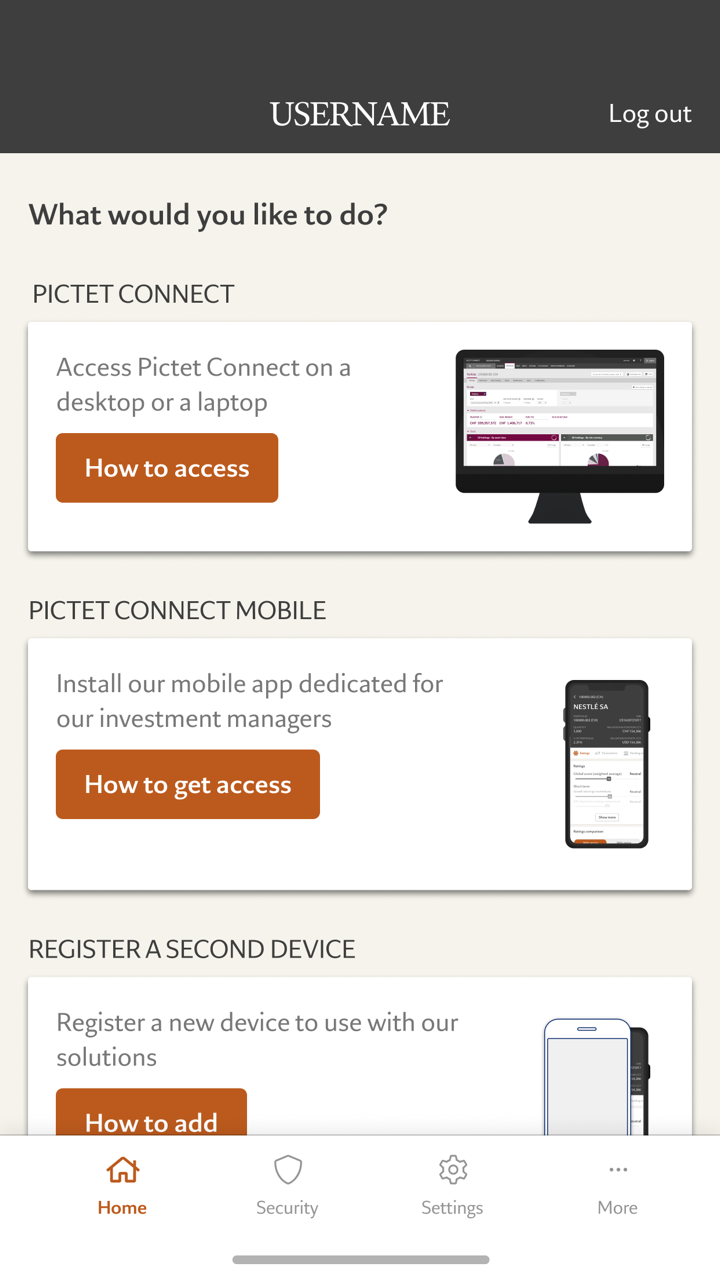

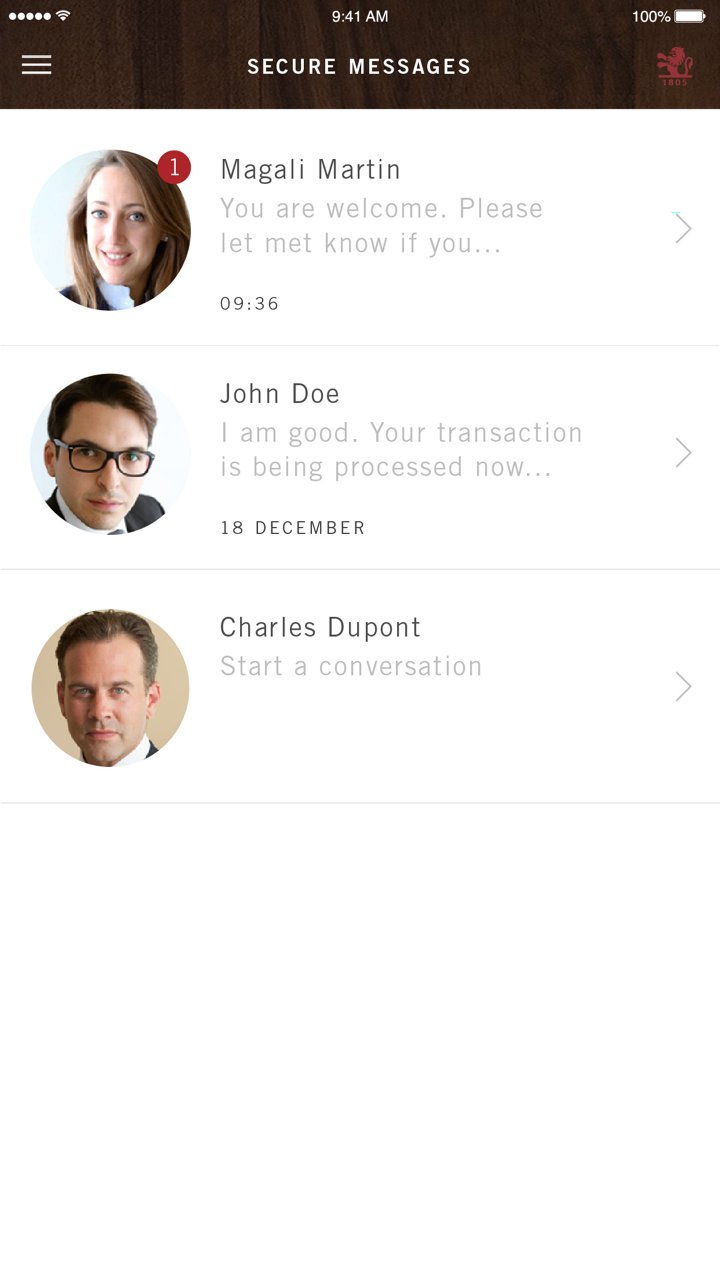

From my research and personal approach as a trader who values transparency and robust regulation above all, I carefully examined Pictet’s offering as described in official records and summary materials. Pictet is a long-established institution, with over 200 years of history and SFC regulation in Hong Kong, primarily focused on wealth and asset management services rather than typical retail forex operations. Their focus is squarely on institutional investors, family offices, and high-net-worth individuals, which shapes their entire service model—including how deposits and withdrawals are typically handled.

Based on what’s disclosed publicly, Pictet does not position itself as a retail forex broker offering instant funding via credit cards, PayPal, Skrill, or cryptocurrencies. Instead, as is often the case with private banks and institutional-oriented asset managers, I expect that funding tends to occur through traditional banking channels—most likely via wire transfers. This is consistent with the high standards of compliance and security required by regulatory authorities like the SFC, and it matches my experience with similarly positioned institutions.

It’s important to note that, for clients like myself seeking rapid, digital deposits or withdrawals through fintech providers, Pictet’s structure and regulatory obligations may make such options unavailable. For anyone considering Pictet, I would advise reaching out directly for precise details, as processes can sometimes vary depending on client status or account type. I personally prefer to use only brokers with transparent, clearly stated deposit and withdrawal procedures, and I always verify these details cautiously before committing funds.

Broker Issues

Deposit

Withdrawal

Tricia54

1-2年

What are the primary advantages and disadvantages of trading through Pictet?

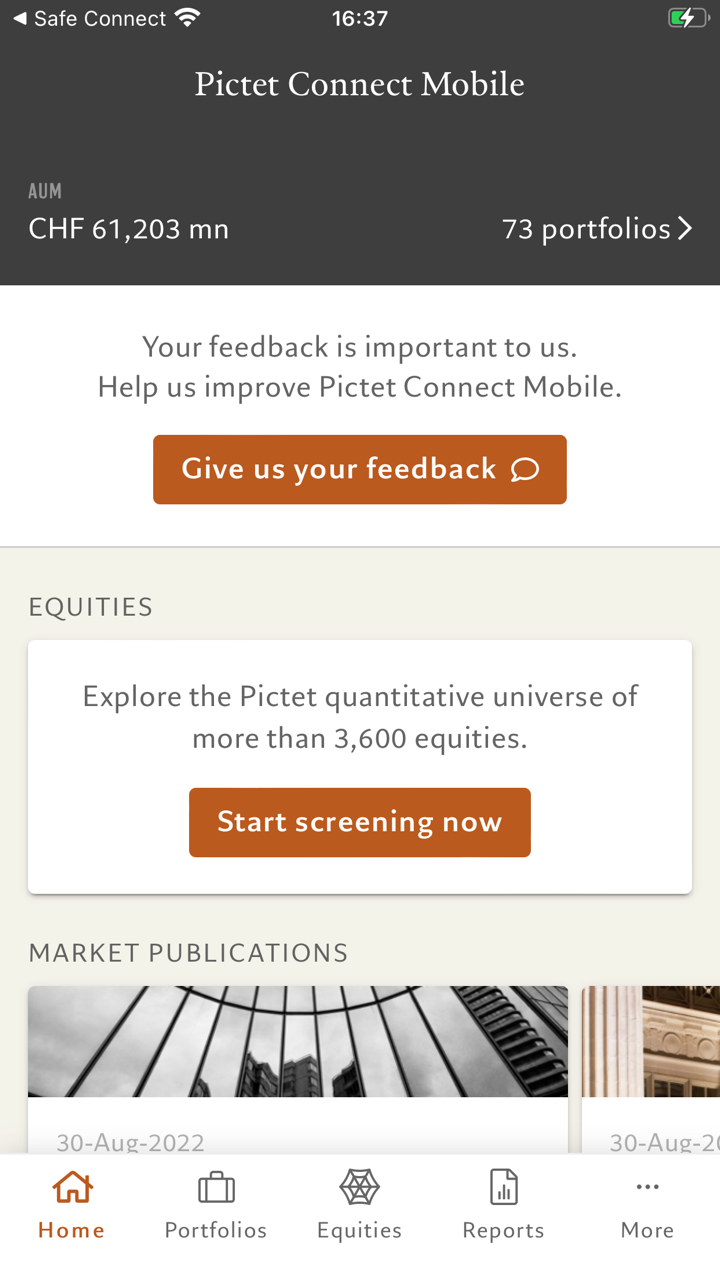

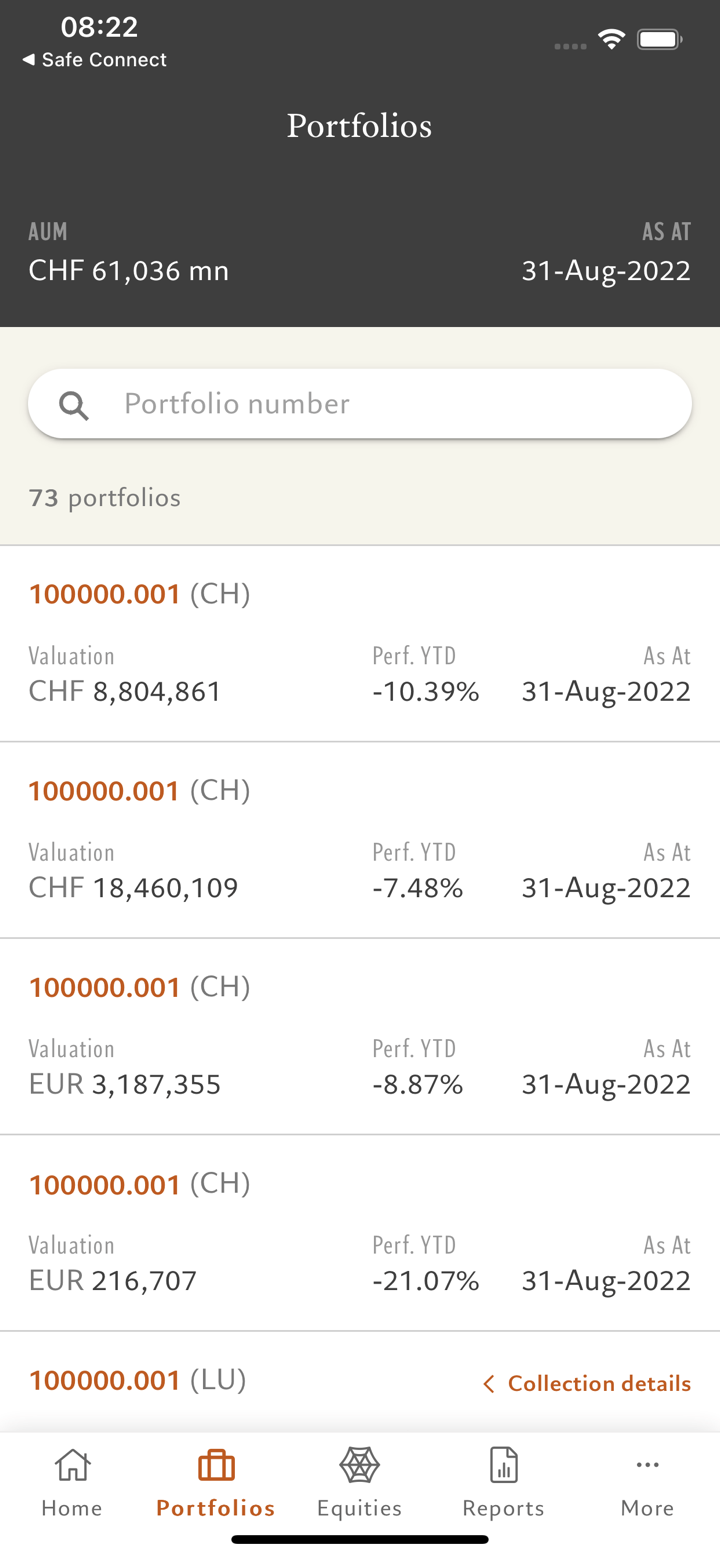

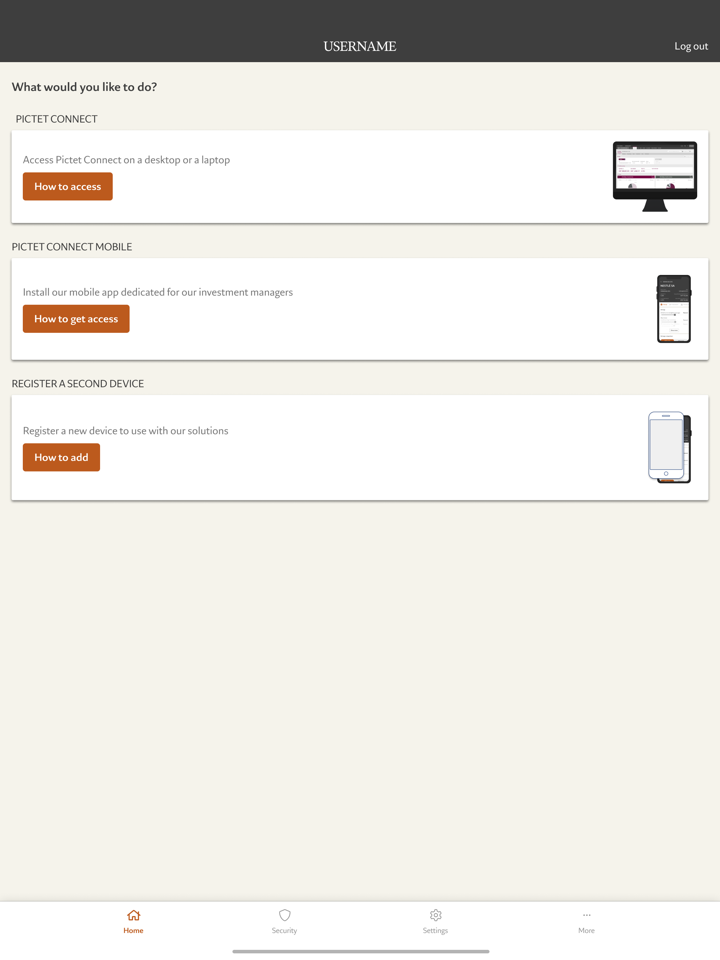

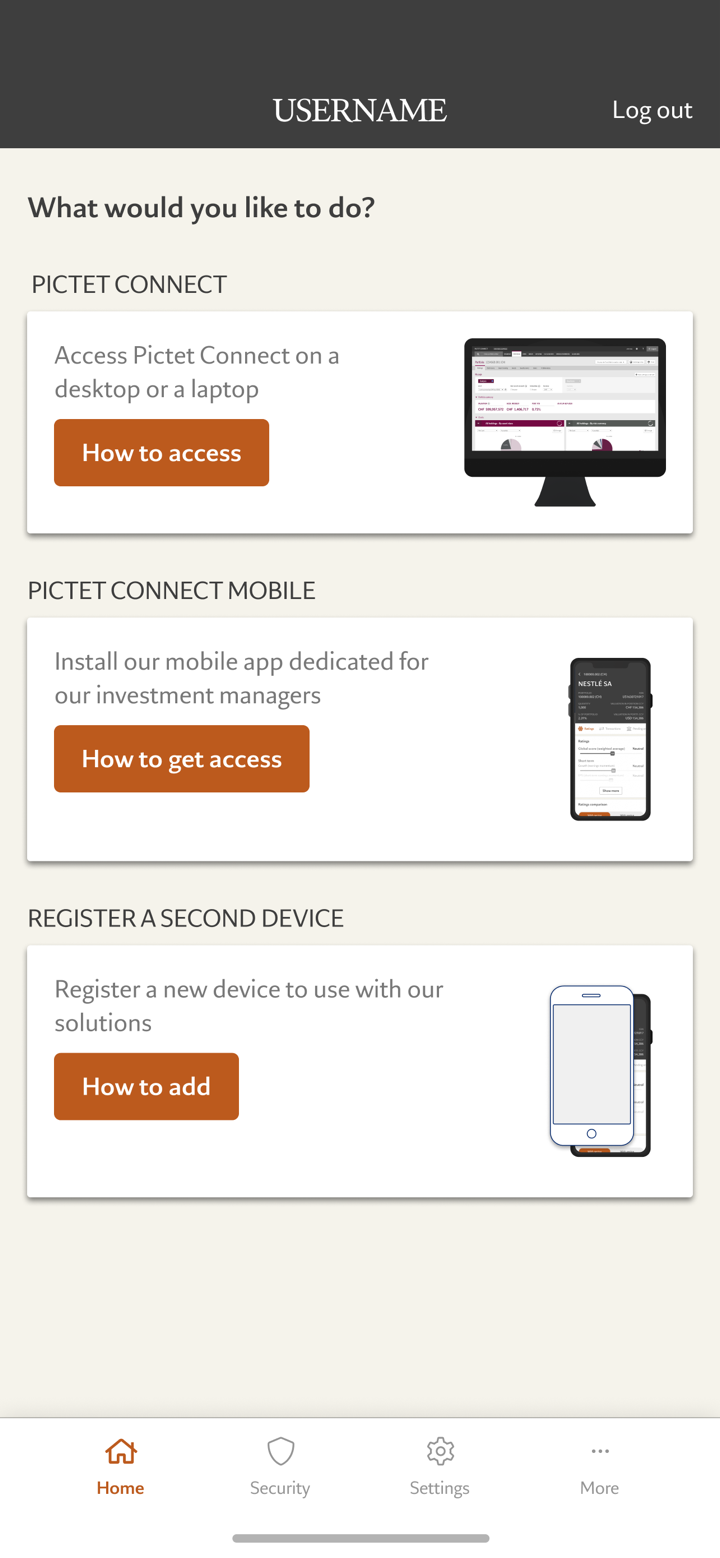

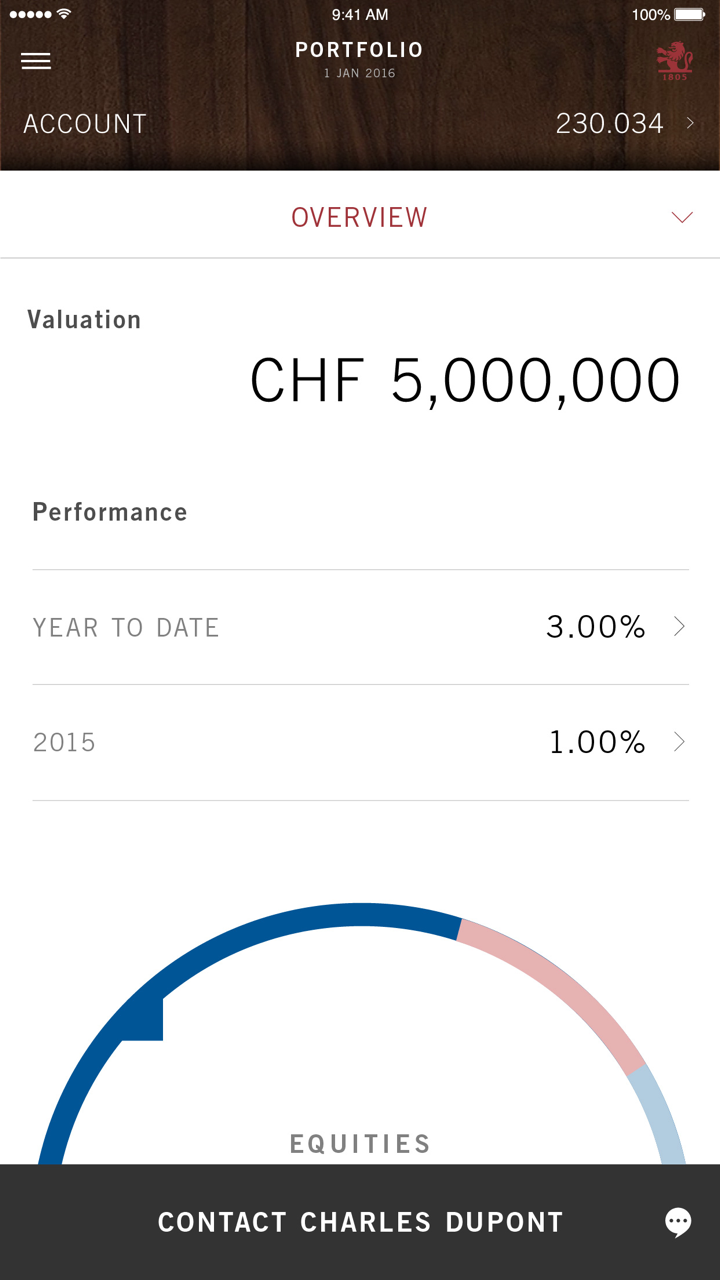

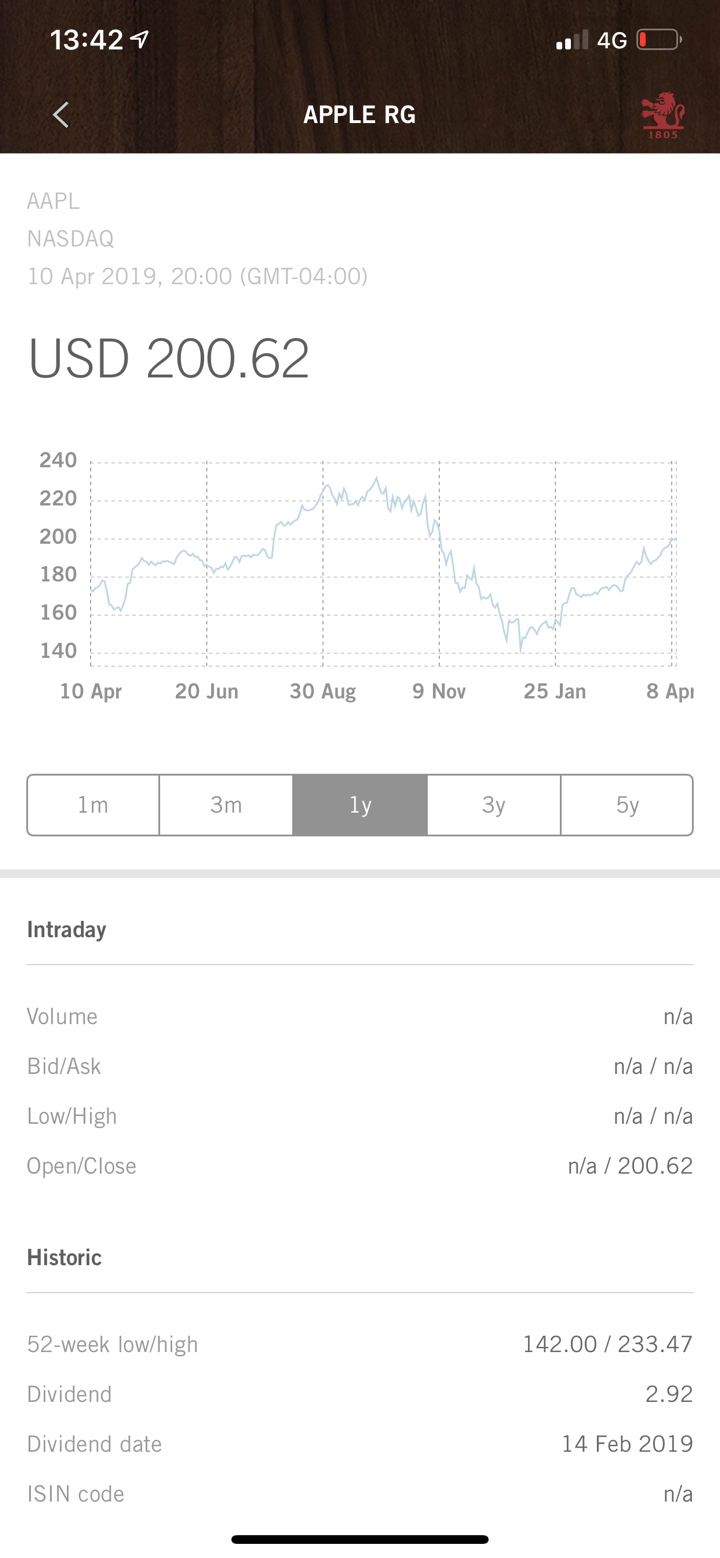

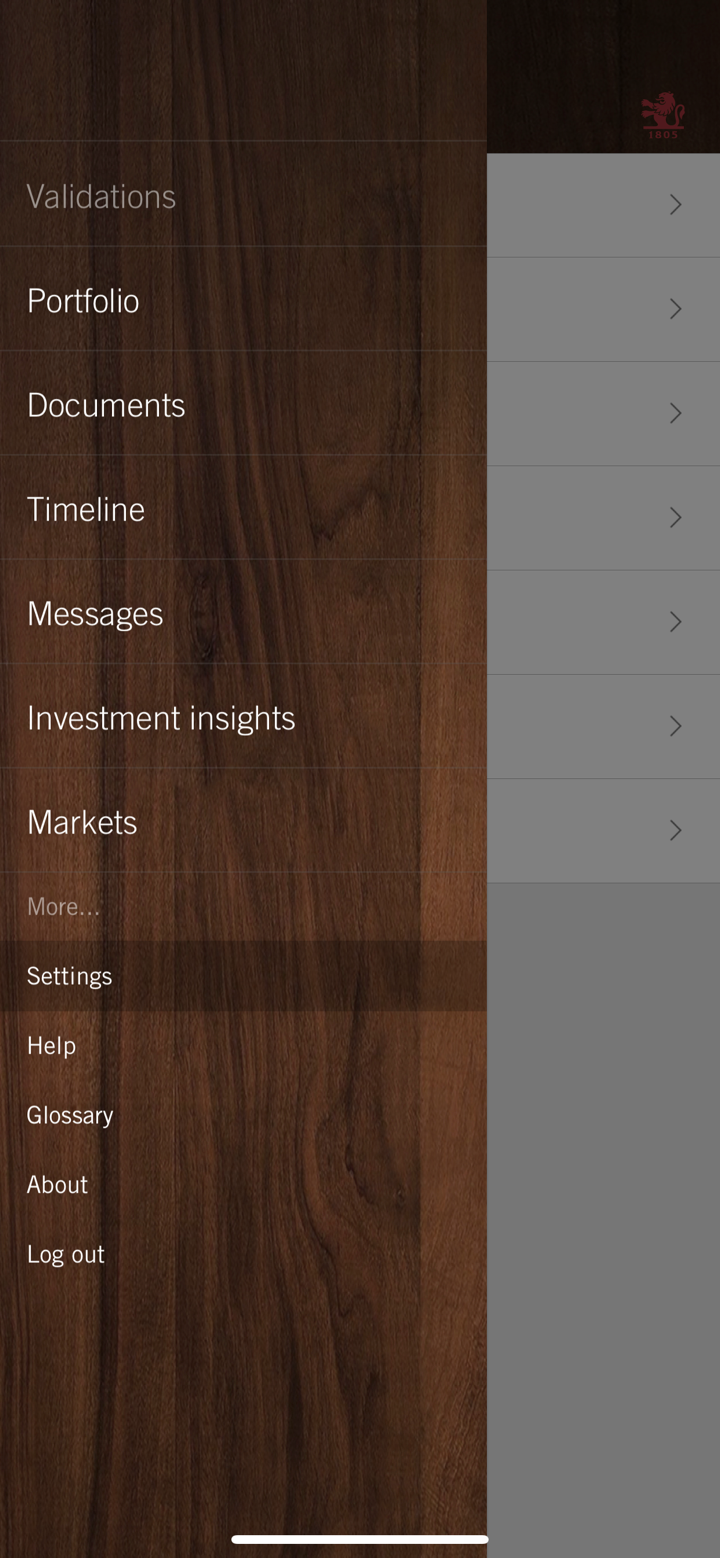

Having traded through numerous brokers over the years, I take regulation and operational transparency very seriously, especially for my longer-term capital. Trading with Pictet stands out primarily because of its exceptionally long history—founded in 1805 and operating for over 200 years—paired with solid regulatory oversight from the SFC in Hong Kong. For me, this kind of regulatory environment adds a degree of trustworthiness that’s critical when dealing with substantial investments or more complex products like futures contracts. I also appreciate that Pictet isn’t just a broker but a highly diversified financial institution offering asset management, wealth management, and alternative investments, which is important for anyone seeking comprehensive solutions beyond simple forex speculation.

However, my experience also highlights a few distinct disadvantages with Pictet, especially for individual traders like myself. While the level of professionalism and institutional focus is commendable, I find there is a notable lack of specific details surrounding their fee structures. This lack of transparency makes it difficult to accurately assess the true cost of trading or investing through them without direct engagement, and for me, clear cost expectations are essential. Additionally, Pictet’s suite of services seems far more tailored toward high-net-worth individuals and institutional clients rather than retail forex traders. Their advanced self-developed systems and global reach sound appealing, but for active traders or those looking for retail-focused features and flexibility, this broker might not fit all needs. Overall, Pictet’s legitimacy and stability are strong advantages, but its approach is better suited for clients seeking long-term, institution-grade service with a conservative risk appetite.

Hhduy

1-2年

What is the highest leverage Pictet provides for major forex pairs, and how does this differ for other asset classes?

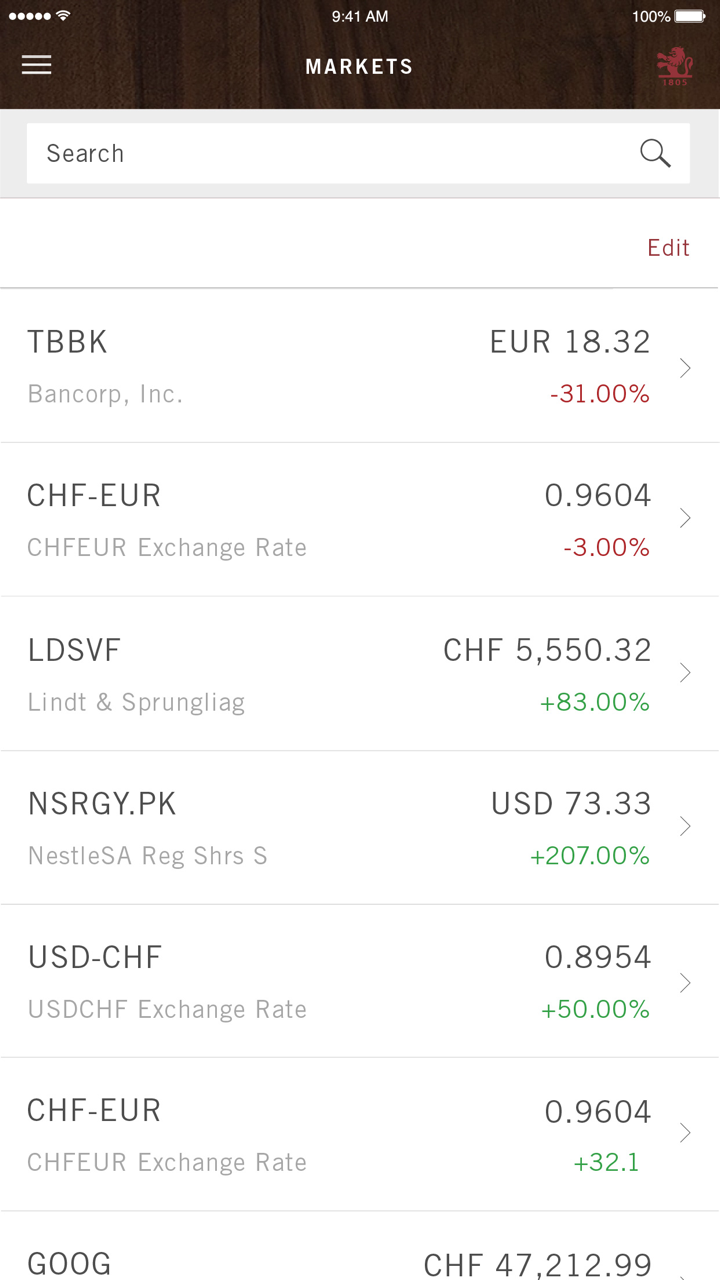

Based on my experience and a careful review of Pictet’s available public information, I must note that Pictet’s core offerings differ significantly from many standard retail forex brokers. Pictet, with a history reaching back to 1805, operates primarily in the domains of wealth management, asset management, alternative investments, and asset servicing—rather than focusing on margin forex trading for individual traders. Their licensing in Hong Kong specifically refers to “dealing in futures contracts,” which typically pertains to institutional products rather than retail FX.

From what I’ve gathered, there is no explicit mention of maximum leverage for forex pairs provided by Pictet. This lack of disclosure is important; as a cautious trader, I see it as a sign to avoid making any assumptions about high leverage availability, especially for major currency pairs. In my experience, reputable firms with institutional or high-net-worth clients often tailor leverage according to the profile, regulations, and risk appetite of each client, and are not known for the ultra-high leverage sometimes found at retail brokers.

For other asset classes such as futures or alternative investments, the leverage—if provided at all—tends to be conservative and is granted in line with regulatory requirements. The absence of clear, published leverage information suggests that anyone considering Pictet for leveraged trading should approach with measured expectations and seek direct clarification from their representatives. Ultimately, I view this cautious approach as aligned with my own risk management standards.

Broker Issues

Instruments

Account

Platform

Leverage

Sanjay sirohi

1-2年

Could you give an in-depth explanation of Pictet’s fee structure, outlining their commissions and spreads in detail?

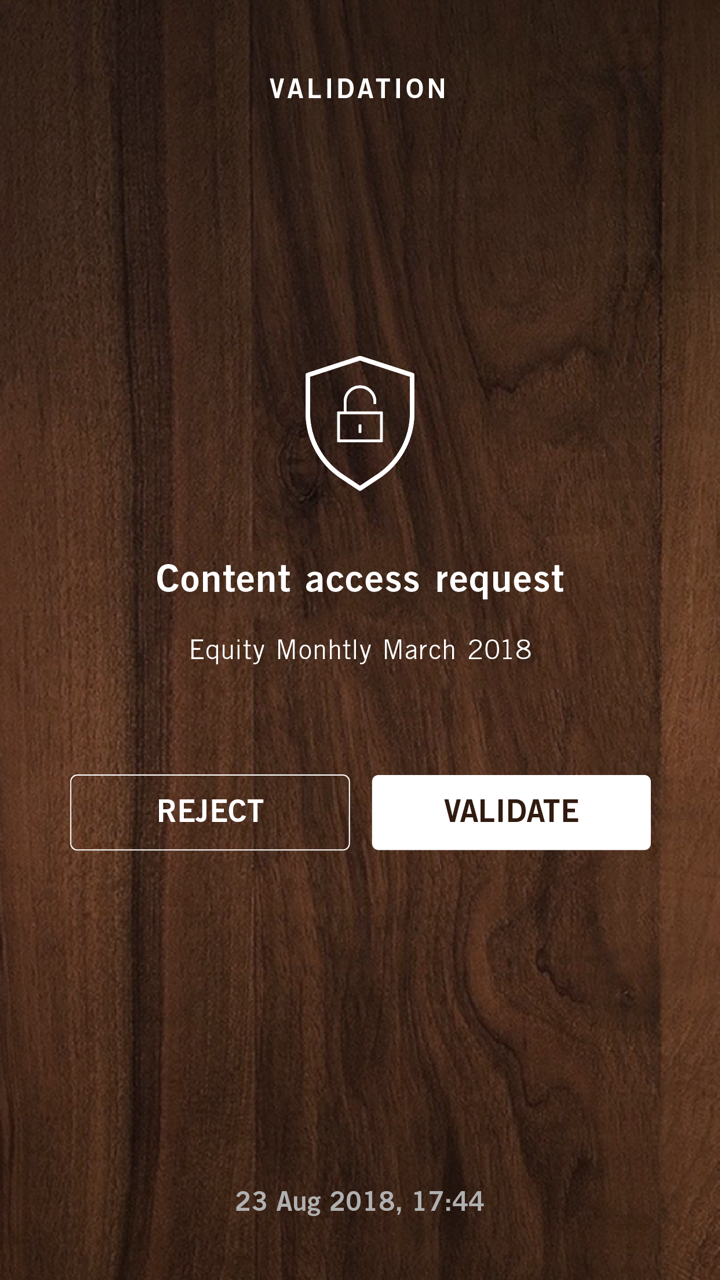

In my experience as a trader evaluating brokers, one of the most critical factors to consider is transparency around fees, commissions, and spreads. When I looked into Pictet, I noticed a distinct lack of specific public information regarding their fee structure, which is important for anyone prioritizing cost control and informed trading decisions. Pictet operates with regulation under the Hong Kong Securities and Futures Commission (SFC) and has a long-standing history in wealth and asset management, but detailed breakdowns of their commissions and spreads are not readily disclosed on their main informational resources.

From what I can gather, Pictet primarily serves institutional clients, high-net-worth individuals, and professional managers, focusing on futures contracts, wealth management, and alternative investments. In my professional judgment, firms offering highly personalized wealth management often tailor their fee structures to individual circumstances, client profiles, and the nature of requested services. This can mean that fees are negotiated privately, often involving management fees, potential performance fees on alternative investments, and possibly custody or administration costs instead of the simple spread/commission model standard in retail forex trading.

The absence of detailed, standardized information makes it impossible for me to provide concrete numbers for spreads or commissions. For prospective clients or traders, I would advise approaching Pictet directly for a formal, written breakdown of all possible costs and asking for a clear explanation of any trading, management, or performance-based fees before opening an account. This cautious approach protects you from unforeseen expenses and aligns with best practices for managing personal or institutional funds responsibly.

Broker Issues

Fees and Spreads