Company Summary

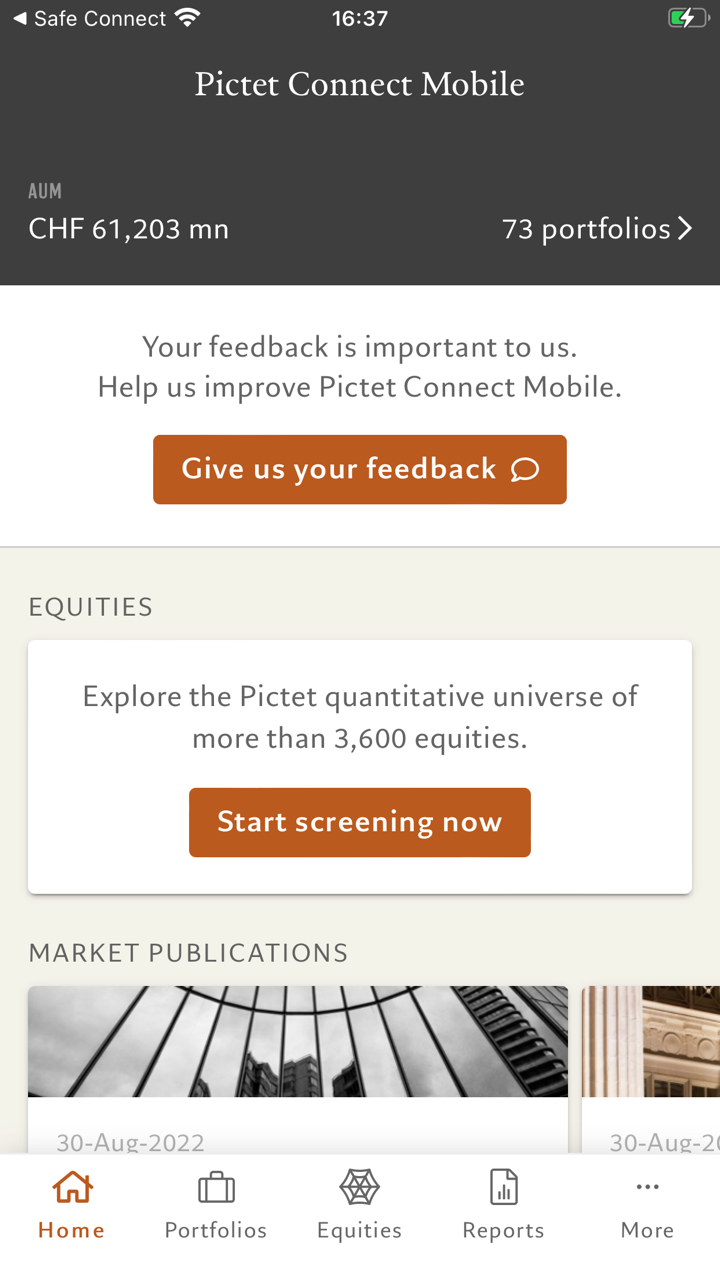

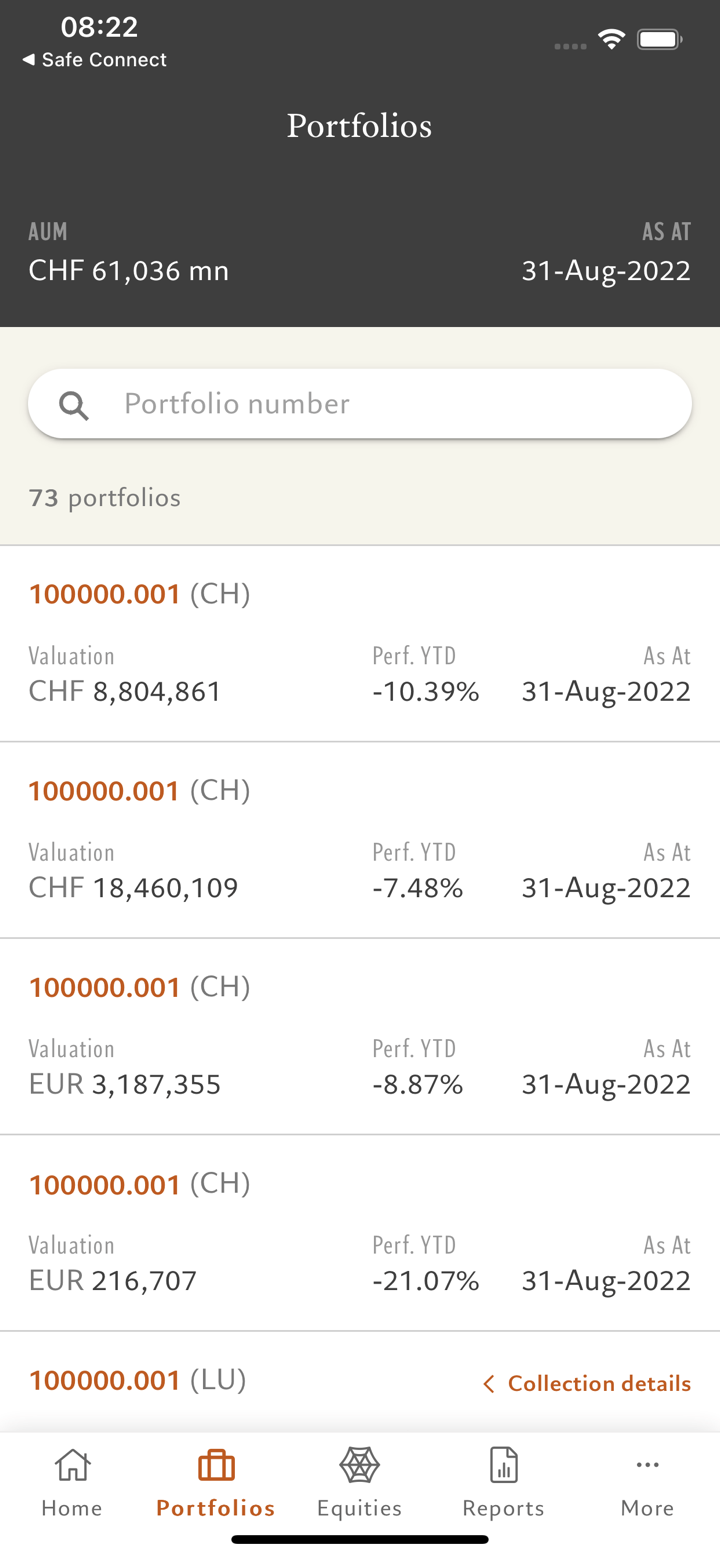

| Pictet Review Summary | |

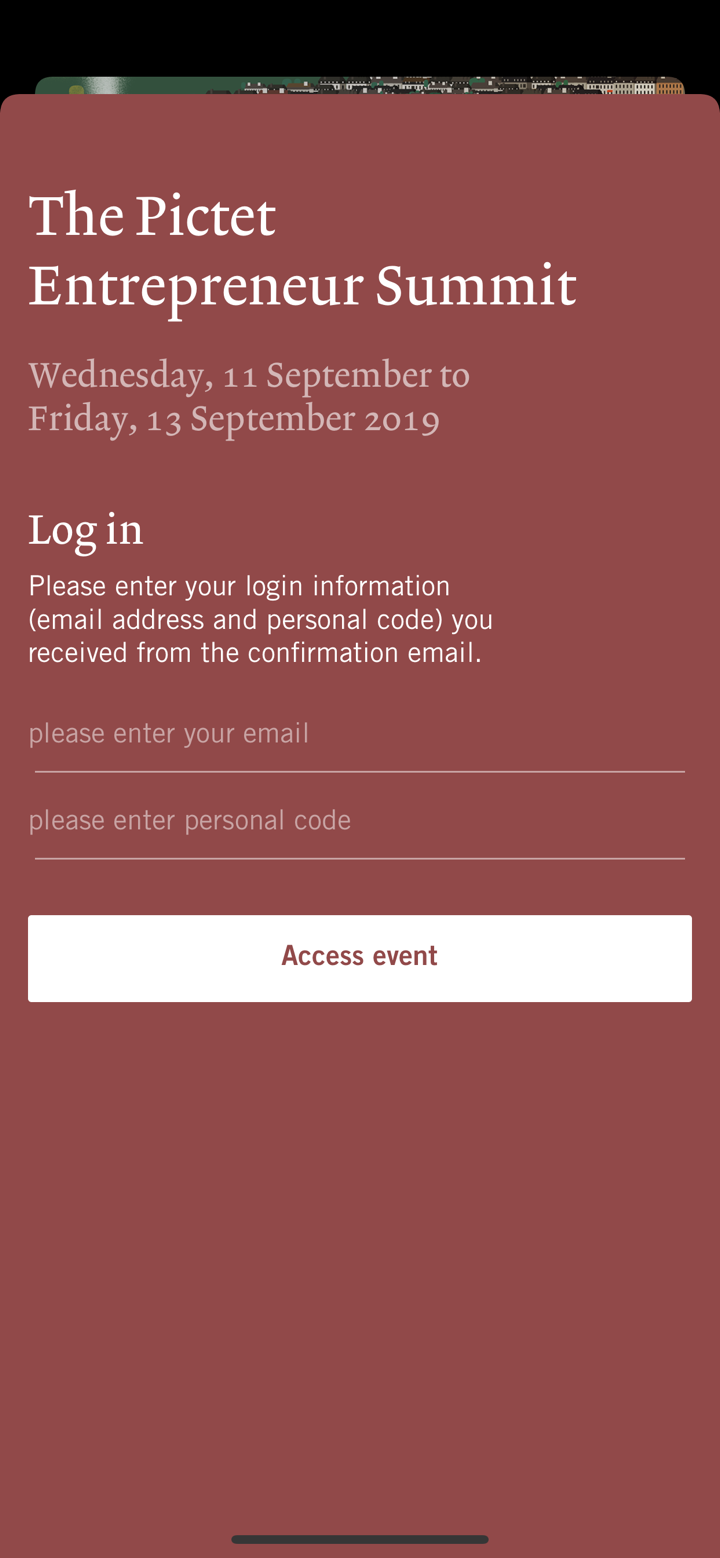

| Founded | 1805 |

| Registered Country/Region | Switzerland |

| Regulation | SFC |

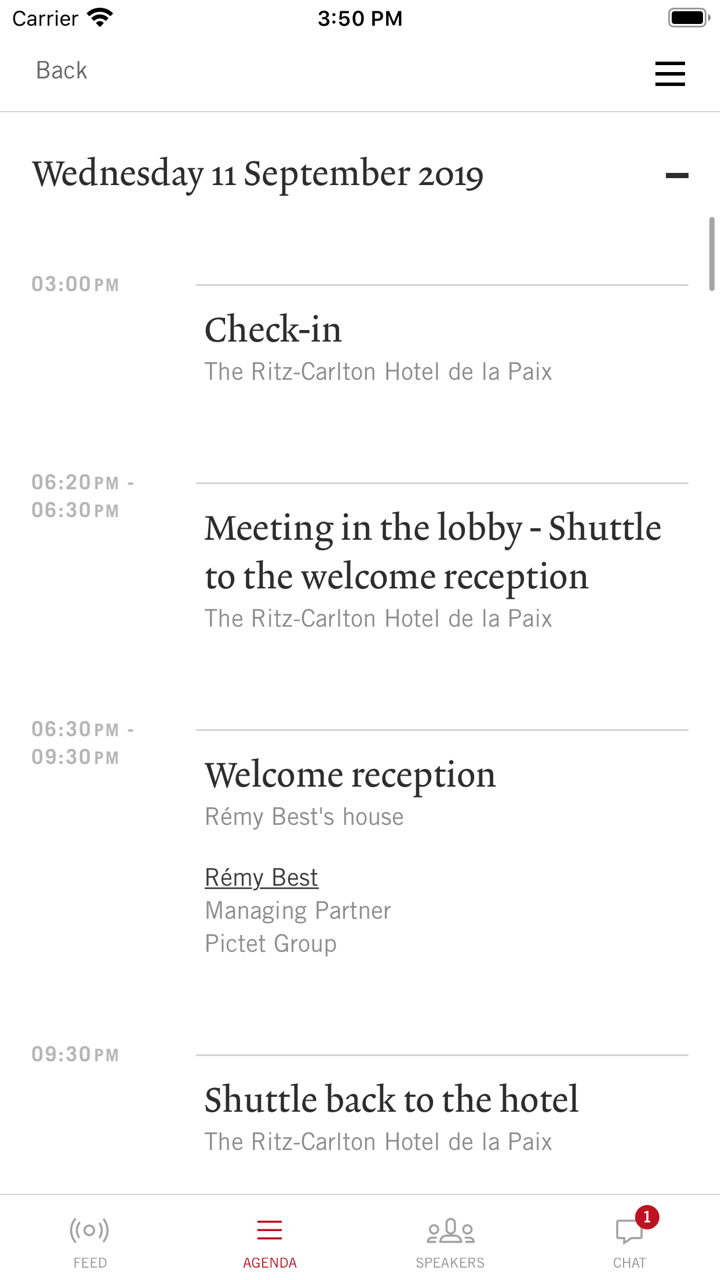

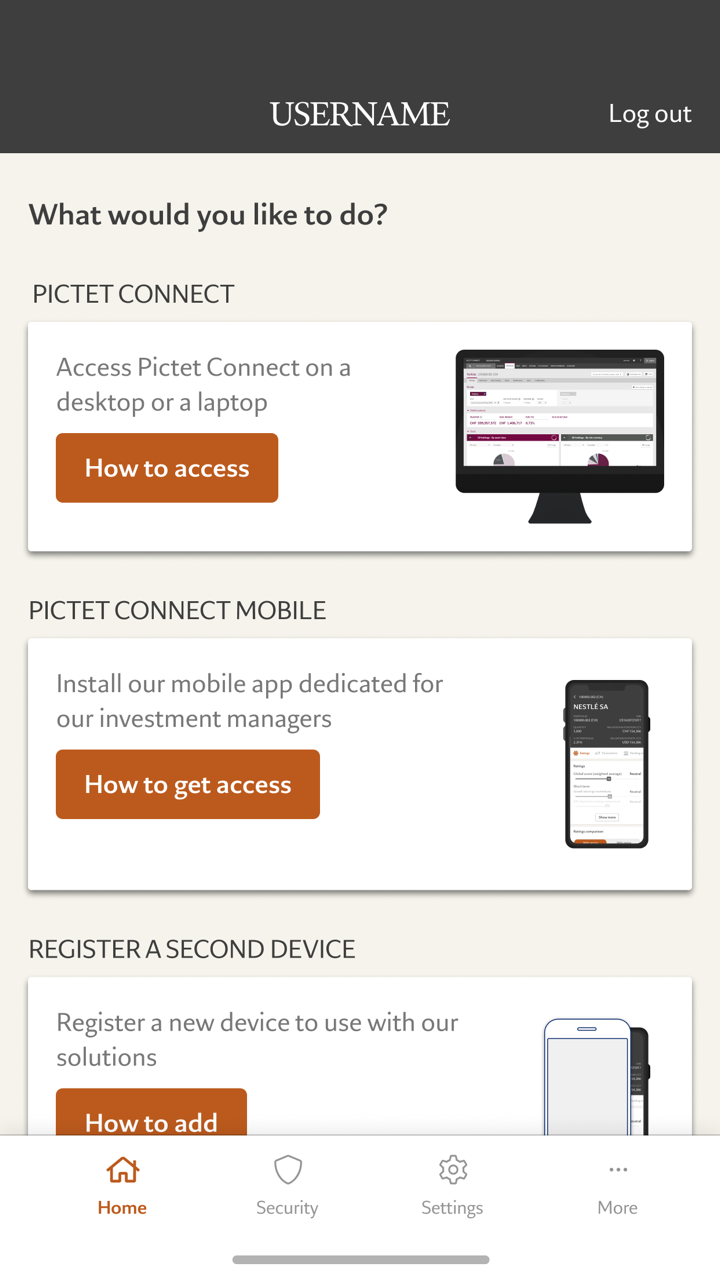

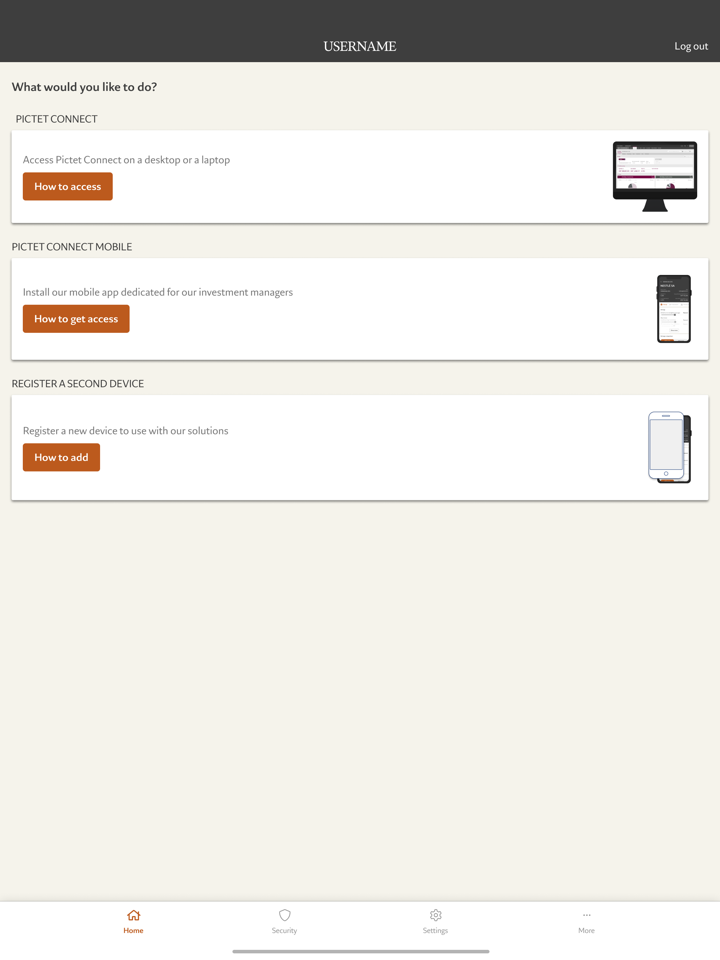

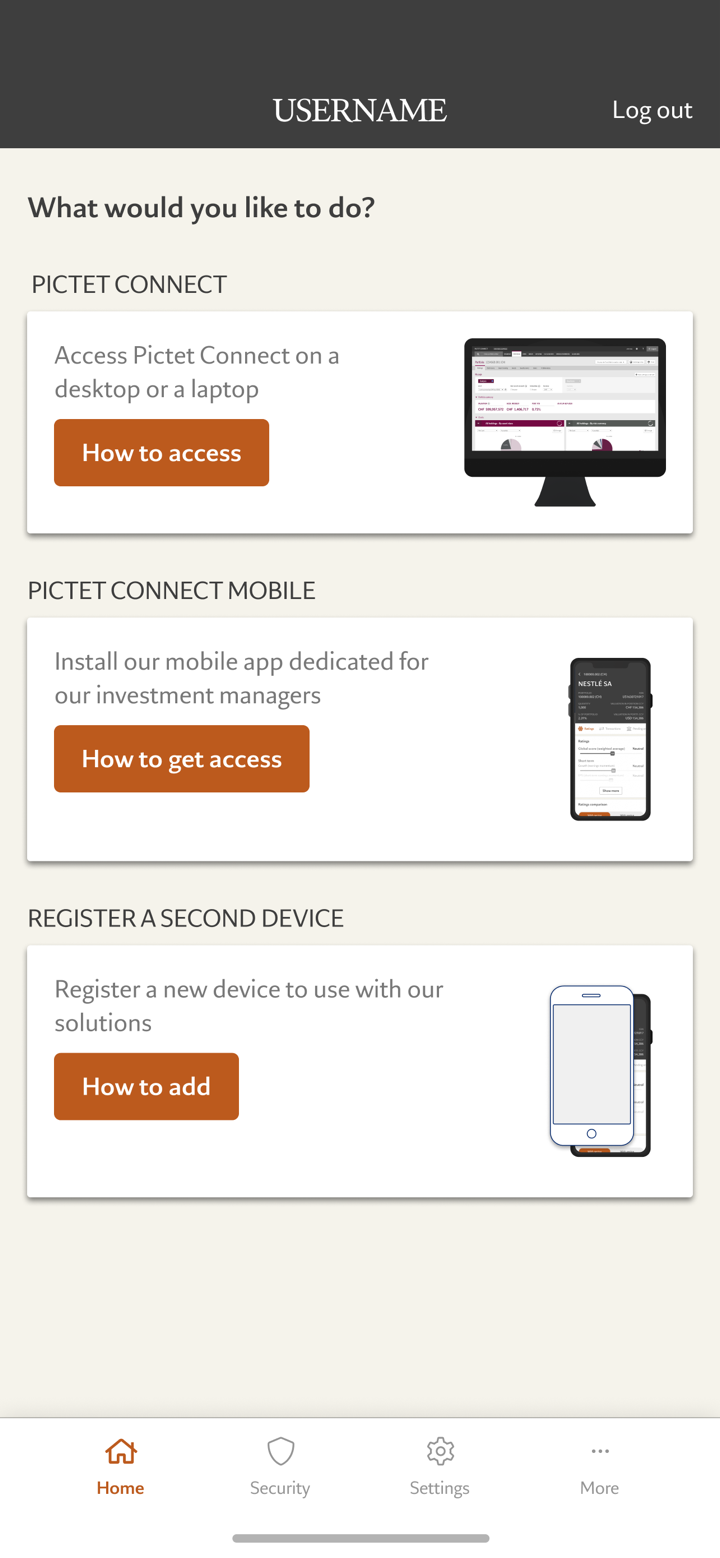

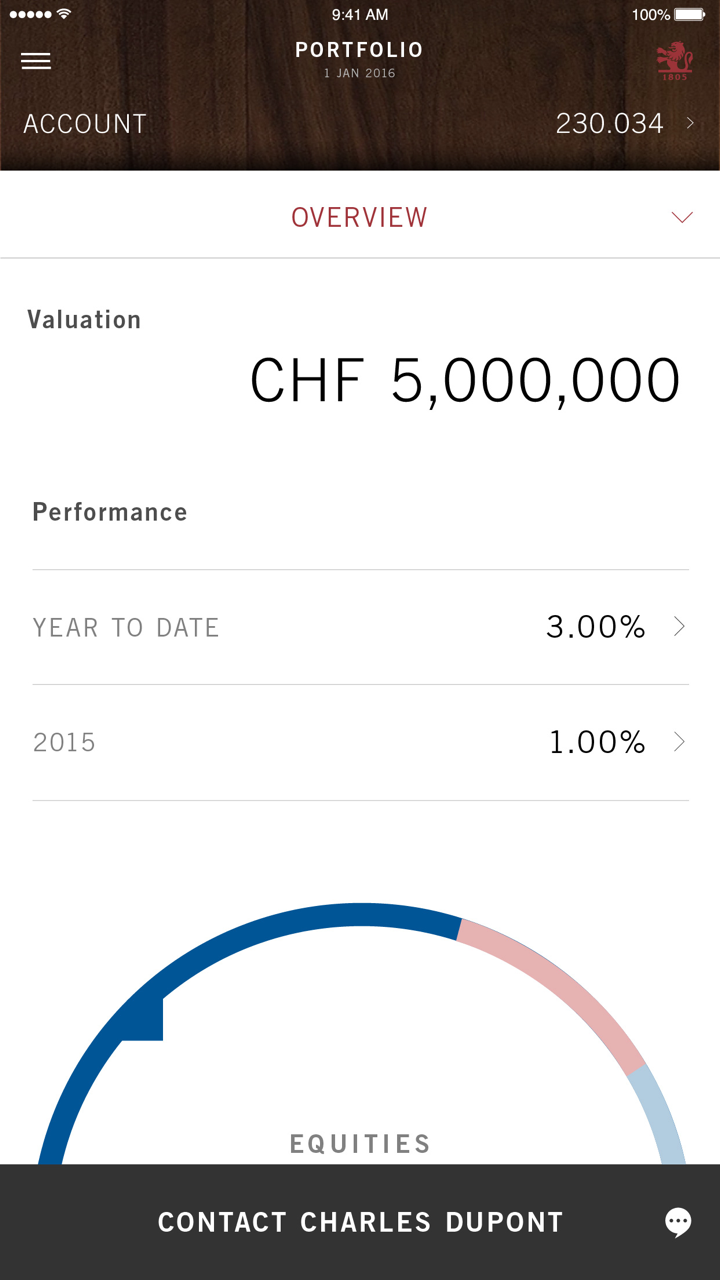

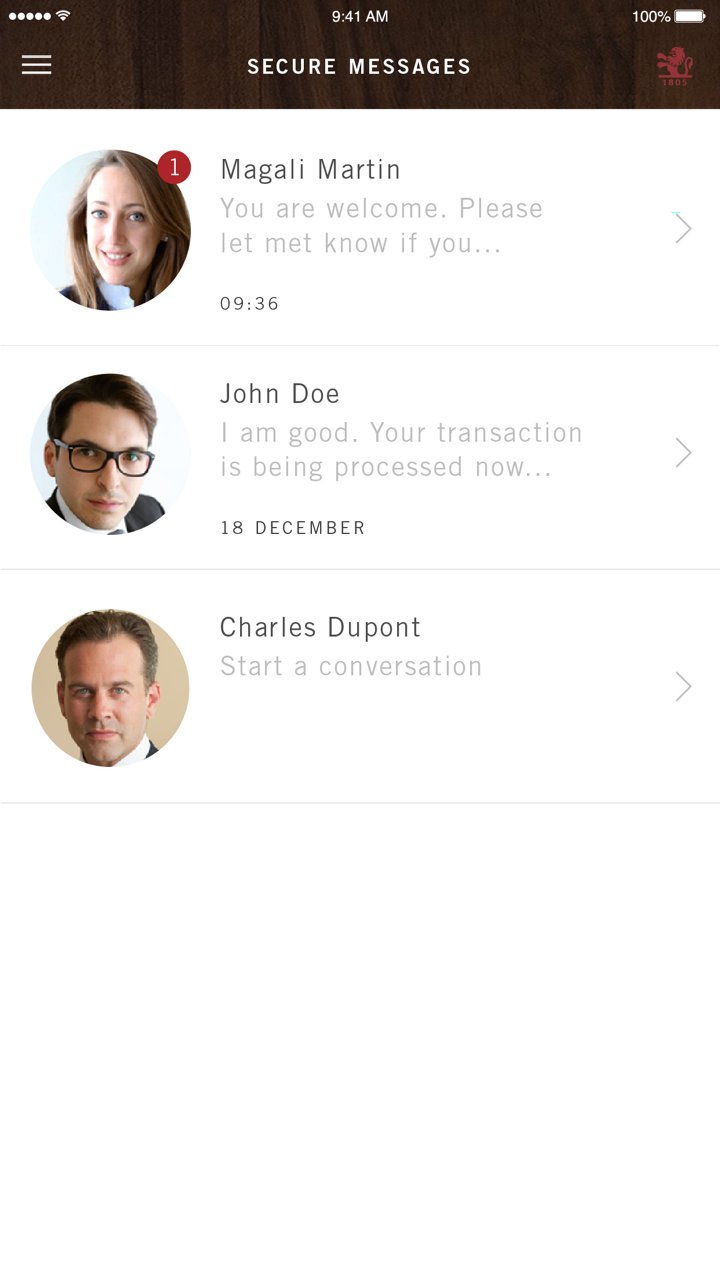

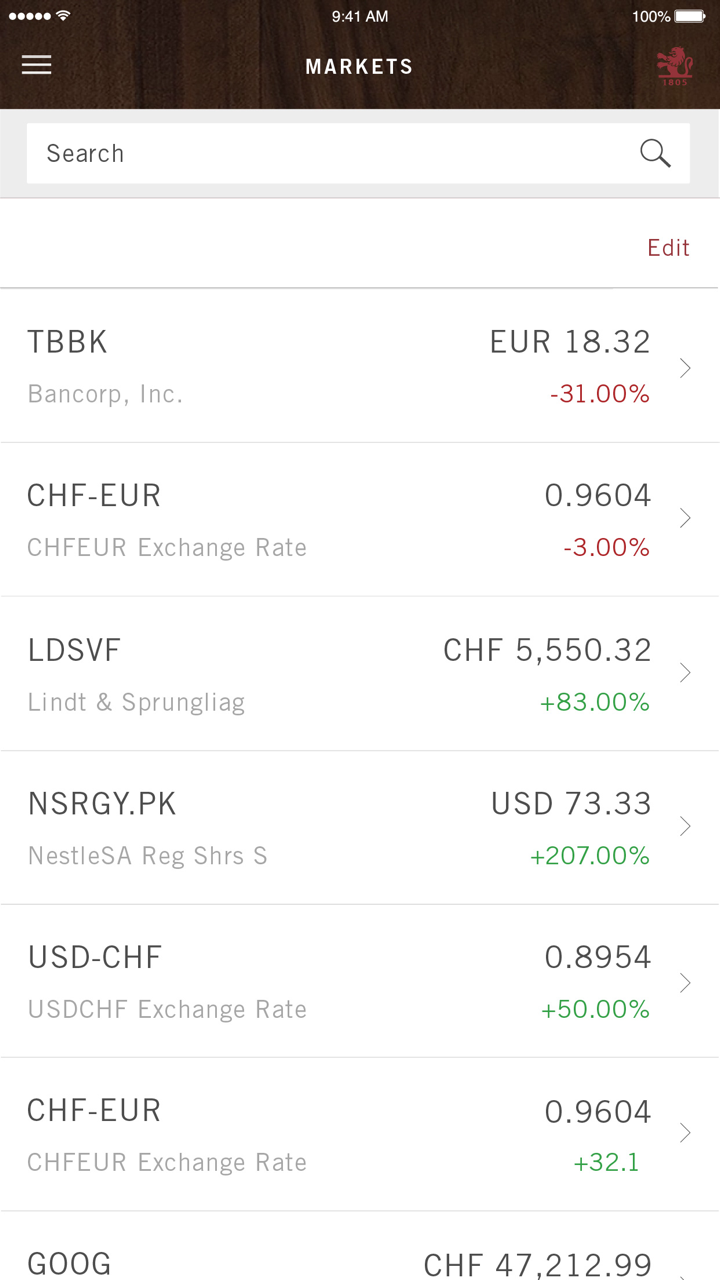

| Services | Wealth management, asset management, alternative investments, asset services |

| Customer Support | Tel: +41 58 323 23 23Tel.: +852 3191 1805 |

| Fax: +852 3191 1808 | |

Pictet Information

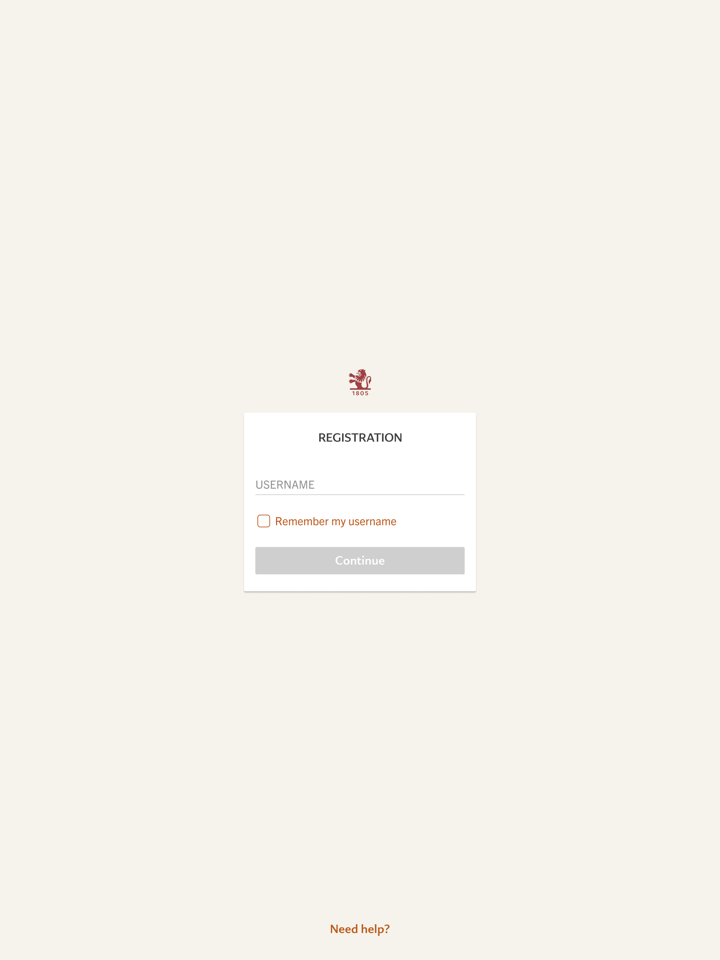

Pictet, established in 1805 and based in Switzerland, is regulated by the SFC. They offer wealth management, asset management, alternative investments, and asset services, with customer support available via phone and fax.

Pros and Cons

| Pros | Cons |

|

|

|

Is Pictet Legit?

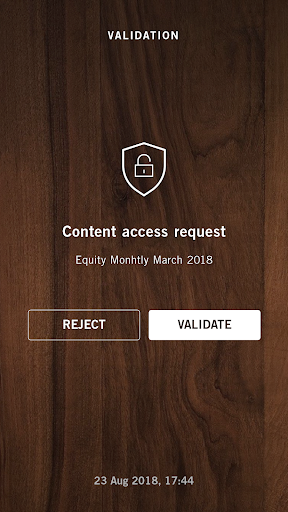

Pictet has a “Dealing in futures contracts” license regulated by the Securities and Futures Commission (SFC) in Hong Kong with a license number of AAG715.

Who Pictet Serves?

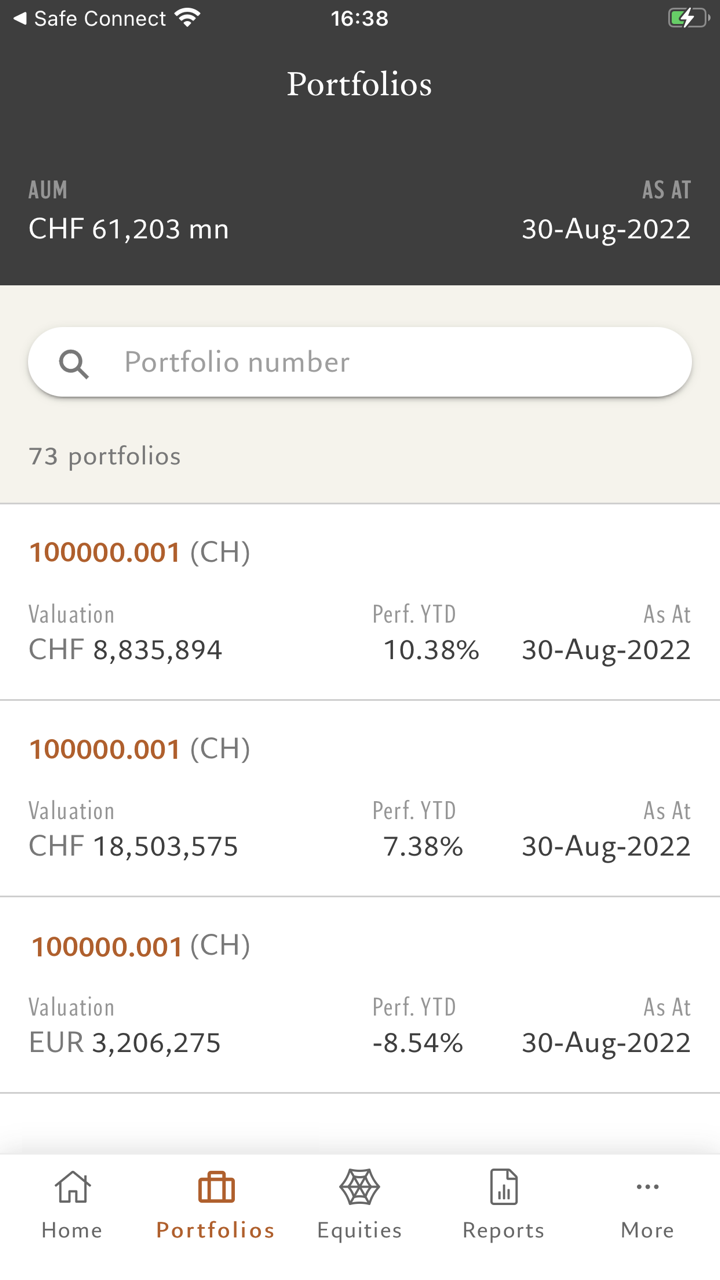

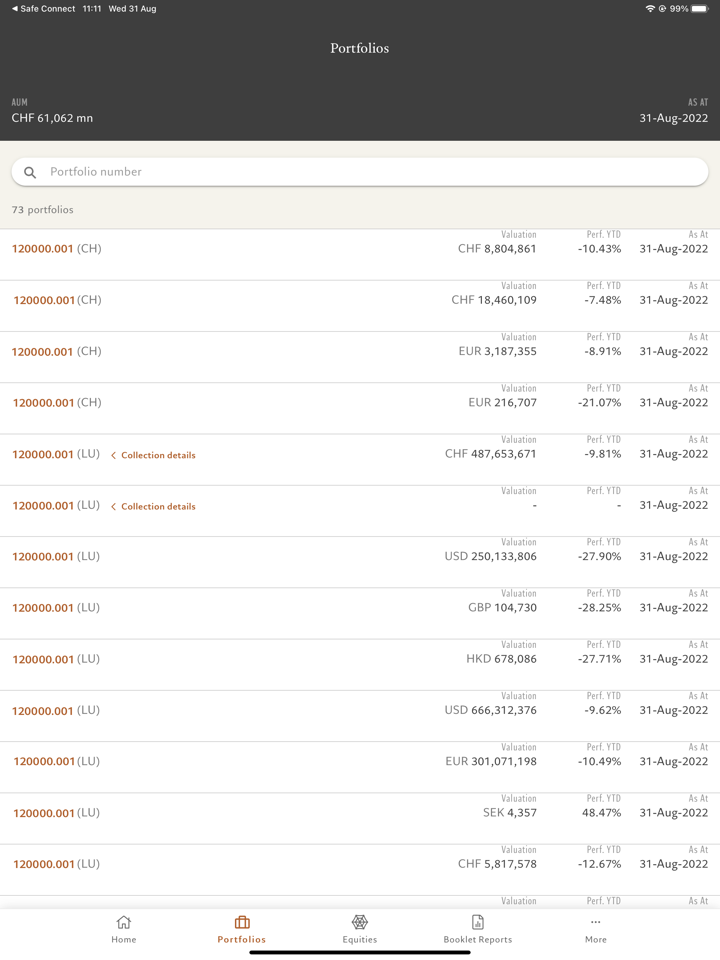

- Individuals and families: Pictet offers funds to help financial institutions and intermediaries achieve their clients' investment objectives, while also providing servicing solutions to streamline administration, trading, and reporting.

- Financial institutions and intermediaries: Pictet offers funds to help financial institutions and intermediaries achieve their clients' investment objectives. They also provide servicing solutions to simplify administration, trading, and reporting processes.

- Institutional investors: Pictet provides investment strategies and servicing solutions to major institutional investors globally, including pension funds, endowments, and sovereign wealth funds.

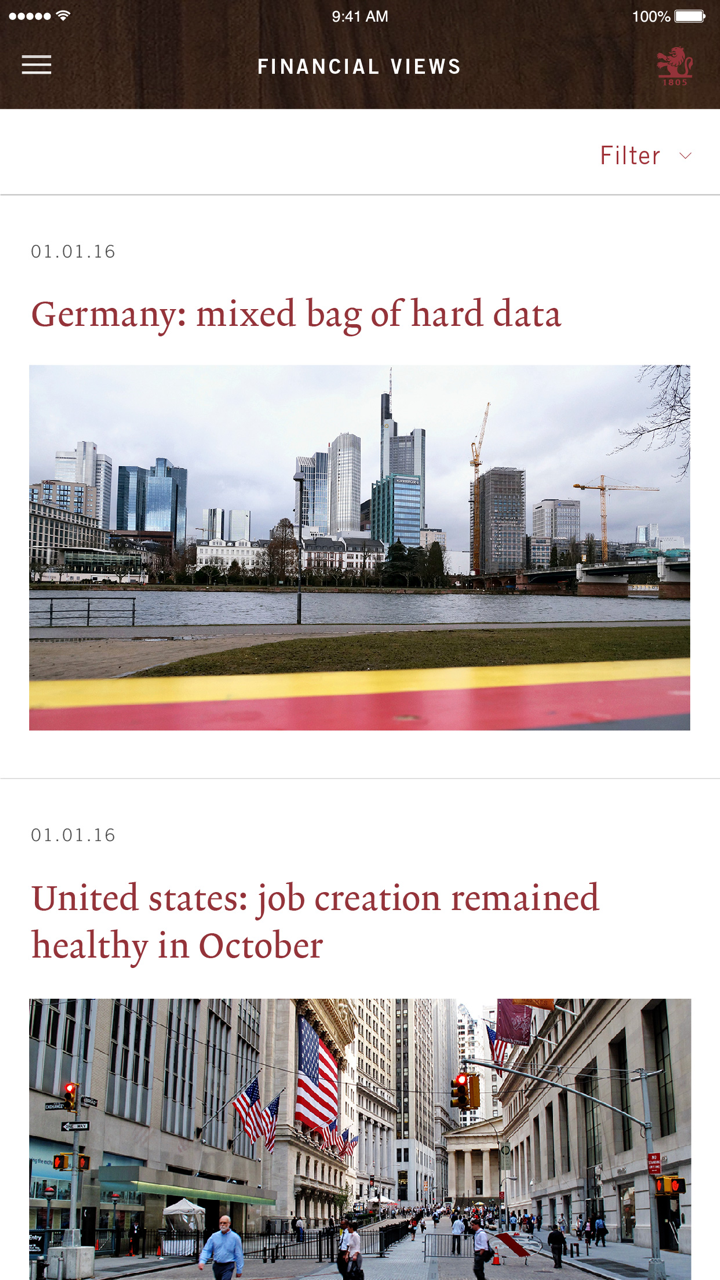

What Pictet Does?

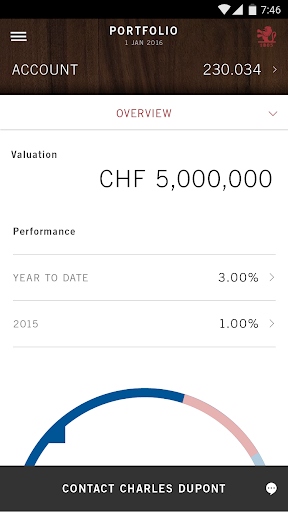

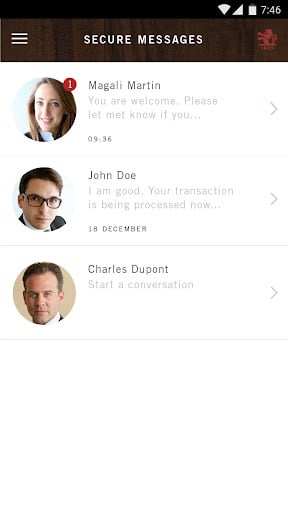

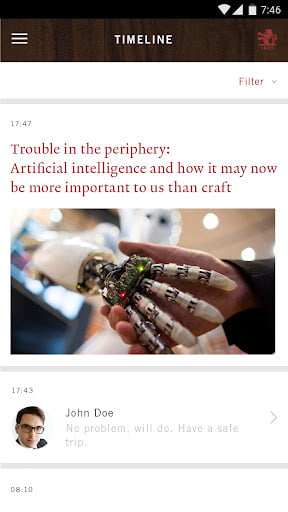

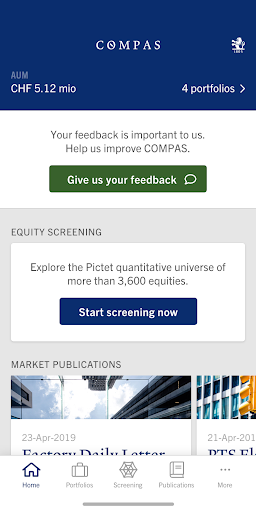

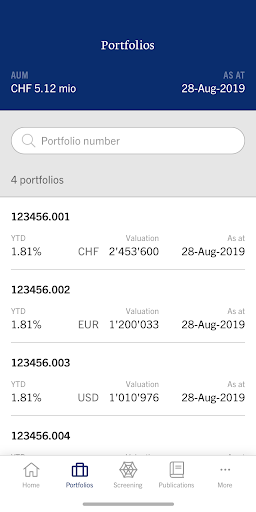

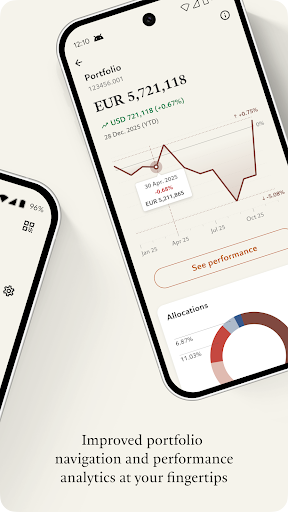

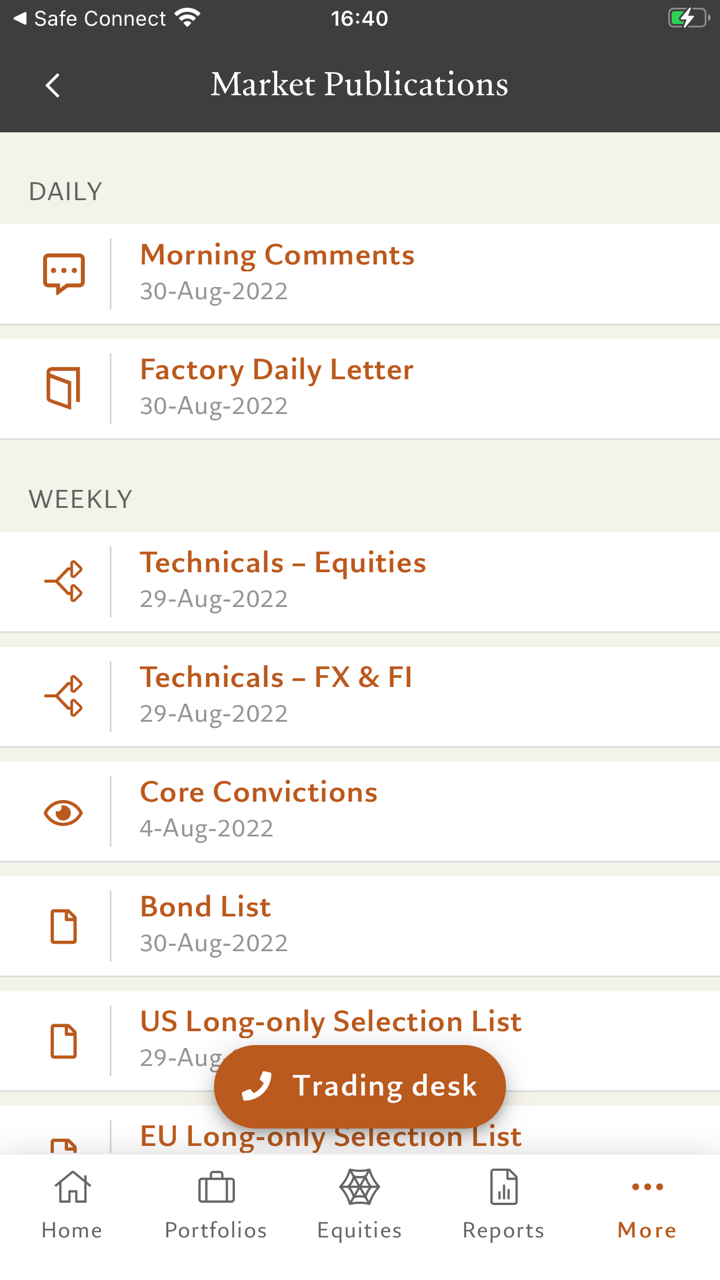

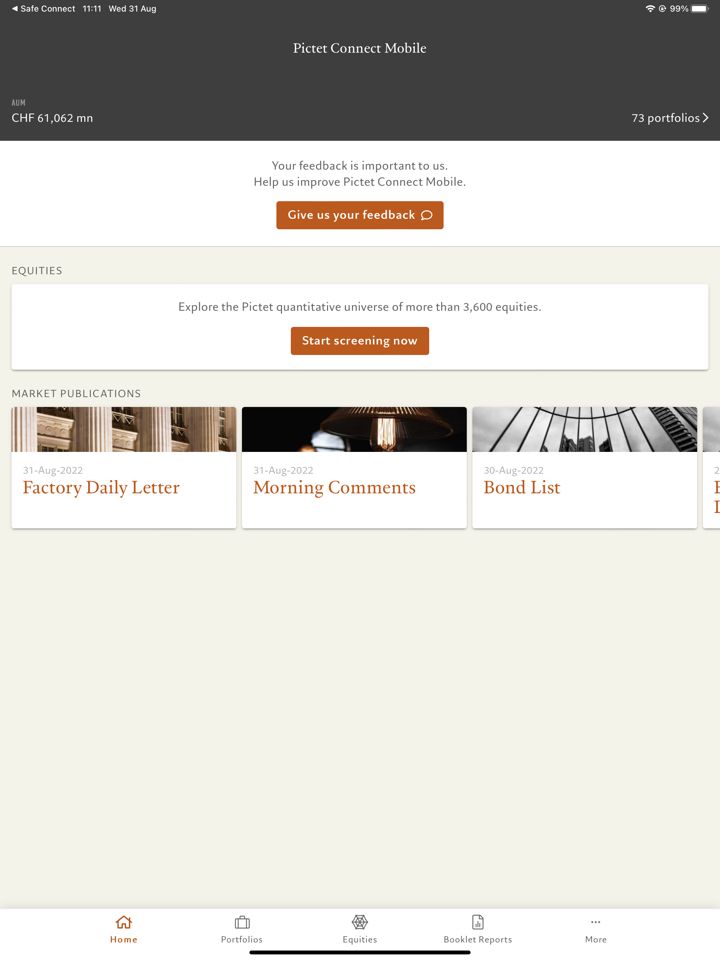

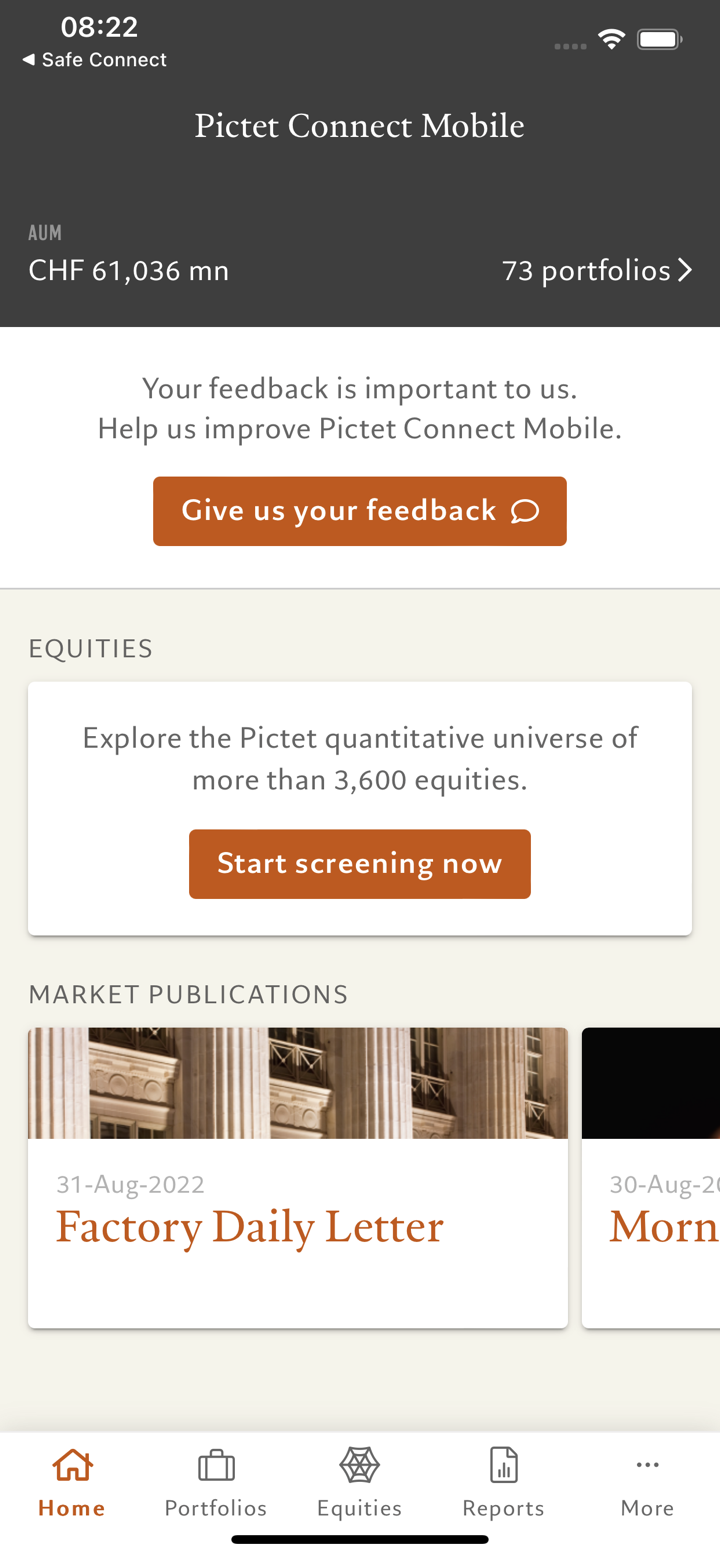

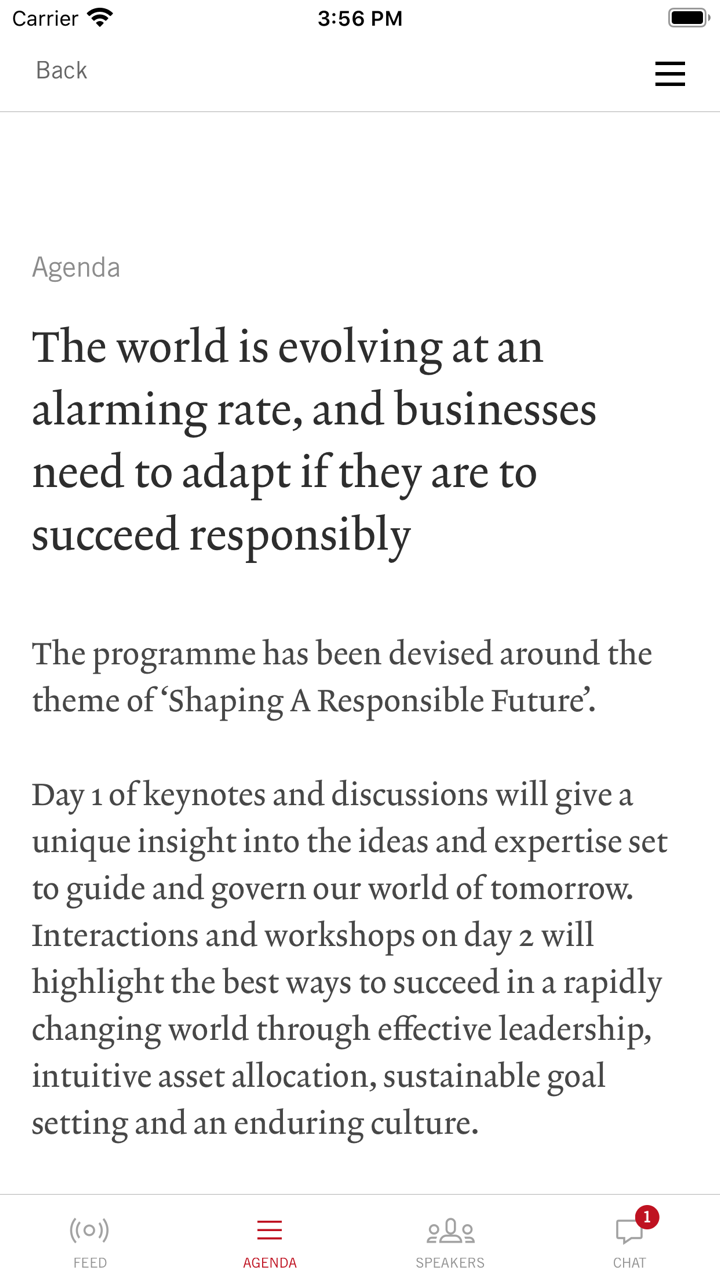

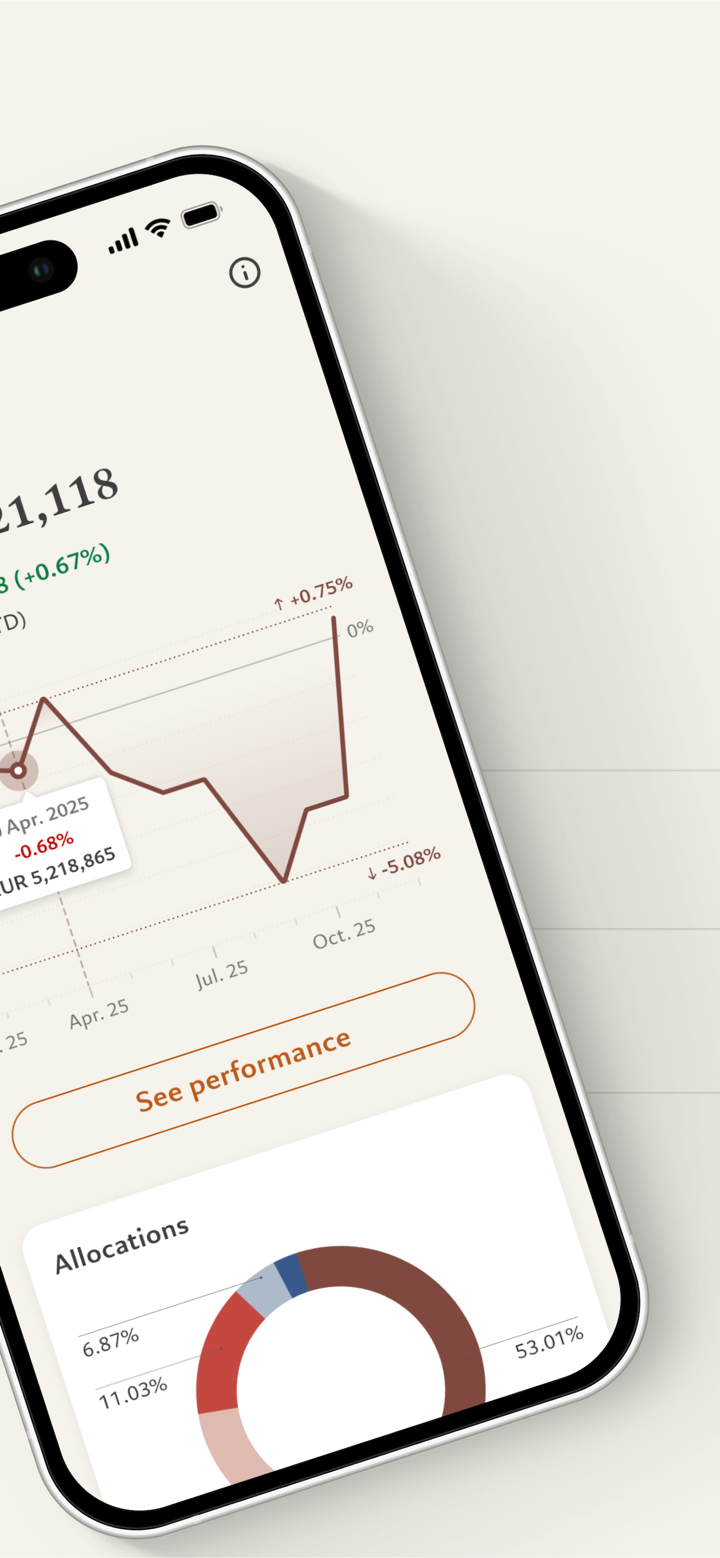

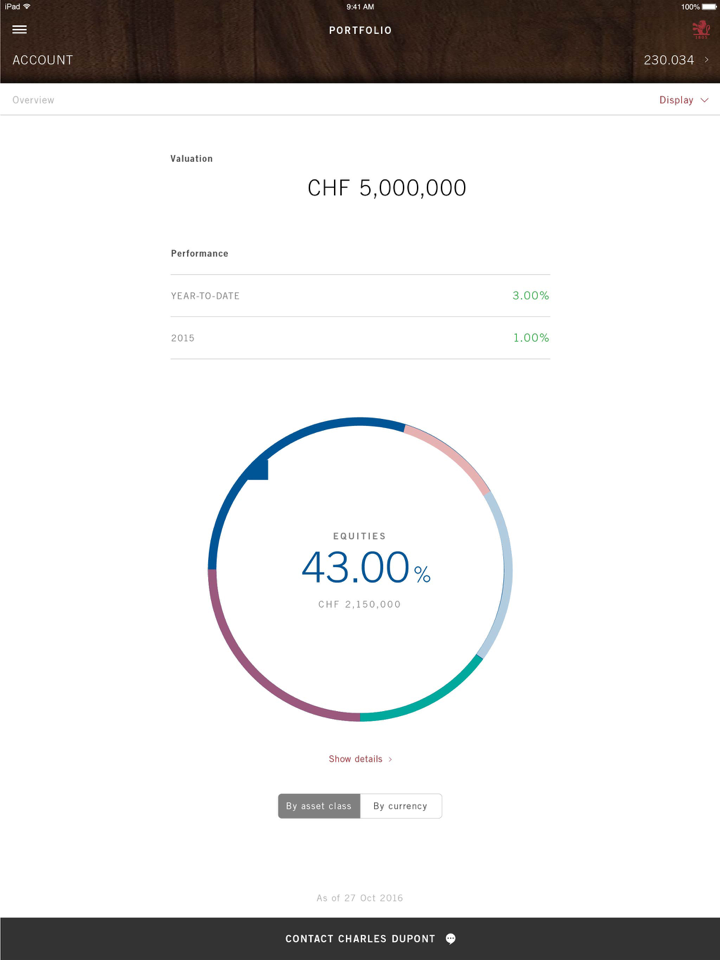

- Wealth management: For over 200 years, Pictet Wealth Management has focused on assisting private clients and family offices in managing, growing, and safeguarding their wealth for the long term. Their services aim to help clients build businesses, protect assets, and ensure preservation for future generations.

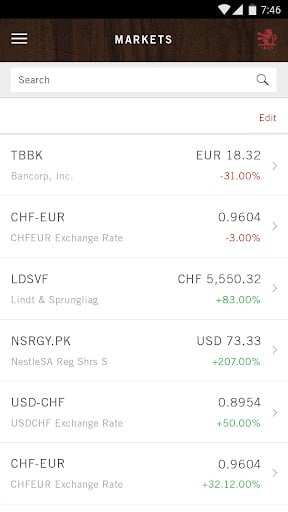

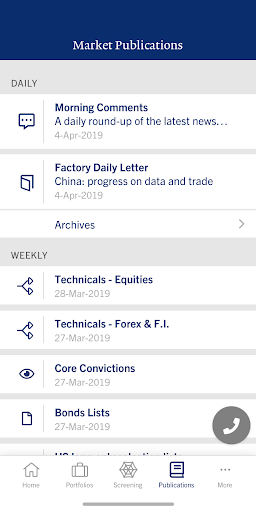

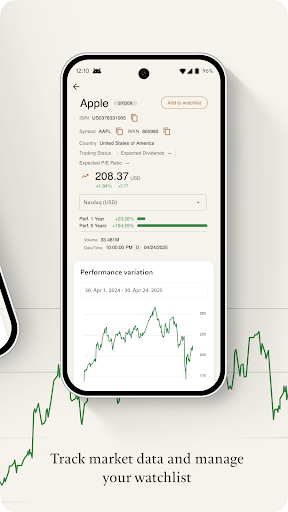

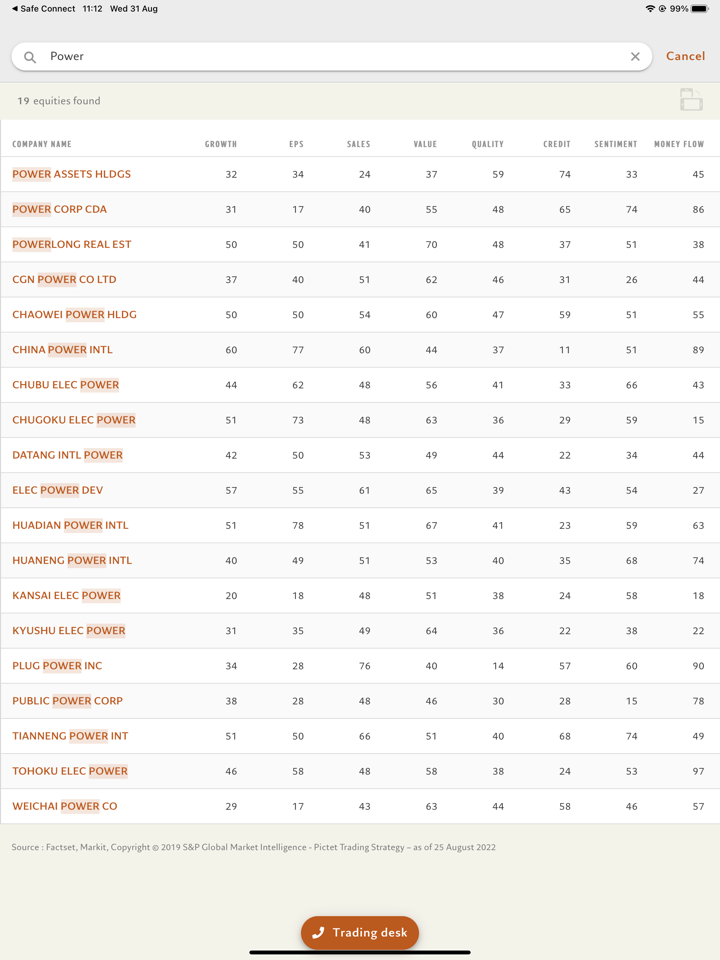

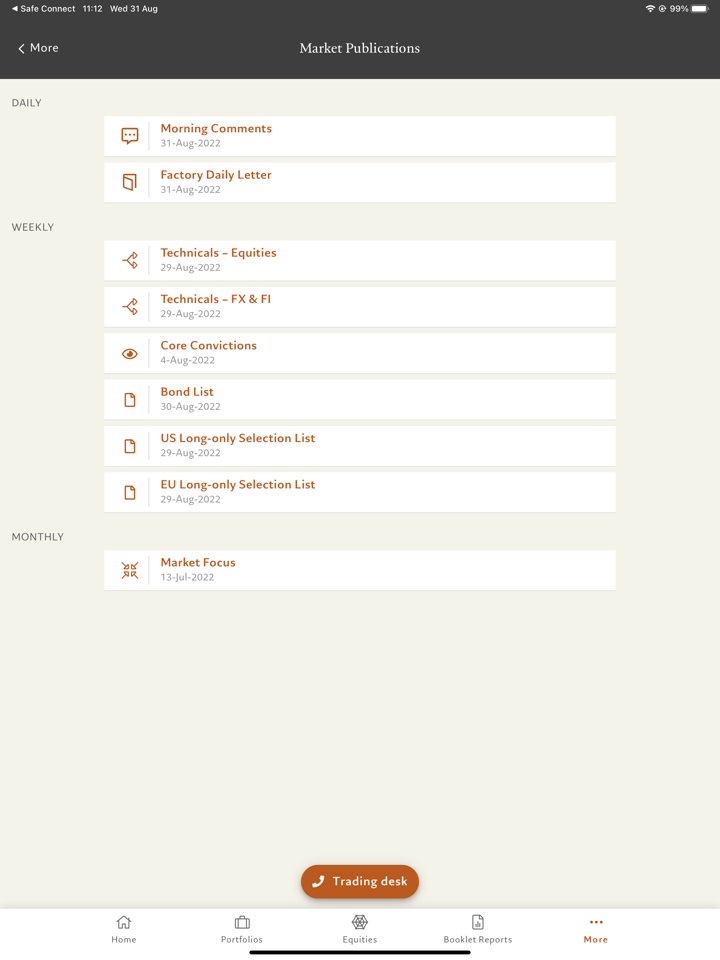

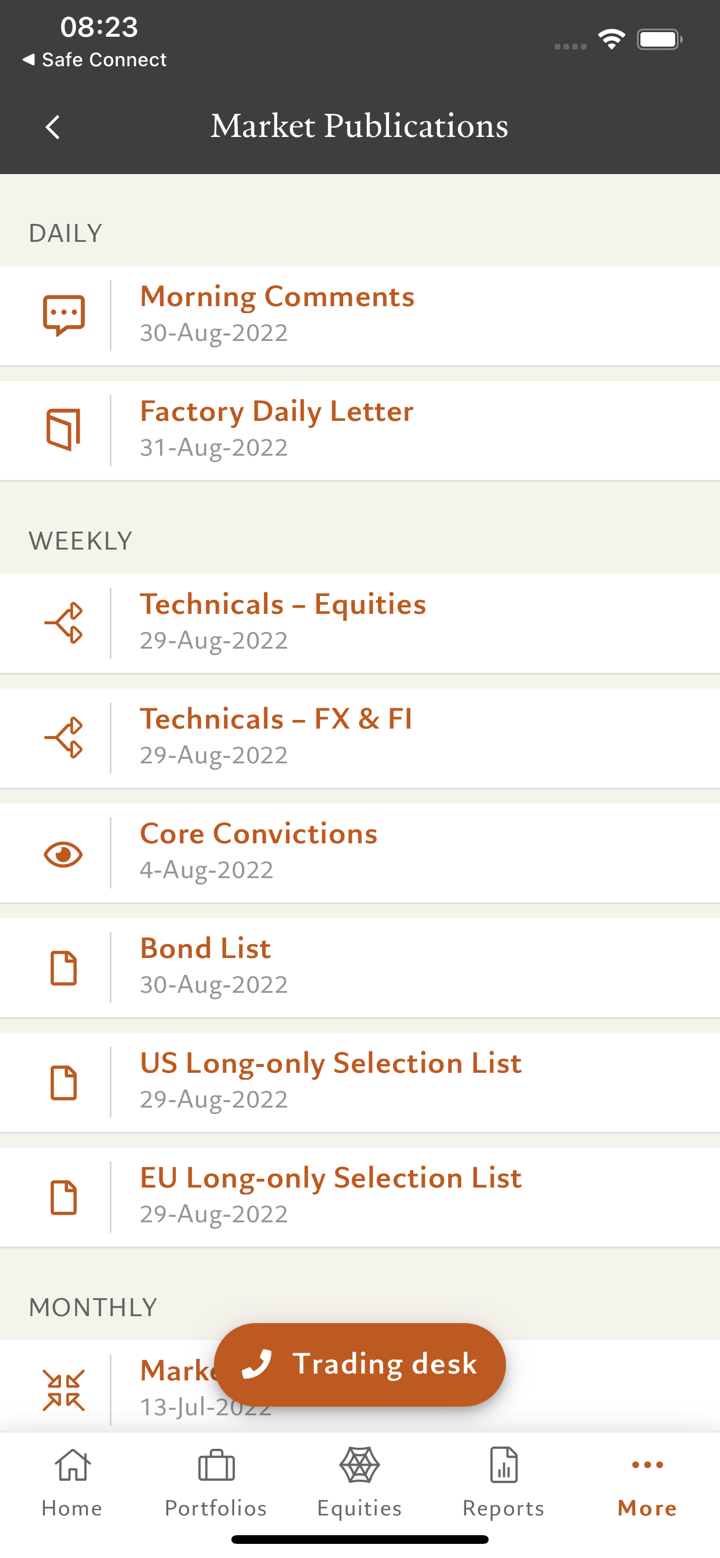

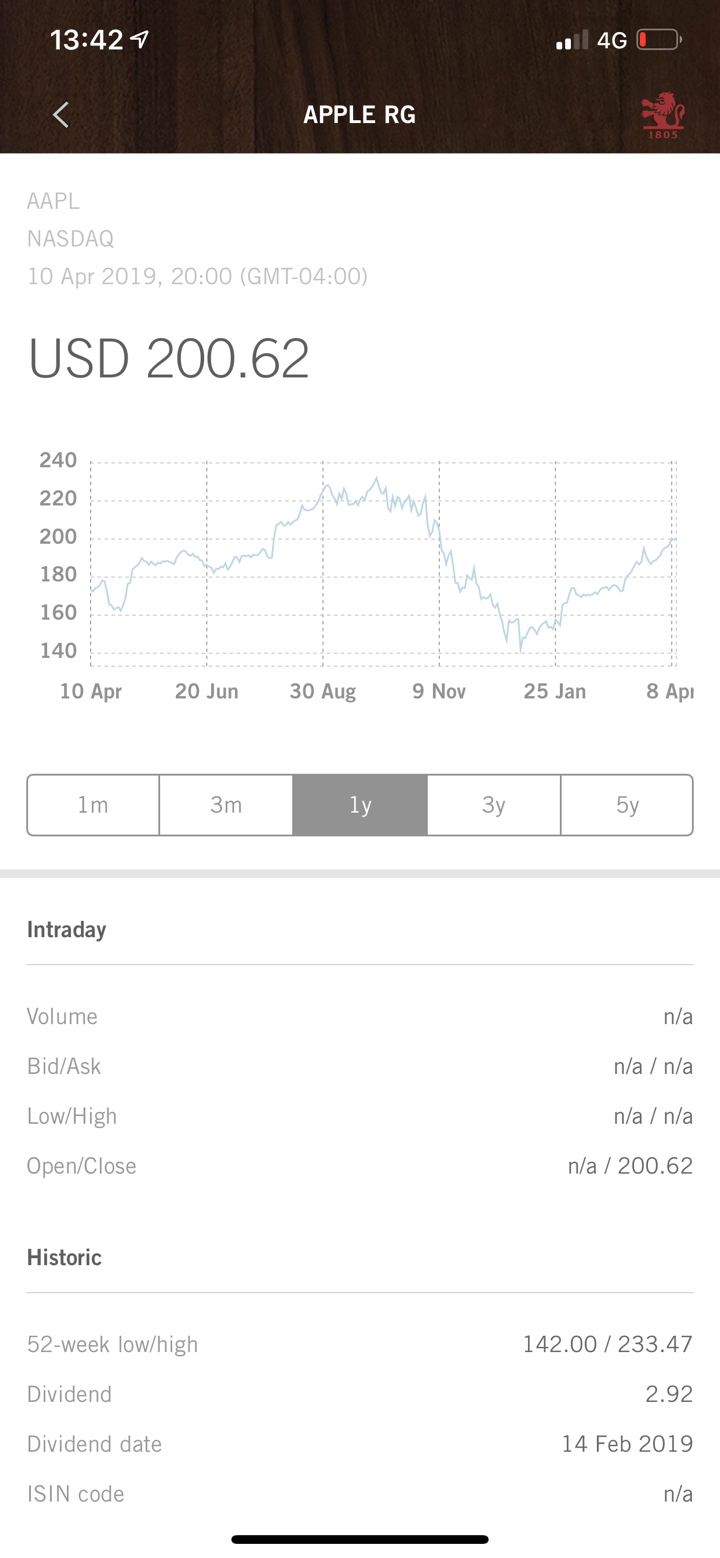

- Asset management: Pictet Asset Management is an independent firm that manages investments across various asset classes like equity, fixed income, and alternatives on behalf of its clients.

- Alternative investments: Pictet Alternative Investments provides discerning investors with access to unique opportunities and has utilized alternative strategies for decades to aim for strong results.

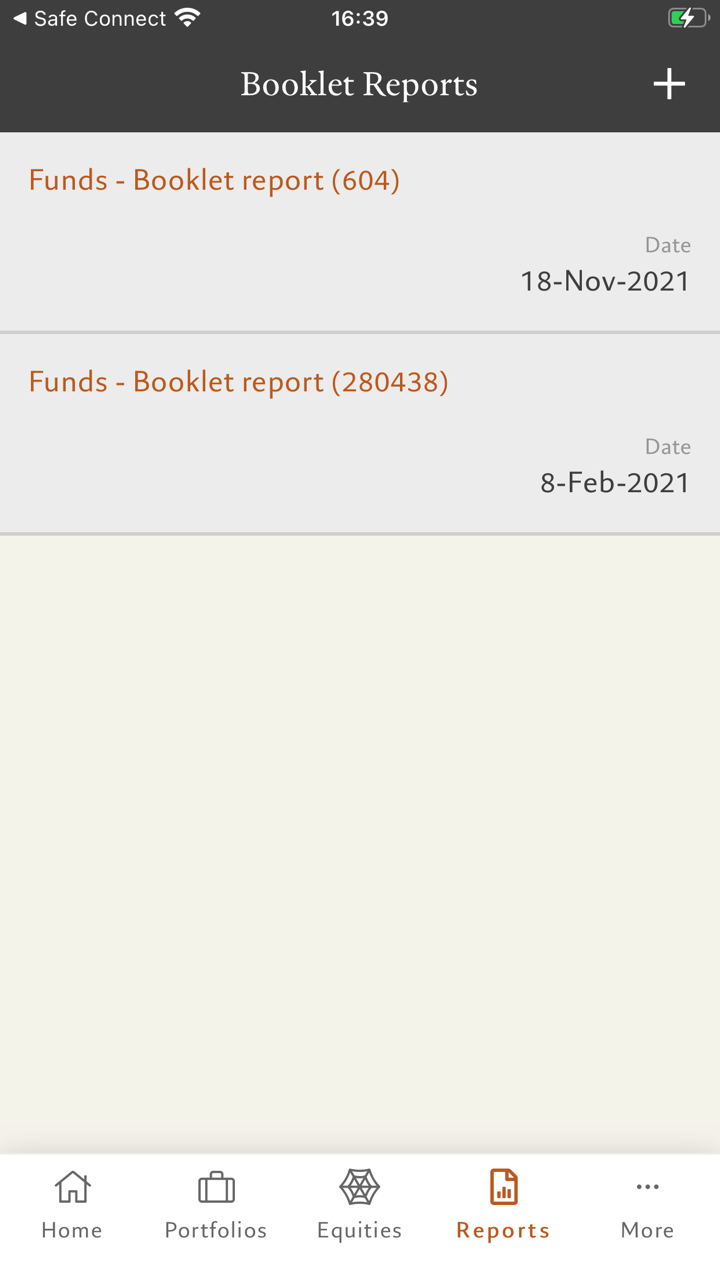

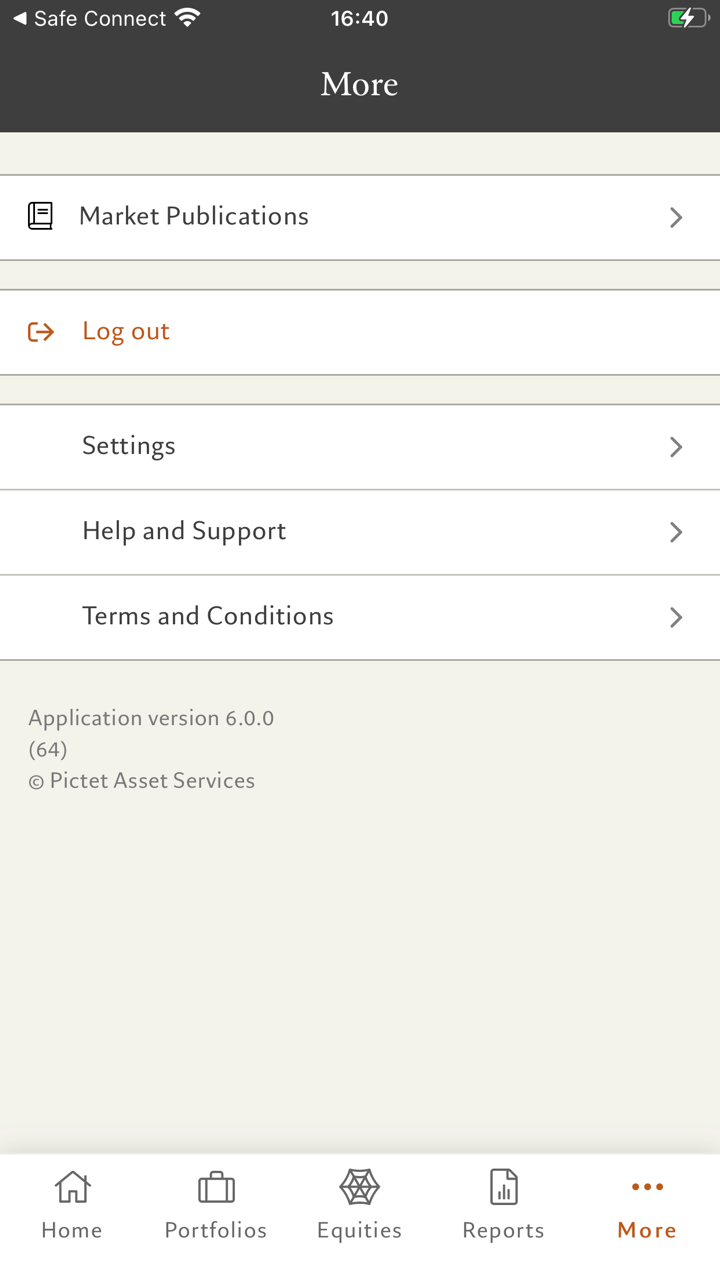

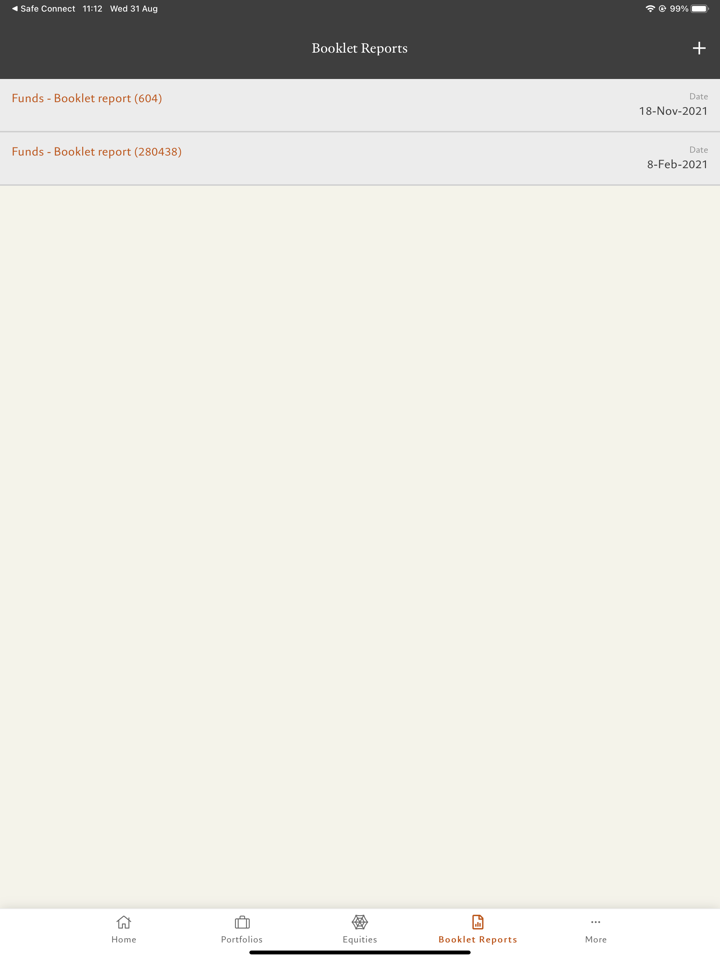

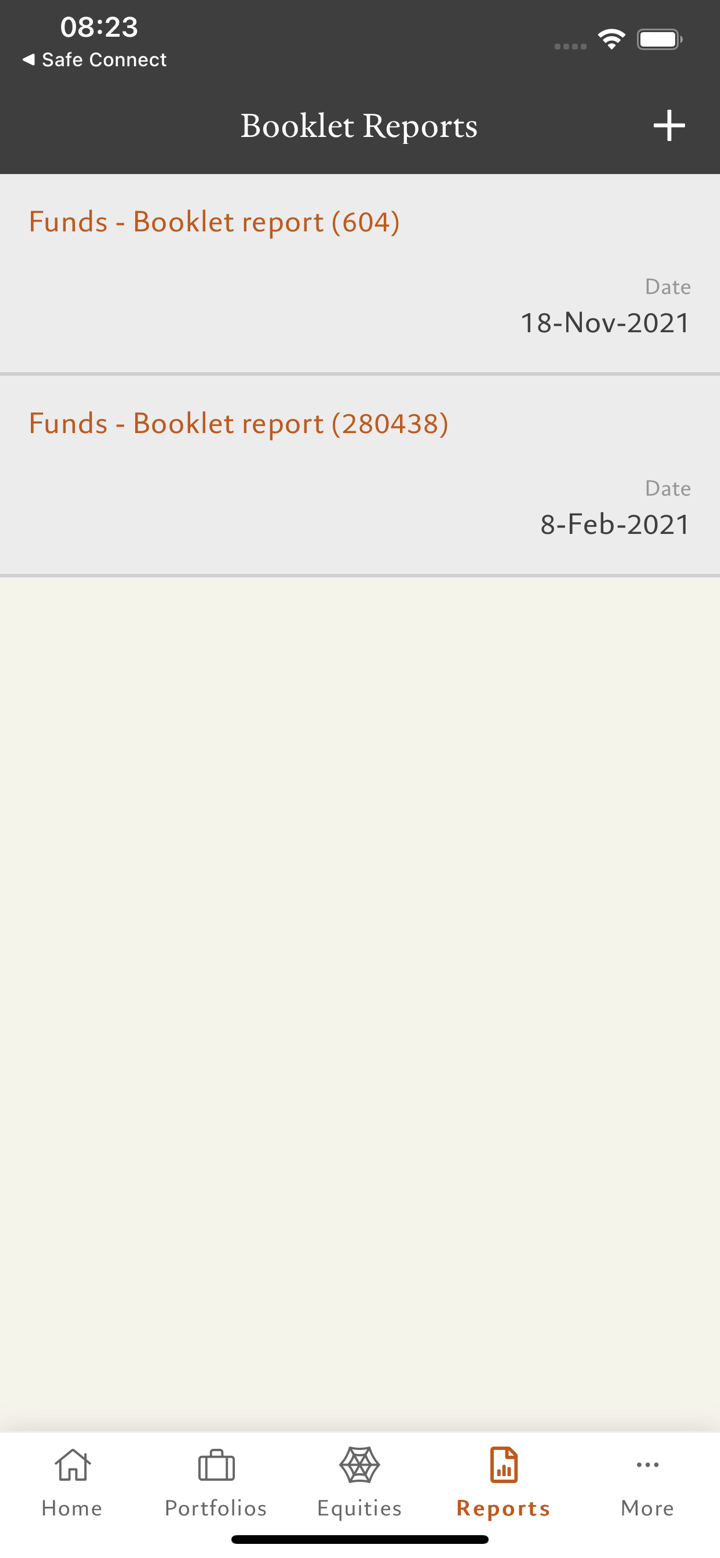

- Asset services: Pictet Asset Services manages all aspects of the asset-servicing process, allowing clients to focus on distribution and generating portfolio performance.