公司简介

| Bell Potter审查摘要 | |

| 注册时间 | 20年以上 |

| 注册国家/地区 | 澳大利亚 |

| 监管 | 受监管 |

| 市场工具 | 股票、衍生品、基金与固定收益等 |

| 交易平台 | Bell Potter 客户 |

| 客户支持 | 1300 023 557 |

| Twitter、Facebook、LinkedIn、YouTube | |

Bell Potter 信息

Bell Potter 是澳大利亚领先的全方位证券经纪和财务咨询公司,由Bell Financial Group(BFG.ASX)拥有。它为个人投资者、公司和机构客户提供服务,包括澳大利亚/国际证券经纪、固定收益、养老金规划、公司融资(如IPO、并购)和研究分析。该公司通过其全球网络支持客户投资。

优缺点

| 优点 | 缺点 |

| 受监管 | 服务门槛不明确 |

| 全方位覆盖 | 费用透明度一般 |

| 国际市场覆盖有限 |

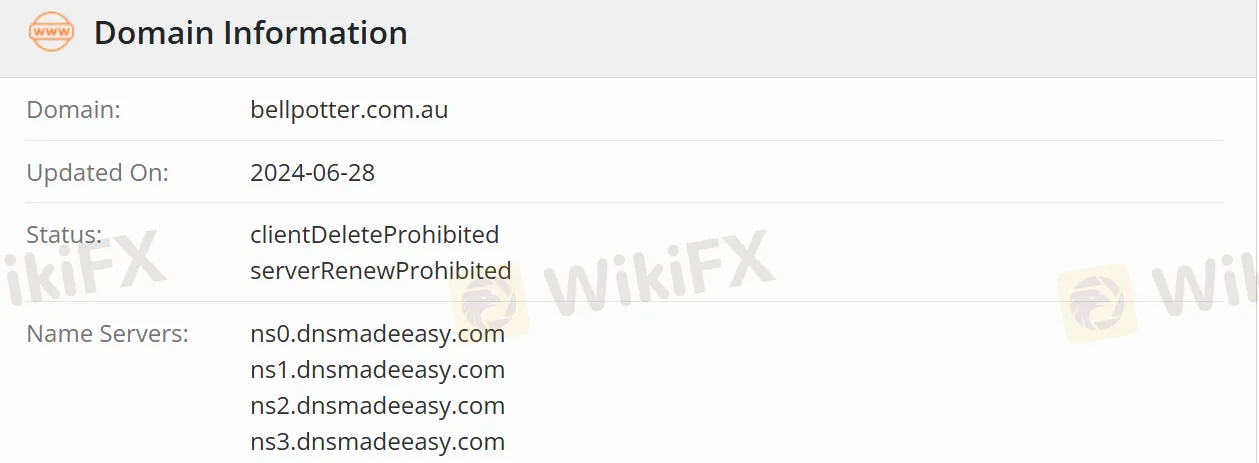

Bell Potter 是否合法?

Bell Potter 拥有澳大利亚金融服务许可证(AFSL),由上市公司Bell Financial Group拥有,并受澳大利亚证券和投资委员会(ASIC)监管,许可证号为000243480。

Bell Potter 可以交易什么?

| 交易工具 | 具体类型/描述 |

| 股票 | 澳大利亚股票(在ASX上市)、国际股票 |

| 衍生品 | 认股权证、期货(需要经过持牌衍生品专家的指导) |

| 基金和固定收益 | 上市投资公司、交易所交易基金(ETFs)、固定收益产品(债券、混合证券)、养老金产品 |

| 其他 | 外汇交易、杠杆交易和mFunds |

账户类型

根据官方网站,Bell Potter 提供以下账户类型:

个人投资账户:适用于个人投资者,支持澳大利亚股票、国际股票、ETF等交易,并可配合养老金规划服务。

企业账户:为企业客户量身定制,提供IPO、股权融资、并购咨询等服务,需要定制申请。

机构账户:专为基金公司和资产管理机构设计,提供交易执行、研究协调和企业接入服务。

中介服务账户:专为财务规划师设计,可代表客户进行基于客户的交易,提供研究支持和定制研讨会。

交易平台

投资者可以通过网络访问Bell Potter客户访问门户,查看实时信息,如投资组合估值。此外,第三方平台集成支持通过CHESS系统进行电子结算,实现与其他ASX交易资产的统一管理。

存款和取款

存款支持银行转账(澳元和外币账户)。取款将通过原路返回到绑定的银行账户,需要通过账户后台提交申请。澳元交易通常在1-2个工作日内到账,而国际转账可能延长至3-5个工作日。

主要货币为澳元,国际交易需要转换为当地货币(适用外币交易所 兑换费用s)。

dd4516

柬埔寨

SoonTrade5交易软件非常便捷

好评

HxIn

塞浦路斯

好公司,好服务。我的交易经验很好。存款根本不需要时间,但取款对我来说太花时间了。

好评

阳谷电缆

哥伦比亚

我非常喜欢bellpotter提供的MT4平台。 MT4 如此受欢迎是有道理的,因为它功能丰富且易于使用。

好评

FX1024642656

香港

Bell Potter 貌似值得信赖,但我还没有决定要不要跟他们一起投资。最低初始资本对我来说很有吸引力。只要投资5美元,我就有机会赚钱。另一点吸引我的是经纪人支持 PayPal 付款,而其他大多数经纪人,至少在我看来,很少有人提供。然而...我也从他们的网站上看到提款通常需要 7 天才能出现在我的帐户中,所以我犹豫..是的..我也需要 s

好评

...61405

香港

SSSSO 很容易上手!我刚用 5 美元开设了我的帐户!祝我好运!

好评

你好99363

香港

我需要说,这个经纪人要求一个小的初始资本,这是一个很好的部分。但是,您还应该注意,闲置费是您需要支付的费用。我会说,也许你可以考虑这家公司来帮助你做出一些财务决定。

好评