公司简介

| 国联期货 评论摘要 | |

| 成立时间 | 2002 |

| 注册国家/地区 | 中国 |

| 监管 | CFFEX |

| 交易产品 | 商品期货、金融期货、期权 |

| 模拟账户 | ✅ |

| 交易平台 | CTP主系统、FastQuote v3、FastQuote v2、博易云、无限易、国联期货 APP 和模拟交易软件 |

| 最低存款 | / |

| 客户支持 | 电话:95570 / 400-8888-012 |

| 传真:0510-82752315 82759156 | |

| 邮箱:admin@glqh.com | |

| 地址:江苏省无锡市财经一街8号6楼 | |

国联期货 信息

国联期货有限公司是中国证监会批准的综合期货公司。总部位于江苏省无锡市,拥有20多家分公司和1家风险管理子公司,服务网络覆盖中国各大城市。业务范围涵盖商品期货经纪、金融期货经纪、期货投资咨询、资产管理等。适合国内期货投资者,尤其是新手和机构客户。

优缺点

| 优点 | 缺点 |

| 提供模拟账户 | 部分高级服务收费 |

| 受CFFEX监管 | 国际业务有限(仅限国内期货) |

| 业务全面 | |

| 多种交易平台 | |

| 营业时间长 | |

| 适合新手 |

国联期货 是否合法?

国联期货是中国证监会批准的持有期货经纪、资产管理等合法资格的金融机构,受中国期货业协会(CFIA)监管。证券公司由中国金融期货交易所(CFFEX)监管,许可证号为0118。

| 监管机构 | 当前状态 | 持牌实体 | 监管国家 | 许可证类型 | 许可证号 |

| 中国金融期货交易所(CFFEX) | 监管 | 国联期货股份有限公司 | 中国 | 期货许可证 | 0118 |

我可以在国联期货上交易什么?

可交易产品涵盖主要国内期货和期权市场,如商品期货、金融期货、期权以及模拟交易产品,供投资者通过模拟进行练习。

| 交易产品 | 支持 | 子类别 | 代表品种 |

| 商品期货 | ✔ | 农产品 | 大豆、玉米、棉花、豆粕、豆油、棕榈油、活猪等 |

| 金属 | 铜、铝、锌、镍、黄金、白银等 | ||

| 能源化工 | 原油、燃料油、甲醇、PTA、乙二醇、沥青等 | ||

| 金融期货 | ✔ | 股指期货 | 沪深300(IF)、中证500(IC)、中证1000(IM)等 |

| 国债期货 | 10年期国债(T)、5年期国债(TF)、2年期国债(TS) | ||

| 期权 | ✔ | 商品期权 | 大连商品交易所2506系列(例如豆粕、玉米期权)、郑商所(白糖、棉花期权)等 |

| 金融期权 | 沪深300股指期权(IO)、中证1000股指期权(MO)等 |

交易平台

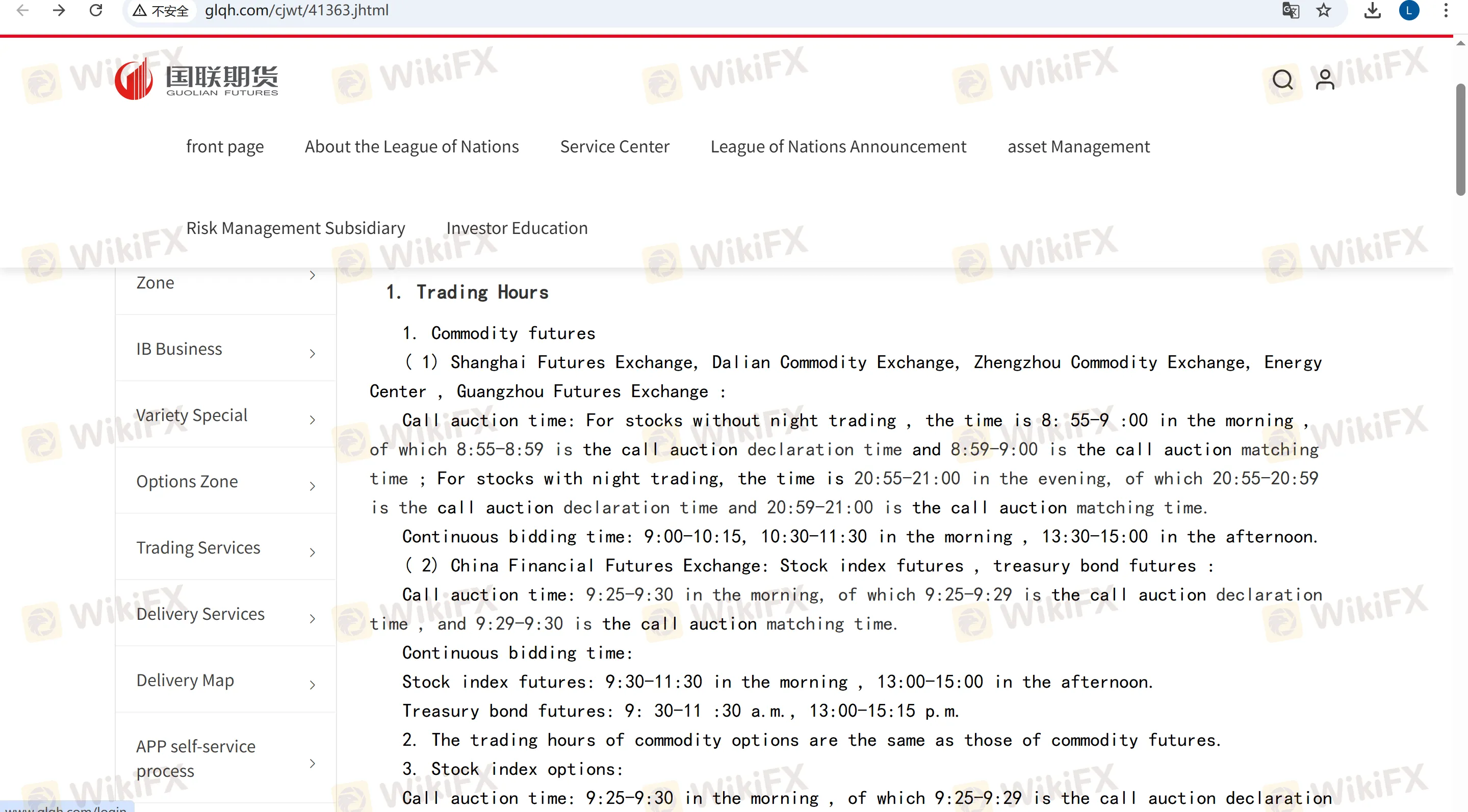

国联期货 提供桌面软件、移动软件和模拟交易平台。具体来说,包括CTP主系统、FastQuote v3/v2、博易云、无限易以及国联期货 APP等。

| 类型 | 软件名称 | 特点 | 适用对象 |

| 桌面软件 | CTP主系统 | 主流交易系统 | 高频交易者、专业投资者 |

| FastQuote v3 | 多屏分析、完整历史市场数据和高级图表工具 | 技术分析交易者 | |

| FastQuote v2 | 快速下单 | 短线交易者、日内交易者 | |

| 博易云 | 支持期权交易和CTP平台 | 期权/期货一体化交易者 | |

| 无限易 | 多账户管理 | 机构投资者、量化团队 | |

| 移动软件 | 国联期货 APP | 开户、交易 | 普通投资者、新手用户 |

| 模拟平台 | 模拟交易软件 | 模拟股指期货和期权策略,无实际资本风险 | 新手练习、策略测试 |

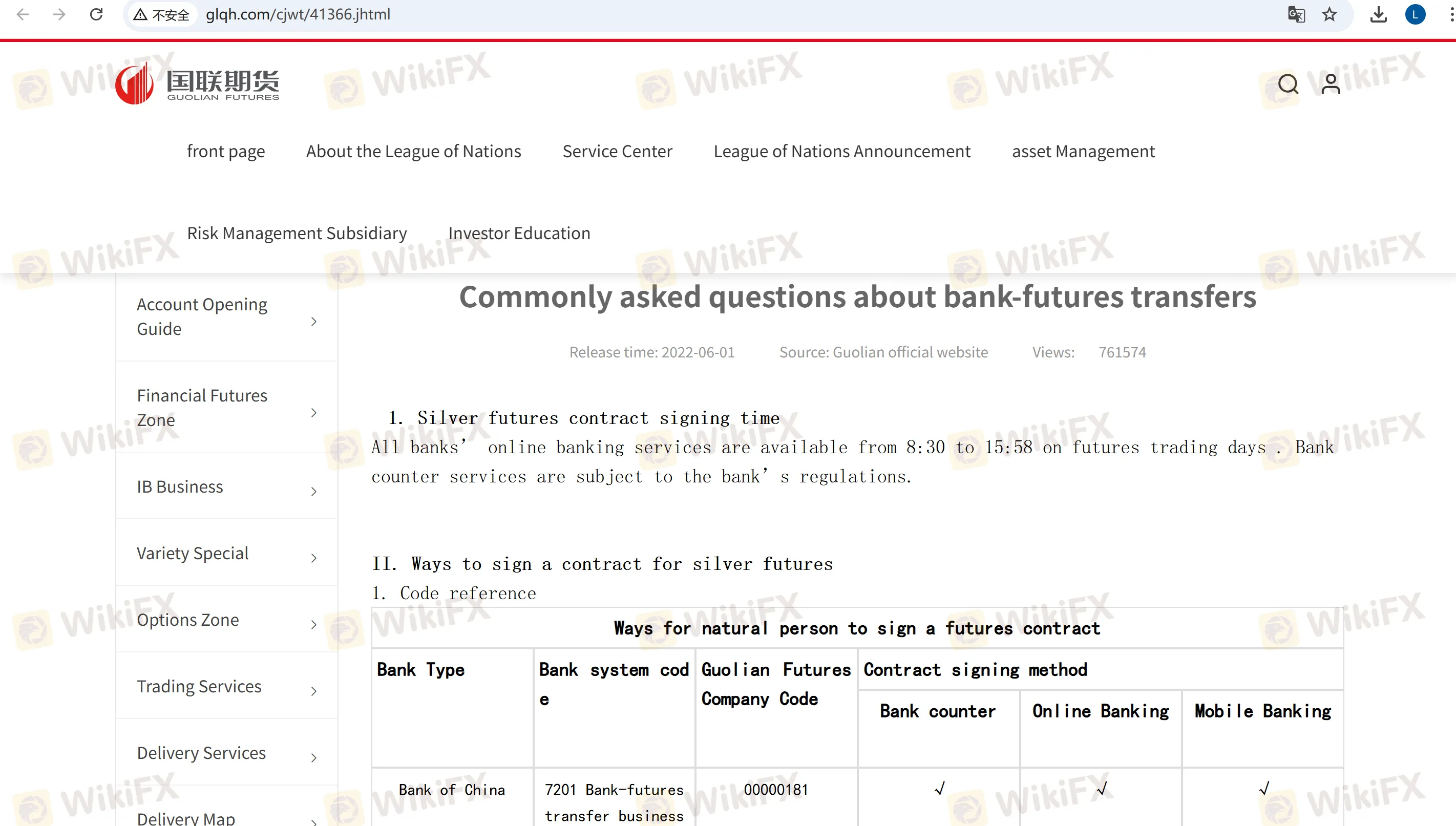

存取款

银行转账 存款支持主要银行,实时到账,免手续费。对于第三方支付(需要提前确认合规性),到账时间和处理手续费取决于支付提供商。提现时间为指定交易时间,通常从9:00至15:30,部分产品支持夜间提现。