tabawan_dreamer

1-2年

Could you give a comprehensive overview of SK’s fees, covering both commissions and spread charges?

After examining SK, I must point out that the broker does not publicly disclose detailed information about its trading fees, commission structures, or spread charges. As someone who aims to make informed trading decisions, this lack of transparency is a significant red flag for me. When approaching any broker, particularly one active in forex and securities trading, I find it essential to have easy access to clear explanations of all costs involved. Unfortunately, SK’s platform does not provide information on minimum spreads, commission rates, or additional trading costs—these are critical for evaluating the true expense of executing trades.

What concerns me more is SK's operational status: despite providing investment and brokerage services in South Korea, SK is not under the oversight of local financial regulators like the FSC or FSS. Without regulatory supervision, there is no official requirement for the broker to maintain fair or competitive fee structures, nor is there a clear dispute resolution process should issues arise with commissions or spreads. From my experience, this amplifies the level of risk and uncertainty for clients.

In summary, because SK fails to disclose basic pricing details and operates without regulatory oversight, I would approach any potential trading relationship with extreme caution. I recommend that traders prioritize platforms that offer straightforward, transparent breakdowns of all their fee and commission policies before funding an account or initiating trades.

Broker Issues

Fees and Spreads

Hhduy

1-2年

Can you tell me the typical spread for EUR/USD when trading on SK's standard account?

In my experience evaluating brokers like SK, I always prioritize transparency, and unfortunately, SK presents significant limitations in this regard. Based on the available facts, SK does not disclose any concrete information about spreads, including for EUR/USD, across its accounts. I could not find typical, average, or minimum spread values specified anywhere in the materials I reviewed. This lack of clarity is concerning, especially for someone like me who considers competitive and consistent spreads essential for cost-effective trading.

Just as important, SK operates without any recognized regulatory oversight; this increases the overall risk and means there are fewer assurances of fair dealing or transparent order execution. The absence of regulatory supervision often goes hand-in-hand with less robust disclosures about pricing or trading conditions. From my standpoint, when a broker does not provide basic information about trading costs such as spreads, I treat it as a red flag and proceed with substantial caution.

For anyone considering SK, I would underline that you will not know your expected transaction costs—such as the EUR/USD spread—before depositing funds or opening trades, which is not a risk I willingly accept. This uncertainty, coupled with regulatory gaps, means I cannot recommend SK for traders who value transparency and reliable cost structures.

Broker Issues

Fees and Spreads

Rojas

1-2年

Does SK offer traders the option to open an Islamic (swap-free) account?

In my experience as a forex trader, one of the key considerations when evaluating a broker is transparency regarding account types, especially those that cater to specific needs such as Islamic (swap-free) accounts. After reviewing all the available information about SK, I could not find any mention or evidence that SK offers Islamic or swap-free accounts designed in compliance with Sharia law. This absence stands out to me, since brokers that provide such options usually make it clear in their service offerings or account details.

Another concern I have is the lack of regulatory oversight for SK. According to my research, SK is not supervised by major South Korean regulatory bodies like the FSC or FSS, and this adds to my cautious approach. The limited transparency around trading conditions—including aspects like account structure, minimum deposits, and leverage—further reinforces my reservations.

Given these uncertainties, I would personally be very cautious and would not assume that SK accommodates Islamic trading preferences. For traders with specific requirements like swap-free accounts, I recommend seeking out brokers that are both clearly regulated and fully disclose their account options. This approach helps ensure both transparency and a higher level of investor protection.

Broker Issues

Instruments

Leverage

Platform

Account

Sam35

1-2年

Is it possible to trade assets such as Gold (XAU/USD) and Crude Oil on SK?

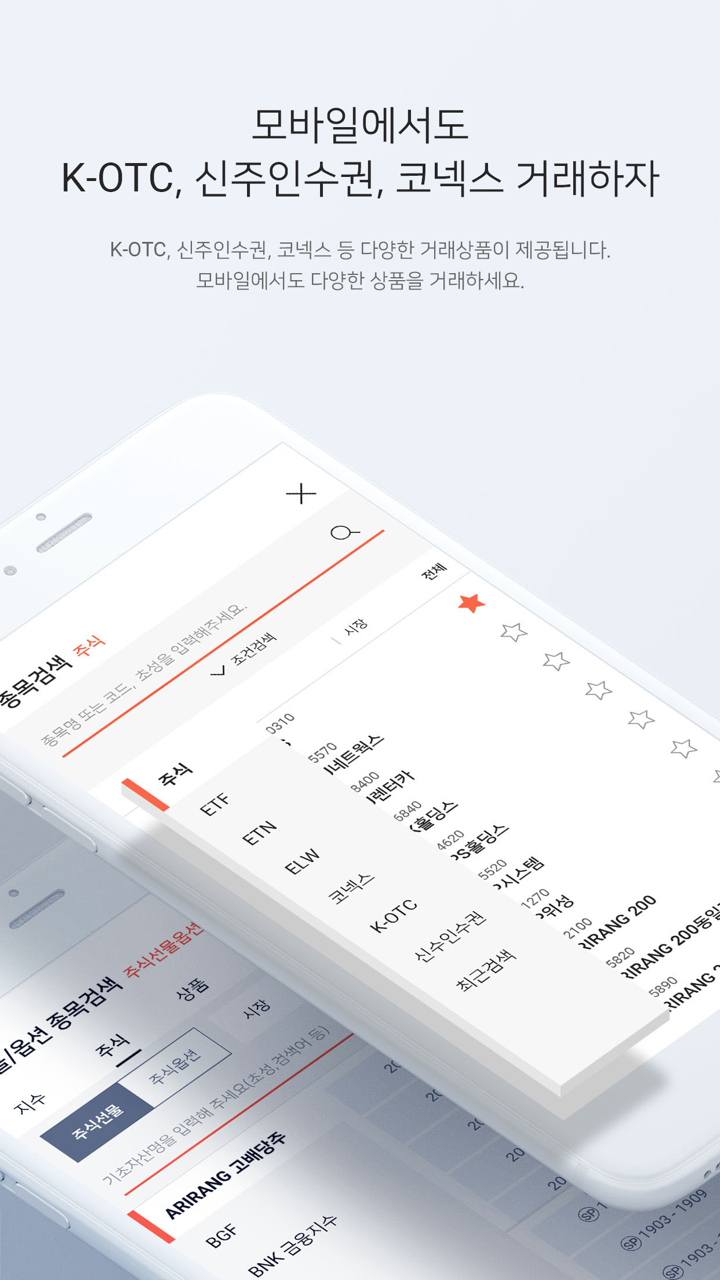

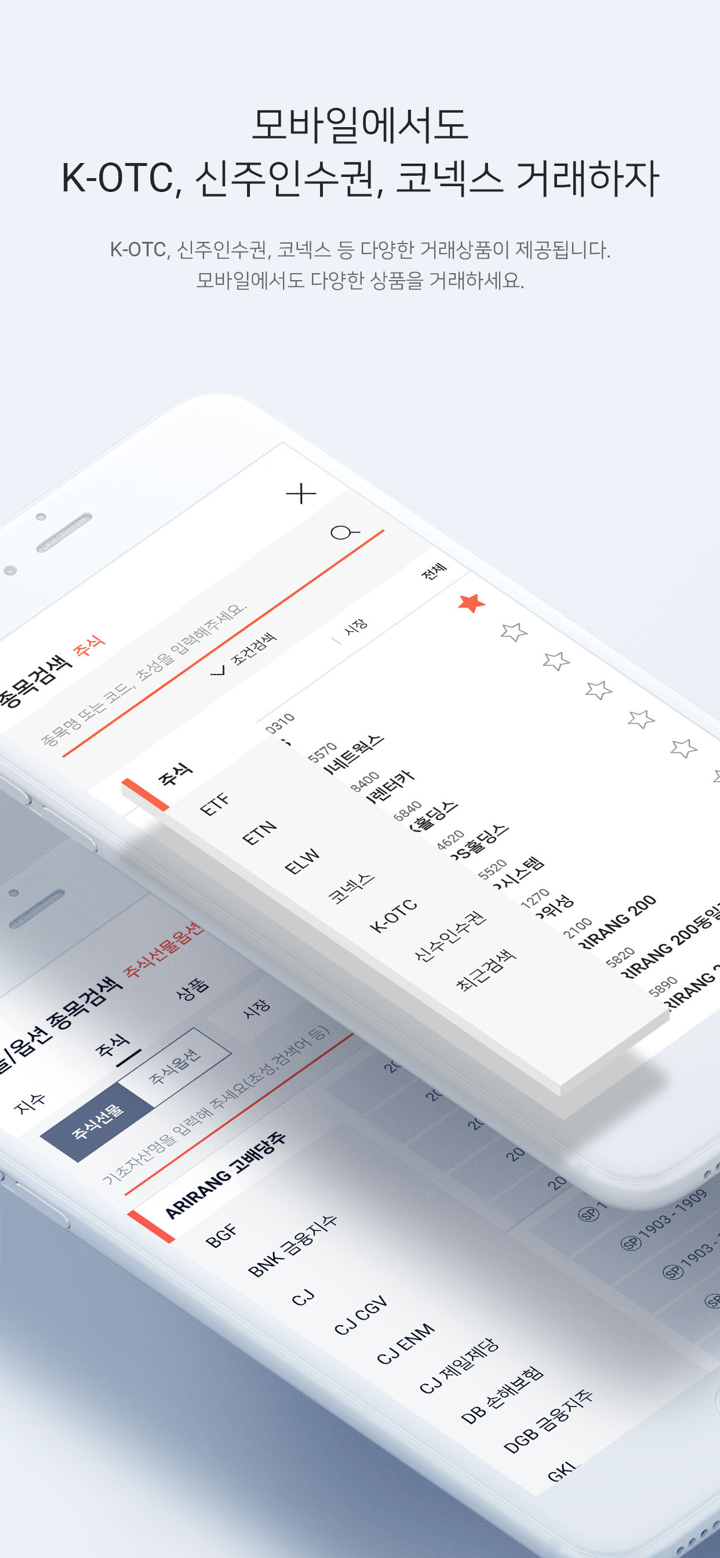

After reviewing SK Securities from the perspective of an active trader, I find there is very limited transparency regarding the range of tradable assets, especially popular instruments like Gold (XAU/USD) or Crude Oil. The available information indicates SK focuses primarily on Korean stock trading, corporate finance, structured finance, asset management, and digital investment solutions including robo-advisory services. Nowhere is there explicit mention of spot commodity trading or contracts for difference (CFDs) on metals or energy products.

Additionally, SK lacks oversight from major financial regulatory bodies, which, for me, significantly increases the risks related to asset security and dispute resolution. In my experience, well-regulated forex and CFD brokers make their market offerings—including gold and oil—very clear and accessible, often listing trading conditions publicly. That level of clarity is absent here. Without concrete confirmation and specific trading terms disclosed for Gold or Crude Oil, and considering SK's apparent lack of a global forex license, I would have strong reservations about considering SK as a viable venue for such commodities trading. For anyone prioritizing safety and transparency, it's prudent to seek brokers with clear listings, established reputations, and robust regulation, especially for high-risk assets like gold and oil.

Broker Issues

Account

Leverage

Platform

Instruments