公司简介

| T.RowePrice评论摘要 | |

| 成立时间 | 1995 |

| 注册国家/地区 | 美国 |

| 监管 | SFC |

| 产品与服务 | 基金、股票、固定收益、多资产、私募股权、私募信贷、目标日期解决方案和影响投资 |

| 模拟账户 | / |

| 杠杆 | / |

| 点差 | / |

| 交易平台 | / |

| 最低存款 | / |

| 客户支持 | 电话:+1-410-345-2000 |

| 社交媒体:LinkedIn | |

| 地址:美国马里兰州巴尔的摩市Point Street 1307号 邮编21231 | |

T.RowePrice 信息

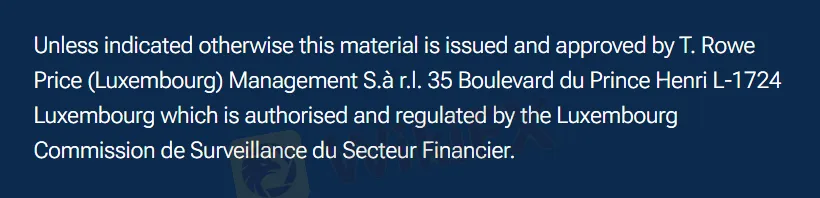

T. Rowe Price向个人投资者、财务顾问、机构和顾问提供全面的投资产品,包括股票、固定收益、多资产策略、私募股权、私募信贷、目标日期基金和影响投资。尽管官方网站提到受卢森堡金融监管局授权,实际监管范围目前仅限于香港。账户类型、费用结构和存取款程序等关键信息未公开披露。投资者在做出任何决定之前应彻底核实平台的合法性和透明度。

优点与缺点

| 优点 | 缺点 |

| 受SFC监管 | 缺乏透明度 |

| 多样的服务和产品 | |

| 提供28种语言的客户支持 | |

| 悠久的运营历史 |

T.RowePrice 是否合法?

尽管T. Rowe Price声称受卢森堡金融监管局授权和监管,但实际上受香港证券及期货事务监察委员会监管,许可证号码为AVY670。

| 监管国家 | 监管机构 | 监管状态 | 受监管实体 | 许可证类型 | 许可证号码 |

| 中国(香港) | 香港证券及期货事务监察委员会(SFC) | 受监管 | T. Rowe Price香港有限公司 | 从事期货合同交易 | AVY670 |

产品与服务

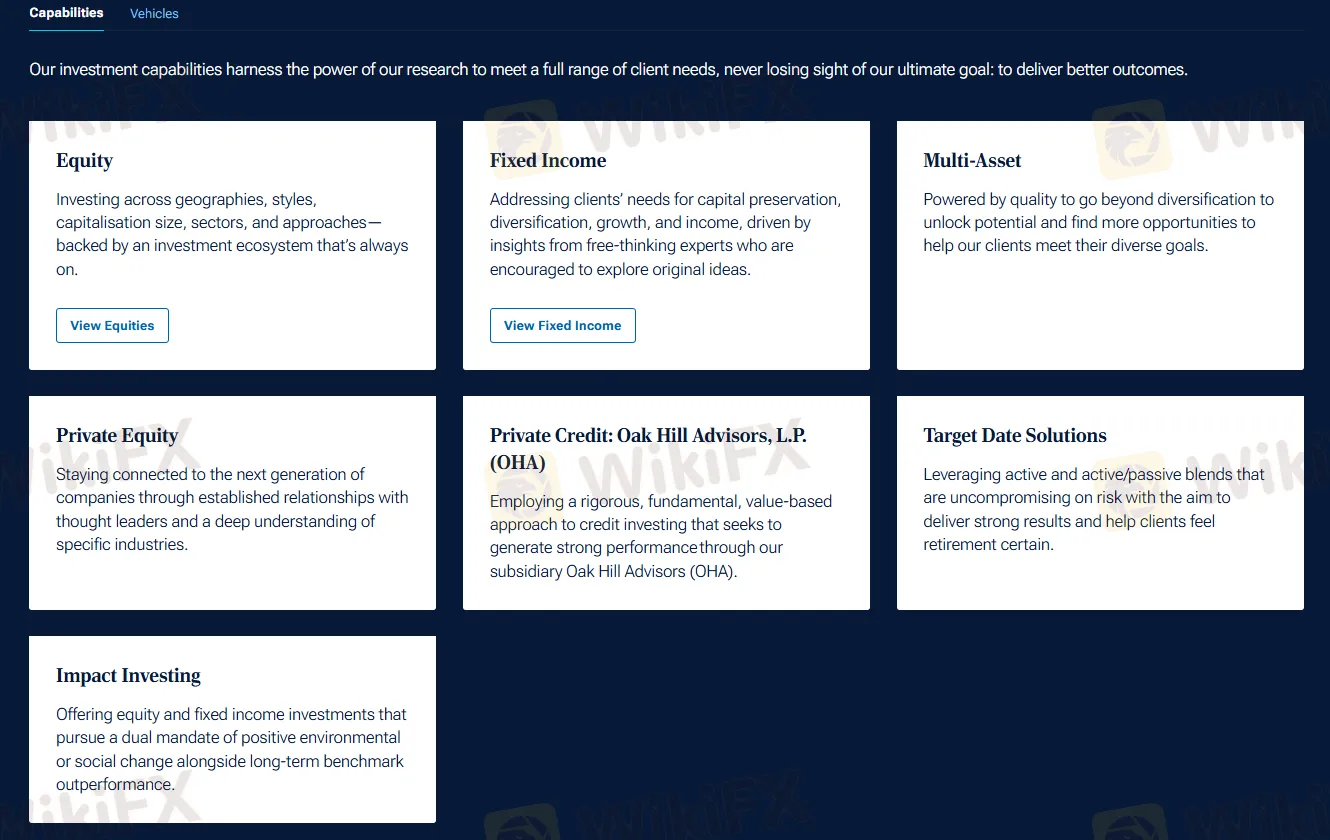

T. Rowe Price提供全面的投资产品和服务,满足个人投资者、财务顾问、机构投资者和顾问的需求,提供股票、固定收益、多资产、私募股权、私募信贷(Oak Hill Advisors, L.P. (OHA))、目标日期解决方案和影响投资等投资服务。

| 产品与服务 | 可用 | |

| 基金 | 个人投资者 | ✔ |

| 财务顾问 | ✔ | |

| 机构投资者 | ✔ | |

| 顾问 | ✔ | |

| 投资 | 股票 | ✔ |

| 固定收益 | ✔ | |

| 多资产 | ✔ | |

| 私募股权 | ✔ | |

| 私募信贷:Oak Hill Advisors, L.P. (OHA) | ✔ | |

| 目标日期解决方案 | ✔ | |

| 影响投资 | ✔ | |