PitBull

1-2年

What are the main risks or downsides I should consider before investing with XP Investimentos?

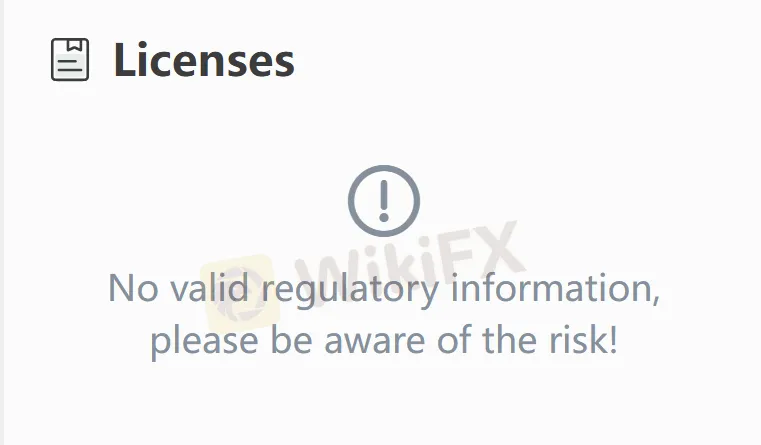

In my experience as a trader, evaluating XP Investimentos for potential risks requires careful scrutiny. What immediately stands out for me is the broker's lack of proper regulation. Despite operating in the financial markets for several years, XP Investimentos remains unregulated, which fundamentally means there are no formal oversight authorities ensuring client fund protection or monitoring their operational transparency. This alone significantly raises my level of caution since, without appropriate regulatory frameworks, recourse in the case of disputes or malpractice can be severely limited.

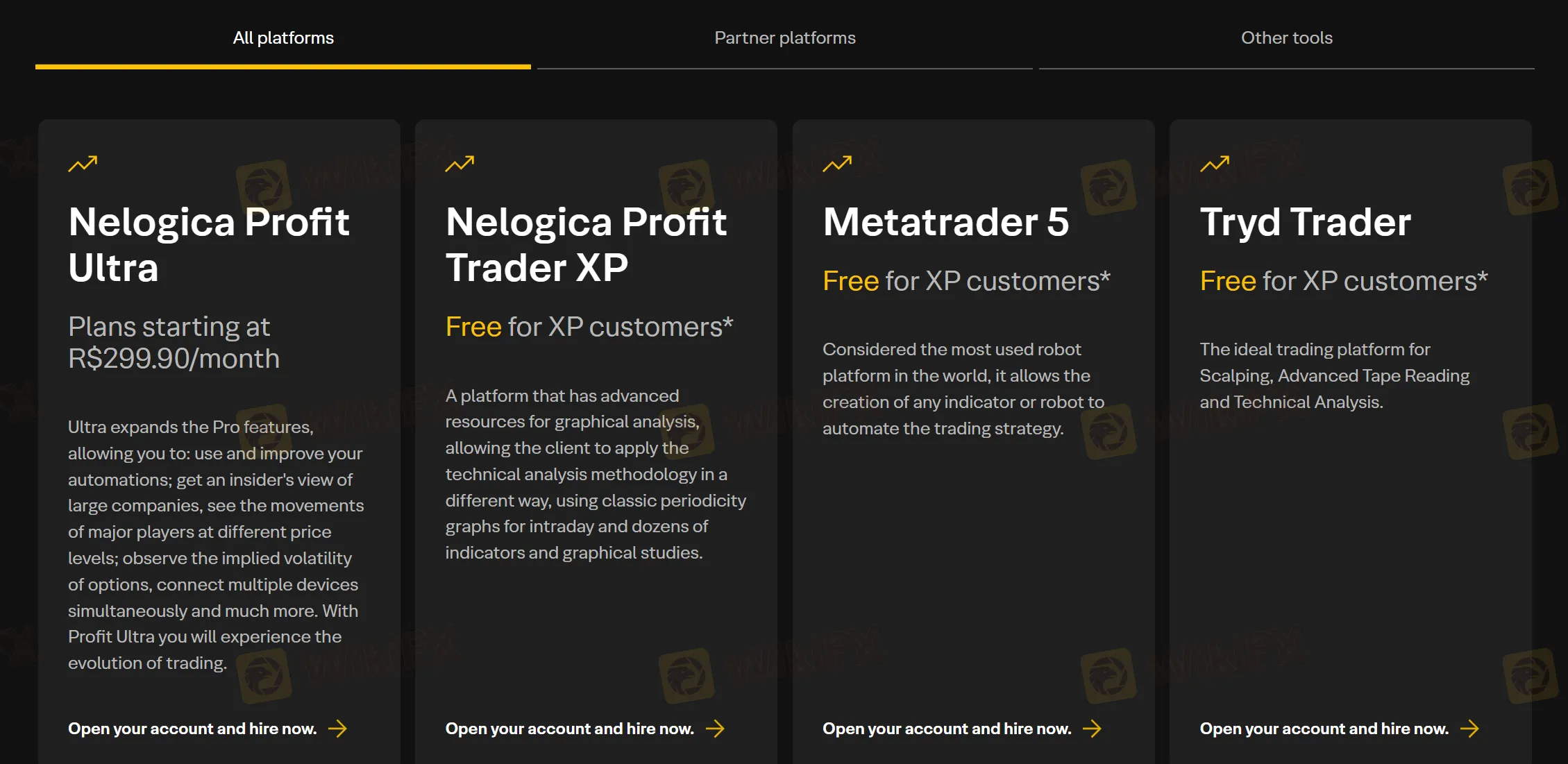

Another concern is the “suspicious regulatory license” flag, which prompts me to question the reliability and safety of trading activities with them. While they do offer a full MetaTrader 5 license and access to reputable trading platforms, I remind myself that good technology doesn’t substitute for clear legal safeguards.

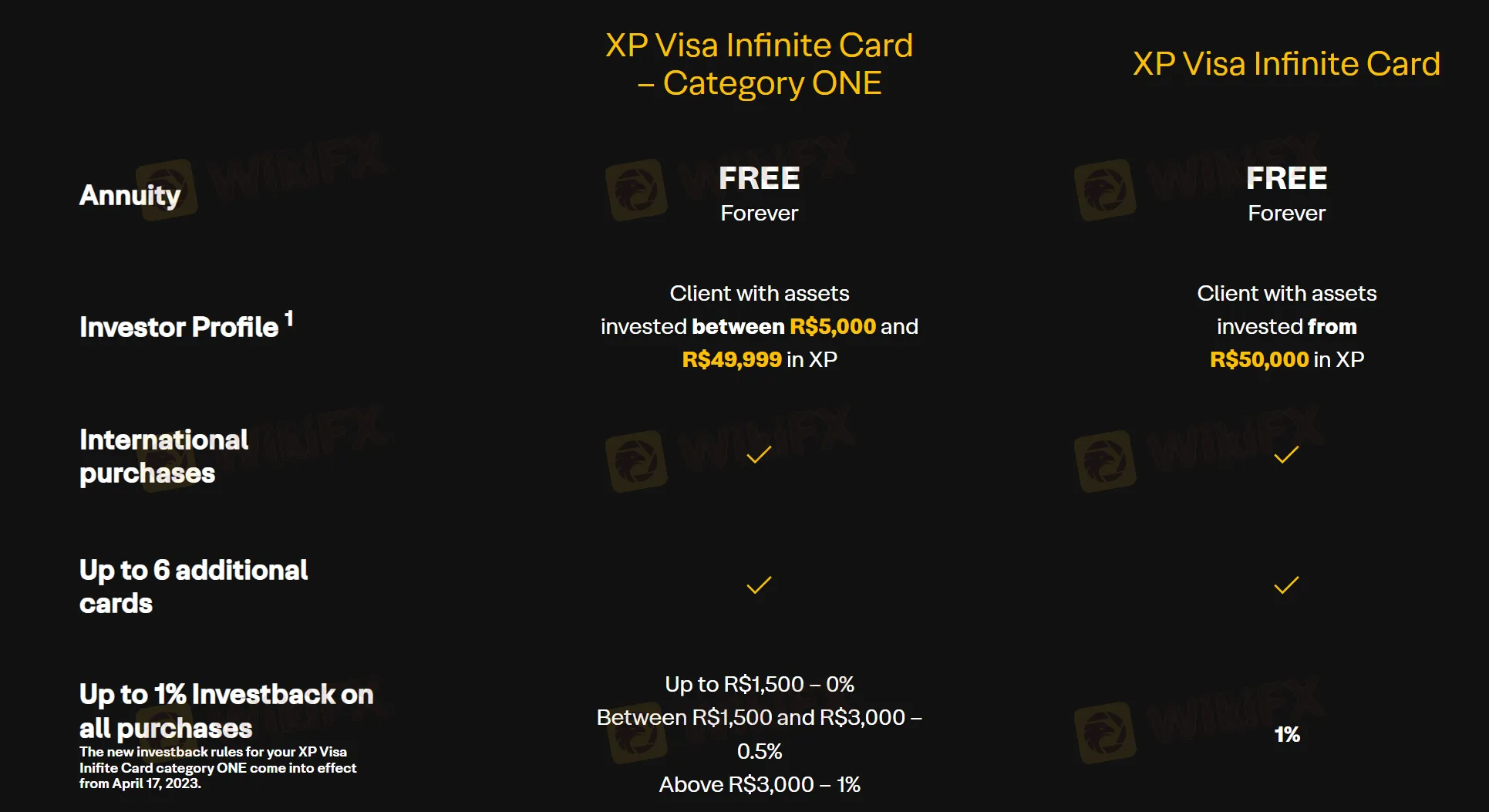

I also noticed certain fee structures, like international procurement fees ranging from 0.5% to 1%, which could impact trading costs, especially for cross-border activities. Although the broker touts a broad product range and some appealing features, such as investment rebates via their Visa Infinite Card, these benefits do not compensate for the absence of regulation. For me, a key risk is that clients are inherently exposed to greater financial vulnerabilities and, therefore, must practice a higher degree of due diligence. In summary, the unregulated status and ambiguous regulatory signals present the most critical downsides that, for me, outweigh the platform’s broader service offerings.

Rpy Sundram

1-2年

Does XP Investimentos apply any charges when you deposit or withdraw funds?

Based on my research and experience with brokers, including a close review of XP Investimentos, I was unable to find clear or explicit information regarding specific deposit or withdrawal fees charged by XP Investimentos in the provided context. This lack of transparency immediately raises a concern for me as a trader who prioritizes understanding all costs associated with moving funds in and out of a brokerage account. While XP Investimentos is known for a broad selection of services and even offers certain fee waivers for its Visa Infinite card, there is no detailed mention of charges related to account funding or withdrawals. From a risk management perspective, especially with XP Investimentos being an unregulated entity and flagged for high potential risk, I believe it is essential to approach with caution. In my view, before opening an account or transferring any funds, it would be wise for prospective clients to contact XP Investimentos directly, request written clarification on any potential deposit or withdrawal fees, and evaluate how this may impact overall trading costs. For me, clear and accessible fee information is a cornerstone of trustworthiness—its absence is a factor I weigh heavily when considering any broker.

Broker Issues

Withdrawal

Deposit

Ahmed Harb

1-2年

Which types of trading instruments can you access at XP Investimentos, such as stocks, forex, commodities, indices, or cryptocurrencies?

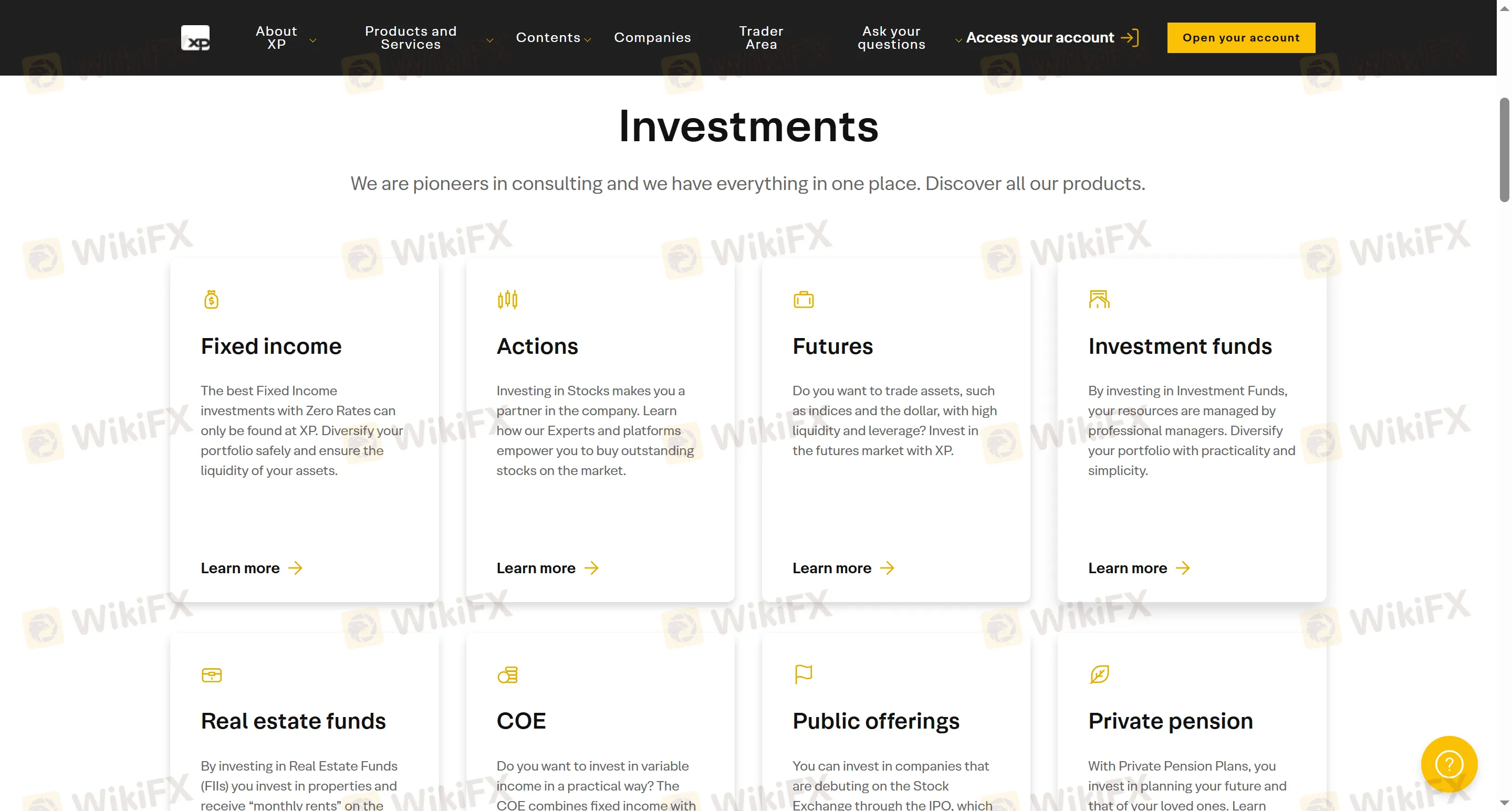

As an experienced trader who has reviewed and closely examined XP Investimentos, I can confirm that this broker provides access to a notably broad range of financial instruments, catering primarily to the Brazilian market. In my direct experience and observation, XP Investimentos stands out for its offering of traditional asset classes: traders can invest in fixed income products, stocks, futures, investment funds, and real estate funds (FIIs). These allow for a variety of strategies, from conservative allocation in bonds to more speculative plays in the equity and futures markets. Additionally, the firm provides access to structured products like COEs, which combine fixed and variable returns, as well as opportunities to participate in IPOs. Further, they offer private pension plans and life insurance, which, while not trading instruments in the conventional sense, may appeal to those looking for long-term financial planning.

However, I must note what is not supported: there is no mention of access to forex pairs, commodities, indices, or cryptocurrencies within their product suite. For me, this absence significantly narrows the broker’s suitability for globally minded traders or those eager to access diverse asset classes beyond Brazil’s main listed products. In summary, XP Investimentos is geared toward investors and traders focused on the Brazilian market, rather than those seeking comprehensive exposure to international forex, commodities, or crypto trading. This is an important factor I consider when evaluating any brokerage's fit for my trading objectives.

Broker Issues

Instruments

Platform

Leverage

Account

DoreenVanDenHeever

1-2年

How much do you need to deposit at a minimum to start a live trading account with XP Investimentos?

As an independent forex trader who’s worked with a variety of brokers, it’s always my priority to verify core details like minimum deposit requirements before funding any live trading account. In my thorough review of XP Investimentos, I found that their public materials, as summarized above, do not specify a clear minimum deposit amount for opening a standard live trading account. This absence of transparent information immediately stands out for me, especially when compared to international brokers that disclose clear entry thresholds.

From my experience, a reputable broker usually makes such foundational information visible up front, as it’s a critical part of financial planning and risk management for any trader. The lack of stated minimum deposit does not necessarily mean there is no minimum – instead, it could reflect policy flexibility or perhaps a focus on higher-net-worth accounts, but in either case, I would treat the situation cautiously. I would not proceed with deposits or larger financial commitments without direct and official confirmation from XP Investimentos about their minimum deposit conditions. For me, this level of conservatism is necessary—especially since, in this case, the broker is not regulated by a recognized authority, which only increases the need for extra due diligence. I always recommend reaching out directly to their customer support and getting explicit, up-to-date information before committing funds. This approach is essential for safeguarding both my capital and my peace of mind as a trader.

Broker Issues

Withdrawal

Deposit