Company Summary

| XP Investimentos Review Summary | |

| Registered On | 5-10 years |

| Registered Country/Region | Brazil |

| Regulation | Unregulated |

| Products and Services | Fixed income products, Futures, Stocks, Investment funds, Real estate funds (FIIs), COE, IPO, Private pension plans, and Life insurance |

| Demo Account | ✅ |

| Leverage | / |

| Spread | / |

| Trading Platform | Nelogica Profit Ultra, Metatrader 5, Tryd Trader, and Nelogica Profit Trader XP |

| Min Deposit | / |

| Customer Support | WhatsApp: +55 11 4935-2720 |

| 0800-772-02020800-000-0078 | |

| oficios@xpi.com.br (Ombudsman) | |

XP Investimentos Information

XP Investimentos is a comprehensive financial services platform that not only offers a wide range of investment products and services but also provides convenient and efficient investment experiences for individual and corporate clients. In terms of products, it covers various asset classes, from traditional stock and bond investments to emerging futures and investment funds. In terms of services, it has launched digital account services for corporate clients.

Pros and Cons

| Pros | Cons |

| Multiple products and services | Unregulated |

| Low threshold for XP Empresas | International procurement fees (0.5% - 1%) |

| XP Visa Infinite Card with permanent annual fee waiver | |

| MT5 available |

Is XP Investimentos Legit?

XP Investimentos has operated in the financial market for many years, but it is not regulated. Traders are always advised to choose investment firms with formal financial licenses and regulatory.

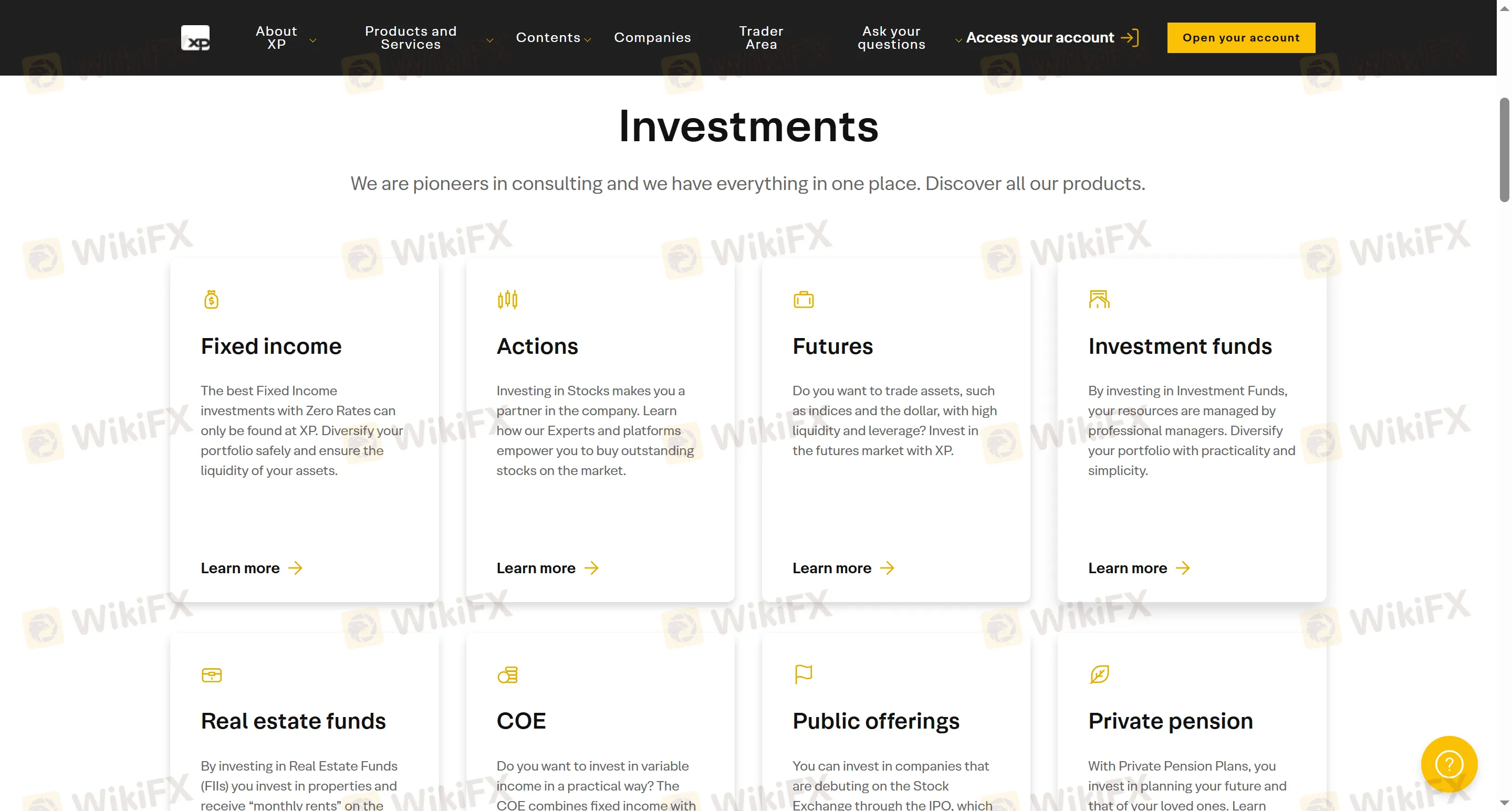

What Products and Services Does XP Investimentos Provide?

At XP Investimentos, you can trade multiple types of assets and services, including fixed income products, stocks, futures, investment funds, real estate funds (FIIs), and other investment products such as COE (combining fixed income and variable income), public offering stocks (IPO), private pension plans, life insurance, etc.

| Products and Services | Supported |

| Fixed income products | ✔ |

| Futures | ✔ |

| Stocks | ✔ |

| Investment funds | ✔ |

| Real estate funds (FIIs) | ✔ |

| COE | ✔ |

| IPO | ✔ |

| Private pension plans | ✔ |

| Life insurance | ✔ |

Account Type

Through investment accounts at XP Investimentos, traders can invest in fixed-income and variable income applications. With digital accounts, users can handle daily transactions such as paying bills, sending and receiving PIX and TED transfers, and receiving salaries.

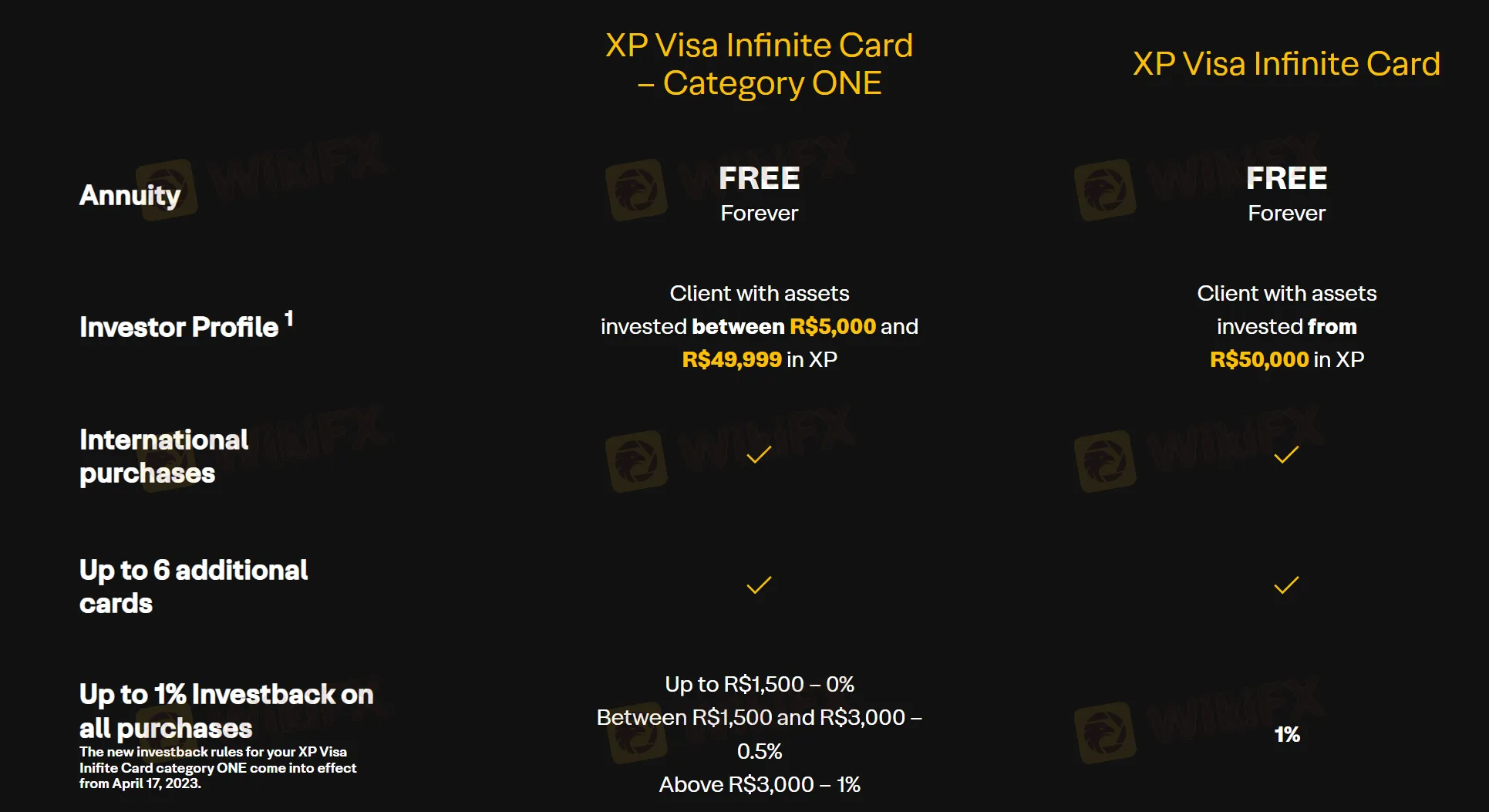

XP Investimentos Fees

The XP Visa Infinite Card - Category One and the XP Visa Infinite Card both offer free annual fees, and customers can receive an investment rebate of up to 1% on all purchases. For the XP Visa Infinite Card - Category One, the investment rebate rates are as follows: 0% for purchases under R$1,500; 0.5% for purchases between R$1,500 and R$3,000; 1% for purchases over R$3,000.

Trading Platform

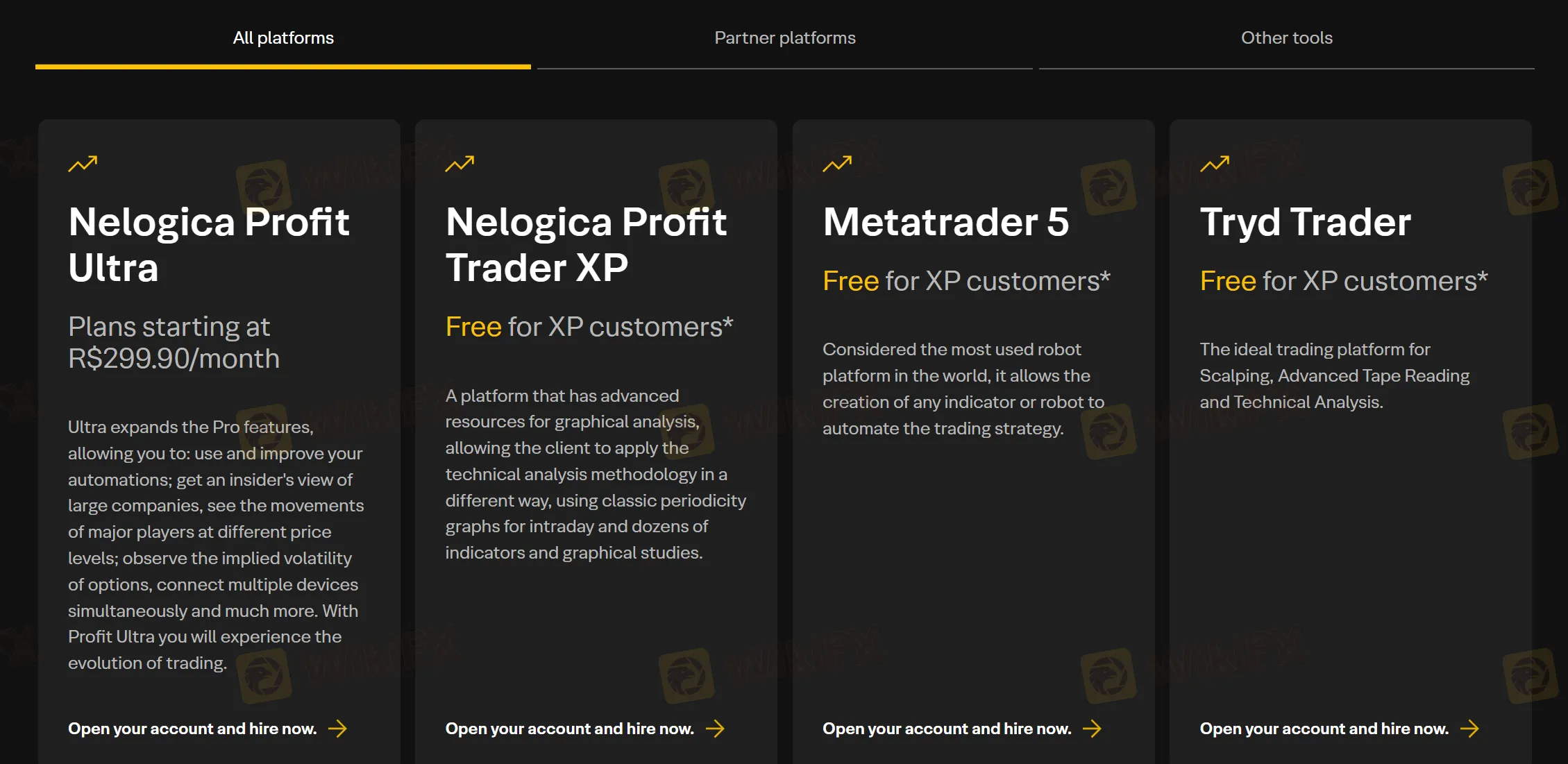

XP Investimentos offers Nelogica Profit Ultra starting at a monthly fee of R$299.90, as well as the globally widely used trading platforms Metatrader 5, Tryd Trader, and Nelogica Profit Trader XP.

| Trading Platform | Supported |

| Nelogica Profit Ultra | ✔ |

| Metatrader 5 | ✔ |

| Tryd Trader | ✔ |

| Nelogica Profit Trader XP | ✔ |