公司简介

| ABX评论摘要 | |

| 注册日期 | 1999-02-26 |

| 注册国家/地区 | 澳大利亚 |

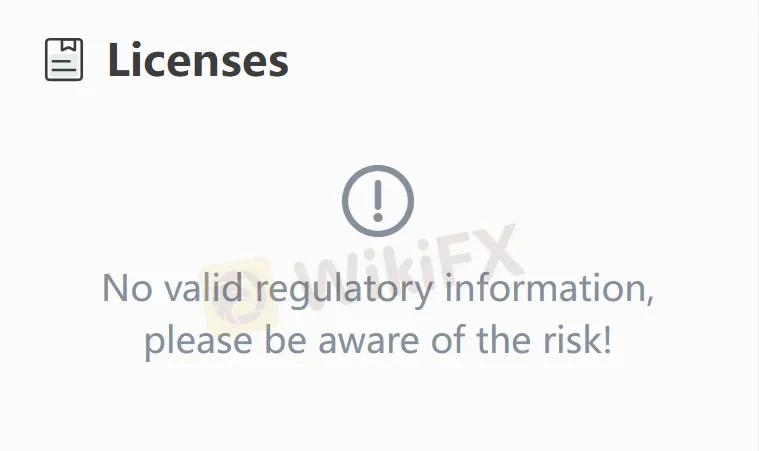

| 监管 | 未受监管 |

| 市场工具 | 黄金、白银和铂金 |

| 交易平台 | MetalDesk |

| 客户支持 | 电话:+61 7 3211 5007(澳大利亚) |

| 电话:+66 (0)2 231 8171(泰国) | |

| 电话:+852 3956 7193(香港) | |

| 电话:+357 25262656(塞浦路斯) | |

| 传真:+61 7 3236 1106(澳大利亚) | |

| 传真:+852 3956 7100(香港) | |

| 传真:+357 25560815(塞浦路斯) | |

| 电子邮件:info@abx.com | |

| 领英、Facebook、Twitter | |

ABX 信息

Allocated Bullion Exchange (ABX) 是一家全球电子交易所,专门从事实物贵金属交易。通过其自主开发的MetalDesk平台,ABX 连接了全球七个主要交易中心,提供黄金、白银和铂金等定向实物贵金属交易服务。该平台为整个行业链的参与者提供高效的交易解决方案,从矿工到投资者。

优点和缺点

| 优点 | 缺点 |

| 全球交易多样化的黄金、白银和铂金 | 未受监管仅限贵金属 |

| 对某些产品存在较高的准入壁垒(例如,最低交易单位为25,000盎司的白银) |

ABX 是否合法?

ASIC 对 ABX 进行监管,但实际上并非如此。建议交易者向ASIC监管机构核实此声明的真实性。

ABX 可以交易什么?

在 ABX 平台上,投资者可以交易各种实物贵金属产品,包括黄金、白银和铂金。