公司简介

| India Advantage 评论摘要 | |

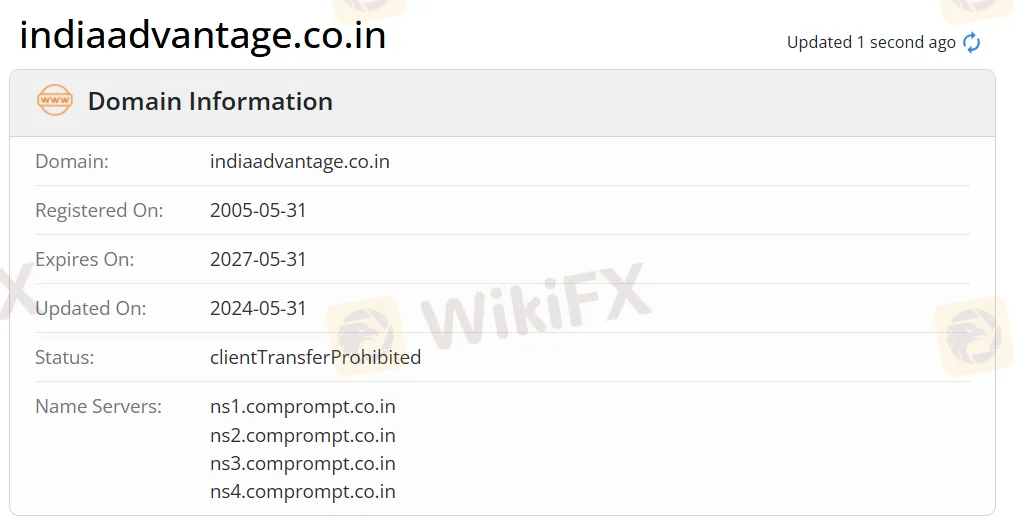

| 成立时间 | 2005 |

| 注册国家/地区 | 印度 |

| 监管 | 无监管 |

| 市场工具 | 股票、衍生品(期货与期权)、货币、大宗商品 |

| 模拟账户 | ❌ |

| 交易平台 | / |

| 最低存款 | / |

| 客户支持 | 联系表单 |

| 电话:+91-022-6616 8800 | |

| 电子邮件:contact@indiaadvantage.co.in | |

| 社交媒体:Facebook、LinkedIn、Whatsapp | |

| 地址:Mumbai - 400 067,Kandivli(西),Kandivli Station对面,Vasanji Lalji Road,Om Plaza 4楼 | |

India Advantage 信息

India Advantage 是印度证券交易所的一家未受监管的高级经纪和金融服务提供商。它提供股票、衍生品(期货与期权)、货币、大宗商品、投资咨询和交易产品与服务。

优缺点

| 优点 | 缺点 |

| 多种联系渠道 | 无演示 账户 |

| 多样化产品与服务 | 无MT4/MT5平台 |

| 营运时间长 | 缺乏监管 |

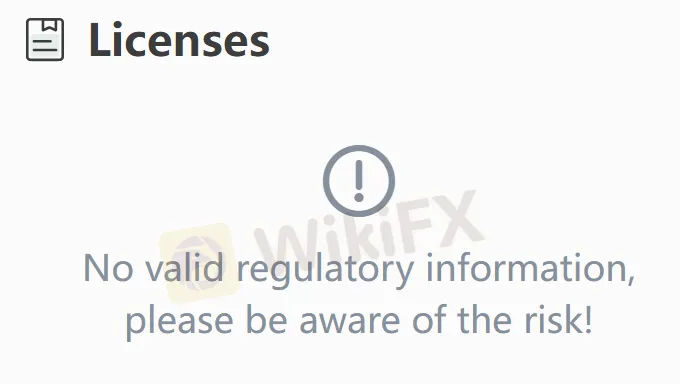

India Advantage 是否合法?

编号 India Advantage 目前 没有有效的监管。请注意风险!

我可以在 India Advantage 上交易什么?

| 交易资产 | 支持 |

| 货币 | ✔ |

| 大宗商品 | ✔ |

| 股票 | ✔ |

| 衍生品 (期权) | ✔ |

| 指数 | ❌ |

| 股票 | ❌ |

| 加密货币 | ❌ |

| 债券 | ❌ |

| 期权 | ❌ |

| 交易所交易基金 (ETFs) | ❌ |

账户类型

该经纪商提供 股票交易账户、大宗商品交易账户、衍生品交易账户和货币交易账户,但详细信息尚未定义。