Davis Wu

1-2年

In what ways does ALKHAIR CAPITAL’s regulatory status help safeguard my funds?

In my assessment as an experienced trader, ALKHAIR CAPITAL’s current regulatory status offers little to no safeguard for client funds. The broker is noted as operating without any valid regulatory oversight, which immediately raises concerns for me regarding the security and segregation of client deposits, dispute resolution, and overall transparency. Over the years, I’ve learned that regulatory supervision is a fundamental measure of protection—it helps ensure that brokers adhere to established financial standards, maintain proper capital reserves, and are subject to regular audits. The absence of this framework at ALKHAIR CAPITAL means there is no independent authority holding them accountable for fair practices or investigating client complaints.

The lack of a demo account further limits my ability to test their platform or withdrawal processes without committing significant funds upfront. Compounding this, I noticed reported user experiences alleging misconduct and high-pressure tactics, which would not be tolerated in a regulated environment. For me, such a high-risk profile and lack of a regulatory backstop would lead me to exercise extreme caution. I would personally avoid depositing funds with a broker in this situation, as the potential recovery avenues are minimal should issues arise. Ultimately, in my trading journey, I prioritize brokers with robust, transparent regulatory oversight because it gives me confidence in the safety of my capital.

Prash_007

1-2年

Does ALKHAIR CAPITAL impose any undisclosed charges on deposits or withdrawals?

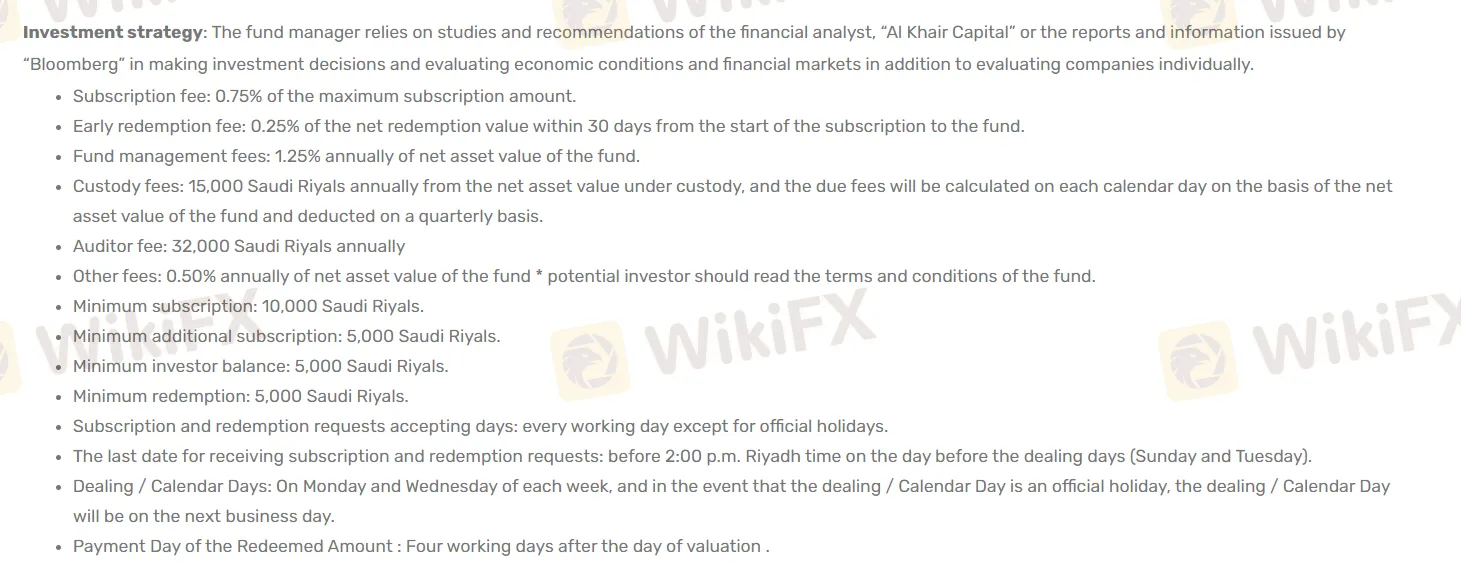

Based on my thorough review of ALKHAIR CAPITAL’s public disclosures and fee breakdowns, I have not found any explicit reference to hidden or undisclosed charges specifically tied to deposits or withdrawals. The broker outlines its fees for fund management, custody, auditing, and subscriptions quite clearly, with detailed percentages and annual minimums for each fund. However, I noticed that the overall transparency on operational charges appears limited. There is no dedicated breakdown or terms concerning transaction-specific costs such as deposit or withdrawal fees, which makes it difficult for me, as a cautious trader, to fully rule out the possibility of additional costs emerging during the actual funding or withdrawal process.

My experience has taught me to be especially careful when a broker lacks regulatory oversight or holds a “high potential risk” label, as is the case with ALKHAIR CAPITAL. The absence of regulation heightens the importance of written fee schedules and explicit terms, since there is no external authority ensuring full clarity or recourse for hidden costs.

Given the elevated minimum deposit, absence of demo accounts, and a user review alleging questionable practices, I would advise anyone—myself included—to obtain written confirmation from ALKHAIR CAPITAL about all possible charges before transacting. While nothing in their materials confirms undisclosed deposit or withdrawal fees, the lack of regulatory protection and granular fee detail means I proceed only with significant caution.

Broker Issues

Fees and Spreads

x1250

1-2年

What is the highest leverage provided by ALKHAIR CAPITAL for major currency pairs, and how does this leverage differ across other asset types?

Based on my experience and analysis of ALKHAIR CAPITAL, I was unable to find any specific information regarding leverage levels for major currency pairs or other asset types. For me, this omission is a significant point of concern, especially given that most regulated brokers are transparent about leverage to help traders make informed risk decisions. In my years of trading, I have learned that lack of clarity around leverage, especially when combined with an unregulated status—as is the case with ALKHAIR CAPITAL—raises serious red flags about both transparency and client safety.

Without confirmation of legitimate regulatory oversight, I cannot verify what, if any, leverage is available, nor whether it would differ between forex and other instruments like equities or funds. This makes it difficult to assess potential risk and suitability for individual strategies. Transparency over leverage is not just a convenience—it's vital for responsible risk management and informed position sizing. While ALKHAIR CAPITAL does provide various investment and brokerage services, the lack of publicly disclosed leverage details contributes further to my cautious stance. For anyone considering them, I strongly recommend demanding explicit leverage information and prioritizing strict due diligence before funding an account.

Broker Issues

Leverage

Instruments

Platform

Account

Aman A

1-2年

Does ALKHAIR CAPITAL charge a commission for each lot traded on their ECN or raw spread accounts?

Having closely reviewed the information available about ALKHAIR CAPITAL, I have some serious reservations based on my trading experience. One of the first things I look for in any broker is detailed fee transparency and credible regulation. ALKHAIR CAPITAL stands out to me because it is completely unregulated as per current information, which introduces significant risk. For someone like me who values safety and oversight, this alone is a red flag.

Regarding commissions per lot on ECN or raw spread accounts, I found no evidence that ALKHAIR CAPITAL even offers typical ECN or raw spread trading conditions familiar from mainstream forex brokers. Instead, their fee structure appears tailored to investment funds, asset management, and custody services rather than straightforward commission-based forex trading. Most of their charges are framed as management, custody, and subscription fees, not transaction-based commissions per traded lot. Their platforms, Pro10Plus and DFNPro9, are also more aligned with proprietary solutions rather than standard MT4/MT5 ECN environments.

In my view, the lack of both regulatory clarity and explicit information about trading commissions is a significant concern. As a rule, I avoid brokers with this level of opacity—especially when trading costs are not explicitly spelled out. For anyone contemplating trading with ALKHAIR CAPITAL, extreme caution is warranted.

Broker Issues

Fees and Spreads