Company Summary

| ALKHAIR CAPITAL Review Summary | |

| Founded | 2009 |

| Registered Country/Region | Kingdom of Saudi Arabia |

| Regulation | No regulation |

| Services | Investment banking, custody & brokerage, asset management, trading software, research services |

| Demo Account | ❌ |

| Trading Platform | Pro10Plus, DFNPro9 |

| Minimum Deposit | SR 10,000 |

| Customer Support | Contact form |

| Tel: +966 11 215 5607 | |

| Email: info@alkhaircapital.com.sa | |

| Fax: +966 11 219 1270 | |

| Address: P.O Box 69410, Quara holding building Kingdom of Saudi Arabia , King Abdulaziz Road, Al Wizarat District | |

| Social media: X, LinkedIn | |

ALKHAIR CAPITAL Information

ALKHAIR CAPITAL is an unregulated service provider of premier brokerage and financial services, which was founded in KSA in 2009. It offers products and services for investment banking, custody & brokerage, asset management, trading software, and research services.

Pros and Cons

| Pros | Cons |

| Long operation time | Lack of regulation |

| Various contact channels | No demo accounts |

| Various financial services | High minimum deposit requirement |

| Trading fees applied | |

| Subscription fees charged |

Is ALKHAIR CAPITAL Legit?

No. ALKHAIR CAPITAL currently has no valid regulations. Please be aware of the risk!

ALKHAIR CAPITAL Services

| Services | Supported |

| Custody & brokerage | ✔ |

| Investments funds | ✔ |

| Sukuk | ✔ |

| Brokerage services | ✔ |

| Asset management | ✔ |

| Investment banking | ✔ |

| Research services | ✔ |

| Trading software | ✔ |

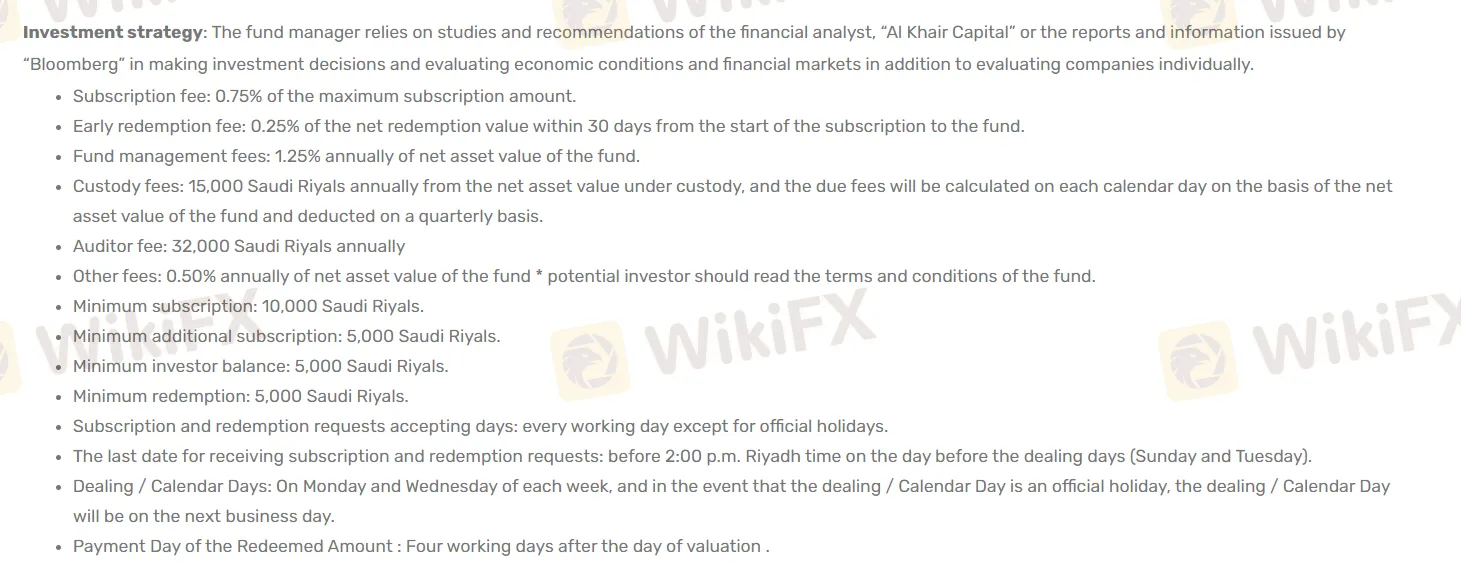

ALKHAIR CAPITAL Fees

| Types of funds | Management Fees | Custody fees | Auditors fees | Other Fees | Redemption Fees |

| Alkhair Capital Murabaha Fund | 0.25% per annum | 15,000 Saudi riyals | 32,000 Saudi riyals per annum | Maximum 0.45% per annum | ❌ |

| Alkhair Capital Sukuk Plus Fund | 0.75% per annum | 15,000 SAR annually | 8,533.33 $ per year | 0.5% per annum | 1% first year, 0.75% second year, 0.5% third year, and no fees after the third year |

| Alkhair Capital Saudi Equity Fund | 1.25% per annum | 15,000 Saudi Riyals Annually | 32,000 Saudi Riyals annually | 0.75% per annually | / |

| Alkhair Capital IPOs Fund | 1.25% annually | 15,000 Saudi Riyals annually | 32,000 Saudi Riyals annually | 0.50% annually | / |

Trading Platform

| Trading Platform | Supported | Available Devices |

| Pro10Plus | ✔ | Mobile, desktop |

| DFNPro9 | ✔ | Mobile, desktop |

Deposit and Withdrawal

| Types of Funds | Minimum Subscription |

| Alkhair Capital Murabaha Fund | SR 10,000 |

| Alkhair Capital Sukuk Plus Fund | USD 10,000 |

| Alkhair Capital Saudi Equity Fund | SR 10,000 |

| Alkhair Capital IPOs Fund | SR 10,000 |