회사 소개

| ALKHAIR CAPITAL 리뷰 요약 | |

| 설립 연도 | 2009 |

| 등록 국가/지역 | 사우디 아라비아 왕국 |

| 규제 | 규제 없음 |

| 서비스 | 투자은행, 보관 및 중개, 자산 관리, 거래 소프트웨어, 연구 서비스 |

| 데모 계정 | ❌ |

| 거래 플랫폼 | Pro10Plus, DFNPro9 |

| 최소 입금액 | SR 10,000 |

| 고객 지원 | 문의 양식 |

| 전화: +966 11 215 5607 | |

| 이메일: info@alkhaircapital.com.sa | |

| 팩스: +966 11 219 1270 | |

| 주소: P.O Box 69410, Quara holding building Kingdom of Saudi Arabia , King Abdulaziz Road, Al Wizarat District | |

| 소셜 미디어: X, LinkedIn | |

ALKHAIR CAPITAL 정보

ALKHAIR CAPITAL는 2009년 사우디 아라비아에서 설립된 프리미어 중개 및 금융 서비스의 규제되지 않은 서비스 제공업체입니다. 투자은행, 보관 및 중개, 자산 관리, 거래 소프트웨어 및 연구 서비스에 대한 제품 및 서비스를 제공합니다.

장단점

| 장점 | 단점 |

| 운영 시간이 길다 | 규제 부족 |

| 다양한 연락 수단 | 데모 계정 없음 |

| 다양한 금융 서비스 | 높은 최소 입금 요구 |

| 거래 수수료 부과 | |

| 구독료 부과 |

ALKHAIR CAPITAL 합법적인가요?

No. ALKHAIR CAPITAL 현재 유효한 규정이 없습니다. 리스크를 인식해주십시오!

ALKHAIR CAPITAL 서비스

| 서비스 | 지원 |

| 보관 및 중개 | ✔ |

| 투자 펀드 | ✔ |

| 수쿡 | ✔ |

| 중개 서비스 | ✔ |

| 자산 관리 | ✔ |

| 투자 은행 | ✔ |

| 연구 서비스 | ✔ |

| 거래 소프트웨어 | ✔ |

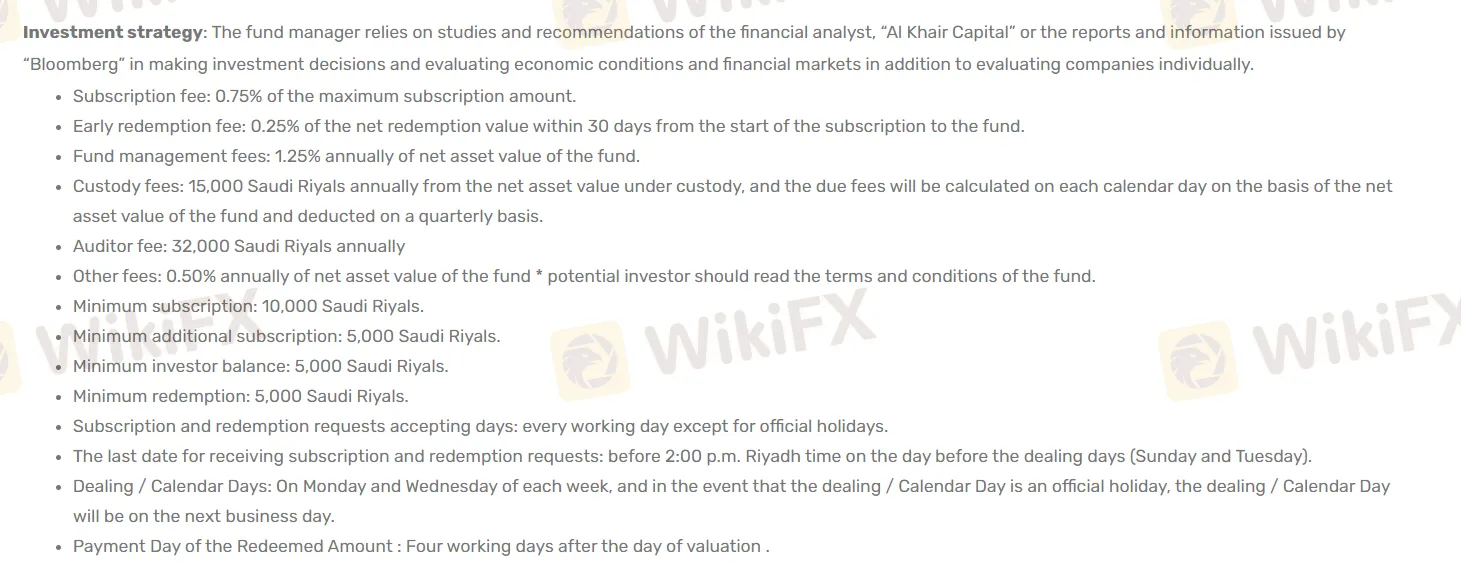

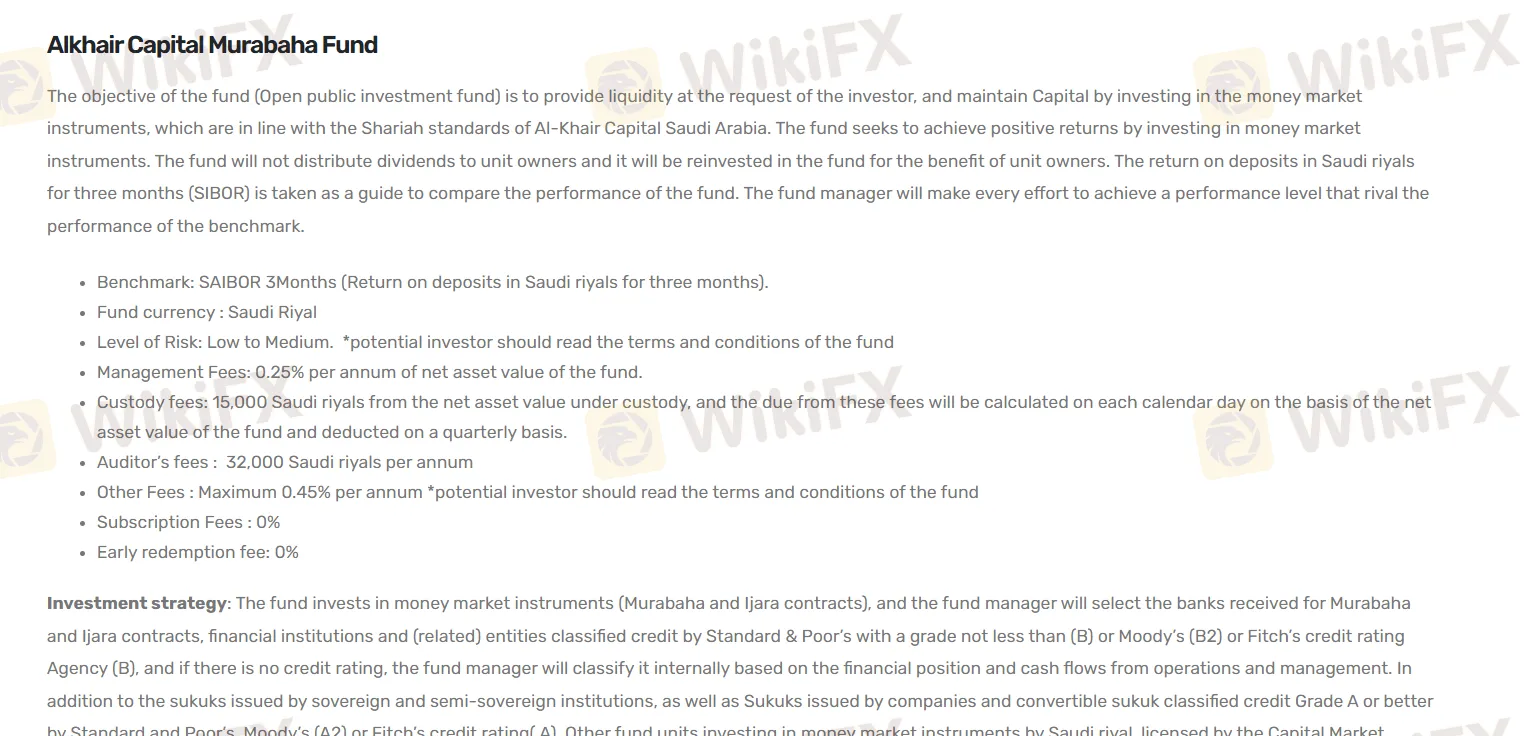

ALKHAIR CAPITAL 수수료

| 펀드 유형 | 관리 수수료 | 보관 수수료 | 감사 수수료 | 기타 수수료 | 상환 수수료 |

| Alkhair Capital Murabaha Fund | 연 0.25% | 15,000 사우디 리얄 | 연 32,000 사우디 리얄 | 연 최대 0.45% | ❌ |

| Alkhair Capital Sukuk Plus Fund | 연 0.75% | 연 15,000 사우디 리얄 | 연 8,533.33 달러 | 연 0.5% | 1년 1%, 2년 0.75%, 3년 0.5%, 3년 이후 수수료 없음 |

| Alkhair Capital Saudi Equity Fund | 연 1.25% | 연 15,000 사우디 리얄 | 연 32,000 사우디 리얄 | 연 0.75% | / |

| Alkhair Capital IPOs Fund | 연 1.25% | 연 15,000 사우디 리얄 | 연 32,000 사우디 리얄 | 연 0.50% | / |

거래 플랫폼

| 거래 플랫폼 | 지원 | 사용 가능한 장치 |

| Pro10Plus | ✔ | 모바일, 데스크톱 |

| DFNPro9 | ✔ | 모바일, 데스크톱 |

입금 및 출금

| 펀드 유형 | 최소 구독 |

| Alkhair Capital Murabaha Fund | SR 10,000 |

| Alkhair Capital Sukuk Plus Fund | USD 10,000 |

| Alkhair Capital Saudi Equity Fund | SR 10,000 |

| Alkhair Capital IPOs Fund | SR 10,000 |