公司簡介

| QNB FINANSINVEST 評論摘要 | |

| 成立年份 | 2016 |

| 註冊國家/地區 | 土耳其 |

| 監管 | 未受監管 |

| 產品與服務 | 投資產品、股票交易、外匯、海外投資交易、VIOP、債券、認股權證、場外衍生品、共同基金交易、交易所交易基金交易和投資諮詢 |

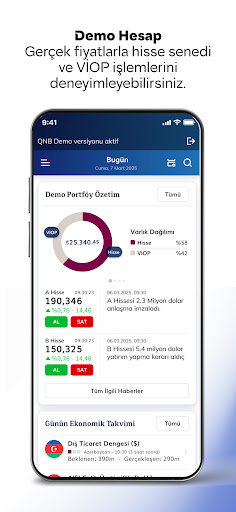

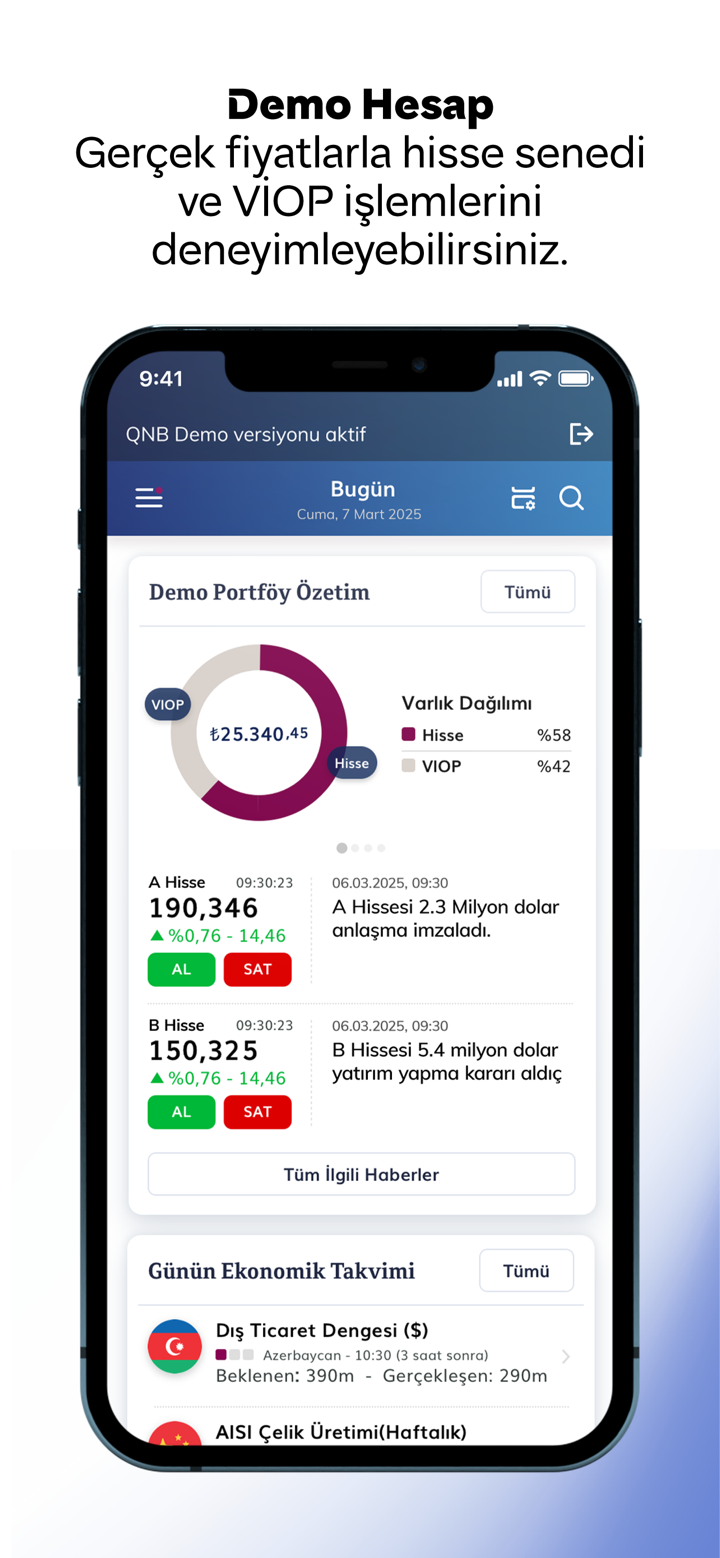

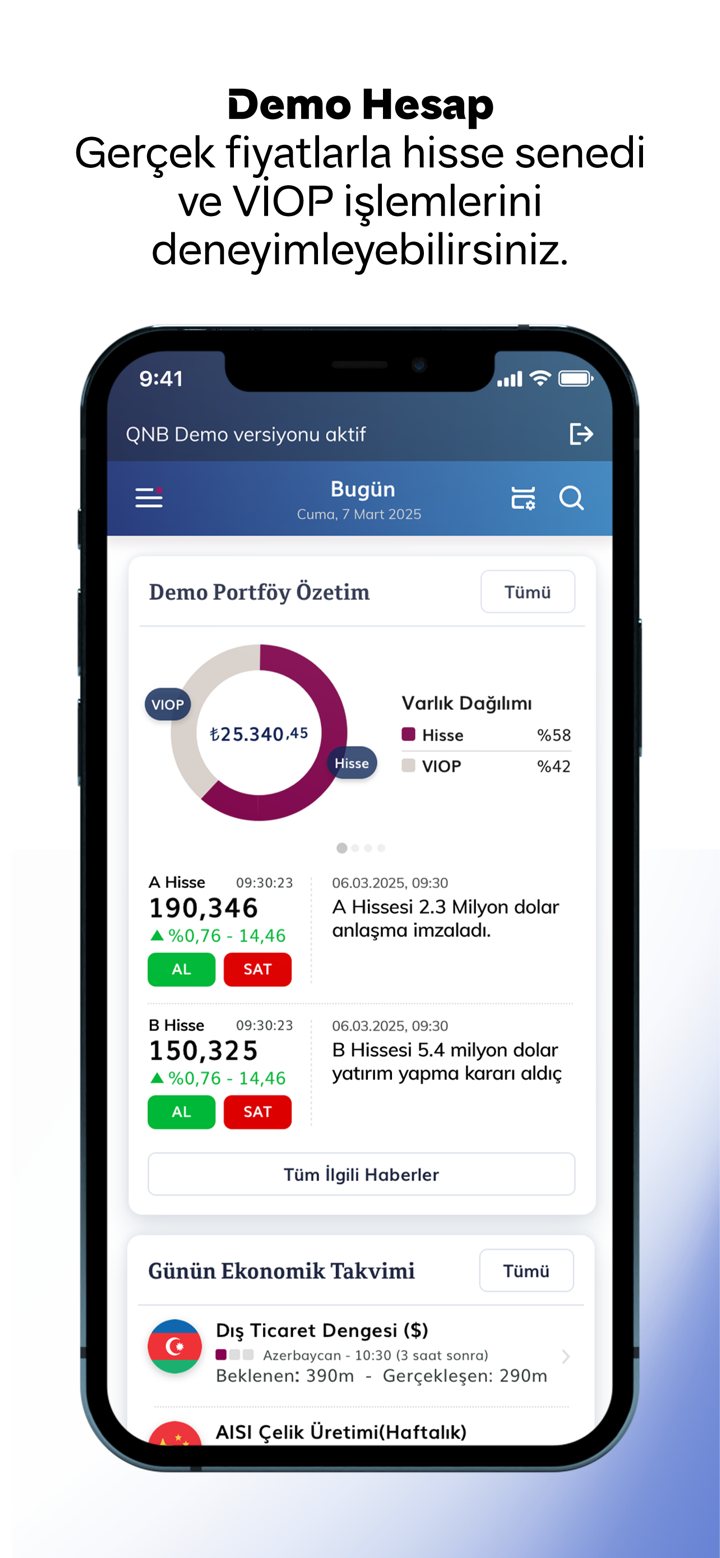

| 模擬帳戶 | ❌ |

| 槓桿 | / |

| 點差 | / |

| 交易平台 | QNB Invest |

| 最低存款 | / |

| 客戶支援 | 在線聊天 |

| 電話:+90 212 336 7373 | |

| 電子郵件:webinfo@qnbfi.com | |

| Twitter、Facebook、Instagram、YouTube和Linkedin | |

| Esentepe Mah. Büyükdere Cad. Kristal Kule Binası No: 215 Kat: 6-7 34394 Şişli / İstanbul | |

QNB Finansinvest成立於2016年,總部位於土耳其,是一家為客戶提供多樣化服務和產品的金融機構。作為QNB集團的子公司,QNB Finansinvest從其母公司中東和非洲地區領先的金融機構之一,擁有超過1500億美元的資產,從其母公司的實力和穩定性中受益。

QNB Finansinvest專注於投資組合管理、投資諮詢、財富管理、投資銀行、固定收益、證券和共同基金,為個人和企業客戶提供服務。自1996年成立以來,該公司在資本市場活動方面已累積了超過25年的經驗。

優點和缺點

| 優點 | 缺點 |

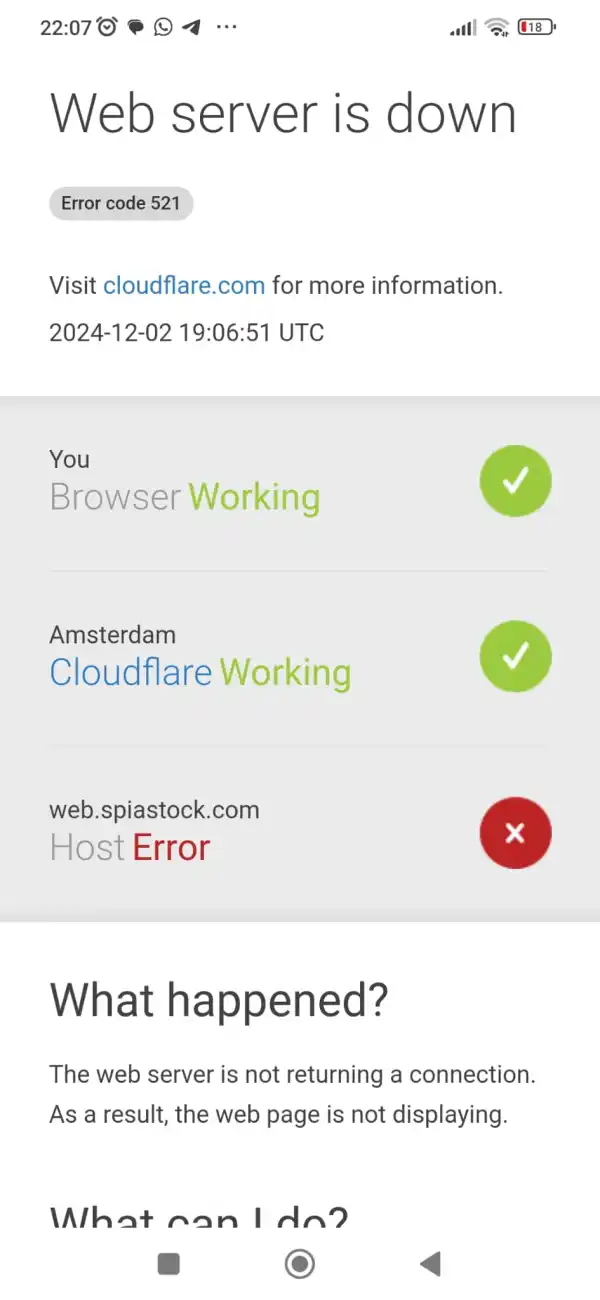

| 多樣的產品和服務 | 網站無法訪問 |

| 在線聊天支援 | 未受監管 |

| 無模擬帳戶 | |

| 交易條件的信息有限 | |

| 不支援MT4/5 |

QNB FINANSINVEST 是否合法?

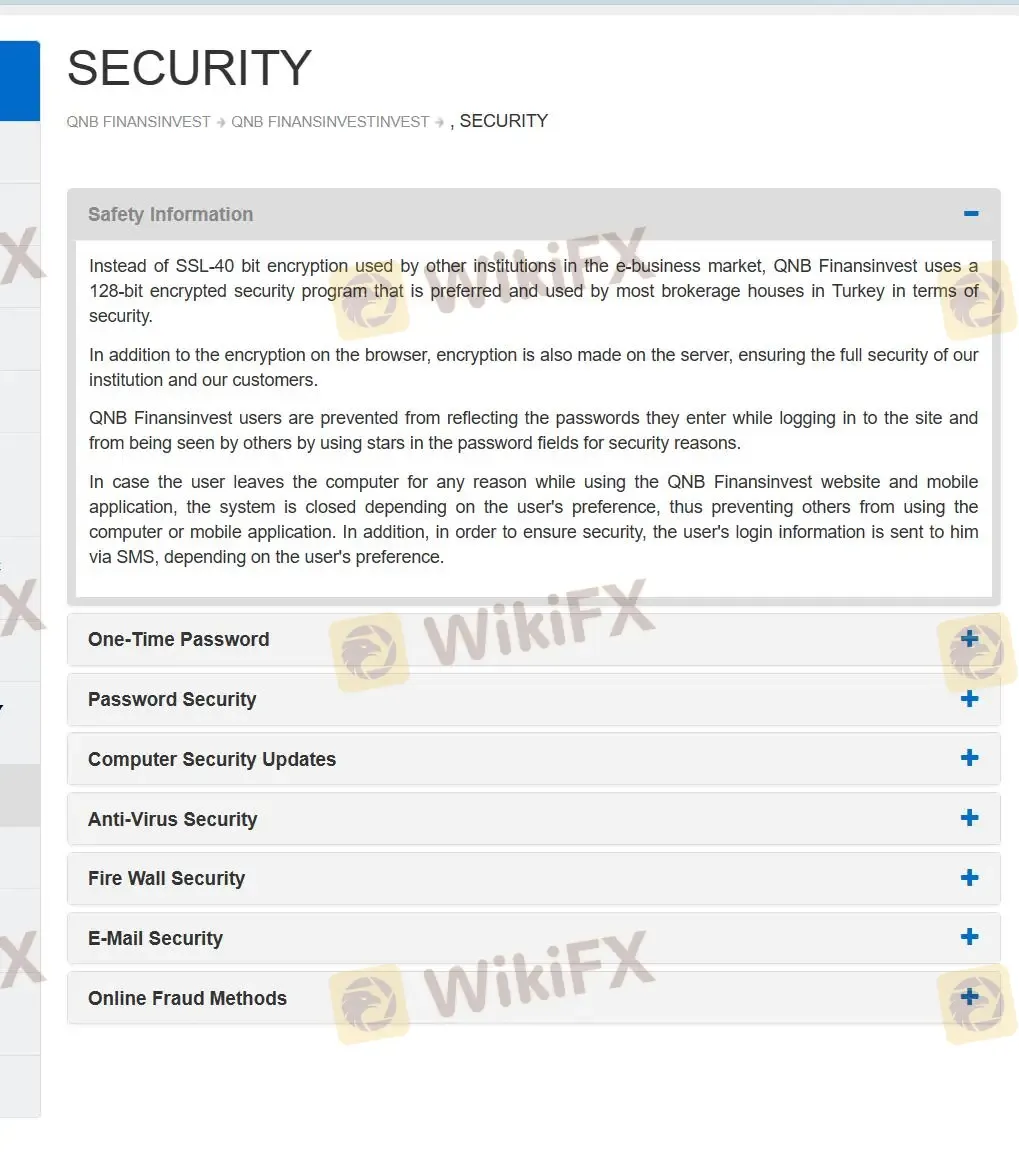

QNB Finansinvest聲稱提供安全措施。他們強調他們的128位加密安全程序優於其他電子商務市場上的標準SSL-40位加密,並突出了該技術在土耳其主要券商中的廣泛應用。這種加密技術被吹捧為行業標準,為在其平台上交換的敏感信息提供了增強的保護。

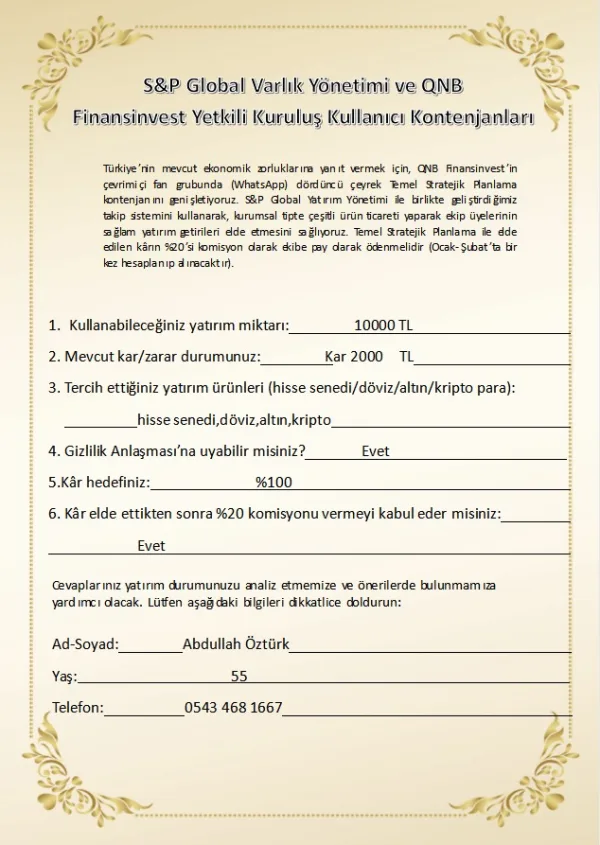

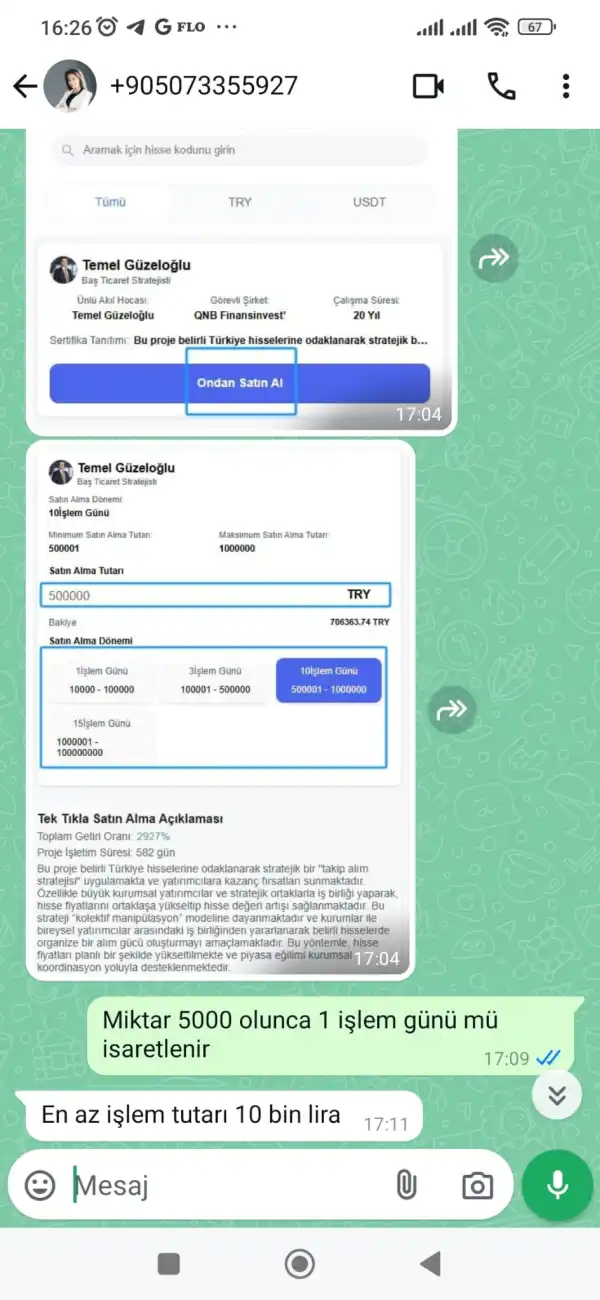

然而,QNB Finansinvest的運營缺乏有效的監管法規,這是一個值得關注的問題。缺乏政府或金融監管機構的監督,投資者面臨著固有的風險。缺乏監管監督意味著沒有外部機構確保符合行業標準、最佳實踐和法律要求。因此,投資者容易受到潛在的剝削,因為缺乏監管留下了濫用和欺詐行為的空間。

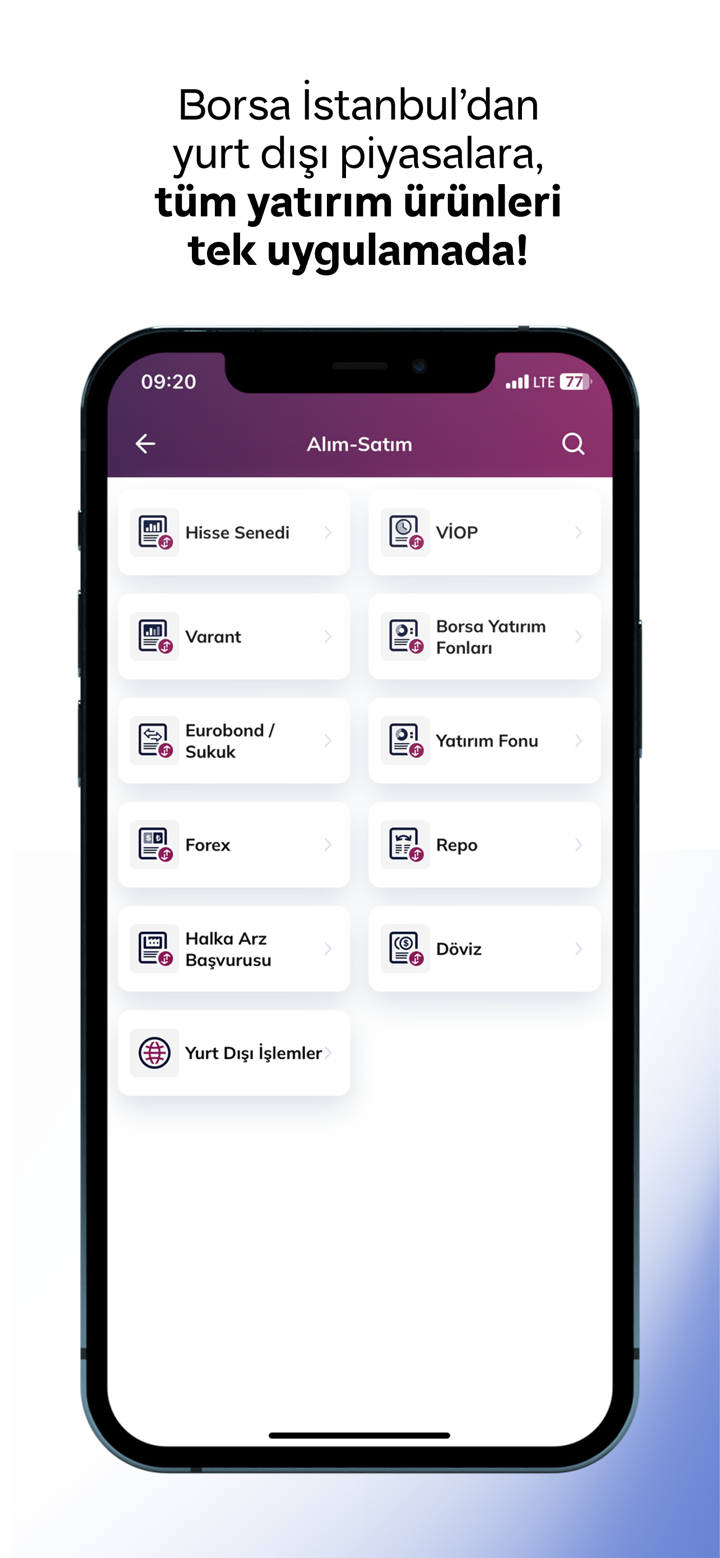

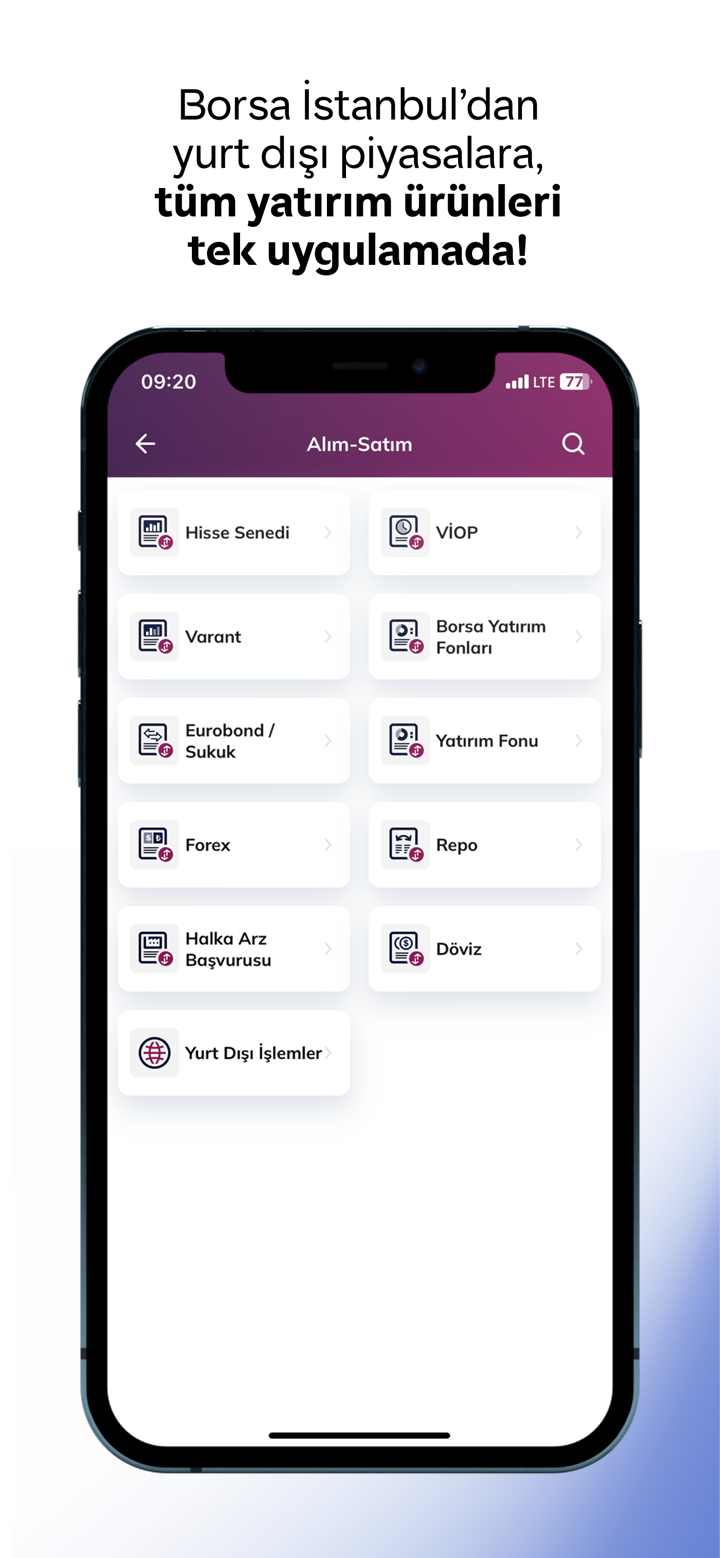

產品和服務

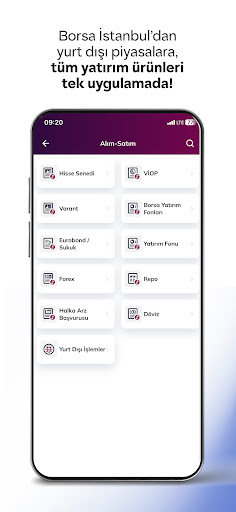

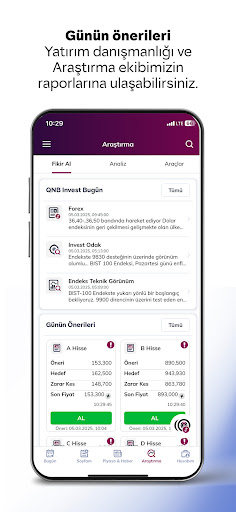

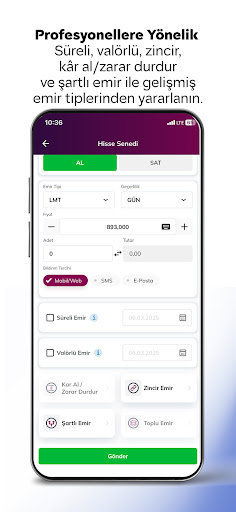

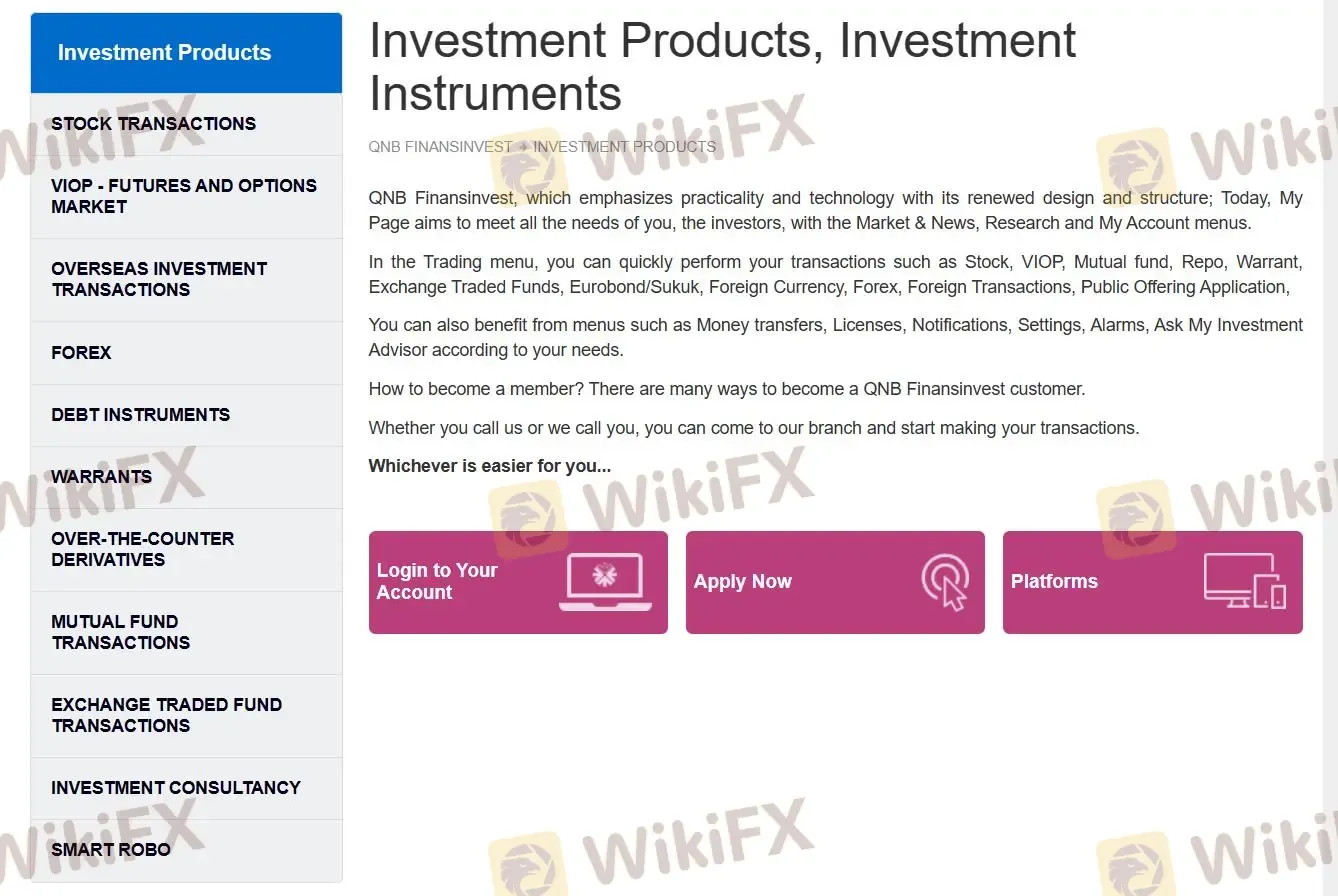

QNB FINANSINVEST提供各種投資產品和服務,包括投資產品、股票交易、外匯、海外投資交易、VIOP、債券、場外衍生品、共同基金交易、交易所交易基金交易和投資諮詢。

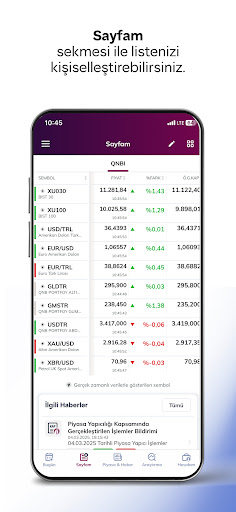

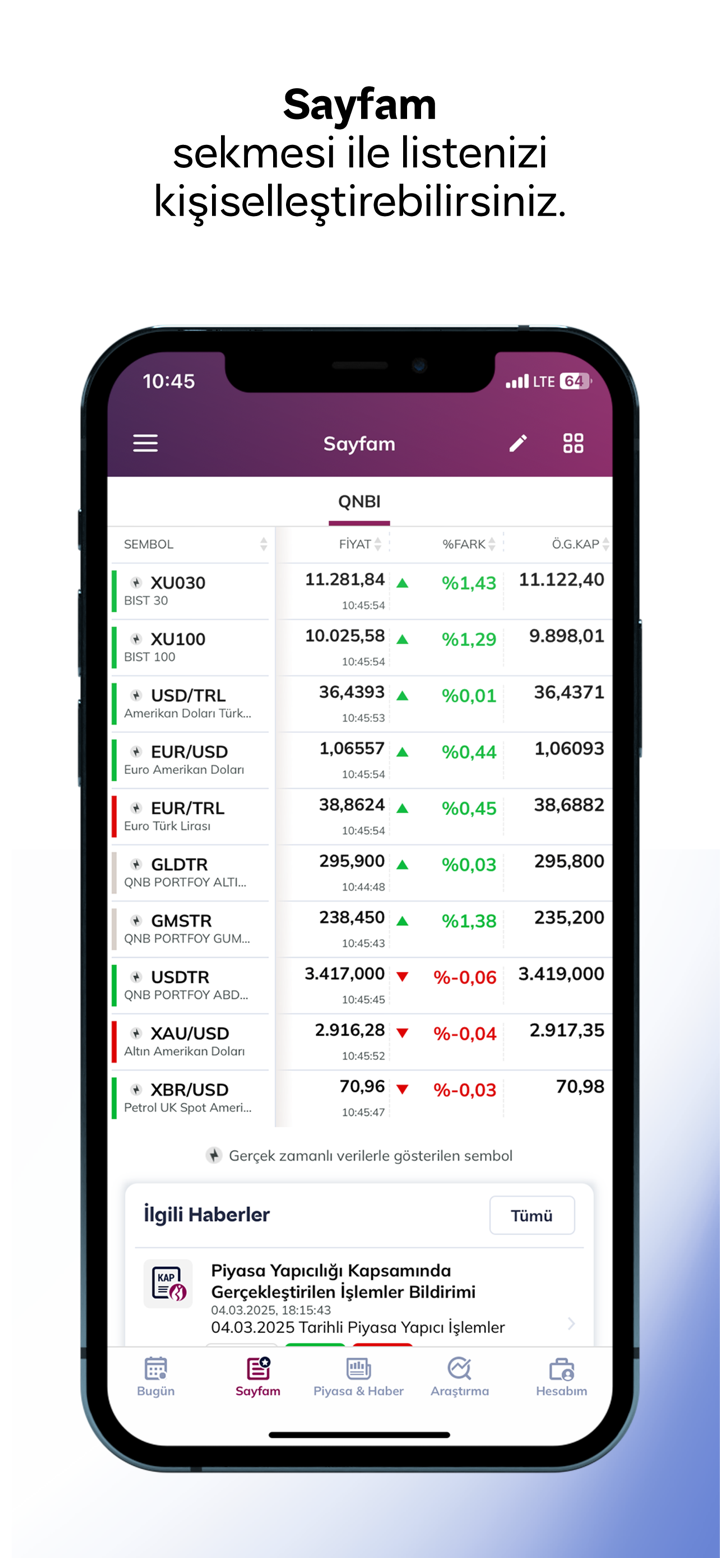

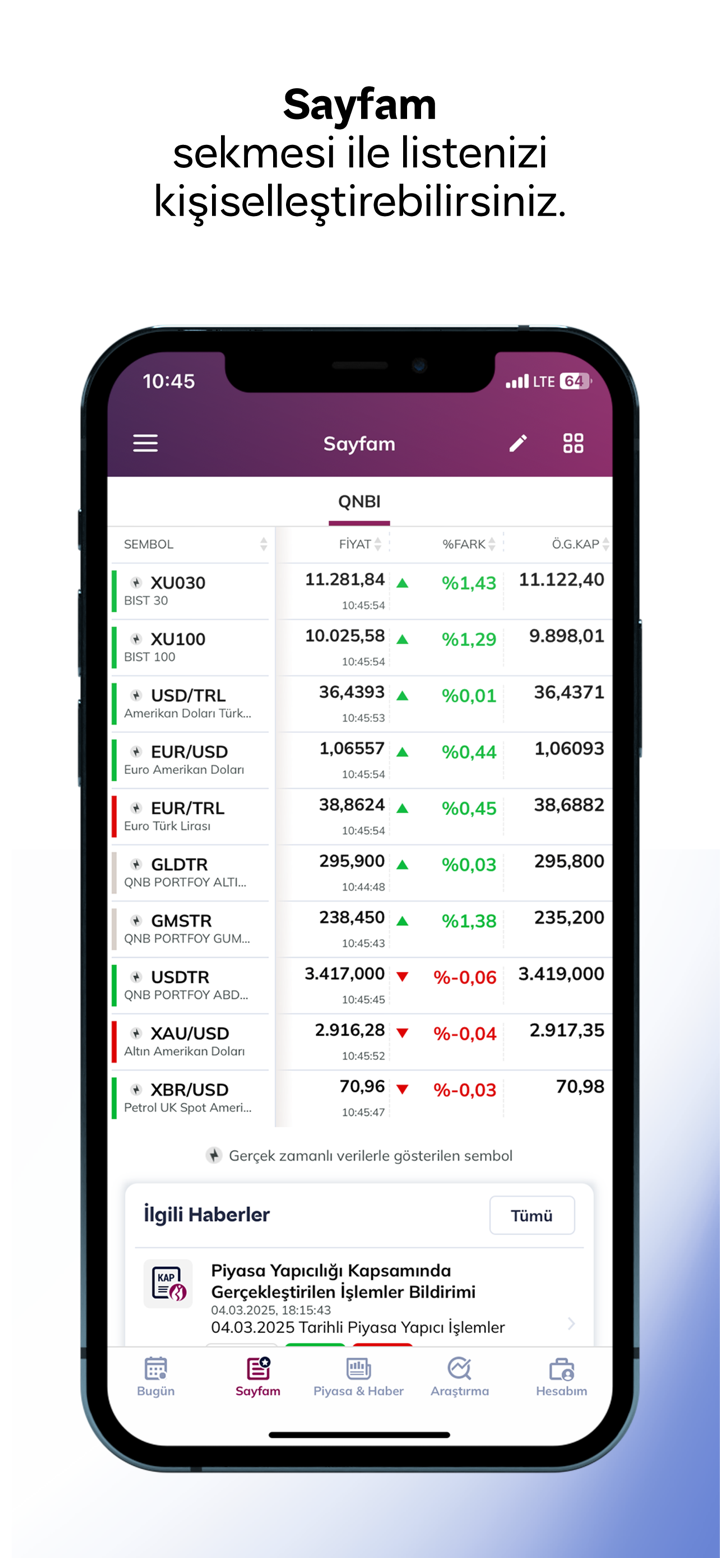

外匯:貨幣對、商品、指數和外匯。

投資產品:股票、VIOP、共同基金、回購、認股權證、交易所交易基金、歐元債券/蘇克、外幣、外匯、外國交易、公開發行申請。

VIOP:根據預期,在股票、股票指數(BIST-30)、匯率(TL/美元、TL/歐元、歐元/美元)、黃金、商品和電力方面,以一定的擔保/保費進行買賣合約,以實現對沖、投資和套利目的。

海外投資交易:外國股票、交易所交易基金、歐元債券和蘇克產品。

債券:回購、國庫券、政府債券、歐元債券和私營部門債券等固定收益產品。

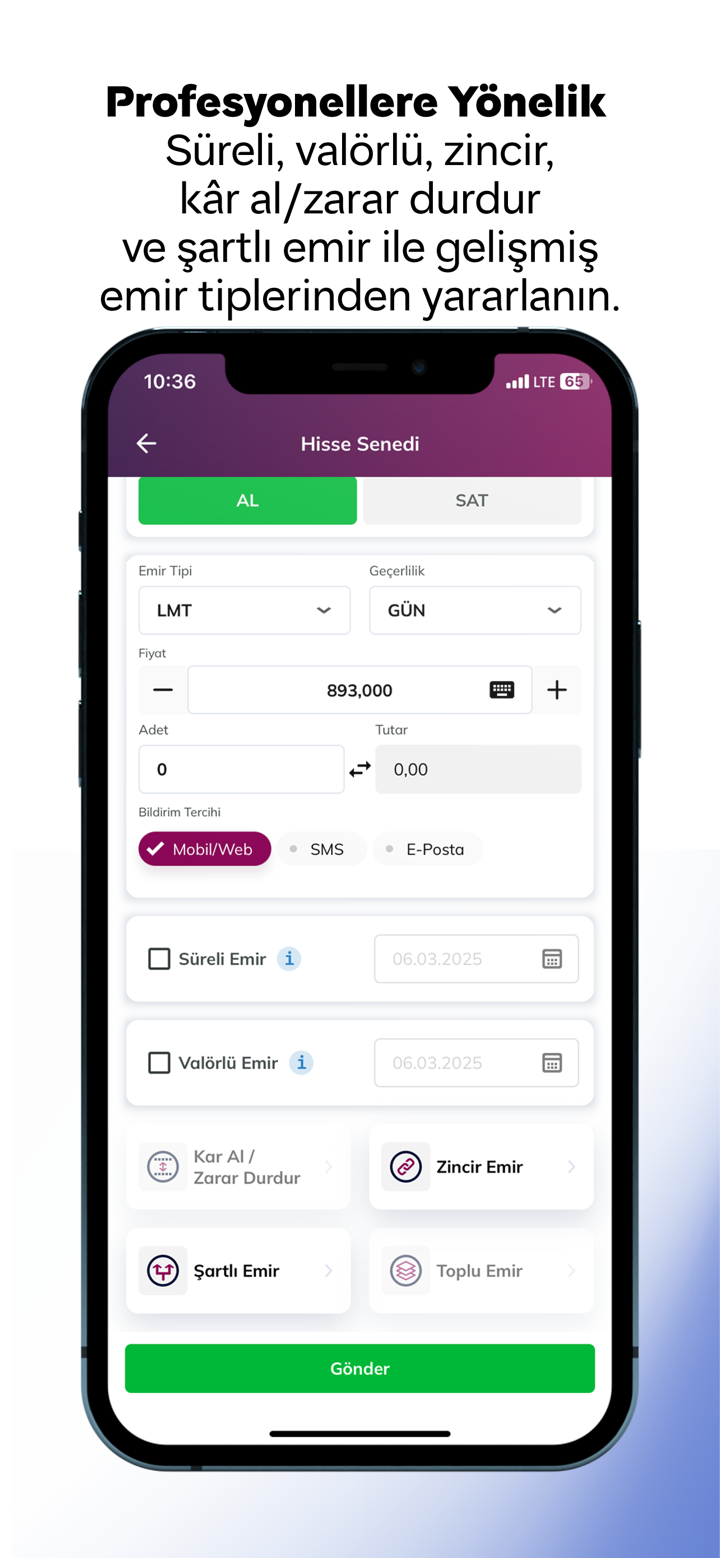

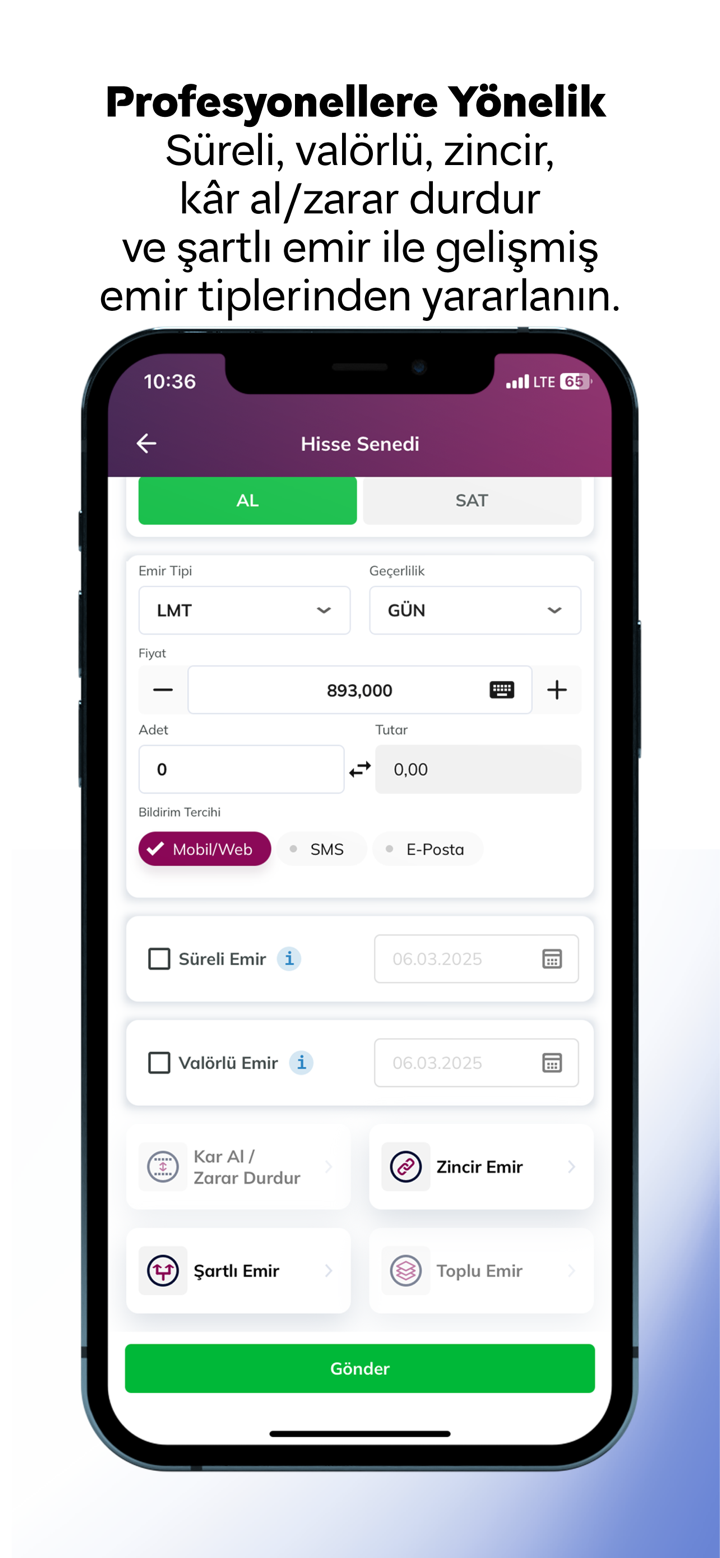

場外衍生品:遠期合約、掉期、期貨、期權和結構性產品。

共同基金交易:貨幣市場基金、私營部門債券基金、短期債券基金、債券基金、歐元債券債券基金、第一對沖基金、QNB組合第一變量基金和ONB組合主要股票基金。

交易所交易基金交易:GOLDIST、USDTR、QOUR和GMSTR。

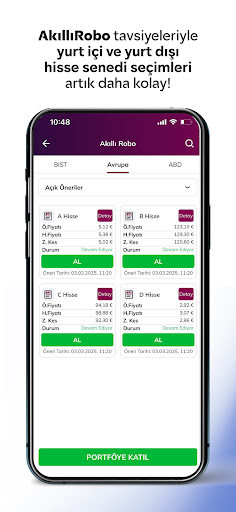

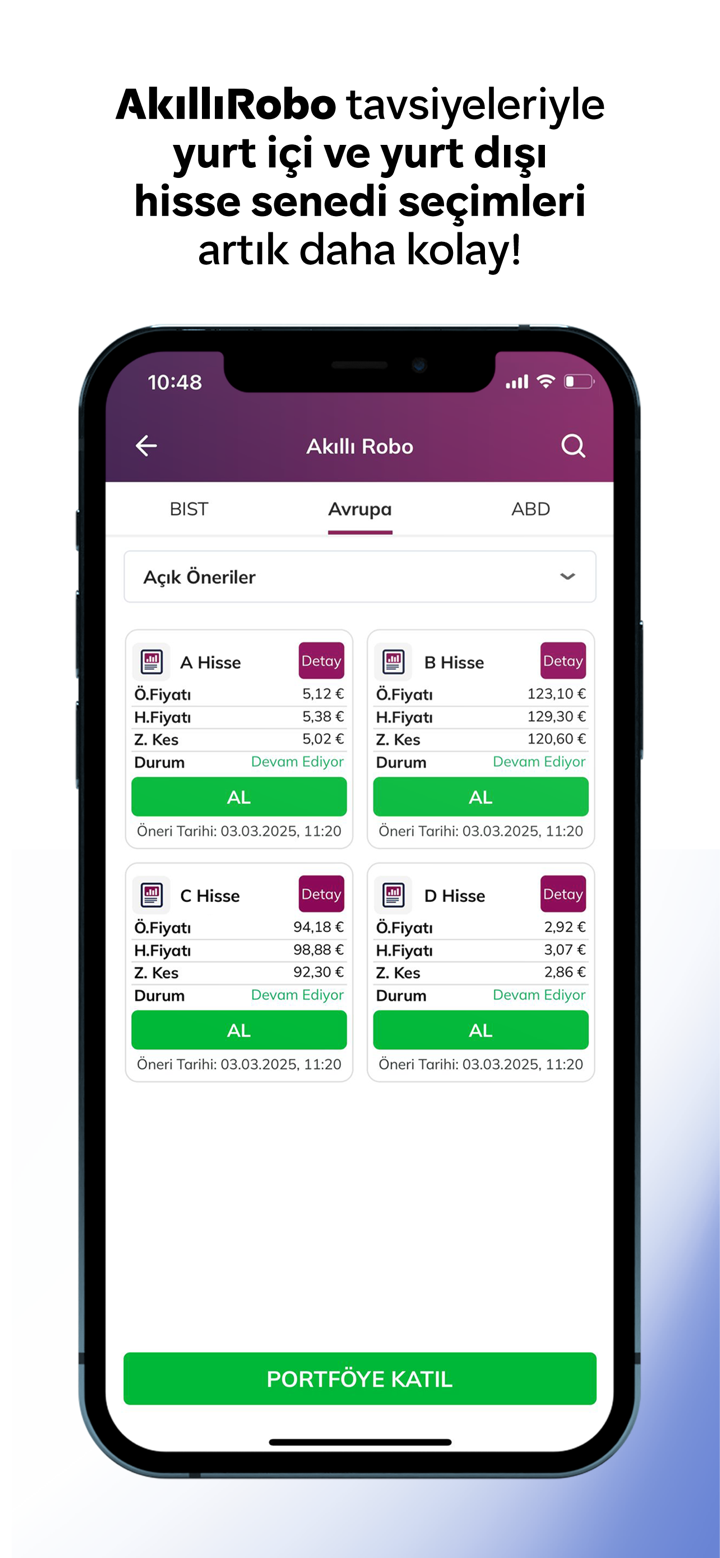

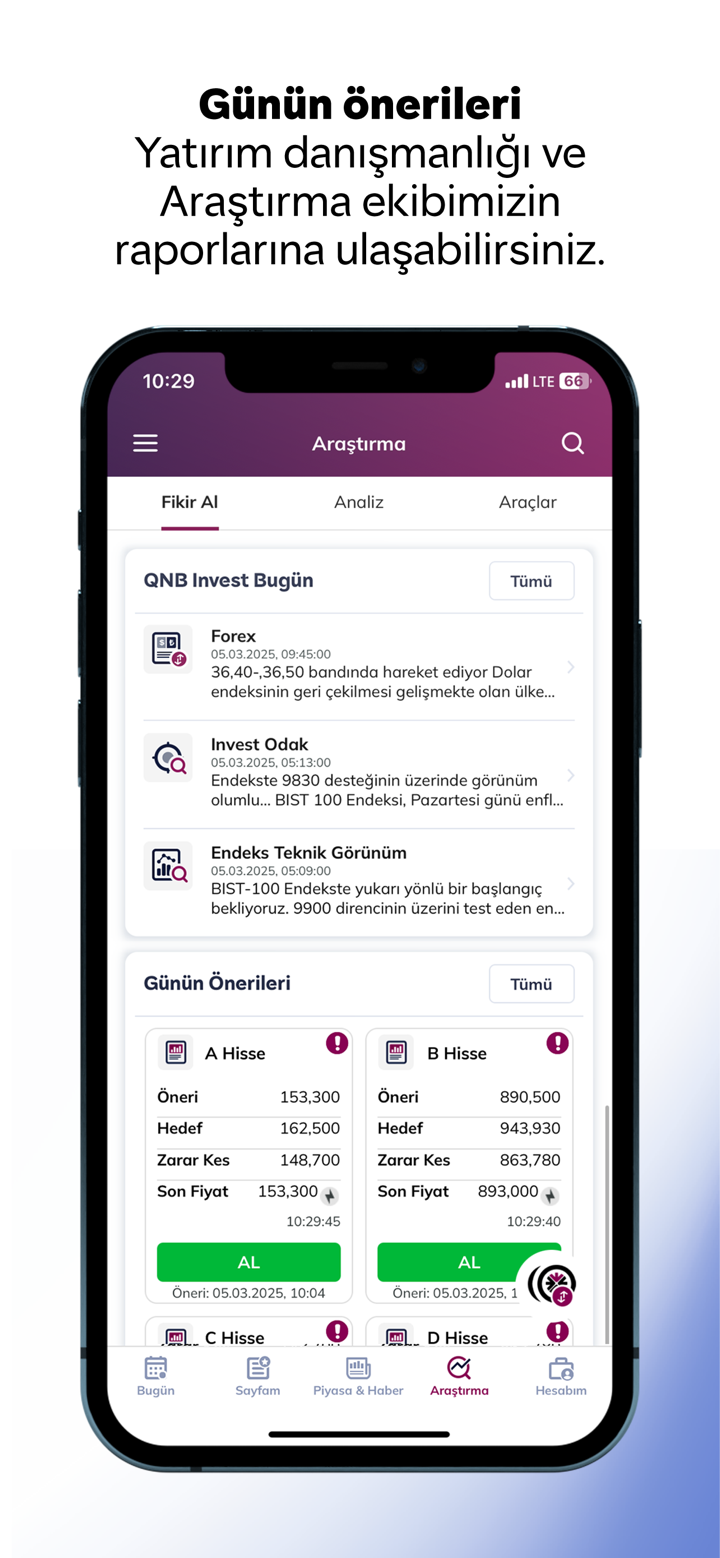

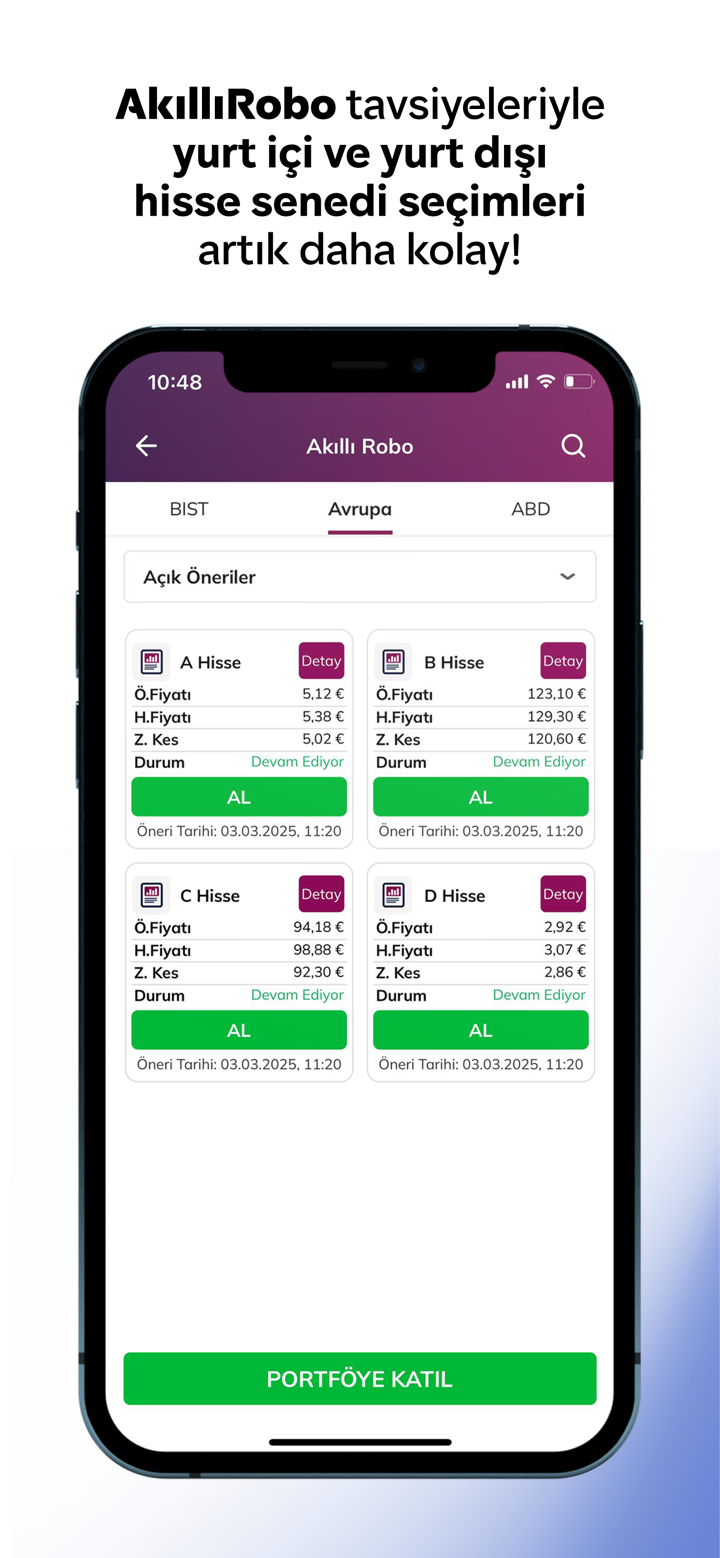

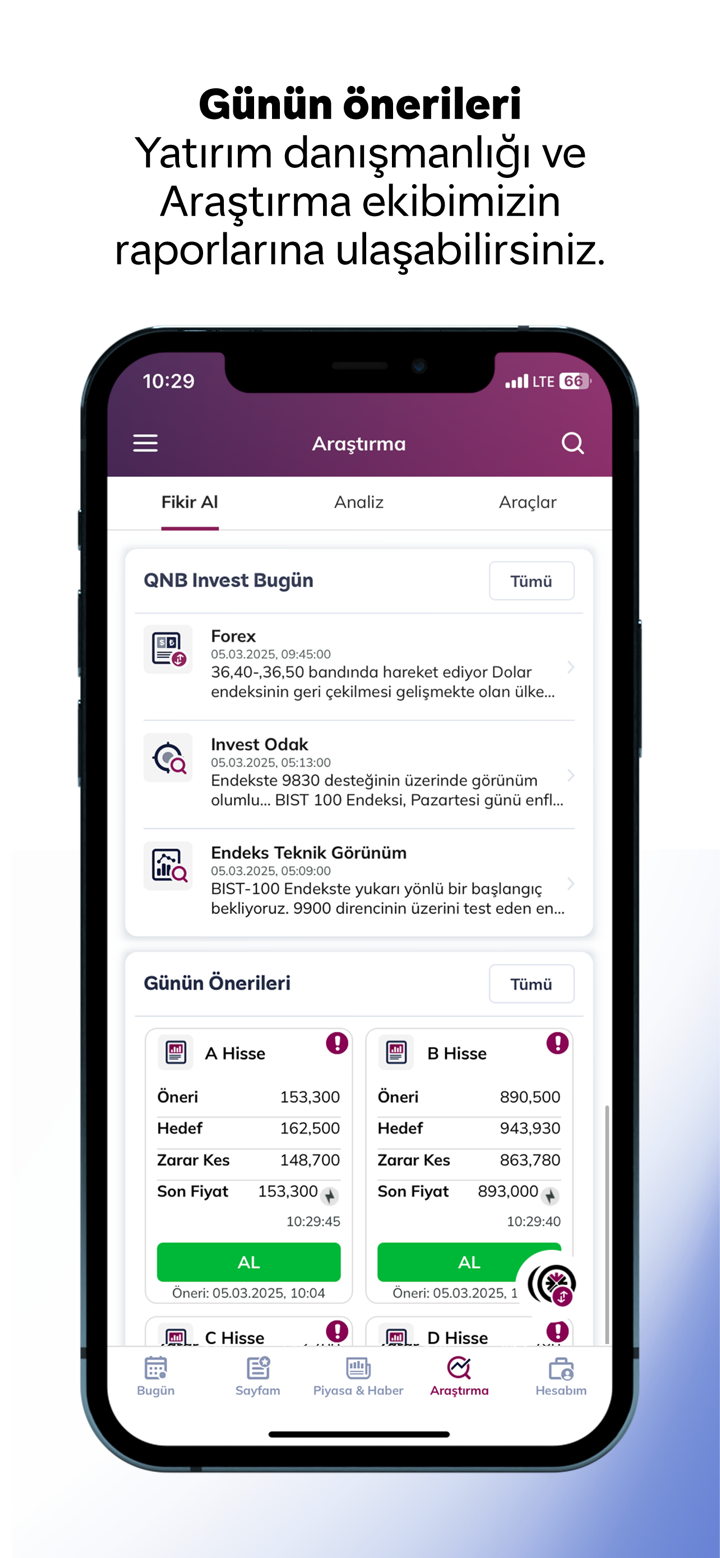

投資諮詢:股票交易建議、投資顧問、模型投資組合和股票支撐阻力。

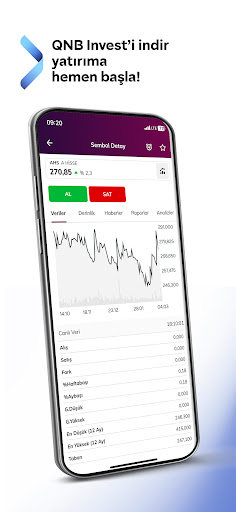

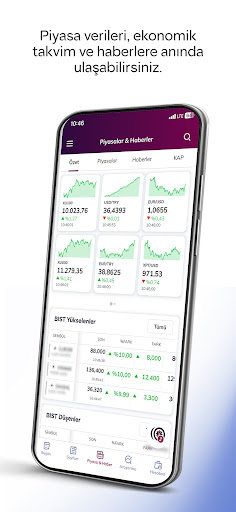

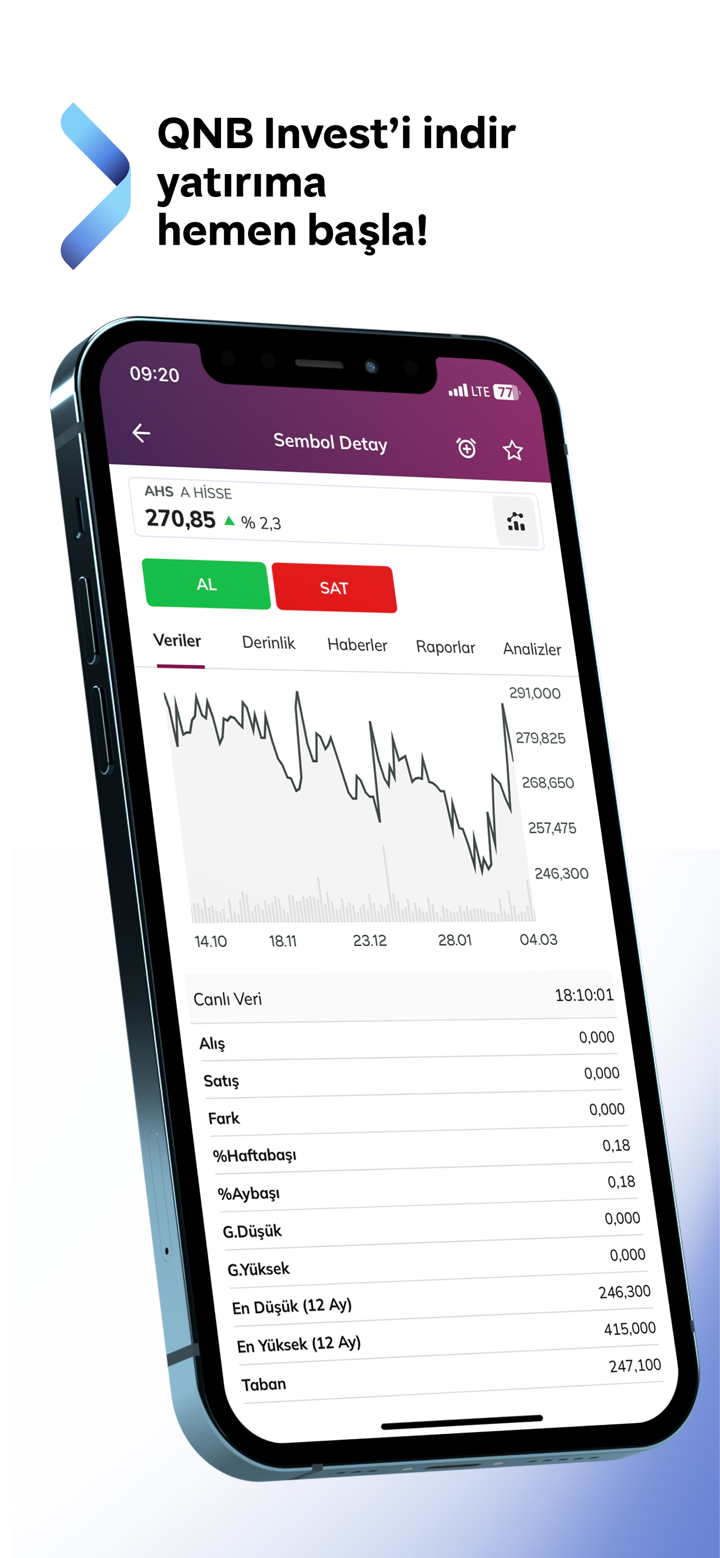

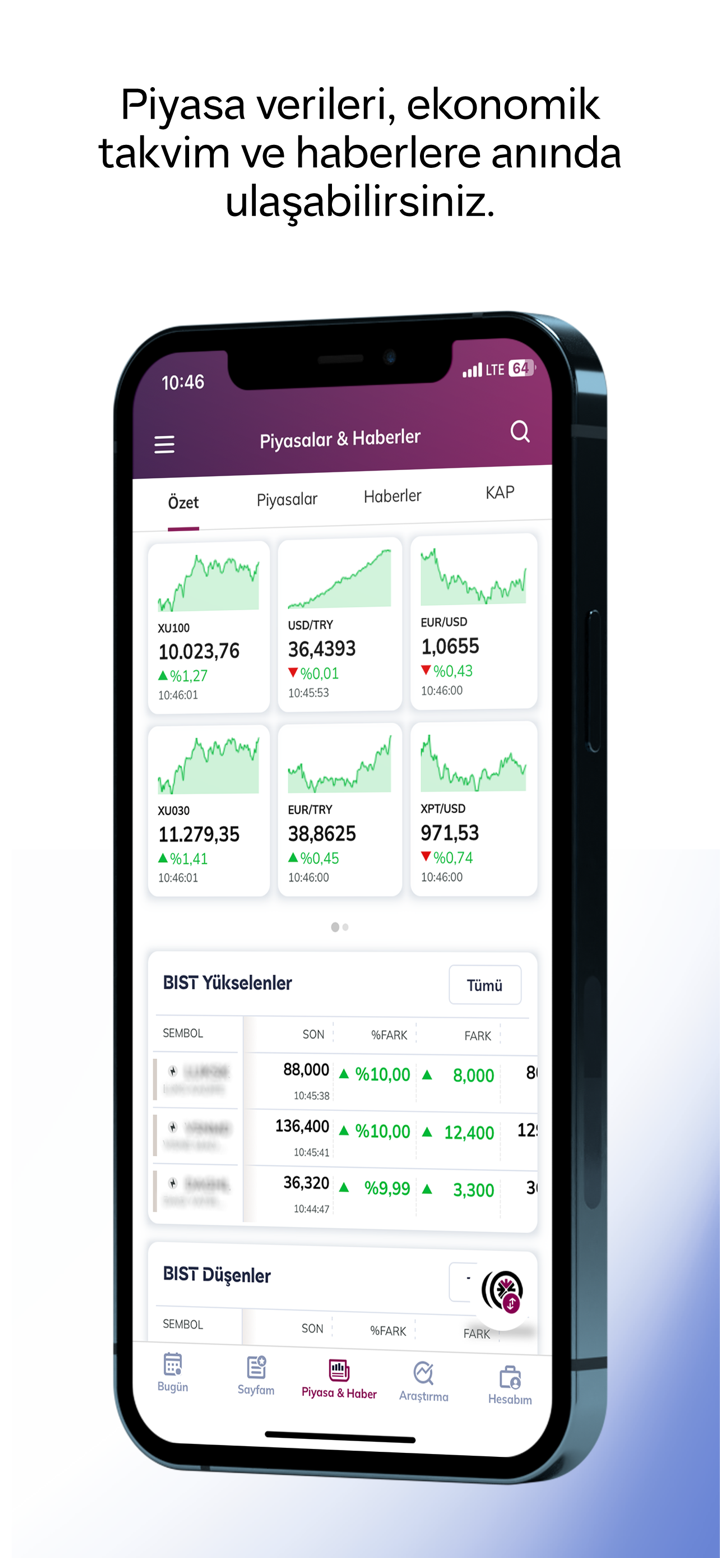

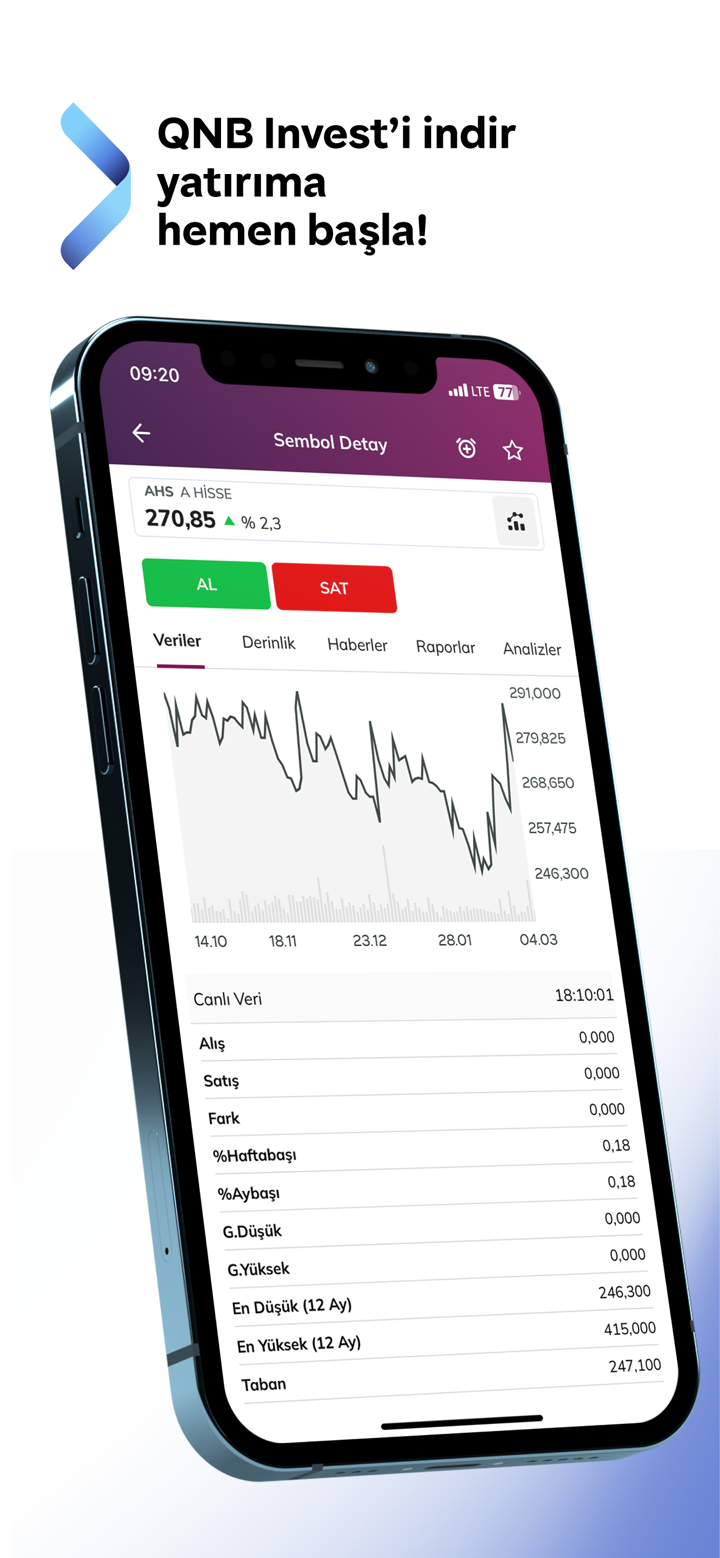

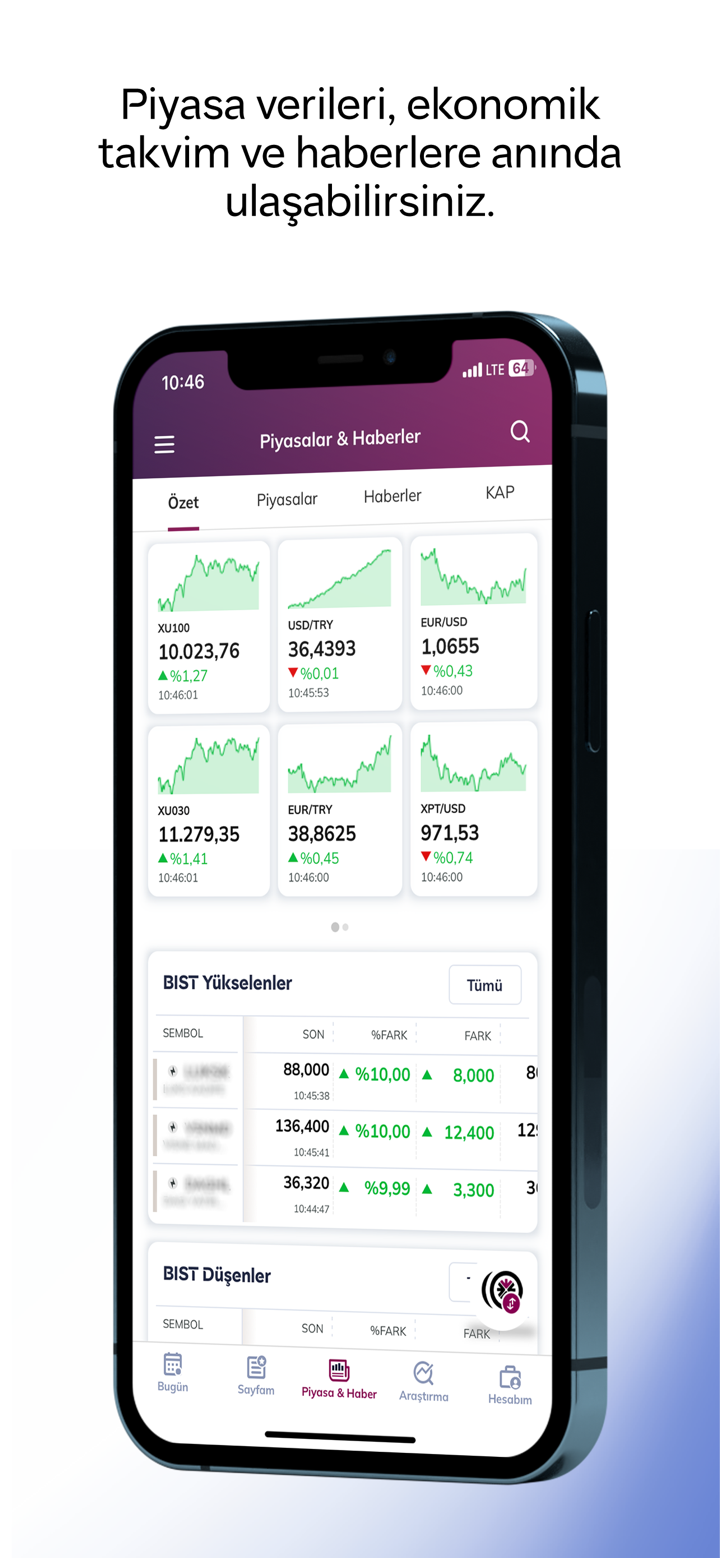

交易平台

| 交易平台 | 支援 | 可用設備 | 適合對象 |

| QNB Invest | ✔ | Web、桌面、平板電腦、Android、iOS | / |

| MT4 | ❌ | / | 初學者 |

| MT5 | ❌ | / | 經驗豐富的交易者 |