公司簡介

| 鴻昇金融 評論摘要 | |

| 成立年份 | 1999 |

| 註冊地區/國家 | 香港 |

| 監管 | SFC(已超額,已撤銷) |

| 服務 | 債務融資、投資產品、資產管理、IPO認購等 |

| 模擬帳戶 | ❌ |

| 交易平台 | 鴻盛證券(網頁和手機版) |

| 最低存款 | / |

| 客戶支援 | 聯絡表格 |

| 電話:(852) 3589 1623 | |

| 電郵:settlement@hungsing.org | |

| 辦公時間:星期一至星期五上午9:00至下午6:00星期六、星期日及公眾假期休息 | |

| 香港上環干諾道中200號信德中心西座25樓2505室地址: | |

鴻昇金融 是一家成立於1999年並在香港註冊的金融公司。提供多項服務:債務融資、投資產品、資產管理和IPO認購。公司提供鴻盛證券平台,可在網頁和手機版本上使用。然而,其證券交易牌照已超額,期貨合約交易牌照已被撤銷,由證券及期貨事務監察委員會(SFC)執行。

優點和缺點

| 優點 | 缺點 |

| 多元化服務 | 超額和撤銷牌照 |

| 多元化客戶支援渠道 | 帳戶資訊有限 |

| 交易費用資訊有限 | |

| 無模擬帳戶 |

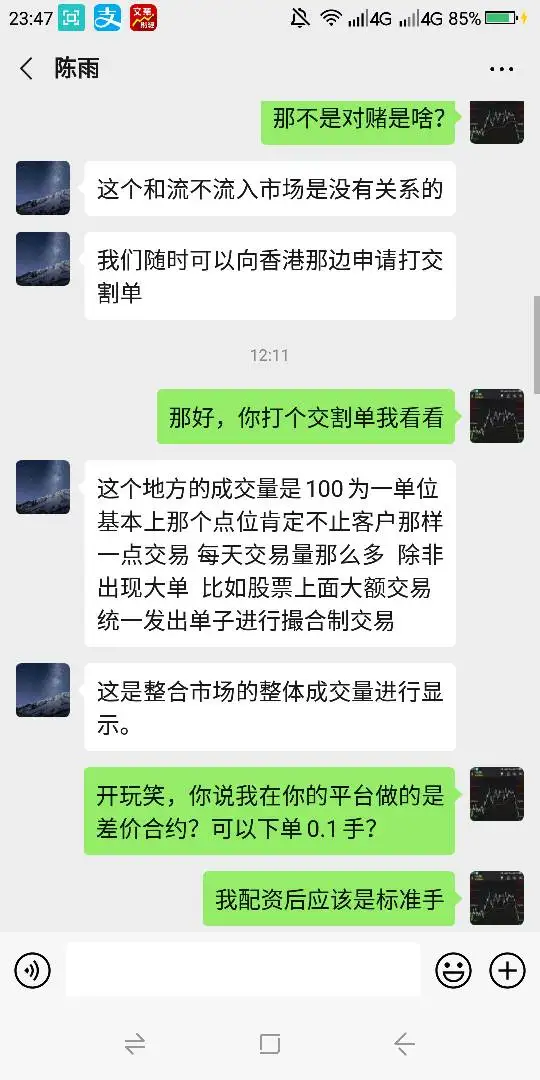

鴻昇金融 是否合法?

目前,鴻昇金融 只持有證監會超額發放的期貨合約交易牌照。其證券交易牌照已被吊銷。我們建議您尋求其他受監管公司的服務。

| 受監管國家 | 監管機構 | 受監管實體 | 當前狀態 | 牌照類型 | 牌照號碼 |

| 證監會 (SFC) | 鴻星期貨有限公司 | 吊銷 | 期貨合約交易 | AFC168 |

| 證監會 (SFC) | 鴻星證券有限公司 | 超額 | 證券交易 | ABS697 |

鴻昇金融 為客戶提供多元化的金融服務,如債務融資、投資產品、資產管理、新股認購等。

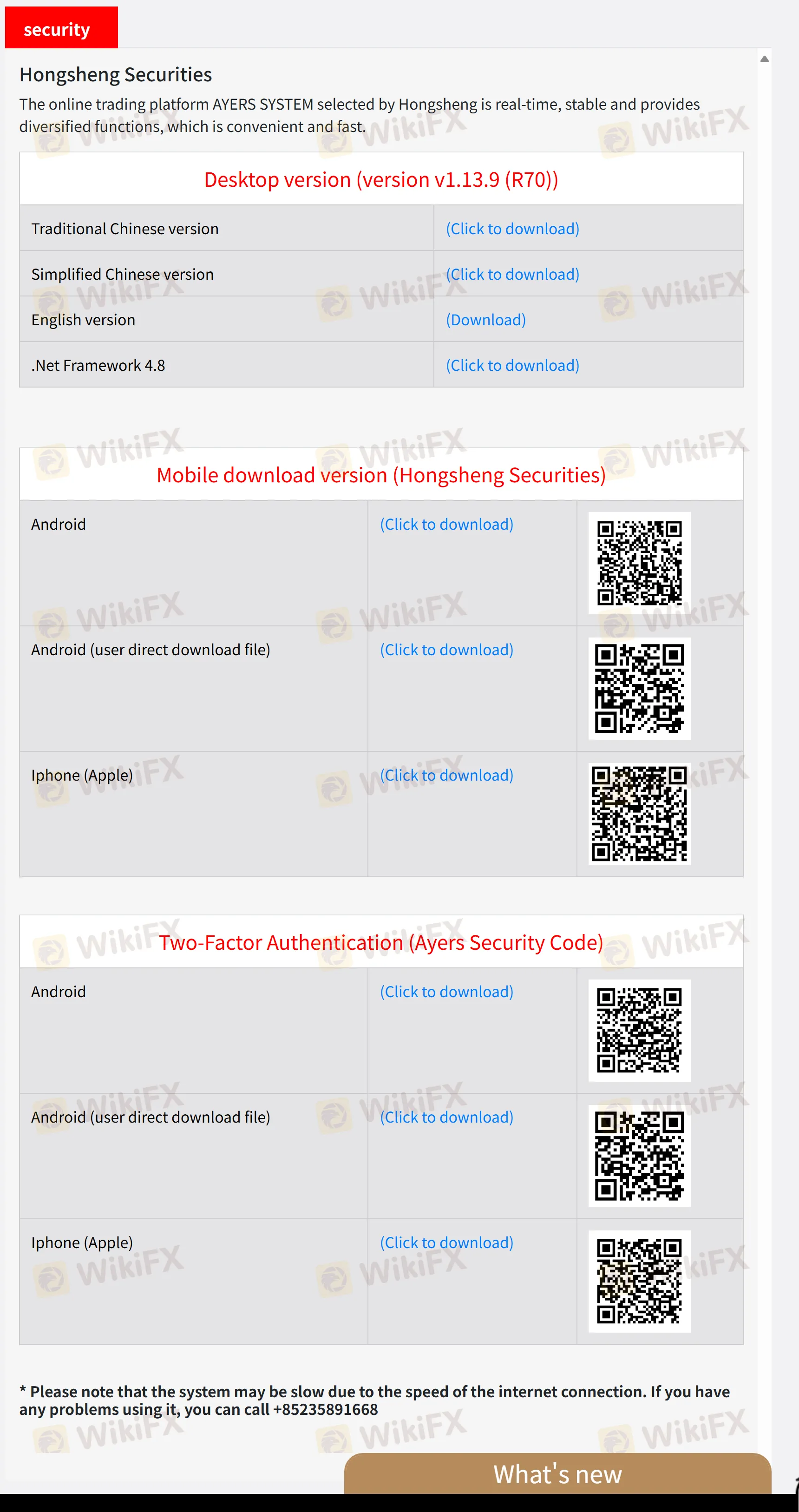

交易平台

| 交易平台 | 支援 | 可用設備 |

| 鴻盛證券 | ✔ | 網頁,手機 |