公司簡介

| 水戶證券評論摘要 | |

| 成立年份 | 1997 |

| 註冊國家/地區 | 日本 |

| 監管 | FSA |

| 市場工具 | 股票,債券,ETF |

| 模擬帳戶 | ❌ |

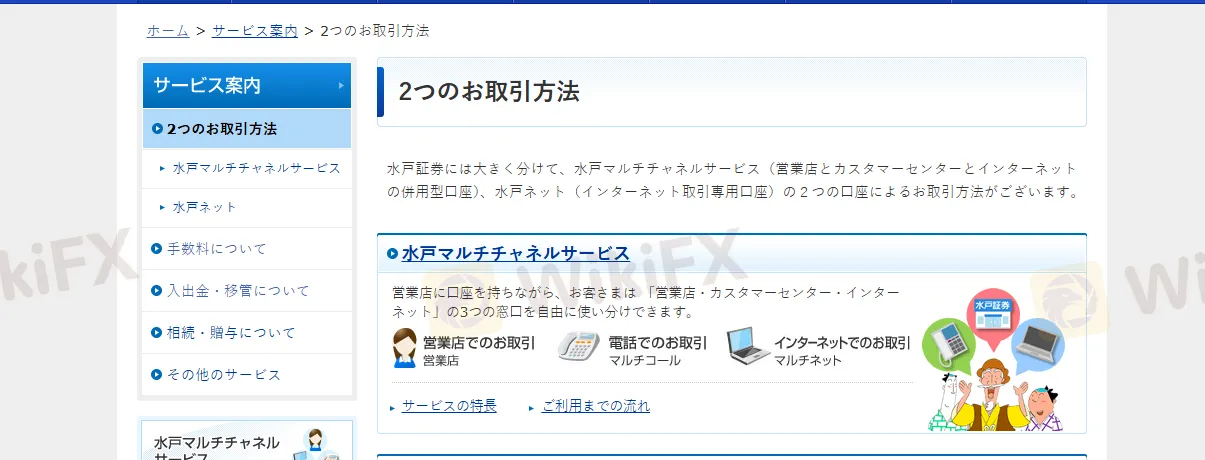

| 交易平台 | 水戶證券 多頻道服務,水戶證券 網頁 |

| 客戶支援 | 電話:0120-310-273 |

水戶證券 是一家成立於1997年的日本金融服務公司,受金融廳(FSA)監管。該公司提供廣泛的交易選擇,包括股票、債券和ETF,迎合不同投資者的偏好。

優點和缺點

| 優點 | 缺點 |

| 受監管 | 交易工具不足 |

| 無模擬帳戶 | |

| 無MT4/MT5 |

水戶證券 是否合法?

是的。水戶證券 獲得FSA許可提供服務。

| 監管機構 | 當前狀態 | 受監管實體 | 牌照類型 | 牌照號碼 |

| 金融廳 | 受監管 | 水戸証券株式會社 | 零售外匯牌照 | 關東財務局長(金商)第181號 |

水戶證券 可以交易什麼?

水戶證券 提供股票、債券和 ETF。

| 可交易工具 | 支援 |

| 債券 | ✔ |

| 股票 | ✔ |

| ETF | ✔ |

| 外匯 | ❌ |

| 大宗商品 | ❌ |

| 指數 | ❌ |

| 加密貨幣 | ❌ |

| 期權 | ❌ |

交易平台

| 交易平台 | 支援 | 可用設備 | 適合對象 |

| 水戶證券 多頻道服務 | ✔ | / | / |

| 水戶證券 網頁版 | ✔ | / | / |

| MT5 | ❌ | / | 經驗豐富的交易員 |

| MT4 | ❌ | / | 初學者 |

存款和提款

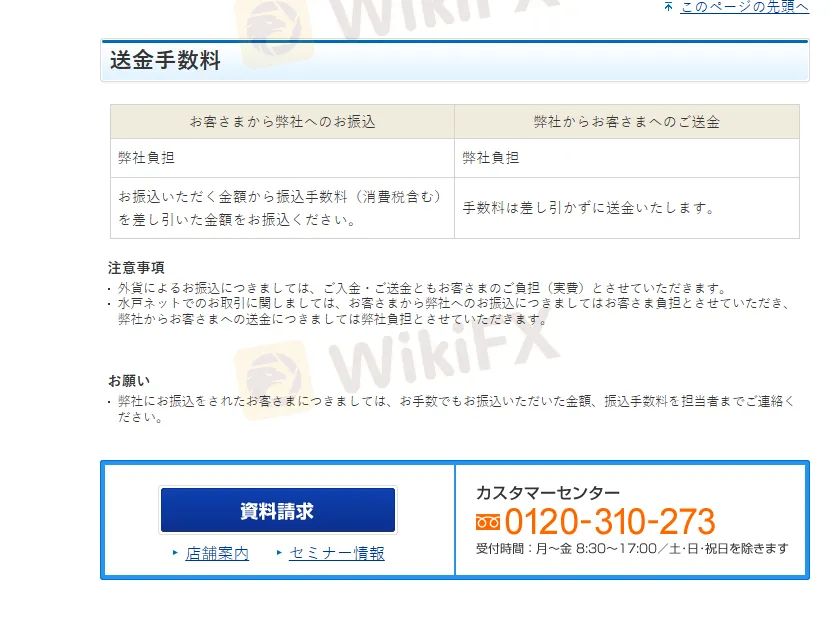

對於外幣轉帳,存款和匯款費用由客戶承擔(實際費用)。

通過 Mito Net 進行交易時,客戶支付給 水戶證券 的所有轉帳費用由 水戶證券 承擔,而支付給客戶的所有轉帳費用由 水戶證券 承擔。