Unternehmensprofil

Allgemeine Informationen und Vorschriften

ADCB, ein Handelsname von ADCB Securities , ist angeblich ein Finanzunternehmen, das in den Vereinigten Arabischen Emiraten registriert ist und von der SCA (Wertpapier- und Rohstoffbehörde), dem ADX (Abu Dhabi Securities Exchange) und dem DFM (Dubai Financial Market) reguliert wird. Der Broker behauptet, sowohl Privatkunden als auch institutionellen Kunden eine große Auswahl an Produkten und Dienstleistungen auf webbasierten und mobilen Handelsplattformen anzubieten.

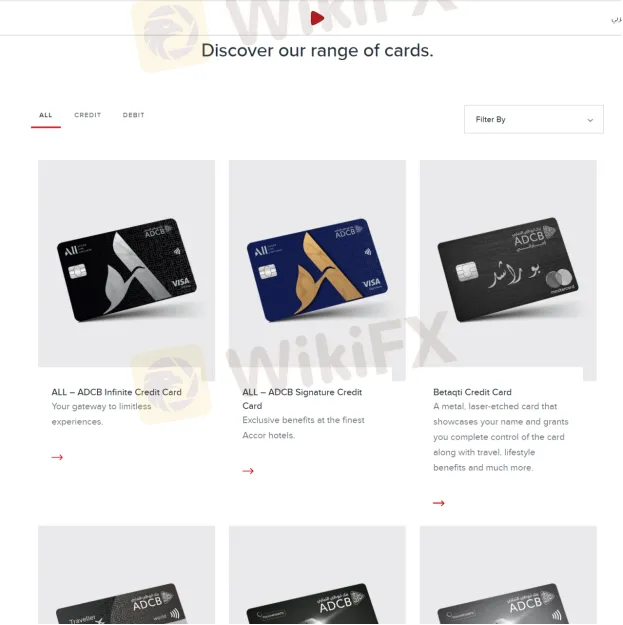

Produkte

ADCBwirbt damit, dass es eine breite Palette von Produkten anbietet, darunter Kredit-/Debitkarten, Kredite und Vermögensverwaltung wie Investitionen, Versicherungen, Vermögensverwaltung, Maklerdienste und Kapitalmärkte.

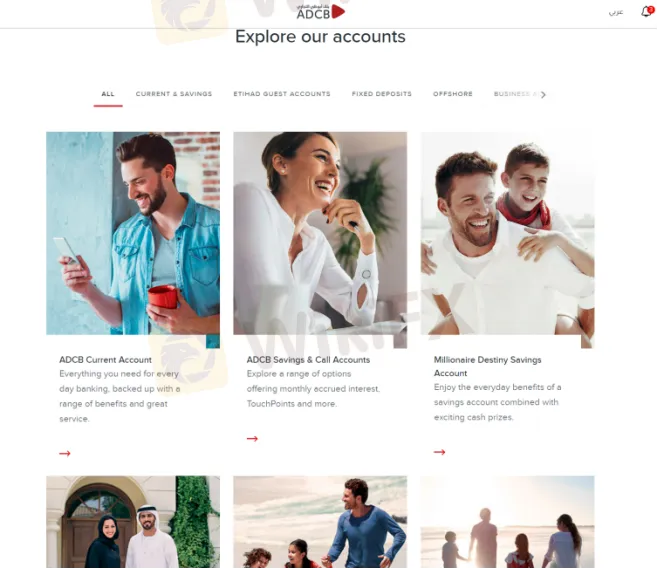

Kontotypen

Im Allgemeinen werden hauptsächlich zwei verschiedene Brokerage-Konten angeboten ADCB , nämlich individuelles Brokerage-Konto und institutionelles Brokerage-Konto. Insbesondere sind Giro- und Sparkonto, Etihad-Gastkonto, Festgeldkonto und mehr verfügbar.

Handelsplattform verfügbar

Plattformen, die für den Handel verfügbar sind ADCB sind die webbasierte Handelsplattform und ADCB Securities App. Der Broker sagt, dass die mobile App es Händlern ermöglichen kann, unterwegs zu handeln, die neuesten Aktienkurse zu überprüfen und ihre Portfolios zu verwalten. Es kann im Apple App Store oder Google Play Store heruntergeladen werden.

Boni

ADCBbehauptet auf seiner Homepage, dass Händler, die sich für eine Touchpoints-Visa-Kreditkarte anmelden, bis zu 250.000 Touchpoints verdienen können. Es kann jedoch nicht sicher sein, ob diese Boni bedingungslos ausgezahlt werden können.

Kundendienst

ADCBDer Kundensupport von s ist von Montag bis Freitag von 08:00 bis 15:00 Uhr telefonisch erreichbar: innerhalb der VAE 600 50 3325, außerhalb der VAE +97126211608 oder senden Sie Nachrichten online, um mit uns in Kontakt zu treten. Firmenadresse: Sheikh-Zayed-Bin-Sultan-Straße, neben der Adnoc-Vertriebsgesellschaft – Abu Dhabi.