Présentation de l'entreprise

Informations générales et règlement

ADCB, un nom commercial de ADCB Securities , serait une société financière enregistrée aux émirats arabes unis et réglementée par la sca (autorité des valeurs mobilières et des matières premières), l'adx (bourse des valeurs mobilières d'abu dhabi) et la dfm (marché financier de dubaï). le courtier prétend fournir aux clients individuels et institutionnels une large sélection de produits et services sur des plateformes de trading en ligne et mobiles.

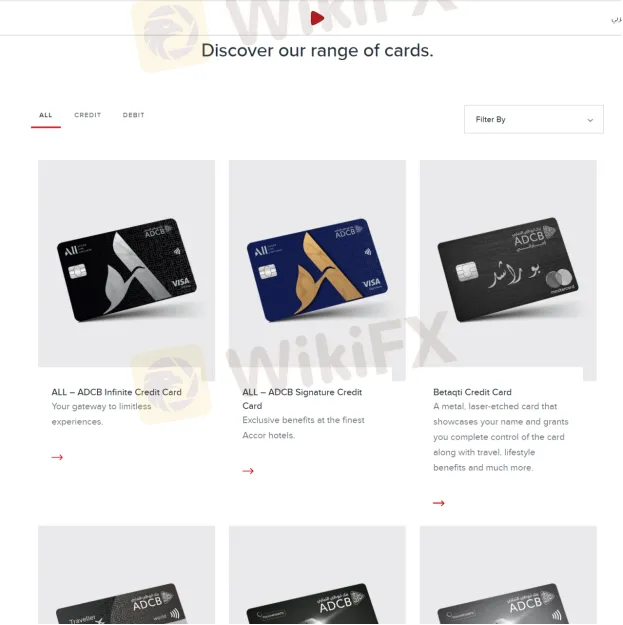

Des produits

ADCBannonce qu'elle offre une grande variété de produits, y compris les cartes de crédit/débit, les prêts et la gestion de patrimoine tels que les investissements, l'assurance, la gestion d'actifs, les services de courtage et les marchés de capitaux.

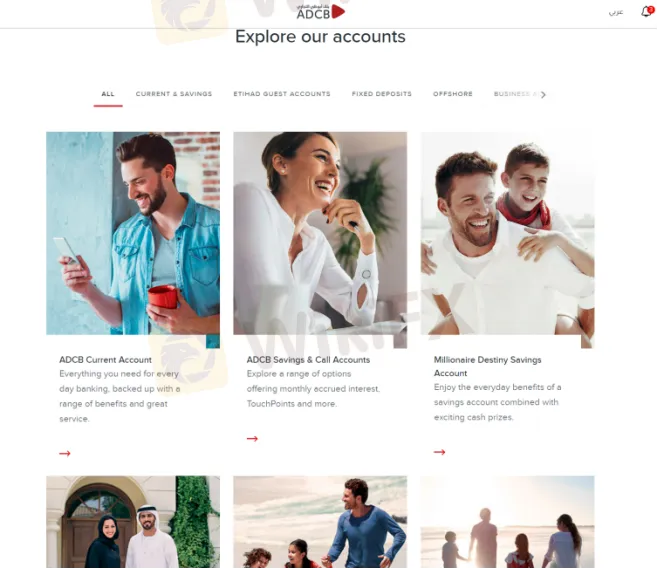

Types de compte

en général, il existe principalement deux comptes de courtage différents proposés par ADCB , à savoir compte de courtage individuel et compte de courtage institutionnel. en particulier, le compte courant et d'épargne, les comptes invités etihad, le compte de dépôt fixe et plus encore sont tous disponibles.

Plateforme de trading disponible

plates-formes disponibles pour le trading sur ADCB sont la plate-forme de négociation en ligne et ADCB Securities application. le courtier dit que l'application mobile peut permettre aux traders de négocier en déplacement et de vérifier les derniers cours des actions, ainsi que de gérer leurs portefeuilles. il peut être téléchargé dans l'App Store Apple ou Google Play Store.

Bonus

ADCBaffirme sur sa page d'accueil que lorsque les commerçants s'inscrivent pour une carte de crédit visa points de contact, ils peuvent gagner jusqu'à 250 000 points de contact. cependant, il ne peut pas être sûr que ces bonus puissent être retirés sans aucune condition.

Service client

ADCBle support client de s est joignable du lundi au vendredi, de 08h00 à 15h00 par téléphone : au sein des eau 600 50 3325, en dehors des eau +97126211608 ou envoyer des messages en ligne pour entrer en contact. adresse de la société: rue sheikh zayed bin sultan, à côté de la société de distribution adnoc - abu dhabi.