Buod ng kumpanya

Pangkalahatang Impormasyon at Regulasyon

ADCB, isang pangalan ng kalakalan ng ADCB Securities , ay di-umano'y isang financial firm na nakarehistro sa united arab emirates at kinokontrol ng sca (securities and commodities authority), ang adx (abu dhabi securities exchange) at ang dfm (dubai financial market). inaangkin ng broker na magkaloob sila ng mga indibidwal at institusyonal na customer ng malawak na seleksyon ng mga produkto at serbisyo sa web-based at mobile na mga platform ng kalakalan.

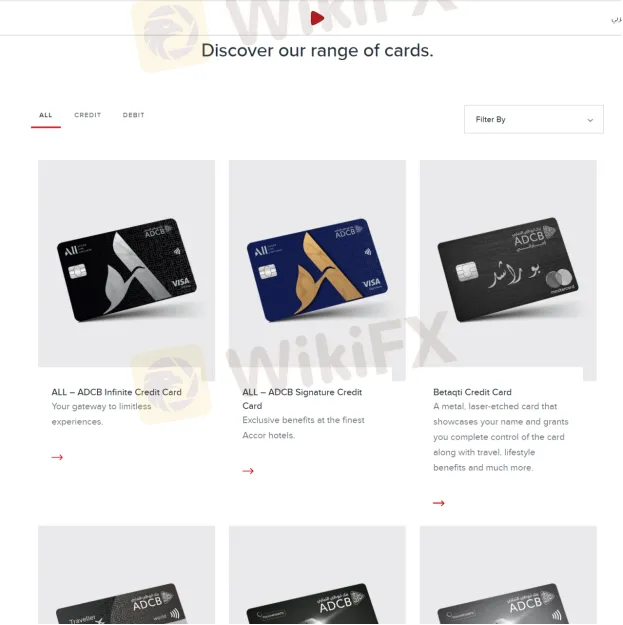

Mga produkto

ADCBnag-aanunsyo na nag-aalok ito ng maraming uri ng mga produkto, kabilang ang mga credit/debit card, mga pautang at pamamahala ng yaman tulad ng mga pamumuhunan, insurance, pamamahala ng asset, mga serbisyo ng brokerage at mga capital market.

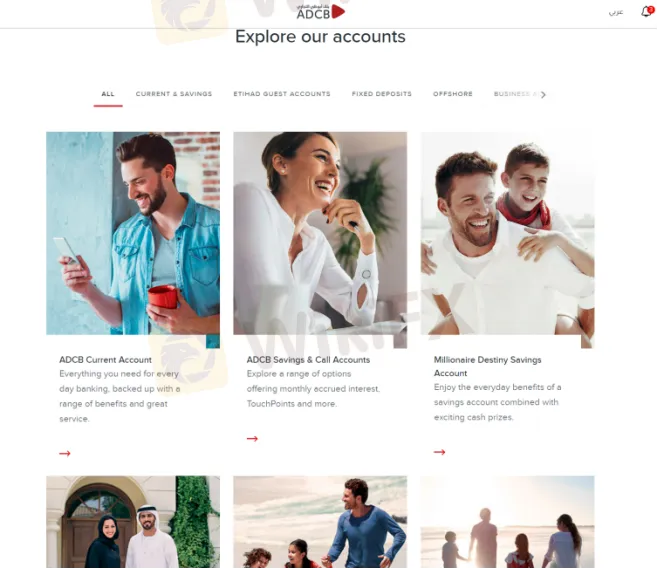

Mga Uri ng Account

sa pangkalahatan, mayroong dalawang magkaibang brokerage account na inaalok ng ADCB , katulad ng indibidwal na brokerage account at institutional brokerage account. sa partikular, ang kasalukuyan at savings account, etihad guest account, fixed deposit account at higit pa ay available lahat.

Available ang Trading Platform

mga platform na magagamit para sa pangangalakal sa ADCB ay ang web-based na platform ng kalakalan at ADCB Securities app. sabi ng broker na maaaring payagan ng mobile app ang mga mangangalakal na mag-trade on the go at suriin ang pinakabagong mga presyo ng stock, pati na rin pamahalaan ang kanilang mga portfolio. maaari itong i-download sa apple app store o google play store.

Mga bonus

ADCBsinasabi sa home page nito na kapag nag-sign up ang mga mangangalakal para sa isang touchpoints visa credit card, maaari silang makakuha ng hanggang 250,000 touchpoints. gayunpaman, hindi makatitiyak kung ang mga bonus na ito ay maaaring bawiin nang walang anumang kundisyon.

Suporta sa Customer

ADCBs customer support ay maaaring maabot mula Lunes hanggang Biyernes, 08:00 am hanggang 03:00 pm sa pamamagitan ng telepono: sa loob ng uae 600 50 3325, sa labas ng uae +97126211608 o magpadala ng mga mensahe online upang makipag-ugnayan. address ng kumpanya: sheikh zayed bin sultan street, sa tabi ng adnoc distribution company - abu dhabi.