Resumo da empresa

Informações Gerais e Regulamento

ADCB, um nome comercial de ADCB Securities , é supostamente uma empresa financeira registrada nos Emirados Árabes Unidos e regulada pela sca (autoridade de valores mobiliários e commodities), adx (bolsa de valores de abu dhabi) e dfm (mercado financeiro de dubai). a corretora afirma fornecer aos clientes individuais e institucionais uma ampla seleção de produtos e serviços em plataformas de negociação móveis e baseadas na web.

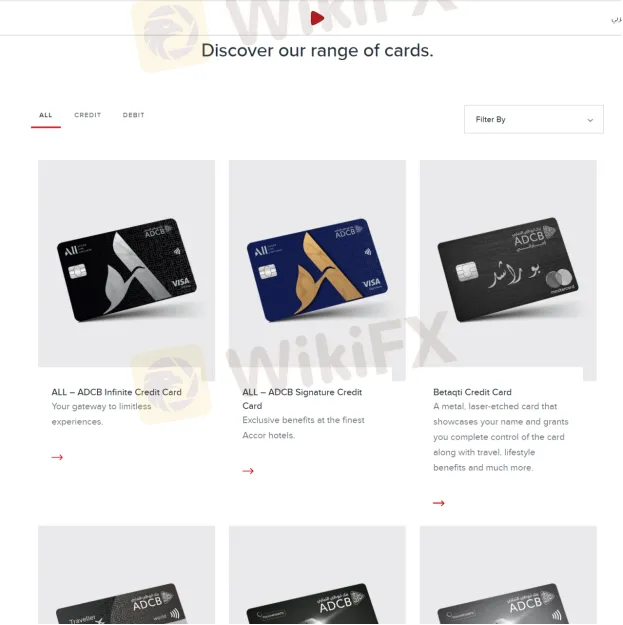

Produtos

ADCBanuncia que oferece uma ampla variedade de produtos, incluindo cartões de crédito/débito, empréstimos e gestão de patrimônio, como investimentos, seguros, gestão de ativos, serviços de corretagem e mercados de capitais.

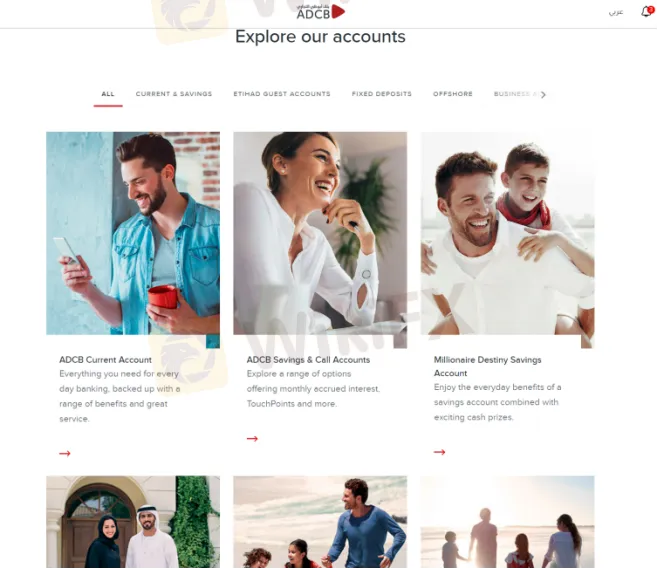

Tipos de conta

em geral, existem principalmente duas contas de corretagem diferentes oferecidas por ADCB , nomeadamente conta de corretagem individual e conta de corretagem institucional. em particular, conta corrente e poupança, contas de convidados etihad, conta de depósito fixo e mais estão disponíveis.

Plataforma de negociação disponível

plataformas disponíveis para negociação em ADCB são a plataforma de negociação baseada na web e ADCB Securities aplicativo. o corretor diz que o aplicativo móvel pode permitir que os comerciantes negociem em movimento e verifiquem os preços das ações mais recentes, bem como gerenciem seus portfólios. ele pode ser baixado na apple app store ou google play store.

bônus

ADCBafirma em sua página inicial que, quando os comerciantes se inscrevem para um cartão de crédito visa de pontos de contato, eles podem ganhar até 250.000 pontos de contato. no entanto, não pode ter certeza se esses bônus podem ser retirados sem qualquer condição.

Suporte ao cliente

ADCBO atendimento ao cliente da s pode ser feito de segunda a sexta-feira, das 08h00 às 15h00, por telefone: nos Emirados Árabes Unidos 600 50 3325, fora dos Emirados Árabes Unidos +97126211608 ou envie mensagens online para entrar em contato. endereço da empresa: rua sheikh zayed bin sultan, ao lado da empresa de distribuição adnoc - abu dhabi.