Company Summary

| JaneStreet Review Summary | |

| Founded | 2000 |

| Registered Country/Region | United States |

| Regulation | Regulated in Hong Kong by SFC (License No. BAL548) for futures; FCA license in the UK (No. 486546) is currently marked as “Exceeded” |

| Products and Services | Market Making, ETFs, Bonds, Equities, Options, Quant Research, Tech Solutions |

| Trading Platform | In-house Trading System, OCaml-based Software |

| Customer Support | New York: +1 646 759 6000 |

| London: +44 (0)20 3787 3200 | |

| Hong Kong: +852 3900 7300 | |

| Amsterdam: +31 (0)20 794 3100 | |

| Singapore: +65 6393 6000 | |

| Media: media@janestreet.com | |

JaneStreet Information

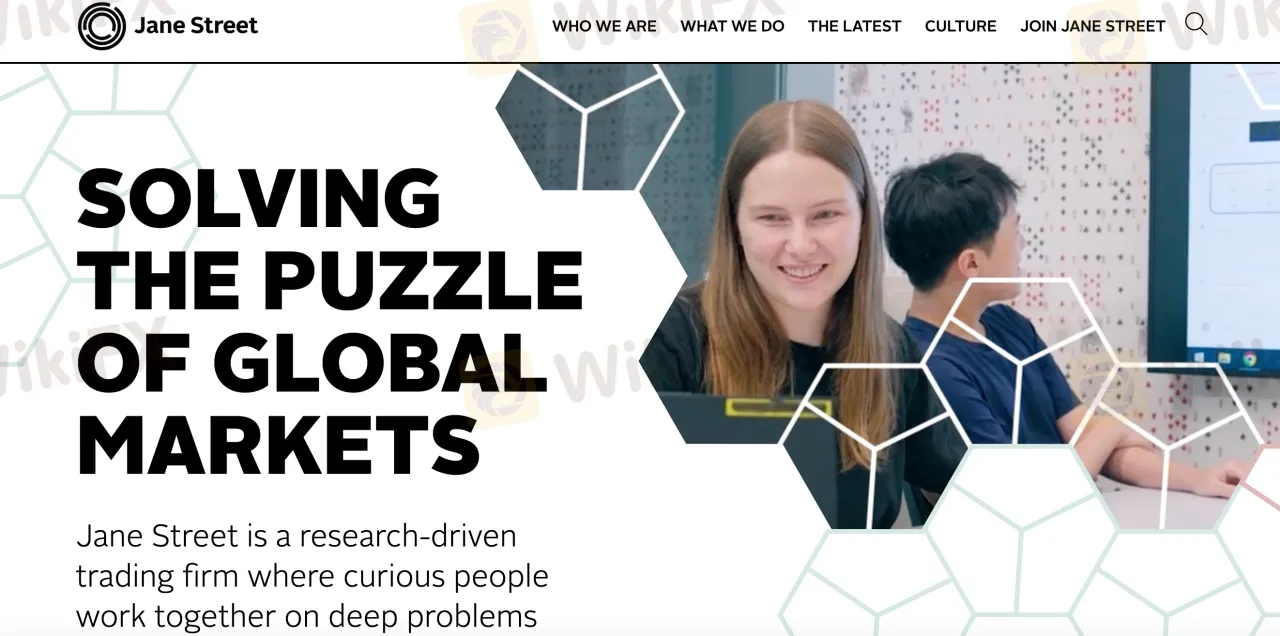

Jane Street is a privately owned American liquidity provider and quantitative trading enterprise that has been around since 2000. The firm focuses on futures market technical innovation, quantitative research, and exchange-traded funds (ETFs). It is not intended for retail trading and lacks any public services or platforms such MT4 or MT5.

Pros and Cons

| Pros | Cons |

| Regulated by SFC in Hong Kong | Not designed for retail or individual investors |

| Operates across 200+ electronic venues globally | No support for MT4/MT5 or traditional trading accounts |

| Strong expertise in quantitative strategies and in-house tech stack | FCA license in the UK is marked “Exceeded” (inactive) |

Is JaneStreet Legit?

Jane Street is regulated in Hong Kong by the Securities and Futures Commission (SFC) with license number BAL548 for dealing in futures contracts. In the UK, it was licensed by the Financial Conduct Authority (FCA) under license number 486546 for investment advisory services, but the status is currently Exceeded, meaning it's no longer active.

Products and Services

Jane Street provides a mix of innovative technology services, quantitative research, and trading. Operating over 200+ electronic venues, it is a significant worldwide liquidity provider noted for its prowess in machine learning-driven quantitative strategies, equities, bonds, options, and ETFs.

| Category | Products/Services Offered |

| Trading | Market making in ETFs, equities, bonds, options, and other asset classes on 200+ venues |

| Quantitative Research | ML-driven model development, strategy design, large-scale data analysis |

| Technology | In-house software and infrastructure (e.g., trading, risk, analytics tools) using OCaml |

| Global Presence | Operations in New York, London, Hong Kong, Singapore, Amsterdam |

| Collaboration | Cross-functional integration of trading, research, and tech teams to tackle market problems |

Company office

Jane Street operates offices in several of the worlds most dynamic financial hubs, including New York, London, Hong Kong, Singapore, Amsterdam, and Chicago.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for What Kind of Traders |

| In-house Trading System | ✔ | Desktop | Institutional traders using proprietary strategies |

| OCaml-based Software | ✔ | Desktop | Quantitative developers and tech-driven trading teams |

| MT4/MT5 | ❌ | – | - |