Company Summary

| Algo GlobalReview Summary | |

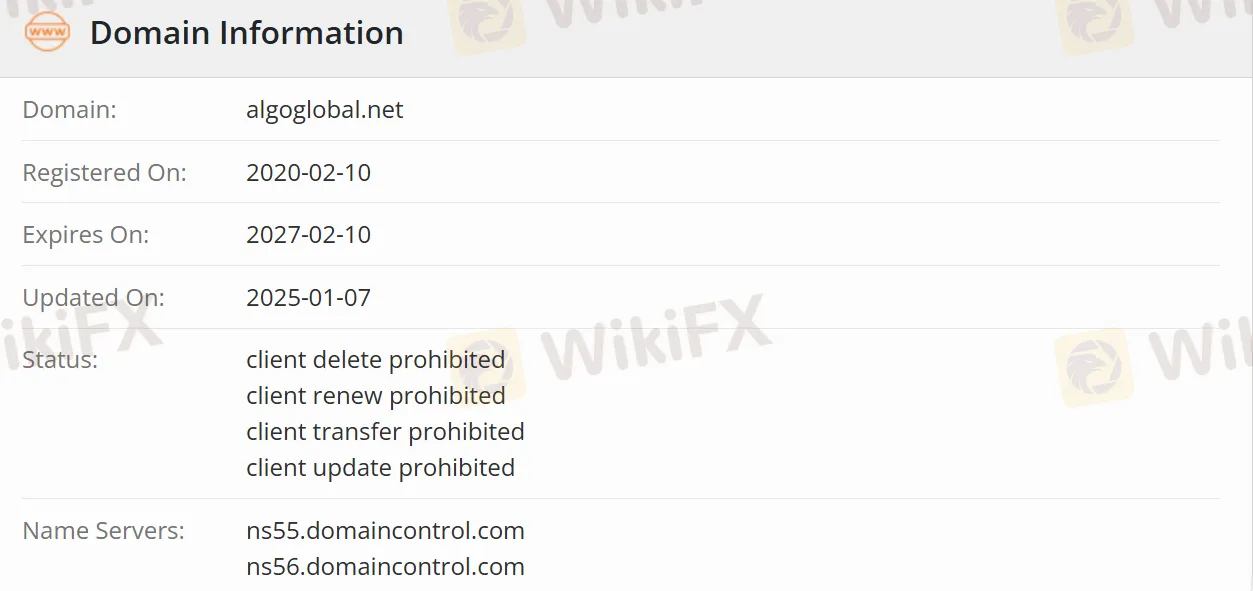

| Founded | 2020-02-10 |

| Registered Country/Region | Belize |

| Regulation | Exceeded |

| Investment Portfolios | Conservative, Moderate, and Aggressive |

| Customer Support | 55 6447 9048 |

| info@algoglobal.net | |

| Facebook, Instagram, TikTok | |

Algo Global Information

Algo Global is a highly influential company in the financial field, committed to providing investors with diversified investment solutions. With more than 15 years of industry experience, it tailors investment strategies for customers. Algo Global offers diverse investment services, including conservative, moderate, and aggressive investment portfolios, with a minimum investment of $1,000. It also provides a liquidity investment portfolio for flexible fund allocation and offers multiple ways to contact customer service to answer questions at any time.

Pros and Cons

| Pros | Cons |

| Diverse investment portfolios (conservative type, moderate type, and aggressive type) | Exceeded |

| Minimum investment threshold as low as $1000 | Uncertainty of returns |

| Liquidity investment portfolio | Limited information transparency (such as the calculation method of penalties for early withdrawal) |

| Multiple ways to contact customer service | Insufficient risk warnings (especially regarding the risks of the aggressive investment portfolio) |

Is Algo Global Legit?

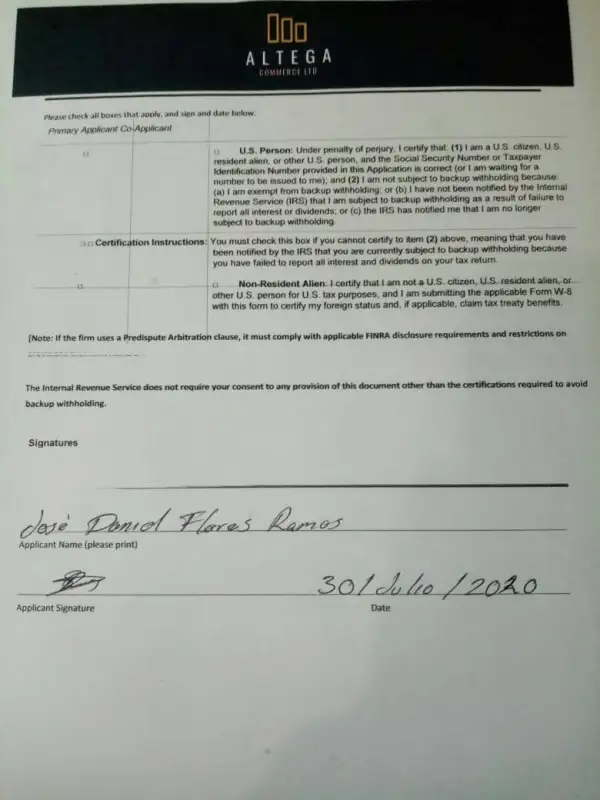

Algo Global has many years of experience in the financial industry and requires a KYC (account verification) process, which is in line with the common practices of compliant financial institutions. However, there is currently a lack of sufficient publicly available regulatory information, making it difficult to accurately determine whether it is subject to strict financial supervision. In addition, the uncertainty of returns and issues regarding the transparency of some information are also concerning.

What Services Does Algo Global Offer?

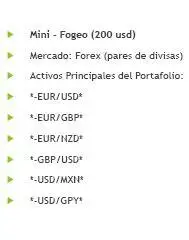

As a professional digital asset management platform, Algo Global provides investors with comprehensive financial service solutions. The core investment portfolio service of the platform is divided into three categories according to the risk preferences of customers:

The conservative portfolio takes principal security and stable returns as its core. The principal and the agreed returns can be guaranteed upon the expiration of the contract.

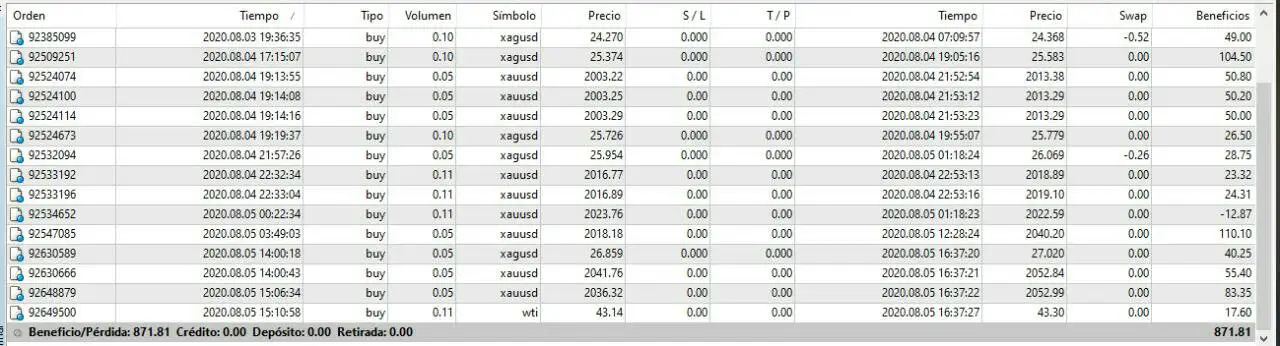

The moderate portfolio pursues moderate growth based on controlling risks. It supports monthly withdrawal of returns and the return of the principal at the end of the term.

The aggressive portfolio adopts a dynamic investment strategy to pursue the maximum appreciation of capital. It also provides monthly return distribution and the return of the principal at the end of the term.

To meet the special needs of high-net-worth customers, the platform has also launched a liquidity investment product. This product adopts an aggressive investment strategy but removes the limitation of a fixed term, allowing large amounts of funds to be deposited and withdrawn at any time, which perfectly balances profitability and liquidity.

In terms of customer service, Algo Global has established an efficient support system. Investors can obtain professional consultations through the online work order system or the exclusive customer service email (support@algoglobal.net). The customer service team promises to respond within 24 hours on working days.

The platform also provides a complete account management service, including account opening and registration, KYC (Know Your Customer) authentication, account information maintenance, and security settings such as two-factor authentication, which comprehensively protects the security of the account.

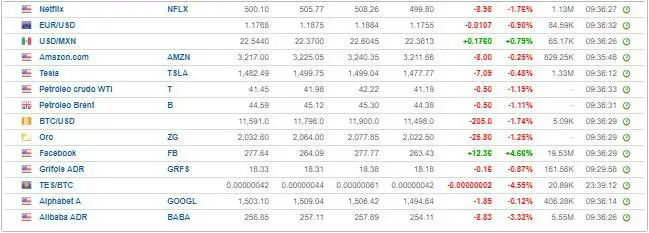

In terms of fund operations, it supports the deposit and withdrawal of mainstream cryptocurrencies (Bitcoin, Ethereum, and USDT stablecoin) and provides KLU card services for corporate customers. Together with the complete function of querying fund transaction records, it makes the asset management of investors more convenient and transparent.