公司简介

| Algo Global评论摘要 | |

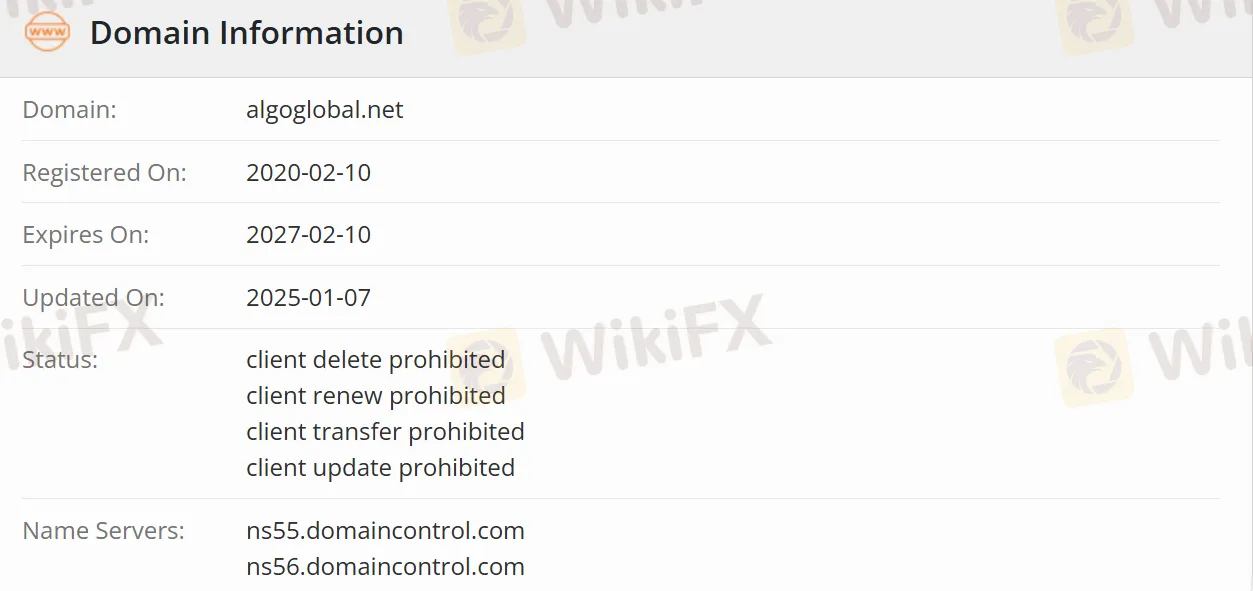

| 成立日期 | 2020-02-10 |

| 注册国家/地区 | 伯利兹 |

| 监管 | 超过 |

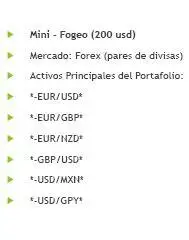

| 投资组合 | 保守型、中等型和激进型 |

| 客户支持 | 55 6447 9048 |

| info@algoglobal.net | |

| Facebook、Instagram、TikTok | |

Algo Global 信息

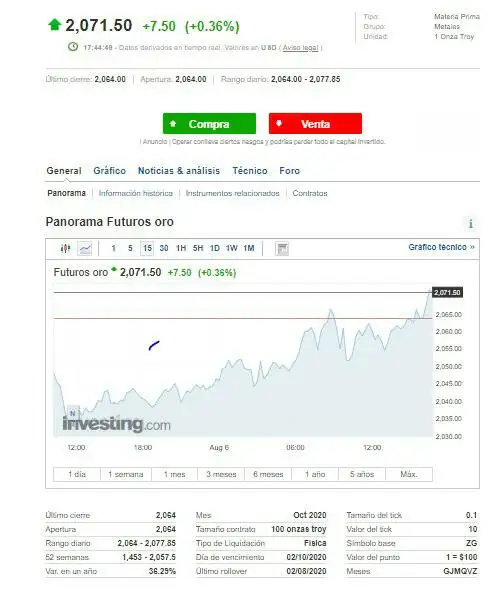

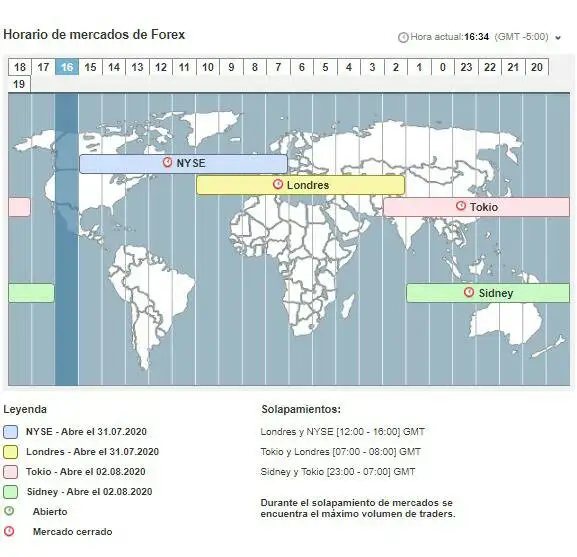

Algo Global 是金融领域中具有很大影响力的公司,致力于为投资者提供多元化的投资解决方案。凭借超过15年的行业经验,它为客户量身定制投资策略。Algo Global 提供多样化的投资服务,包括保守型、中等型和激进型投资组合,最低投资额为1,000美元。它还提供流动性投资组合,以灵活配置资金,并提供多种联系客户服务的方式,随时解答问题。

优点和缺点

| 优点 | 缺点 |

| 多样化的投资组合(保守型、中等型和激进型) | 超过 |

| 最低投资门槛低至1,000美元 | 回报的不确定性 |

| 流动性 投资组合 | 信息透明度有限(例如提前提取罚款的计算方法) |

| 多种联系客户服务的方式 | 风险警示不足(特别是涉及激进型投资组合的风险) |

Algo Global 是否合法?

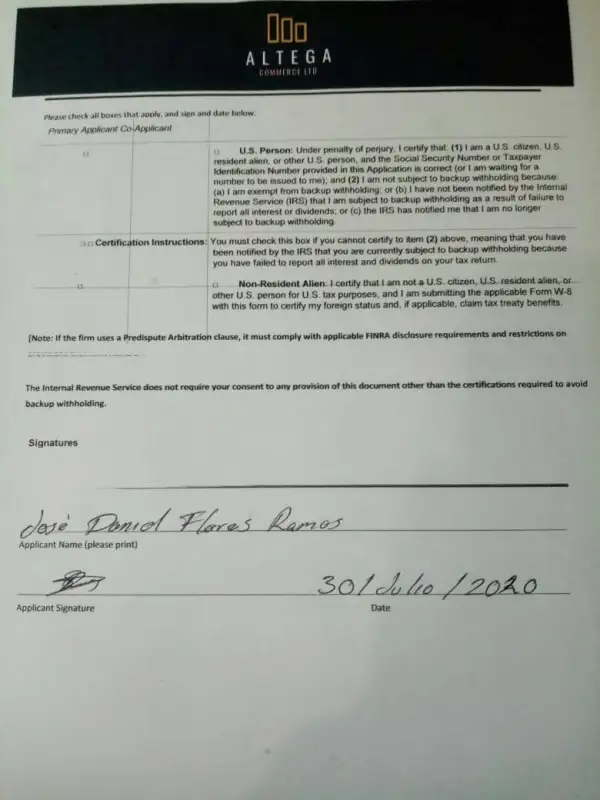

Algo Global 在金融行业拥有多年的经验,并要求进行实名认证(账户验证)流程,符合合规金融机构的常见做法。然而,目前缺乏足够的公开监管信息,难以准确确定它是否受到严格的金融监管。此外,回报的不确定性和部分信息的透明度问题也令人担忧。

Algo Global 提供哪些服务?

作为专业的数字资产管理平台,Algo Global 为投资者提供全面的金融服务解决方案。该平台的核心投资组合服务根据客户的风险偏好分为三类:

保守型投资组合以保护本金和稳定回报为核心。合同到期时可以保证本金和约定的回报。

中等型投资组合在控制风险的基础上追求适度增长。支持月度提取回报和合同到期时本金的返还。

激进型投资组合采用动态投资策略,追求资本的最大增值。还提供月度回报分配和合同到期时本金的返还。

为了满足高净值客户的特殊需求,该平台还推出了一款流动性投资产品。该产品采用积极的投资策略,但取消了固定期限的限制,允许随时存取大量资金,完美地平衡了盈利能力和流动性。

在客户服务方面,Algo Global建立了高效的支持系统。投资者可以通过在线工单系统或专属客服邮箱(support@algoglobal.net)获得专业咨询。客服团队承诺在工作日内24小时内回复。

该平台还提供完整的账户管理服务,包括账户开立和注册、实名认证(实名认证)认证、账户信息维护以及安全等设置,全面保护账户的安全。

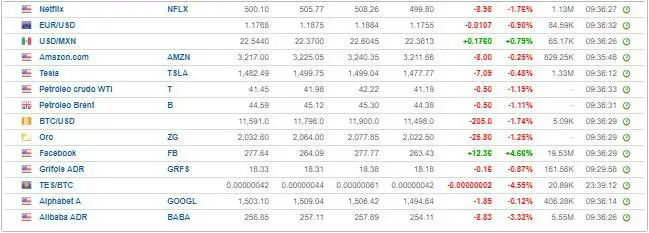

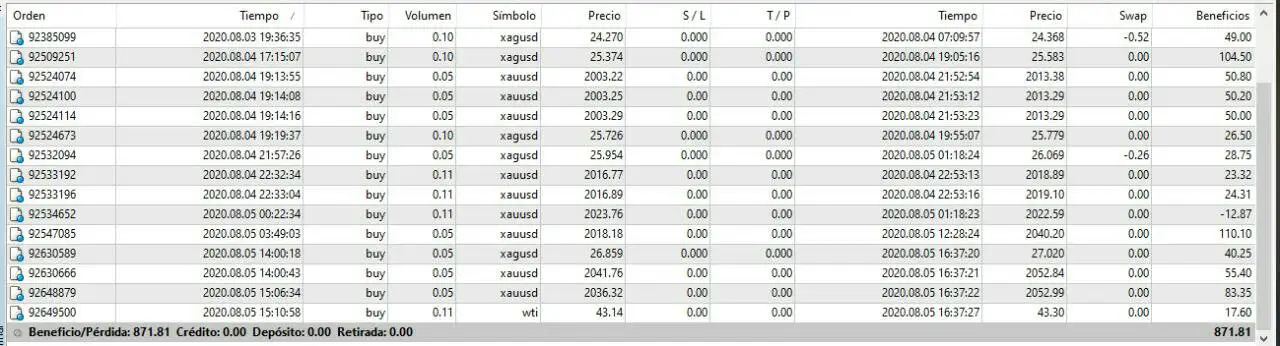

在资金操作方面,支持主流加密货币(比特币、以太币和USDT稳定币)的存取,并为企业客户提供KLU卡服务。结合完整的资金交易记录查询功能,使投资者的资产管理更加便捷和透明。