Company Summary

| StoneX Review Summary | |

| Founded | 2003 |

| Registered Country/Region | United States |

| Regulation | No regulation |

| Market Instruments | Commodities, securities, FX, digital assets |

| Demo Account | ✅ |

| Leverage | / |

| Spread | / |

| Trading Platform | StoneX One |

| Minimum Deposit | / |

| Customer Support | Tel: +12124853500 |

| Address: 230 Park Avenue, 10th Floor, New York, NY 10169 | |

| X, Instagram, LinkedIn, YouTube | |

StoneX Information

Founded in 2003, StoneX is an unregulated broker registered in the United States, offering trading on commodities, securities, FX, and digital assets on StoneX One platform.

Pros and Cons

| Pros | Cons |

| Demo accounts | No regulation |

| Segregated accounts | Unclear fee structure |

| Various trading products | No info on deposit and withdrawal |

| Long operational history |

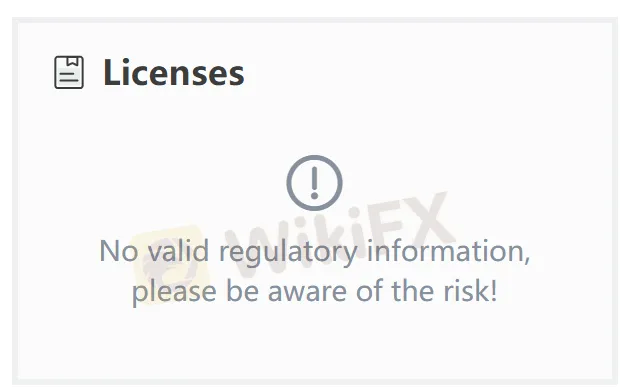

Is StoneX Legit?

No. StoneX currently has no valid regulations. Please be aware of the risk!

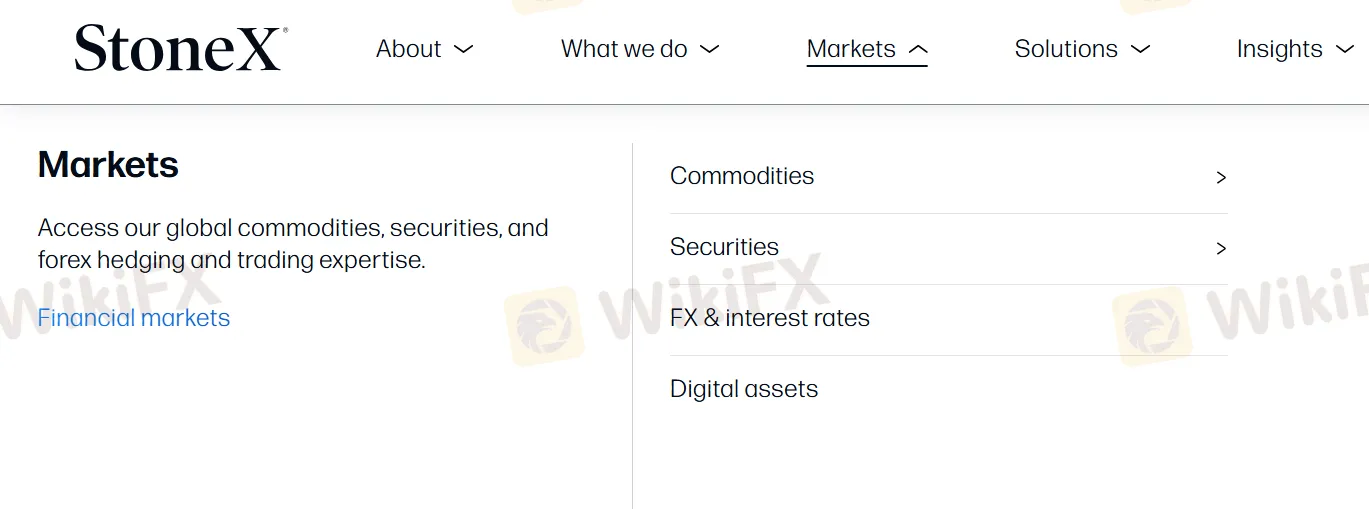

What Can I Trade on StoneX?

StoneX offers trading on Commodities, Securities, FX, and Digital assets.

| Tradable Instruments | Supported |

| Commodities | ✔ |

| Securities | ✔ |

| FX | ✔ |

| Digital assets | ✔ |

| Indices | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

Through StoneX One, investors and traders can open securities accounts, and the accounts currently are available to U.S. residents only. Besides, StoneX One offers demo accounts.

Trading Platform

StoneX One uses its own trading platform.

| Trading Platform | Supported | Suitable for |

| StoneX One | ✔ | / |

| MT4 | ❌ | Beginners |

| MT5 | ❌ | Experienced traders |

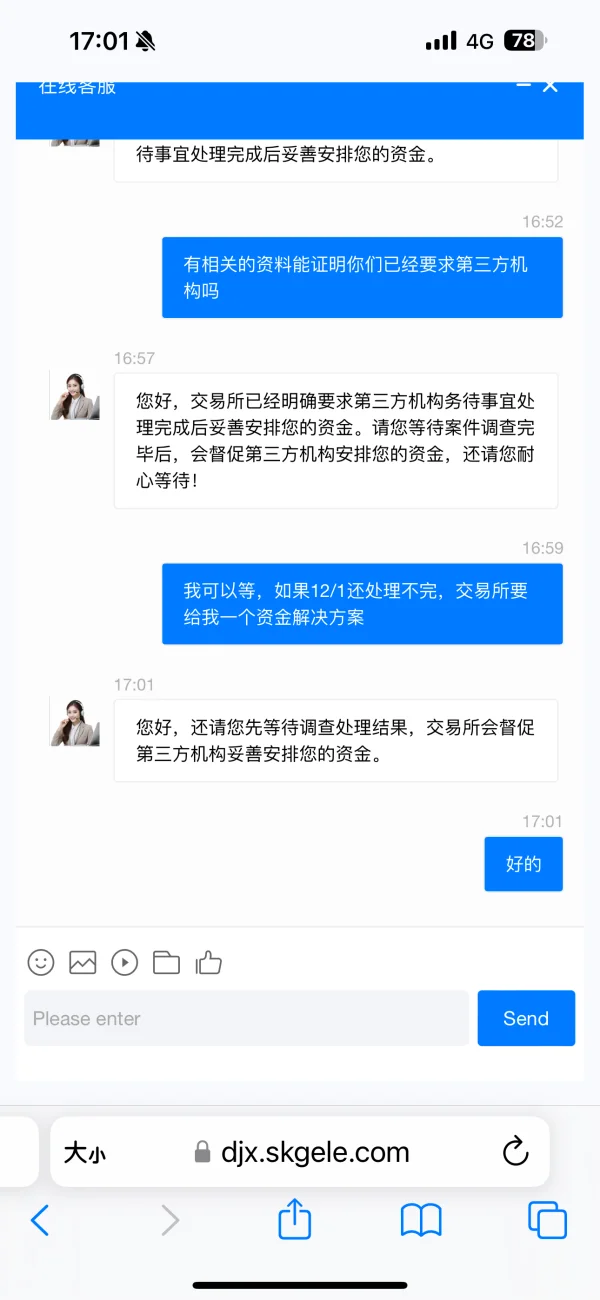

FX1310826796

Hong Kong

First, I registered an account on the Jefferies Exchange. After making just one withdrawal, they started refusing further withdrawals under various pretexts, demanding all sorts of unfrozen funds and security deposits. After finally paying everything off, I could withdraw again. Now they claim my account was frozen during a third-party transfer, so I switched to cash transactions. Then they said the cash was seized by police. Since late October, they've been merging with Stonex, telling me to wait 15 business days—only to extend it another 15 days. Now I can't even log into the Stonex exchange; the link is dead. Please help me find the working link.

Exposure

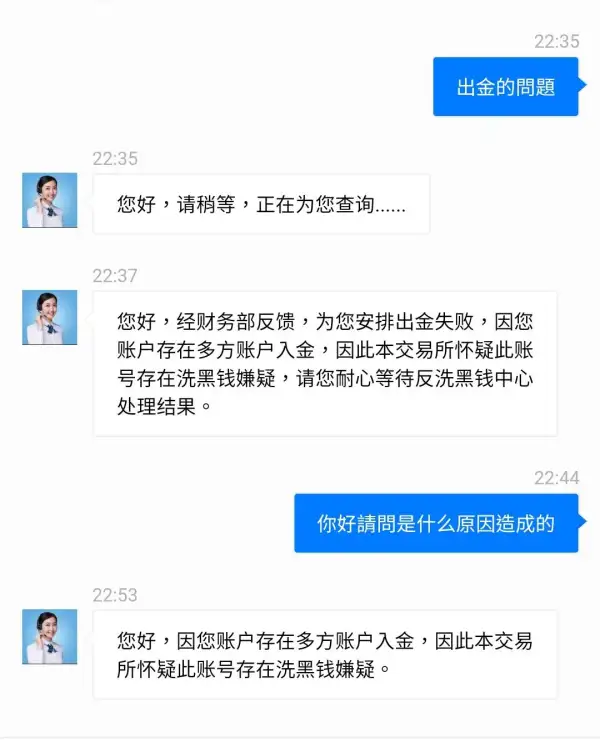

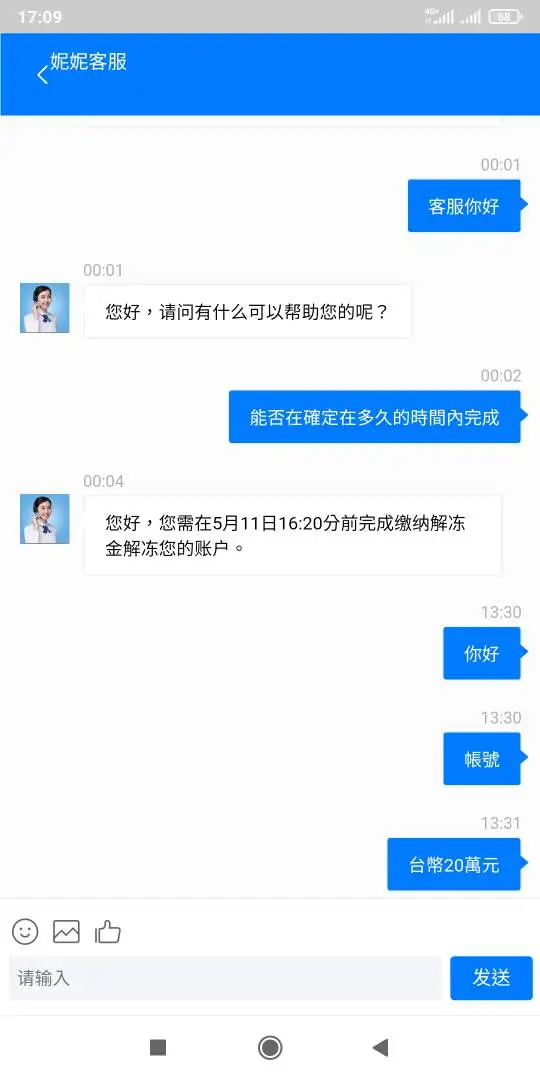

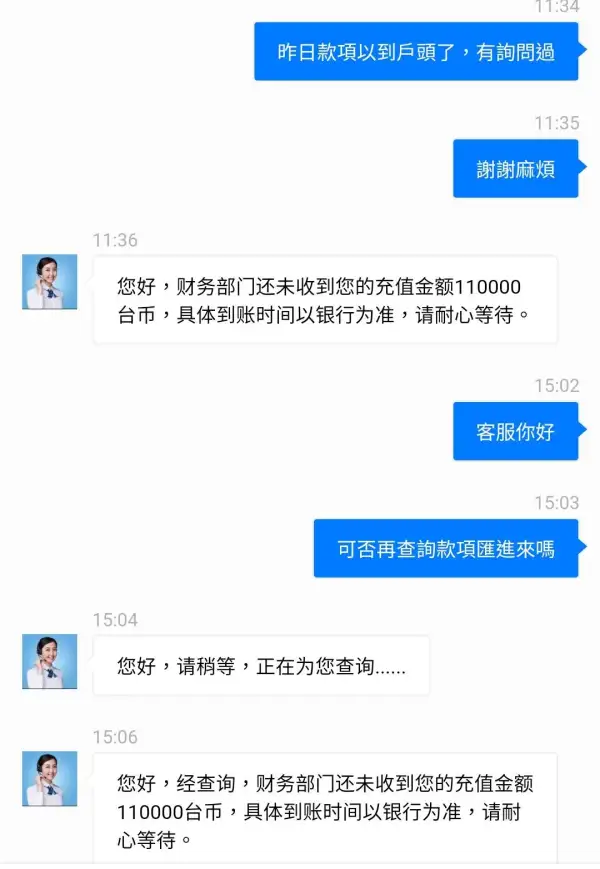

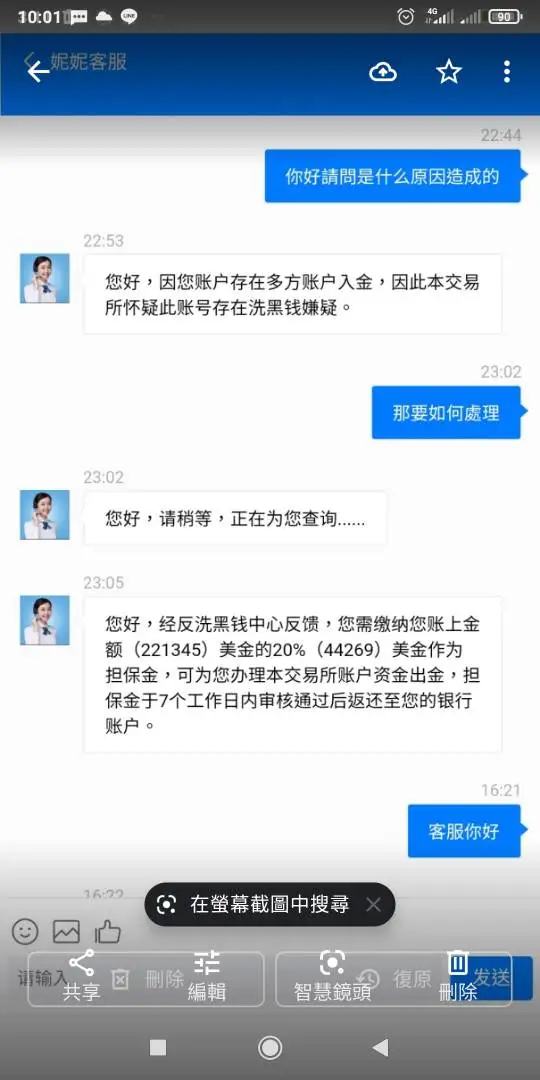

FX2372073304

Taiwan

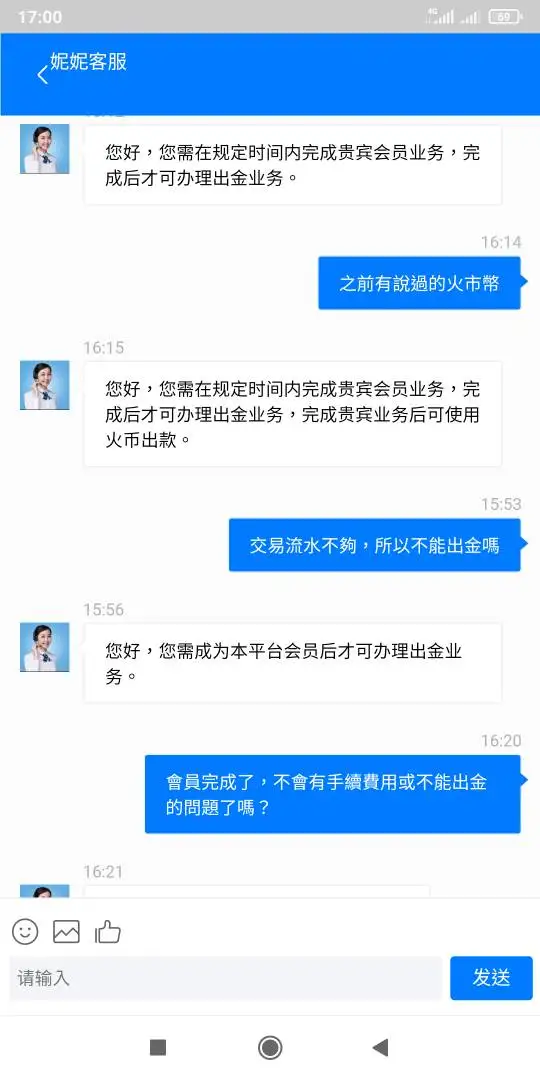

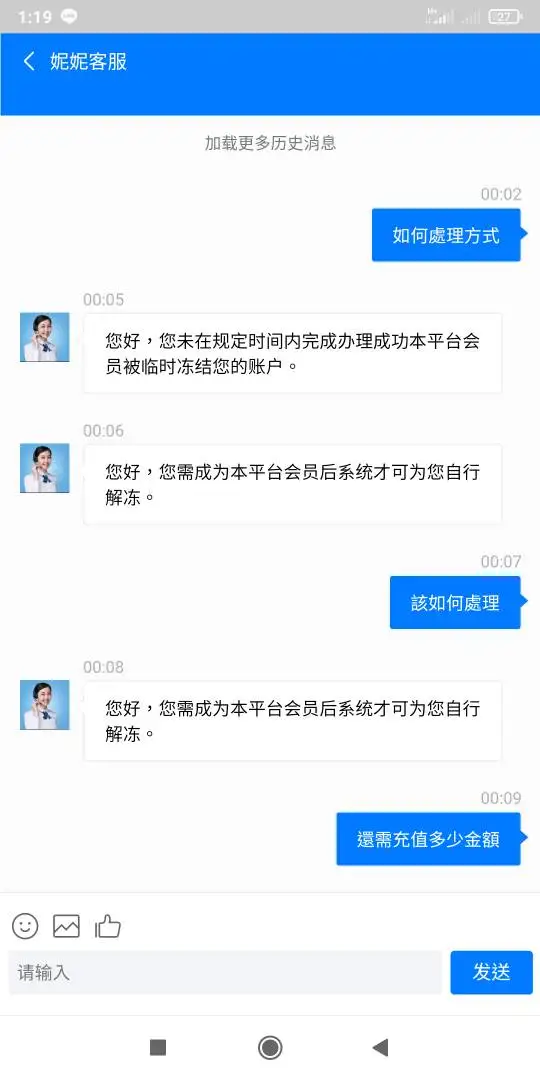

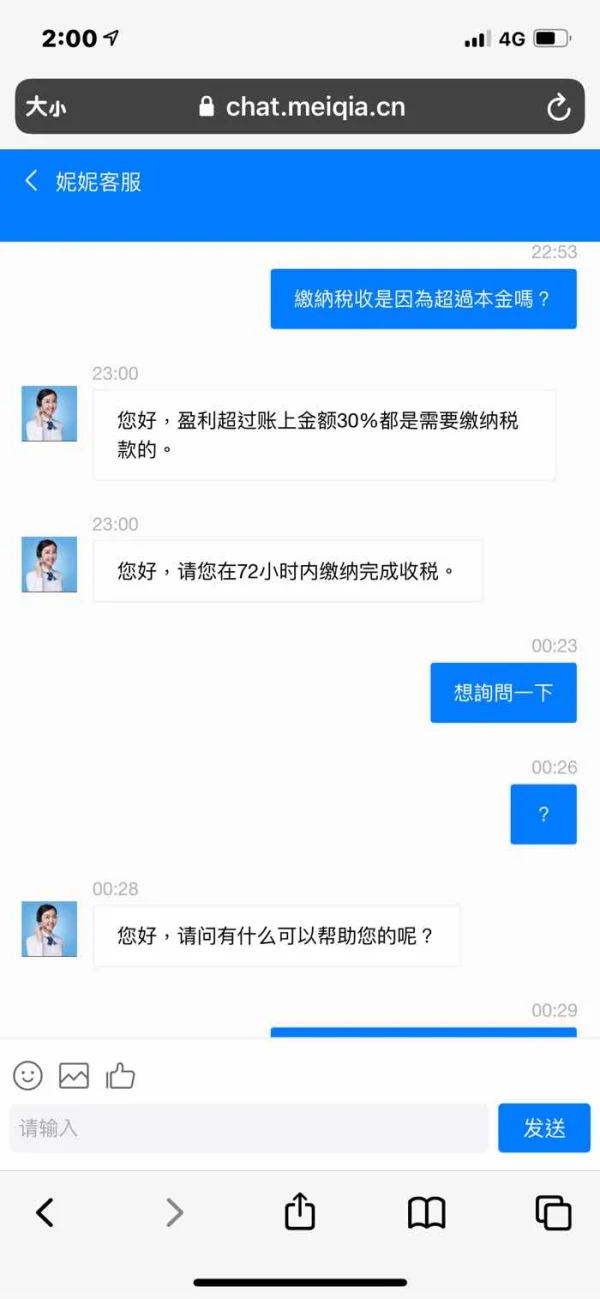

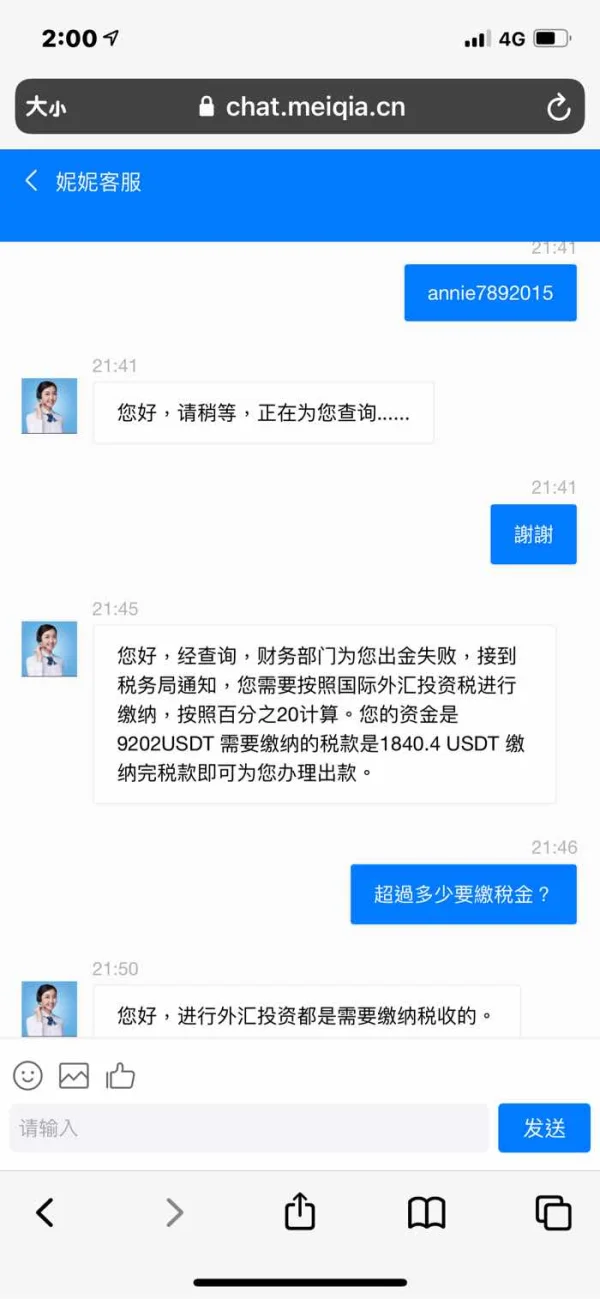

A female friend introduced me to a person who knows a platform with USD. At the beginning, I withdrew funds successfully for the first two times. I did not have a loss within the specified period of time to do foreign exchange. The other party gave a project with a return of 9999 US dollars. 5.2W, after the completion, it is the problem that the member needs 38888 US dollars to join, and the total amount is 10% if it is not completed within the time, and it is necessary to withdraw the money after it is completed. The platform says that the serial number is not enough × 5 times (when all the money is to be withdrawn, it will be The same thing) I made money by doing foreign exchange trading numbers for US dollars, euros, and yen. Sometimes the other party said that I would bet up, but I would press it wrong and press down. I didn’t lose any money at all. In the last time, the money was transferred. The account number is completed, the payment came to 221,345 US dollars, and the payment is to be withdrawn. The platform gave a name for multiple accounts and suspected of money laundering. If the payment cannot be withdrawn, 20% needs to be supplemented. 44269 US dollars as a guarantee, and approved within 7 days After that, without any suspicion, the security deposit of US$44,269 will be returned, and it is still unable to withdraw the money at US$221,345.

Exposure

FX3914838800

Taiwan

It is said that you must pay 20% of the tax before you can withdraw normally. When is it required to pay tax for withdrawals? As a result, the account is frozen later, it is best to return the principal

Exposure

Henry9

New Zealand

Dealing with payments across different countries was a headache before we started using StoneX. Now, it’s smoother with their FX solutions. They handle the complexities, and I focus more on running our business.

Positive

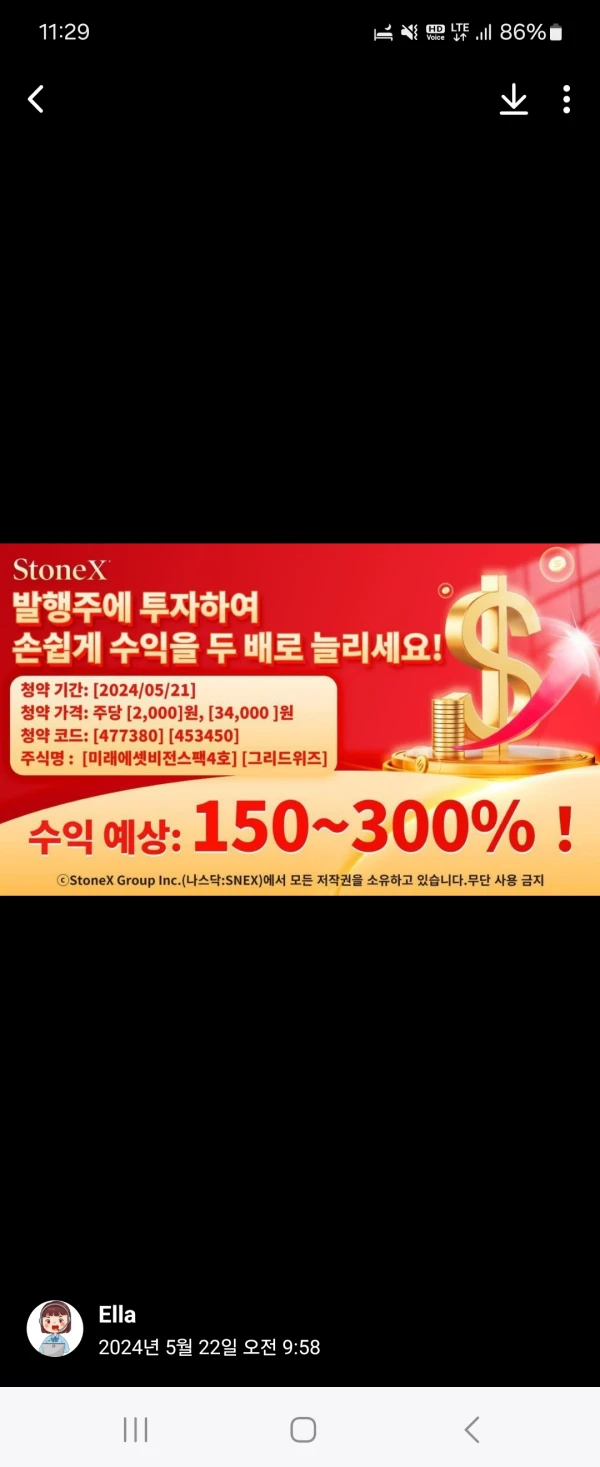

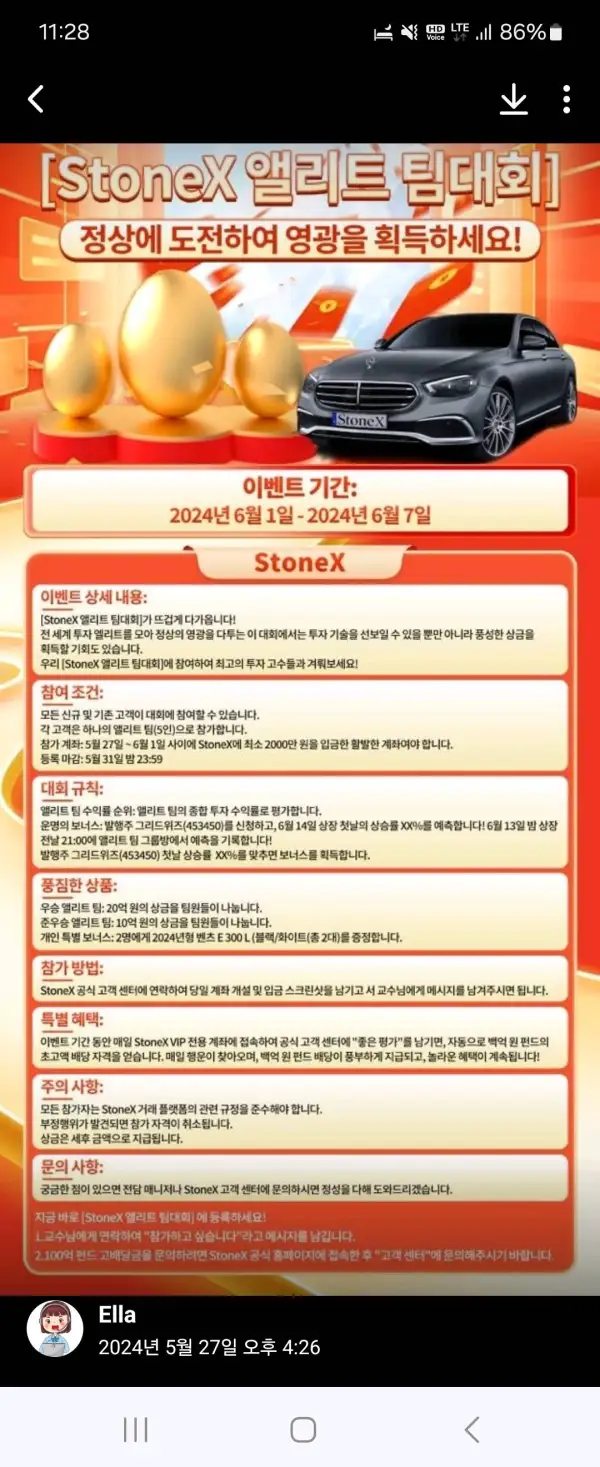

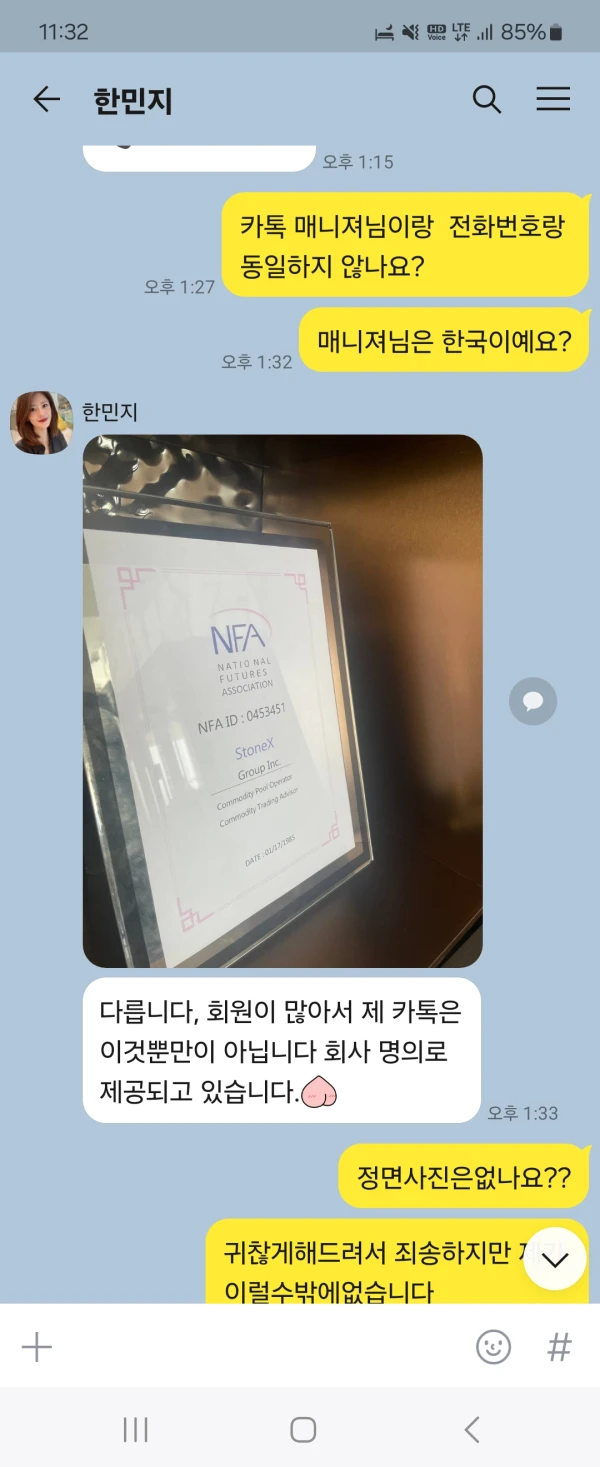

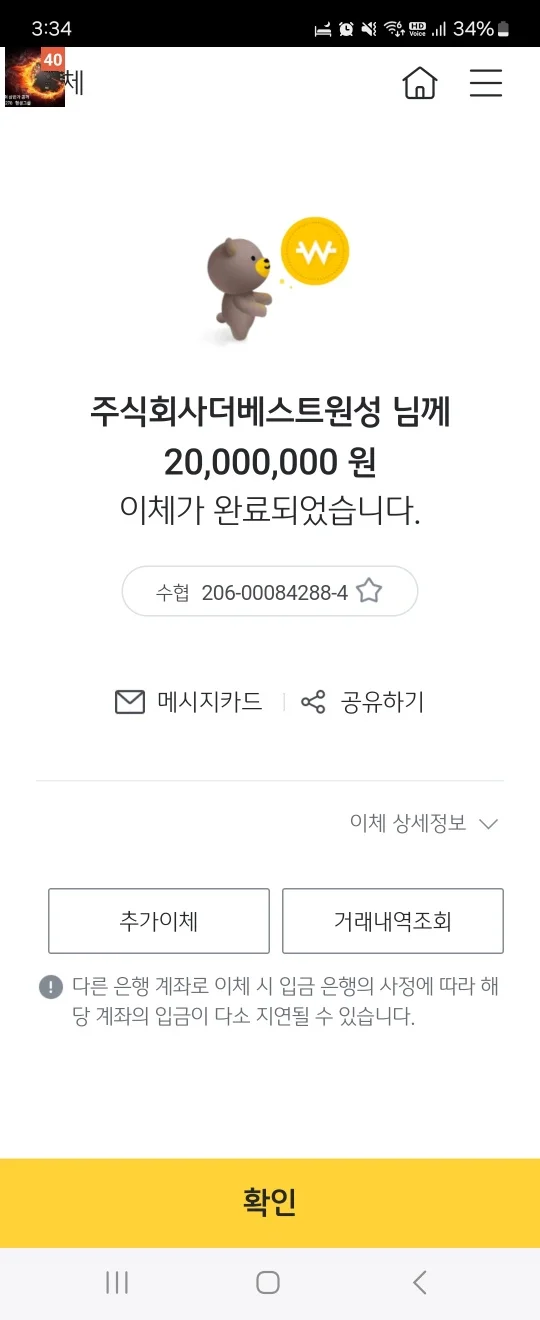

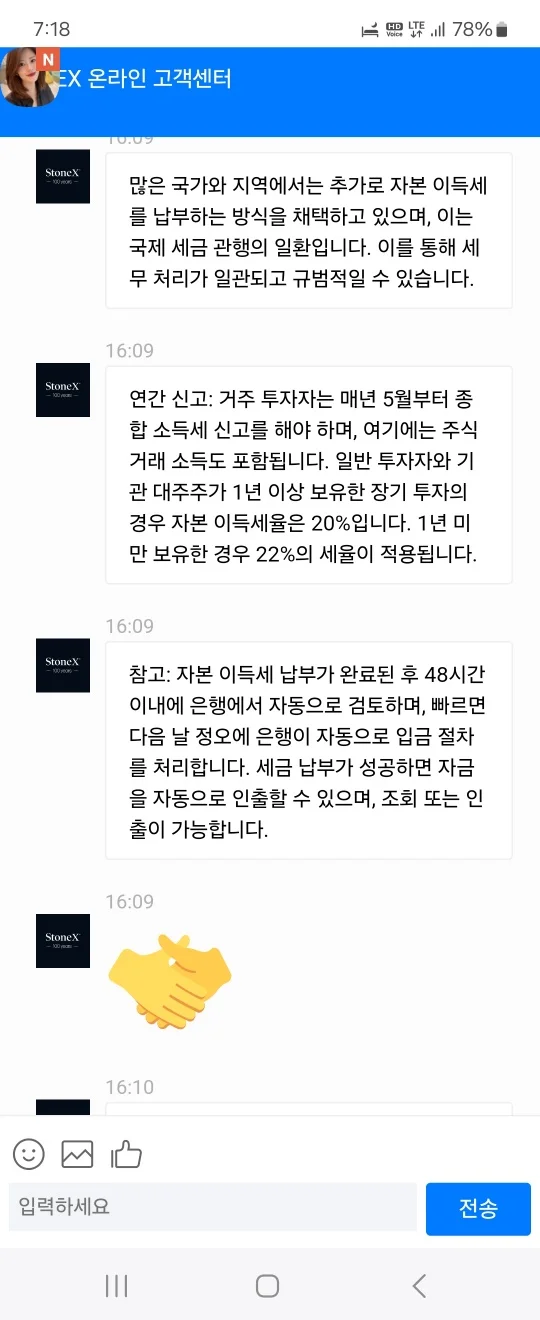

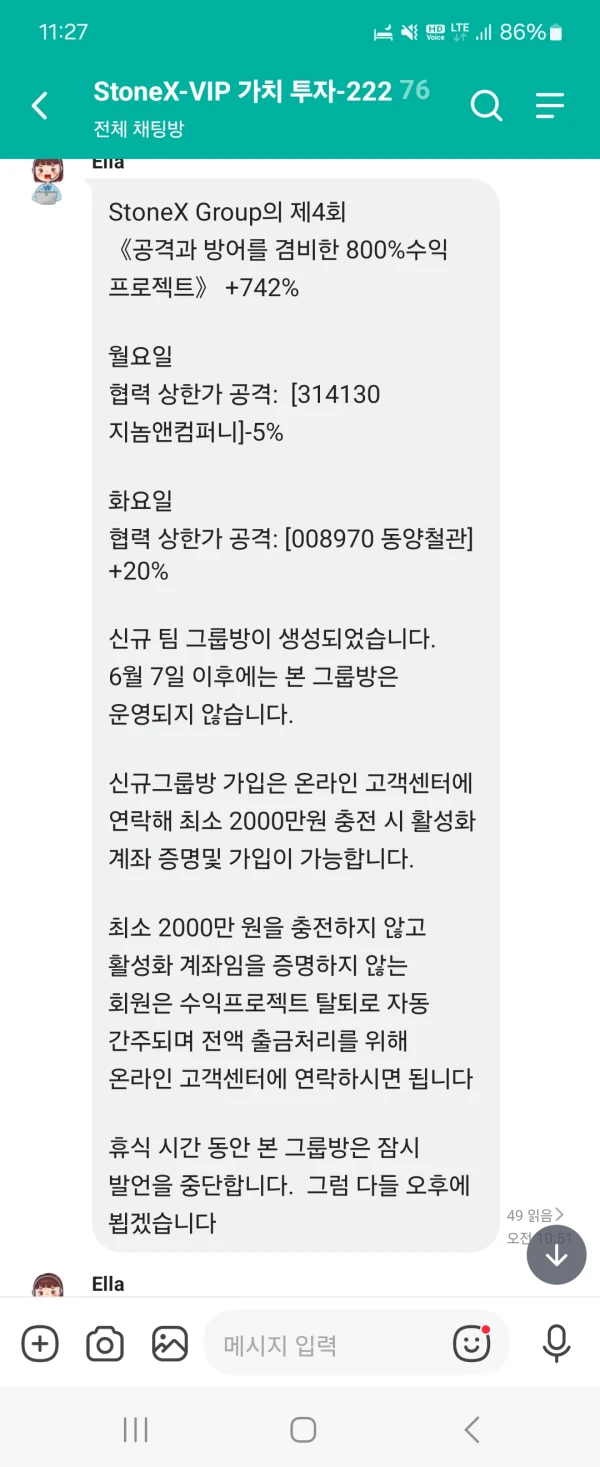

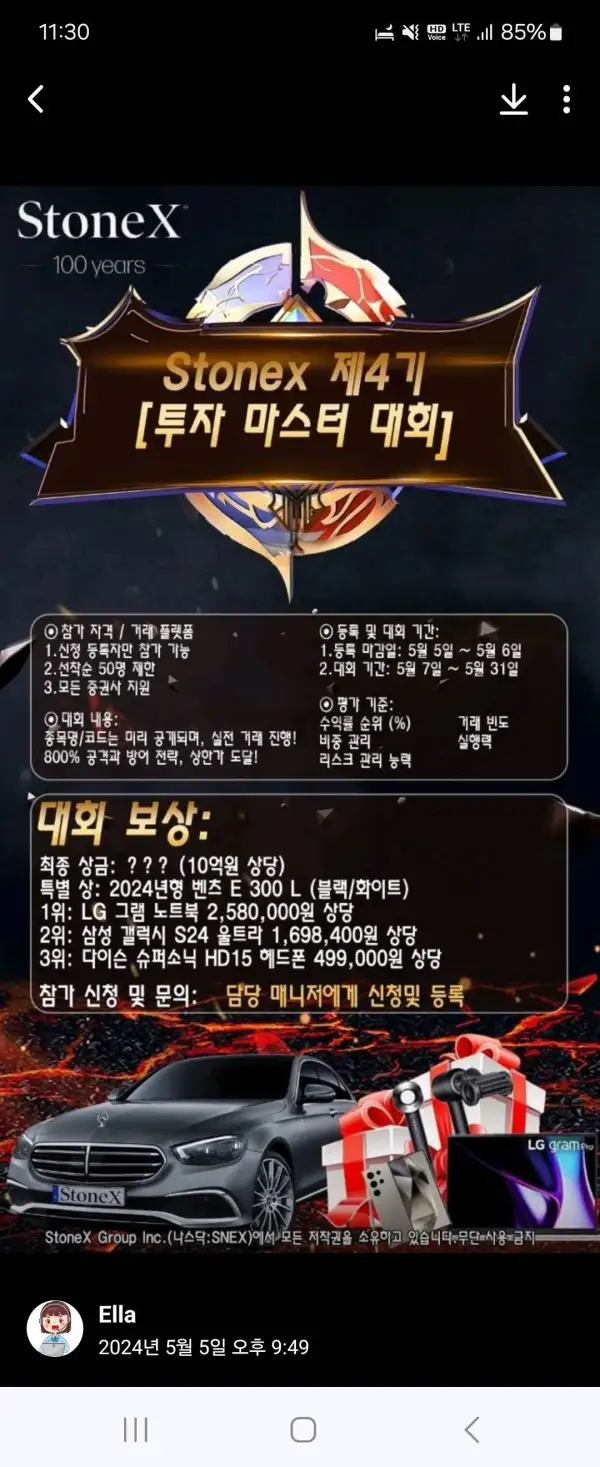

춘자

South Korea

After being told to apply for a public offering and then being informed that I won the subscription, they had me tie up my money and withdraw the full amount, resulting in a fee of 18 million KRW. A 25% loan payment of 20 million KRW. A fast transfer service fee of 15 million KRW. After paying, they now say I have to pay a capital gains tax of 36 million KRW. They say if I don't deposit by today, my money will be frozen. All the accounts seem fake too. Was I scammed?? I ended up putting in way too much money.

Exposure

FX1490860758

United States

I've traded everything from securities to currencies and the diversity has always kept it exciting. The seamless global payments made transactions quick and easy on the pocket. Trading physical commodities was an intriguing experience. However, getting a handle on some of the OTC products was a bit of a learning curve...

Neutral

子衿17205

United Kingdom

I am very satisfied with the products and service of StoneX, as well as great customer support, customized trading conditions and fast execution times!

Positive

HQ

Colombia

The size of this website's interface doesn't look good on my monitor. It seems to me that the site looks a bit outdated. Wikifx says its license is a clone, which scares me a little, and I've decided not to trade here. Do you have a reliable options platform to recommend?

Neutral

Supamit Phompinit

Thailand

I trade on platform https://monteco.top, which generates excellent profits at 124654.41usdt. They said I must transfer the tax first at 10% because they cannot deduct the money from their account.

Exposure