Company Summary

| DXtradeReview Summary | |

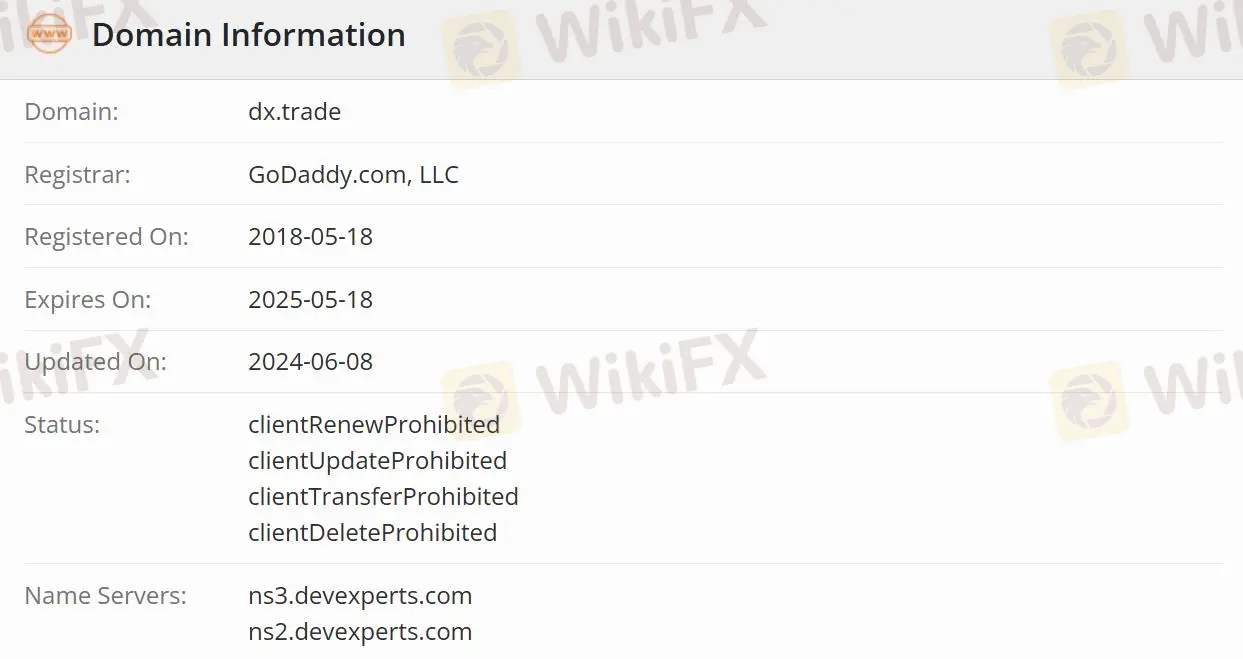

| Founded | 2018-05-18 |

| Registered Country/Region | Ireland |

| Regulation | Unregulated |

| Demo Account | ✅ |

| Trading Platform | DXtrade CFD(Web/Mobile)/DXtrade XT((Web/Mobile)/Prop trading technology |

| Customer Support | Phone: +1 201 685 9280 |

| Social Media: Facebook, Twitter, YouTube, LinkedIn | |

DXtrade Information

DXtrade is a software vendor and a product IT company that has been developing software for financial industry companies since 2002. The core business expertise is trading platforms, namely DXtrade XT for listed securities and derivatives, DXtrade CFD for OTC asset classes, and DXtrade Crypto for cryptocurrencies. This demo account is not for traders. It is a service designed for brokers and prop firms to trial DXtrade software.

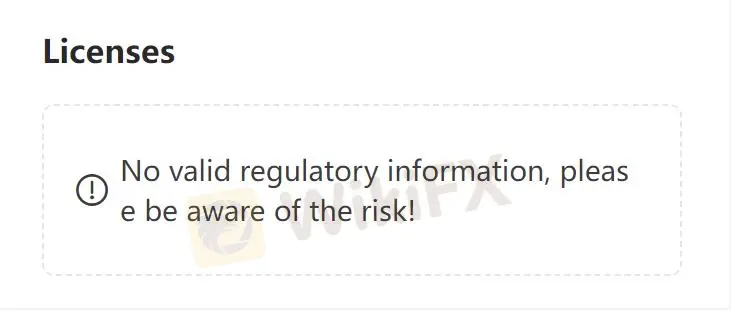

Is DXtrade Legit?

DXtrade is not regulated, making it less safe than regulated brokers.

What trading platform does DXtrade provide?

DXtrade offers access to DXtrade CFD, DXtrade XT, and Prop trading technology. They are available on the web and mobile. DXtrade CFD trading platform for FX, CFD, crypto, and spread-betting brokers; DXtrade XT trading platform for brokers offering stocks, options, futures, mutual funds, and bonds; DXtrade is a platform for prop trading and trading competitions. It provides Startup brokers, Established brokers, and Prop trading firms' clients with professional experience when trading FX, CFDs, and futures.

| Trading Platform | Supported | Available Devices |

| DXtrade CFD | ✔ | Web/Mobile |

| DXtrade XT | ✔ | Web/Mobile |

| Prop trading technology | ✔ | - |

Customer Support Options

Traders can follow the platform on Facebook, Twitter, YouTube, and LinkedIn and contact it via phone.

| Contact Options | Details |

| Phone | +1 201 685 9280 |

| Social Media | Facebook, Twitter, YouTube, LinkedIn |

| Supported Language | English/Spanish |

| Website Language | English/Spanish |

| Physical Address |