Company Summary

| Dragon Capital Review Summary | |

| Founded | 2006 |

| Registered Country/Region | Cyprus |

| Regulation | CySEC |

| Products & Services | Investment services, trading, investment advice, underwriting, custody, forex, derivatives |

| Demo Account | ❌ |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Phone: +357 25 376 300 |

| Fax: +357 25 376 301 | |

| Email: svitlana.rusakova@dragon-capital.com | |

Dragon Capital Information

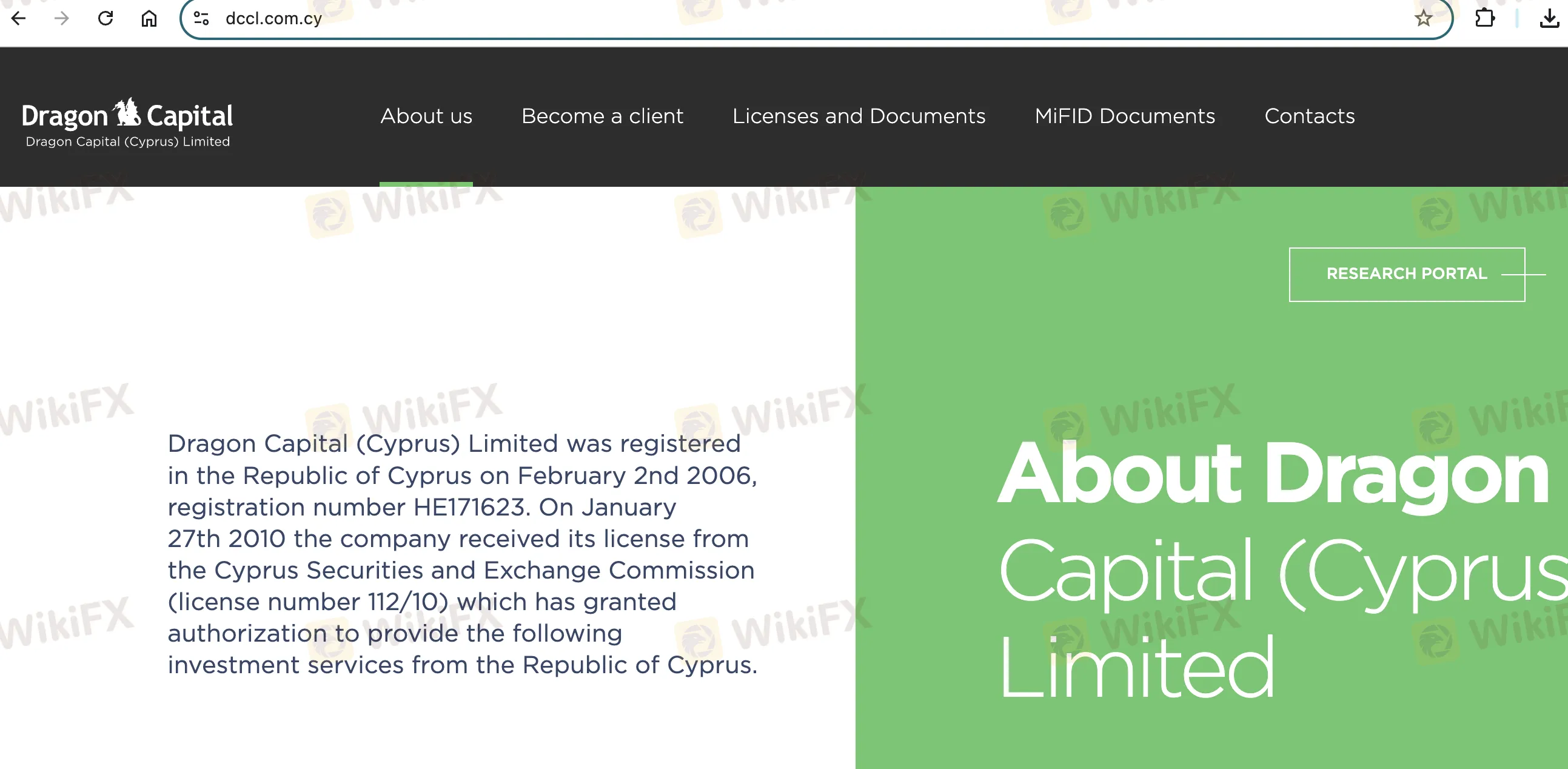

Dragon Capital (Cyprus) Ltd is a licensed investment firm in Cyprus that was created in 2006 and is regulated by CySEC under license 112/10. The company provides an array of investment services, including as order execution, trading on its own account, custody, and investment advice, for different financial instruments.

Pros and Cons

| Pros | Cons |

| Regulated by CySEC | Some fees (such as Ukrainian bond services) are higher than international peers |

| Offers a wide range of financial instruments and services | No demo accounts |

| Comprehensive investment and custody solutions | No platform details |

Is Dragon Capital Legit?

Dragon Capital (Cyprus) Ltd is a licensed and regulated entity under the Cyprus Securities and Exchange Commission (CySEC) with license number 112/10, operating as a Market Maker (MM).

Products and Services

Dragon Capital (Cyprus) Ltd offers a comprehensive range of investment and related services, such as executing orders, trading on its own account, giving investment advice, underwriting, and custody services. These services encompass a wide range of financial instruments, including stocks, derivatives, and money market instruments.

| Products & Services | Supported |

| Securities (stocks, bonds) | ✔ |

| Derivatives & CFDs | ✔ |

| Investment Advice | ✔ |

| Underwriting & Placement | ✔ |

| Custody Services | ✔ |

| Margin & Credit Services | ✔ |

| Forex (linked to investment) | ✔ |

| Investment Research | ✔ |

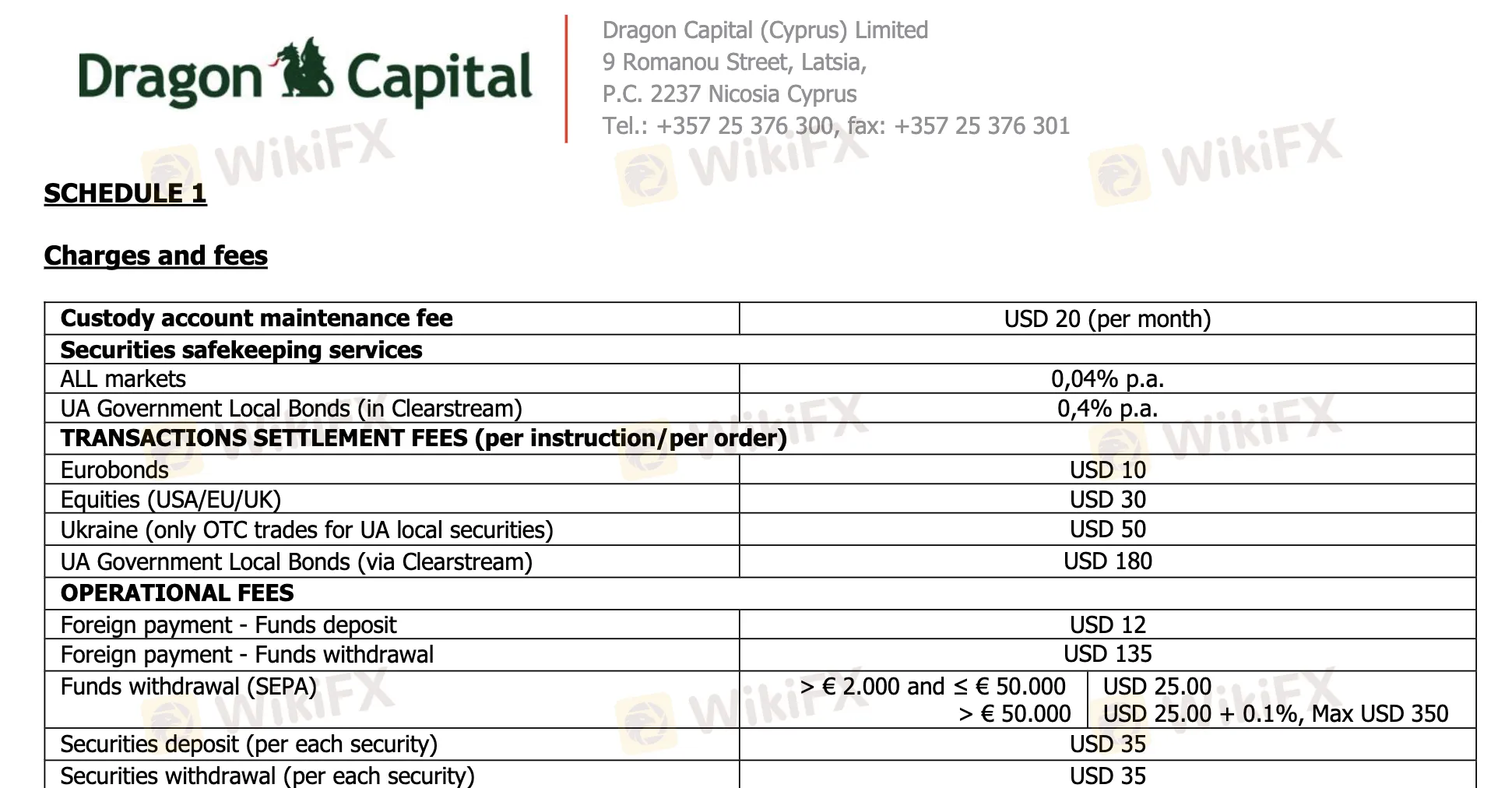

Dragon Capital Fees

Dragon Capital's fees are mostly in line with those of other international investment firms. However, there can be more for some specialist services, like Ukrainian local bonds, corporate actions, and foreign withdrawals.

| Fee Type | Amount |

| Custody Account Maintenance | USD 20 per month |

| Securities Safekeeping (all markets) | 0.04% per year |

| UA Gov Local Bonds (Clearstream) | 0.4% per year |

| Eurobond Settlement | USD 10 per order |

| Equities (USA/EU/UK) Settlement | USD 30 per order |

| UA Local Securities (OTC) Settlement | USD 50 per order |

| UA Gov Bonds (Clearstream) Settlement | USD 180 per order |

Non-Trading Fees

| Non-Trading Fees | Amount |

| Foreign Payment (Deposit) | USD 12 |

| Foreign Payment (Withdrawal) | USD 135 |

| SEPA Withdrawal > €2,000–50,000 | USD 25 |

| SEPA Withdrawal > €50,000 | USD 25 + 0.1% (max USD 350) |

| Securities Deposit / Withdrawal | USD 35 per security |

| Dividend Income Collection (UA only) | 0.2% (min USD 15, max USD 300) |

| Dividend Income Credit (UA only) | USD 20 |

| Full Proxy Voting | USD 100–200 + external costs |

| Buy Back (UA local) | USD 100 + external costs |

| FX Operations EU Banks | 0.1% (min USD 20) |

| FX Operations UA Banks | 0.2% (min USD 40) |

| DR Conversion, Audit Requests, etc. | USD 20–100 + third-party fees |