Company Summary

| PACSHK Review Summary | |

| Founded | 2006 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Products and Services | Corporate Finance & Capital Market, Global Stocks, Global Futures, Asset Mangement |

| Demo Account | ❌ |

| Trading Platform | 全球財富寶 Mobile App, 港股快車閃電交易專業版 (Windows) |

| Customer Support | Phone (HK): +852 3762 9688 |

| Phone (CN): +86 400 841 1061 | |

| Email: cs.pacshk@pingan.com | |

| Fax: +852 3762 9668 | |

PACSHK Information

Specializing in futures trading and investment services, Ping An of China Securities (Hong Kong) Company Limited (“PACSHK”) is the first wholly owned overseas subsidiary of Ping An Securities Company Limited (The Shenzhen headquarter is set up in August 1991). It is a licensed and regulated financial institution under the SFC of Hong Kong. Its proprietary platforms and physical account opening processes include margin financing, private fund access, and IPO solutions.

Pros and Cons

| Pros | Cons |

| Regulated by SFC in Hong Kong | No demo or Islamic account |

| Access to private funds and structured investment tools | Limited to in-person account opening |

| Mobile and PC trading platforms available | No support for Mac or browser-based trading |

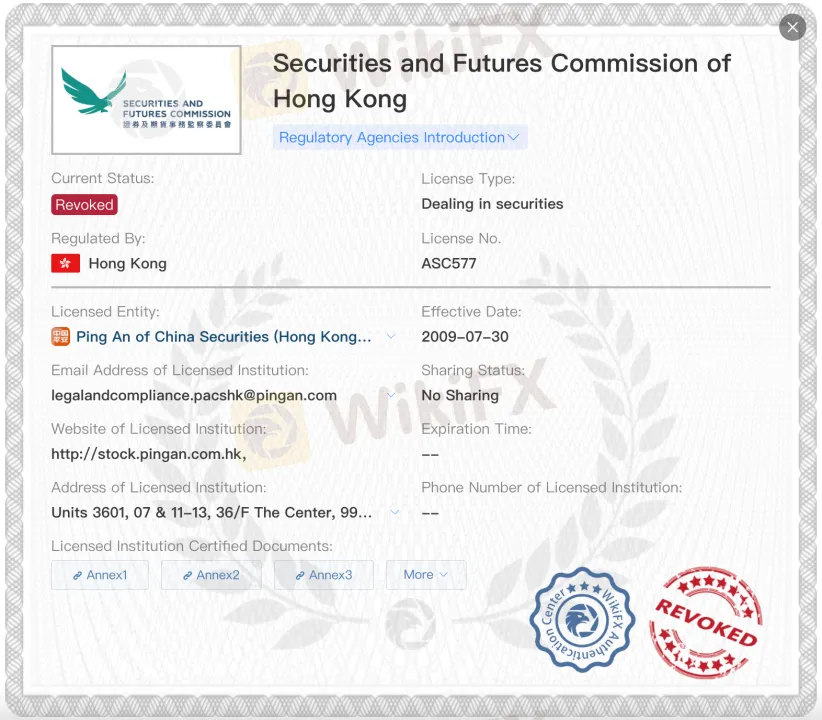

Is PACSHK Legit?

Yes, PACSHK is regulated. The Hong Kong Securities and Futures Commission (SFC) has given it License No. AXR954 for Dealing in Futures Contracts since 2012-03-30.

However, Ping An of China Securities (Hong Kong)'s Securities Dealing License (License No. ASC577) has been revoked. This difference is crucial when confirming Ping An group services or businesses.

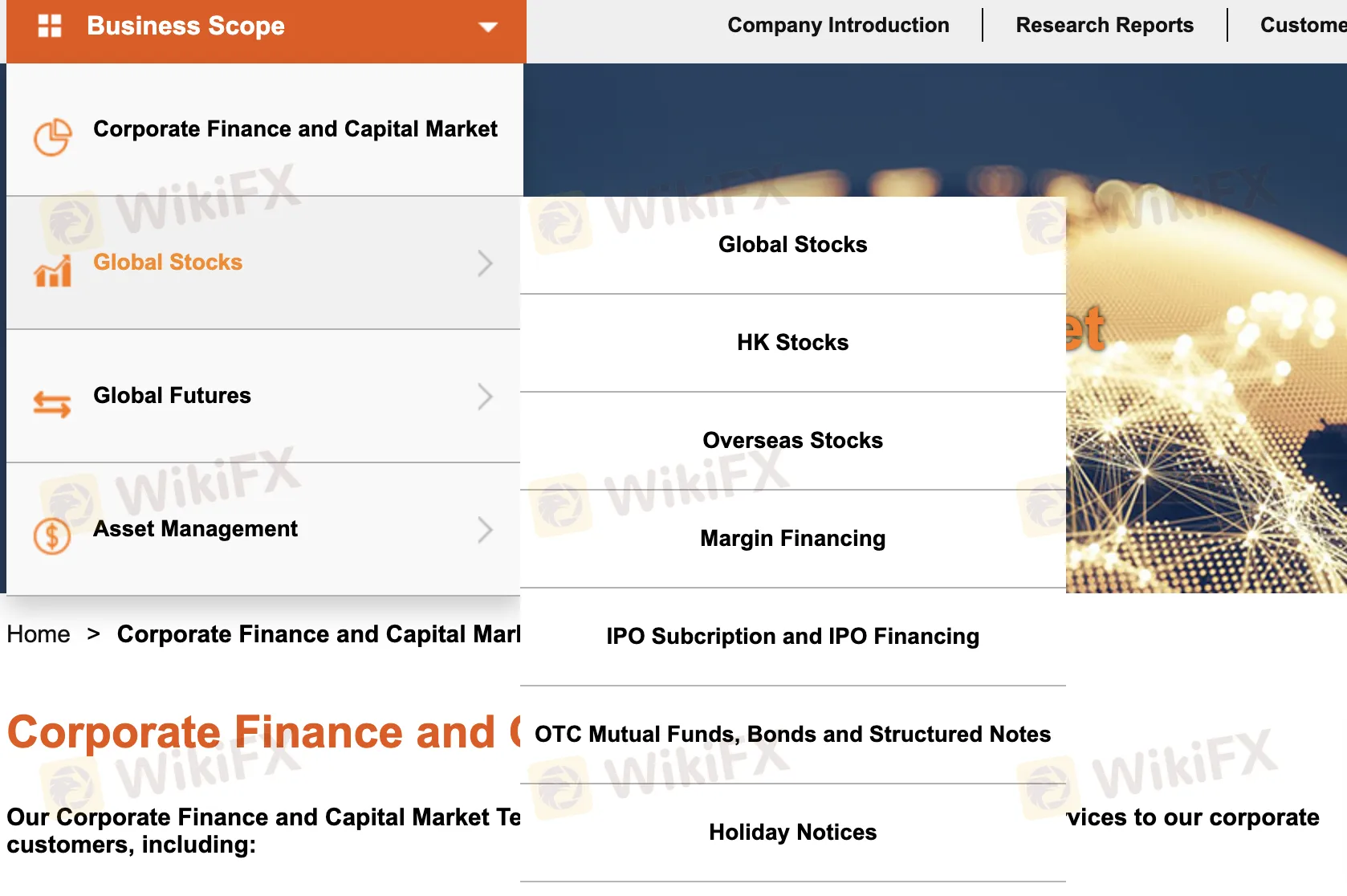

What Can I Trade on PACSHK?

PACSHK offers a wide range of financial products and services including corporate finance solutions, global securities trading, futures and options, and asset management.

| Category | Products/Services Offered |

| Corporate Finance & Capital Market | IPO sponsorship and underwriting |

| Bond and preference share issuance | |

| Convertible bond issuance | |

| Secondary market placements | |

| M&A financial advisory | |

| Private placements | |

| Global Stocks | Hong Kong Stocks (HK Stocks) |

| Overseas/Global Stocks | |

| Margin Financing | |

| IPO Subscription and Financing | |

| OTC Mutual Funds | |

| OTC Bonds | |

| OTC Structured Notes | |

| Global Futures | Hong Kong Futures and Options |

| Global Futures | |

| Asset Management | Privately Offered Funds |

Account Types

PACSHK provides two kinds of live trading accounts: Corporate Accounts and Individual/Joint Accounts. It does not provide Islamic (swap-free) accounts or demo accounts. Opening an account is done in person; each account type is customised to fit various groups of investors depending personal or institutional requirements.

| Account Type | Description | Suitable For |

| Individual/Joint | For personal or joint investors opening in person | Retail or private investors |

| Corporate | For companies or institutional investors | Businesses or corporate entities |

| Demo Account | Not available | — |

| Islamic Account | Not available | — |

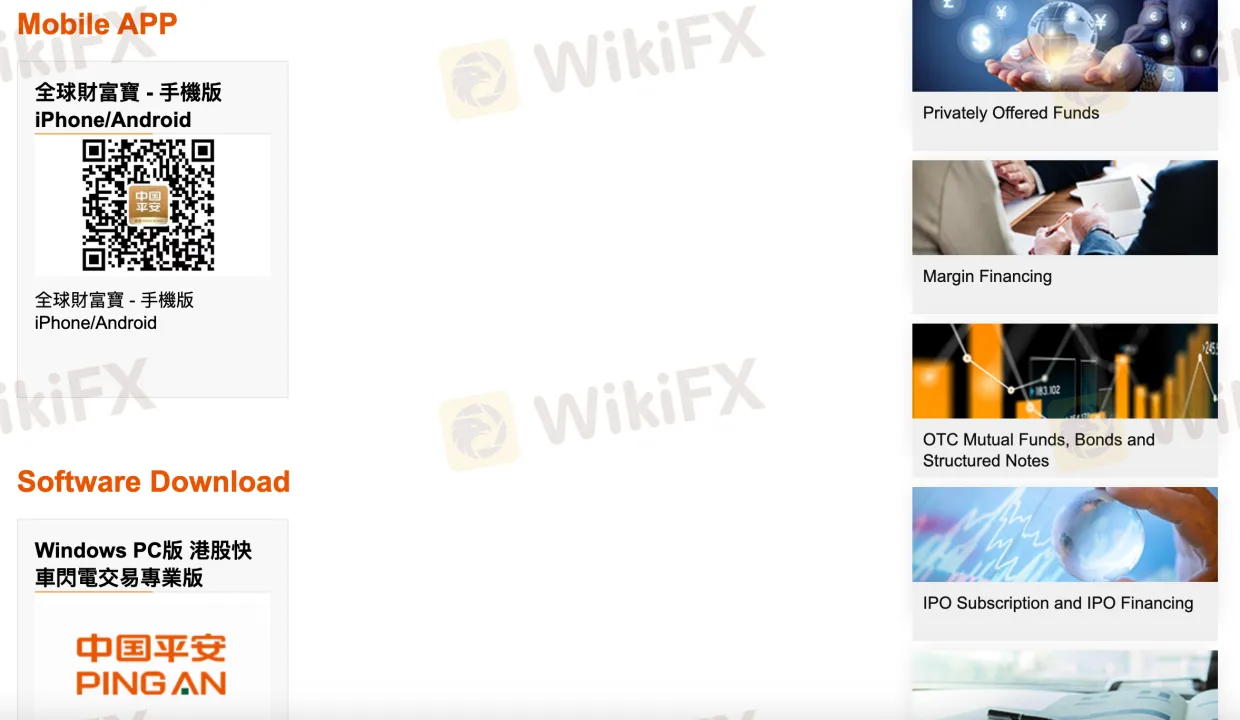

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for What Kind of Traders |

| 全球財富寶 Mobile App | ✅ | iOS, Android (Smartphones) | Mobile-focused traders seeking convenience |

| 港股快車閃電交易專業版 (Windows PC version) | ✅️ | Windows PC | Professional traders requiring desktop tools |

| Mac Version | ❌ | — | Not supported |

| Web-based Platform | ❌ | — | Not supported |

Deposit and Withdrawal

PACSHK charges no fees for withdrawals or deposits. All transfers have to be to/from registered bank accounts; it does not allow third-party or cash deposits.

Deposit Options

| Deposit Method | Min. Deposit | Fees | Processing Time |

| BOC Sub-Account (client-specific) | Not mentioned | Free | 1–2 business days |

| HSBC / Standard Chartered / BOC accounts | Not mentioned | Free | 1–2 business days |

Withdrawal Options

| Withdrawal Method | Min. Withdrawal | Fees | Processing Time |

| To registered bank account | Not mentioned | Free | 1–2 business days |

| To non-registered bank account (via form) | Not mentioned | Free | 1–3 business days |