Company Summary

| Okasan Securities Review Summary | |

| Founded | 1923 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Products and Services | Stocks, ETFs/ETNs/REITs, FX, CFDs, Mutual Funds, iDeCo, NISA, IPOs, MRF etc. |

| Demo Account | ✅ |

| Trading Platform | Okasan Net Trader Series, Easy Ordering, Cub App, Online FX/Web/iPad Apps, NetTrader365FX, Active FX Series, Stock 365 Platforms, RSS Tools |

| Min Deposit | Not specified |

| Customer Support | Capital cities: 4007-2511 |

| Other locations: 0800-001-2511 | |

| WhatsApp: (11) 4007-2511 | |

Okasan Securities Information

Operating under the name 岡三証券株式会社, Okasan Securities provides thorough financial services in Japan, having been established in 1923. Although the original company is well-known, Japan's FSA has identified the online branch 岡三オンライン証券株式会社 as a dubious clone because of license discrepancies. Its wide selection of investment possibilities includes NISA and iDeCo retirement programs, FX, mutual funds, Japanese and Chinese stocks, among others.

Pros and Cons

| Pros | Cons |

| Wide range of products including pension and IPO access | Registered entity shows suspicious clone status |

| Low to zero trading fees on certain stocks/funds | Some advanced services have high assisted-trading fees |

| Platforms available for different asset classes and user levels | No Islamic (swap-free) accounts |

Is Okasan Securities Legit?

Though a valid license under the Japan Financial Services Agency (FSA) for the entity 岡三証券株式会社 (Okasan Securities Co., Ltd.) with license number 関東財務局長(金商)第53号, there is also a dubious clone using similar information under the name 岡三オンライン証券株式会社 (Okasan Online Securities Co., Ltd.), with license number 2010001097479. Inconsistencies in the licensed entity name and mismatched addresses cause the clone status to be detected.

| Regulatory Status | Suspicious Clone |

| Regulated By | Japan (FSA) |

| Licensed Institution | 岡三オンライン証券株式会社 (Okasan Online Securities Co., Ltd.) |

| License Type | Retail Forex License |

| License Number | 2010001097479 |

Products and Services

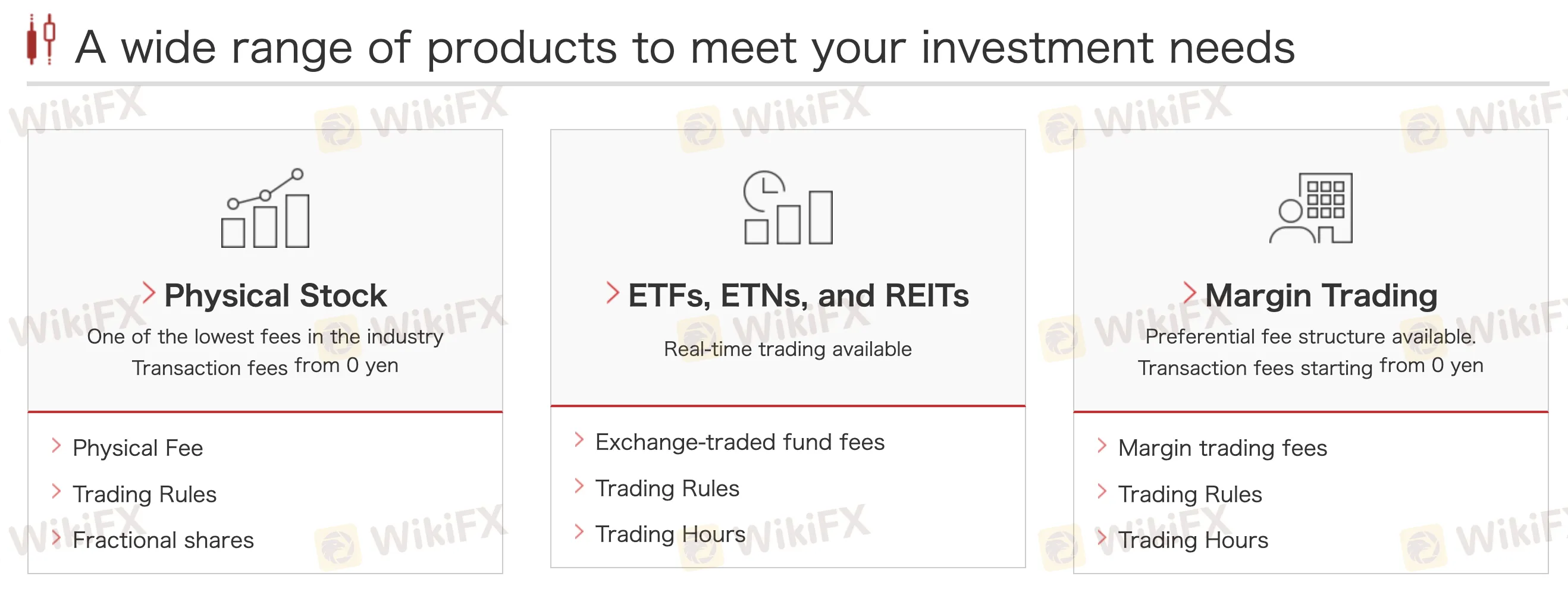

Tailored to both novice and seasoned investors, Okasan Online offers a complete range of financial tools. Its products include real stocks, ETFs, margin trading, mutual funds, FX, CFDs, IPO access, and retirement-related investments such iDeCo and NISA.

| Product / Service | Available |

| Physical Stocks | ✅ |

| ETFs / ETNs / REITs | ✅ |

| Margin Trading | ✅ |

| Investment Trusts (Mutual Funds) | ✅ |

| Exchange FX | ✅ |

| Over-the-Counter FX | ✅ |

| Exchange CFDs | ✅ |

| IPOs | ✅ |

| NISA (Tax-Exempt Account) | ✅ |

| iDeCo (Pension Plan) | ✅ |

| Chinese Stocks | ✅ |

| MRF (Money Reserve Fund) | ✅ |

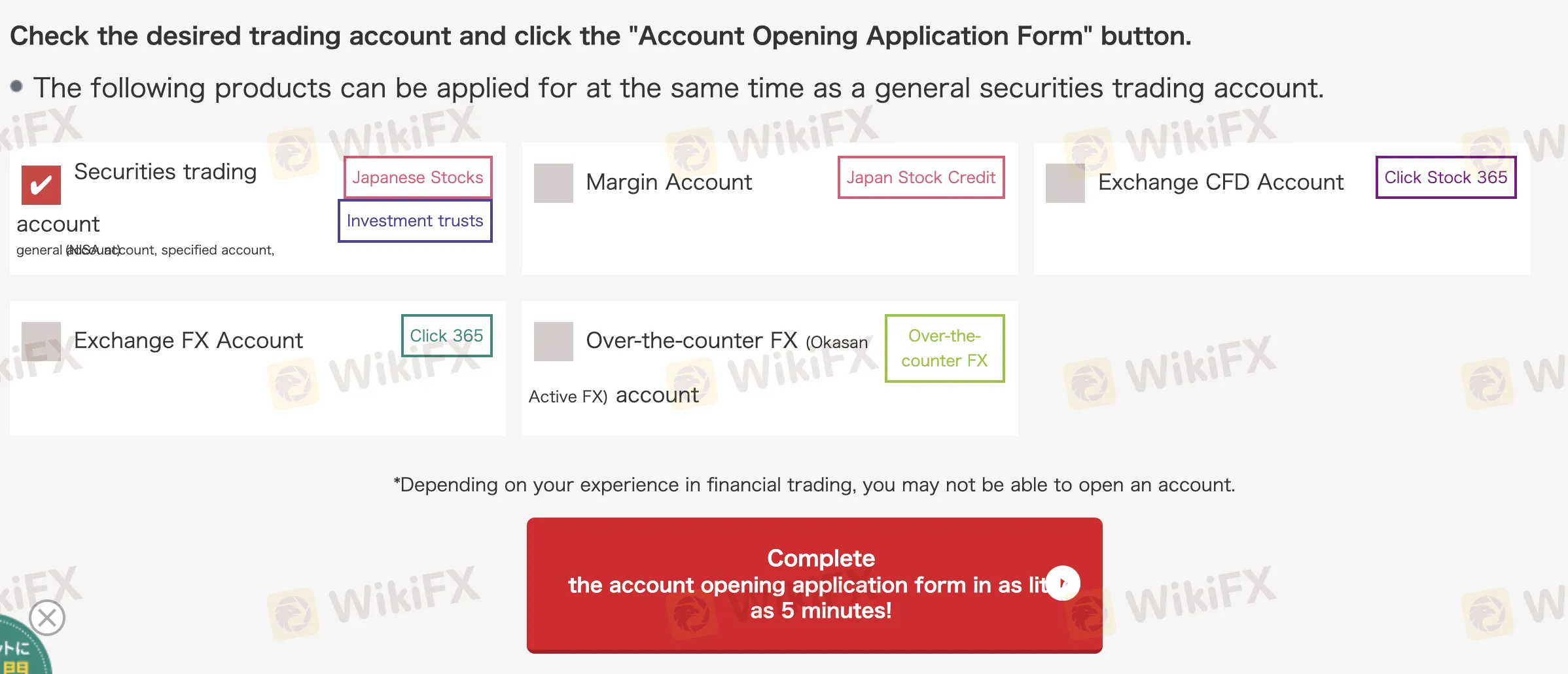

Account Types

Okasan Securities has five live accounts in all: Securities Trading, Margin, Exchange CFD (Click Stock 365), Exchange FX (Click 365), and Over-the-counter FX (Active FX). A demo account is also accessible for practice; Islamic (swap-free) accounts are not provided.

| Account Type | Supported Products | Suitable For |

| Securities Trading Account | Japanese Stocks, Investment Trusts | General investors |

| Margin Account | Japan Stock Credit (Leverage trading) | Traders seeking leverage |

| Exchange CFD Account | Index CFDs (Click Stock 365) | Index-focused traders using JPY |

| Exchange FX Account | Click 365 FX (Exchange-based FX trading) | FX traders preferring regulated platforms |

| Over-the-counter FX Account | Active FX (customized FX platform) | Active FX traders wanting more features |

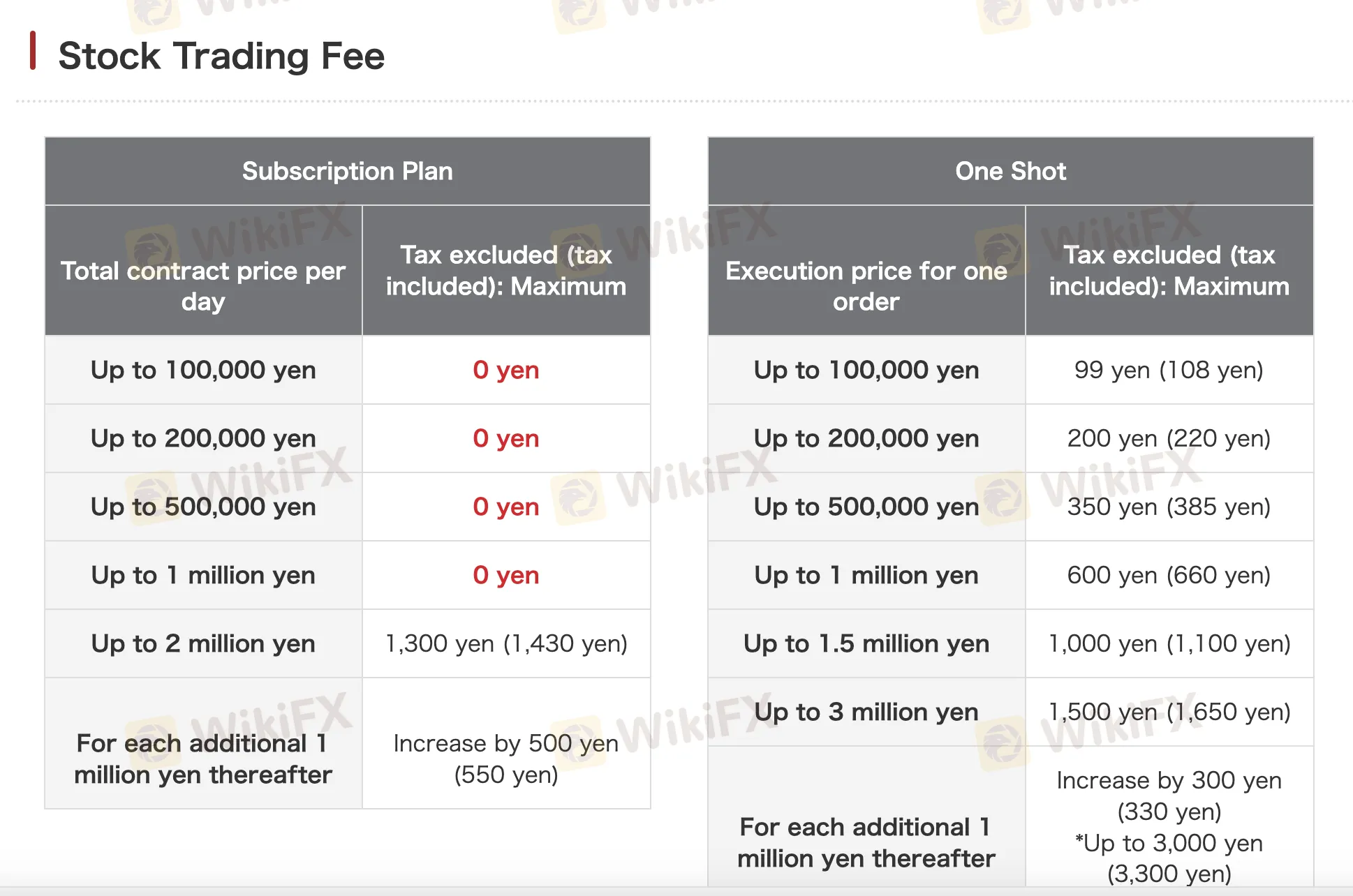

Okasan Securities Fees

Especially for Japanese equities and investment trusts, Okasan Securities' trading costs are usually low in comparison to industry standards. Many items have no commissions under certain plans or criteria, which is appealing for aggressive traders and newcomers. Where relevant, extra costs are obviously fair and well-organized. Some services, such support-assisted trading on Click 365, have significantly greater costs, nevertheless.

| Product | Condition/Volume | Fee (Excl. Tax) | Fee (Incl. Tax) |

| Stock Trading (Subscription Plan) | ≤ ¥100,000 | ¥0 | ¥0 |

| ≤ ¥200,000 | ¥0 | ¥0 | |

| ≤ ¥500,000 | ¥0 | ¥0 | |

| ≤ ¥1,000,000 | ¥0 | ¥0 | |

| ≤ ¥2,000,000 | ¥1,300 | ¥1,430 | |

| Each additional ¥1M | ¥500 | ¥550 | |

| Stock Trading (One-Shot Plan) | ≤ ¥100,000 | ¥99 | ¥108 |

| ≤ ¥200,000 | ¥200 | ¥220 | |

| ≤ ¥500,000 | ¥350 | ¥385 | |

| ≤ ¥1,000,000 | ¥600 | ¥660 | |

| ≤ ¥1,500,000 | ¥1,000 | ¥1,100 | |

| ≤ ¥3,000,000 | ¥1,500 | ¥1,650 | |

| Each additional ¥1M | ¥300 | ¥330 | |

| Margin Trading | ≤ ¥2,000,000 (Super Premium) | ¥0 | ¥0 |

| ≤ ¥2,000,000 (Platinum) | ¥300 | ¥330 | |

| ≤ ¥2,000,000 (Standard) | ¥1,000 | ¥1,100 | |

| Investment Trusts | Purchase | ¥0 | ¥0 |

| Redemption (Stock Funds) | Up to 0.5% | Up to 0.5% | |

| Trust Reserve Fee | ¥110/10K units | ¥110/10K units | |

| Annual Trust Fees | Up to 2.42% | Up to 2.42% | |

| Exchange FX (Click365) | Self Course (Regular) | ¥0 | ¥0 |

| Self Course (Large) | ¥1,018 | ¥1,018 | |

| Support Course (Regular) | ¥1,100 | ¥1,100 | |

| Support Course (Large) | ¥11,000 | ¥11,000 | |

| OTC FX | All clients | ¥0 | ¥0 |

| Exchange CFD | Nikkei, DAX, FTSE100 (Self) | ¥156 | ¥156 |

| Nikkei, DAX, FTSE100 (Support) | ¥3,300 | ¥3,300 | |

| Micro, NYD, NASDAQ (Self) | ¥30 | ¥30 | |

| Micro, NYD, NASDAQ (Support) | ¥330 | ¥330 | |

| ETF (Gold/Silver/etc.) Self | ¥330 | ¥330 | |

| ETF (Gold/Silver/etc.) Support | ¥3,300 | ¥3,300 |

Trading Platform

Okasan Securities offers a wide array of trading platforms tailored to different trader needs, including beginners and advanced users. These platforms support various asset classes like Japanese stocks, FX, and CFDs.

| Trading Platform | Supported | Available Devices | Suitable for what kind of traders |

| Okasan Net Trader Series | ✔ | PC | Pro stock traders |

| Okasan Net Trader WEB2 | ✔ | PC, Smartphone, Tablet | Beginners |

| Okasan Easy Ordering | ✔ | PC | Beginners, investment trusts |

| Okasan Cub Smartphone | ✔ | iOS, Android | Intermediate and advanced stock traders |

| Okasan RSS | ✔ | Excel | Stock traders using Excel |

| Okasan Online FX WEB version | ✔ | Web | Beginners in FX |

| NetTrader365FX | ✔ | PC | Advanced FX traders |

| Okasan Online FX smartphone app | ✔ | iOS, Android | Beginners in FX |

| Okasan Online FX for iPad | ✔ | iPad | Beginners in FX |

| RSS 365FX | ✔ | Excel | FX traders using Excel |

| e-profit FX | ✔ | PC | Advanced FX traders |

| Okasan Active FX (Install version) | ✔ | PC | Advanced FX traders |

| Okasan Active FX C2 | ✔ | PC | Versatile FX traders |

| Okasan Active FX WEB version | ✔ | Web | Beginners in FX |

| Okasan Active FX smartphone app | ✔ | iOS, Android | Beginners in FX |

| Okasan Active FX iPad App | ✔ | iPad | Beginners in FX |

| Okasan Online Stock 365 WEB version | ✔ | Web | Beginners in CFD |

| Net Trader Stock 365 | ✔ | PC | Active CFD traders |

| Okasan Online Stock 365 Smartphone App | ✔ | Smartphone | Beginners in CFD |

| RSS 365CFD | ✔ | Excel | CFD traders using Excel |

| e-profit stock 365 | ✔ | PC | Beginners in CFD |