Company Summary

| Victory Securities Review Summary | |

| Founded | 1971 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Services | Wealth Management, Capital Market, Virtual Asset, Asset Management, Insurance, Brokerage Services, and Employee Stock Ownership Plan (ESOP) |

| Trading Platform | VictoryX, VictorySecurities (Stock), VIC TOKEN, and Securities Trading (Desktop) |

| Customer Support | Phone: +852 2523 1709, +86 147 1501 7408, +852 5498 9438 |

| Fax: +852 2810 7616 | |

| Email: cs@victorysec.com.hk | |

| Address: 11/F, Yardley Commercial Building, 3 Connaught Road West, Sheung Wan, Hong Kong | |

| Contact form, social media | |

Founded in 1971, Victory Securities is a licensed broker regulated by SFC in Hong Kong. It offers a variety of services like Wealth Management, Capital Market, Virtual Asset, Asset Management, Insurance, Brokerage Services, and Employee Stock Ownership Plan (ESOP) via multiple trading platforms such as VictoryX, VictorySecurities (Stock), VIC TOKEN, and Securities Trading (Desktop).

Pros and Cons

| Pros | Cons |

| Regulated by SFC | Complex fee structure |

| Diverse contact channels | No live chat support |

| A wide range of services | |

| Diverse account types | |

| Multiple platforms |

Is Victory Securities Legit?

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number |

| The Securities and Futures Commission (SFC) | Victory Securities Company Limited | Dealing in futures contracts | ABN091 |

Services

Victory Securities provides traditional financial services such as Wealth Management, Capital Market, Virtual Asset, Asset Management, Insurance, Brokerage Services, and Employee Stock Ownership Plan (ESOP).

Account Type

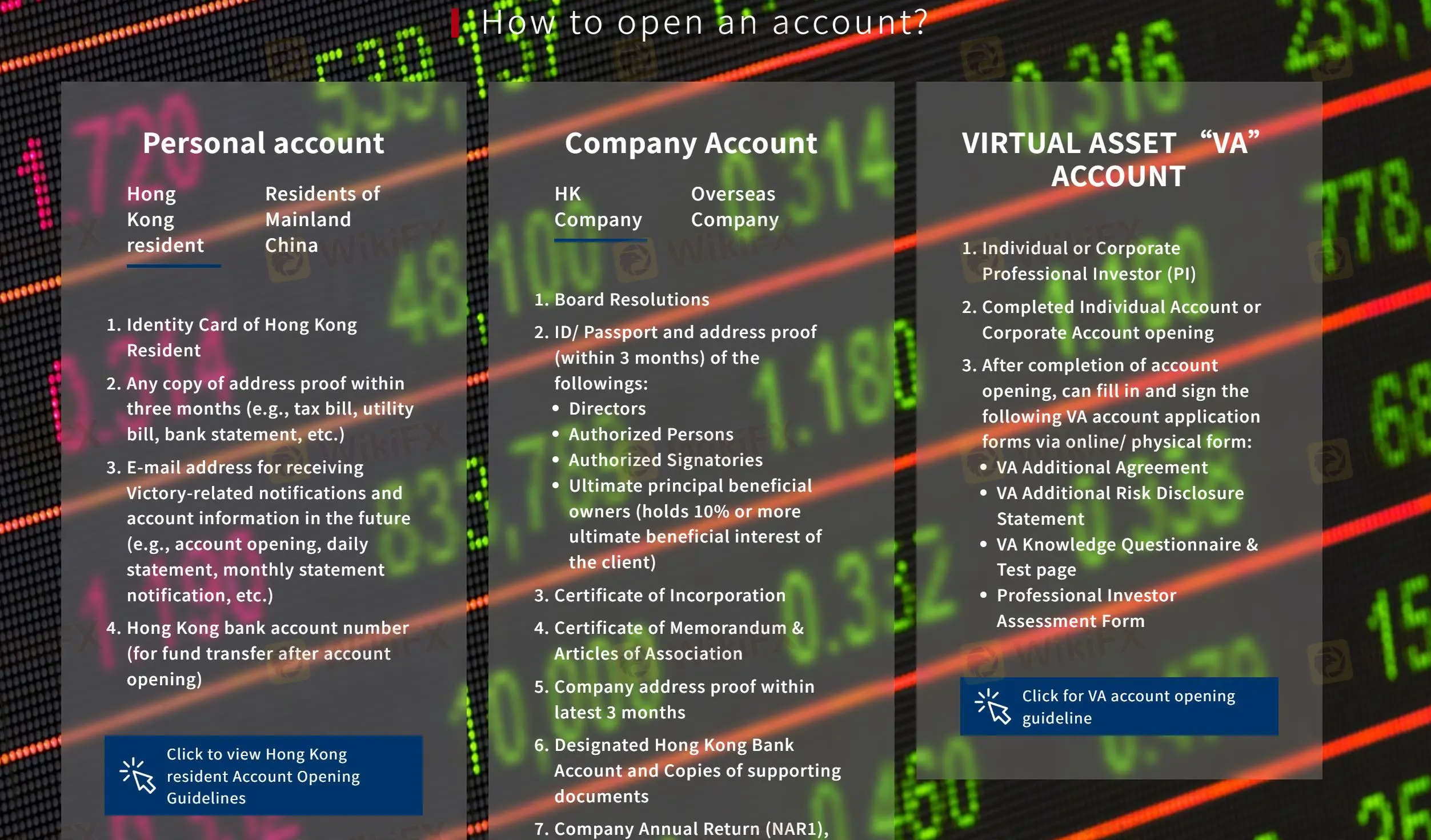

Victory Securities provides three account types for users.

Personal Account is suitable for individual investors residing in Hong Kong or Mainland China.

Company Account is designed for corporate entities, both Hong Kong and overseas companies.

Virtual Asset (VA) Account is available to individual or corporate professional investors who have already opened a personal or company account.

Victory Securities provides two ways to open an account online using the “VictoryX” mobile app and open an account by mail.

Fees

Trading Fees

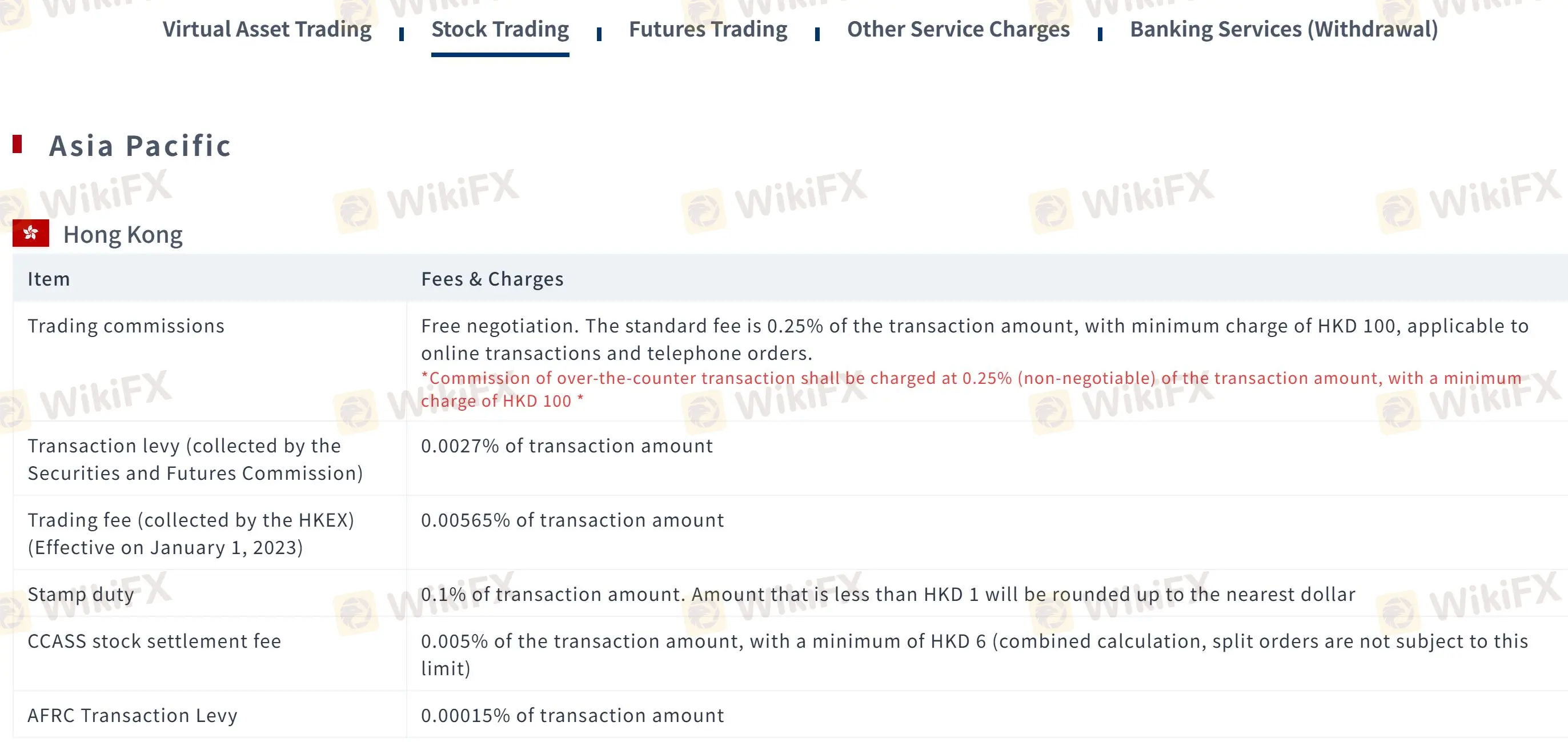

The specific amount of commission of Victory Securities depends on the market, product and transaction type. For example, the commission for stock trading is usually 0.25% to 0.45% of the transaction amount, and the minimum fee varies from region to region.

| Product | Commission | Minimum Charge |

| Hong Kong Stocks | 0.25% (negotiable) | HKD 100 |

| China (Shanghai/Shenzhen Connect) | 0.25% | RMB 100 |

| Japan Stocks | 0.30% (online), 0.40% (telephone) | JPY 3,500 |

| Singapore Stocks | 0.25% | USD 40 |

| Taiwan Stocks | 0.30% | NT$600 |

| Australia Stocks | 0.35% | AUD 50 |

| South Korea Stocks | 0.30% | KRW 20,000 |

| US Stocks | 0.25% | USD 15 |

Non-Trading Fees

There are additional fees associated with their services. These fees cover various aspects of account management, corporate actions, and specific transaction types. Some common examples include Transaction levies and taxes, clearing fees, custody fees and other service fees.

| Fee Category | Amount |

| Transaction Levy | 0.0027% of transaction amount |

| Trading Fee | 0.00565% of transaction amount |

| Stamp Duty | 0.1% of transaction amount (rounded up) |

| CCASS Stock Settlement Fee | 0.005% of transaction amount (minimum HKD 6) |

| AFRC Transaction Levy | 0.00015% of transaction amount |

For more information, please refer to the following website: https://www.victorysec.com.hk/en/help/fee

Trading Platform

| Trading Platform | Suitable for |

| VictoryX | Individual investors seeking a comprehensive and user-friendly trading platform with advanced features. |

| Victory Securities (Stock) | Individual investors are primarily interested in trading stocks. |

| VIC TOKEN | Investors interested in trading cryptocurrencies. |

| Securities Trading (Desktop) | Individual investors who prefer a desktop-based trading platform. |

Deposit and Withdrawal

Deposit

| Deposit Option | MinDeposit | Fee | Processing Time |

| Bank Transfer (online and offline) | / | / | The cut-off time on working days is 4:45 pm. Transfer certificate submitted after this time will be processed on the second working day. |

Withdrawal

| Withdrawal Option | MinWithdrawal | Fee | Processing Time |

| Bank Transfer (online and offline) | $0 | Daily first withdrawal is free of charge, and subsequent withdrawals HKD$500 each. | Applications submitted before 12:00 noon will be processed on the same day. |

| Applications submitted after 12:00 noon will be arranged for processing on the next working day. | |||

| Telegraphic Transfer/Interbank Transfer | $0 | HKD/RMB: Daily first withdrawal $/RMB$300, and subsequent withdrawals $/RMB$800 each; | Applications submitted before 12:00 noon will be processed on the same day. |

| USD: Daily first withdrawal US$25, and subsequent withdrawals US$100 each. | Applications submitted after 12:00 noon will be arranged for processing on the next working day. |