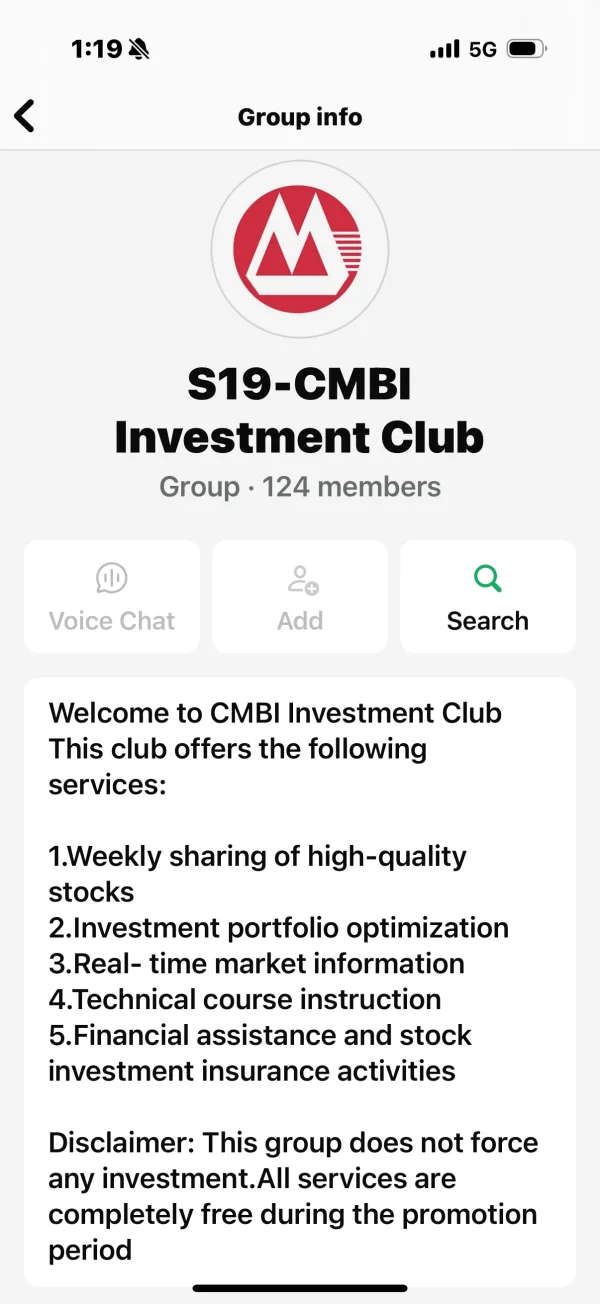

Company Summary

| CMB Review Summary | |

| Founded | 2010 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Trading Products | Stocks, Options, Futures |

| Trading Platform | Yat Lung GloBal, SP Trader, Multicharts |

| Minimum Deposit | / |

| Customer Support | Phone: (852) 3900 0888 |

| Social Media: Wechat | |

| Physical Address: 45th & 46th Floor, Champion Tower, 3 Garden Road, Central, Hong Kong | |

CMB Information

CMB was registered and established in Hong Kong in 2010 and is a comprehensive financial institution. It offers services such as corporate finance, asset management, wealth management, global markets and structured finance. It offers trading in stocks, futures and options and is equipped with three trading platforms for traders.

Pros and Cons

| Pros | Cons |

| Regulated by SFC | Limited trading products |

| 3 types of trading platforms | Limited payment options |

| Various services offered |

Is CMB Legit?

| Regulated Authority | Regulatory Status | Regulated Country/Region | Regulated Entity | License Type | License Number |

| Securities and Futures Commission of Hong Kong (SFC) | Regulated | Hong Kong | CMB International Futures Limited | Dealing in futures contracts | ACQ651 |

Products and Services

CMB is a comprehensive financial services institution. Its products and services include corporate financing, asset management, wealth management, global markets, structured finance, etc.

It provides clients with professional and high-quality comprehensive financial services such as Hong Kong listing sponsorship and underwriting, placement and rights issue of listed companies, financial advisory, bond issuance services, asset management, direct investment, wealth management, stock sales and trading, etc.

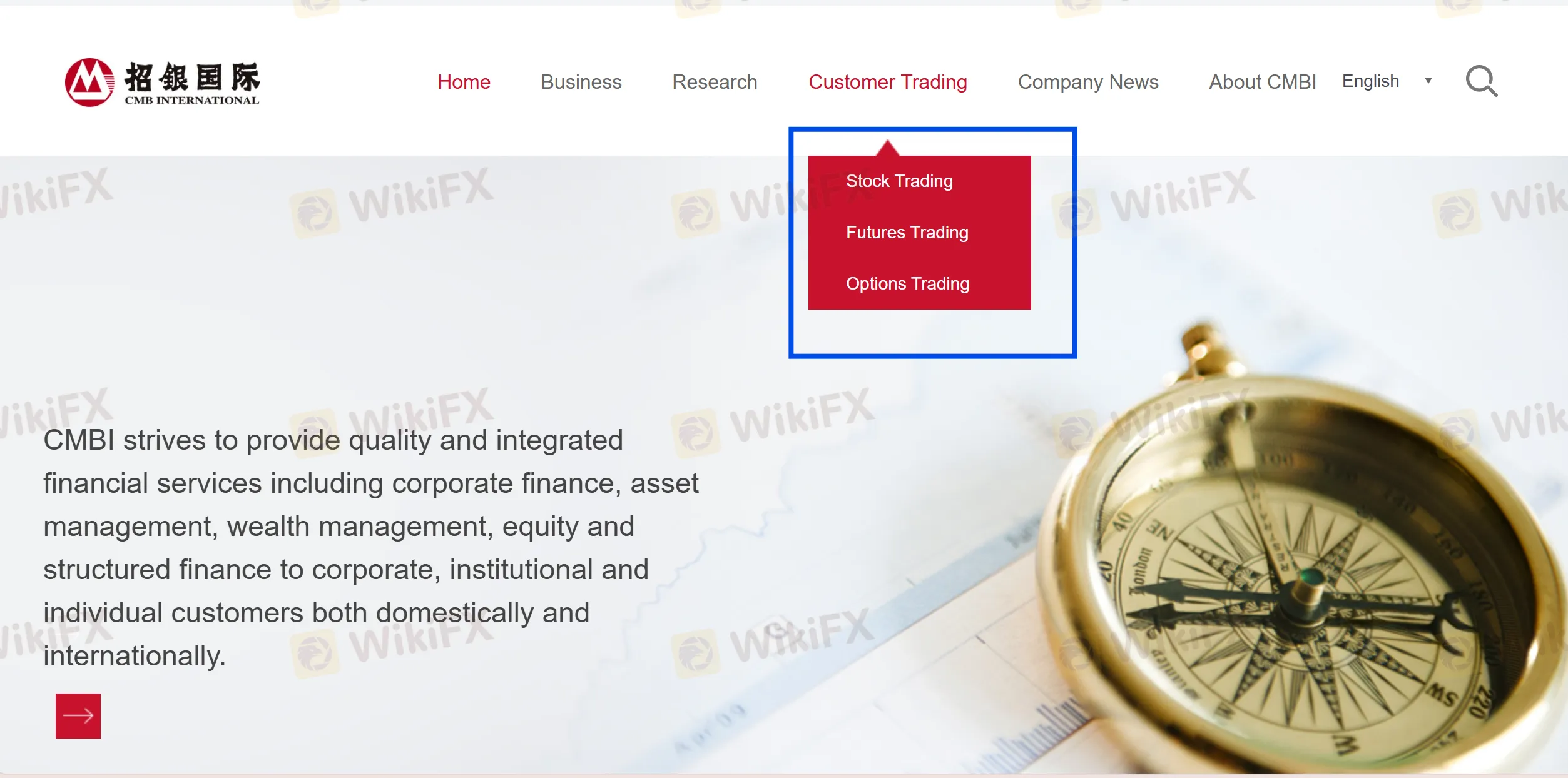

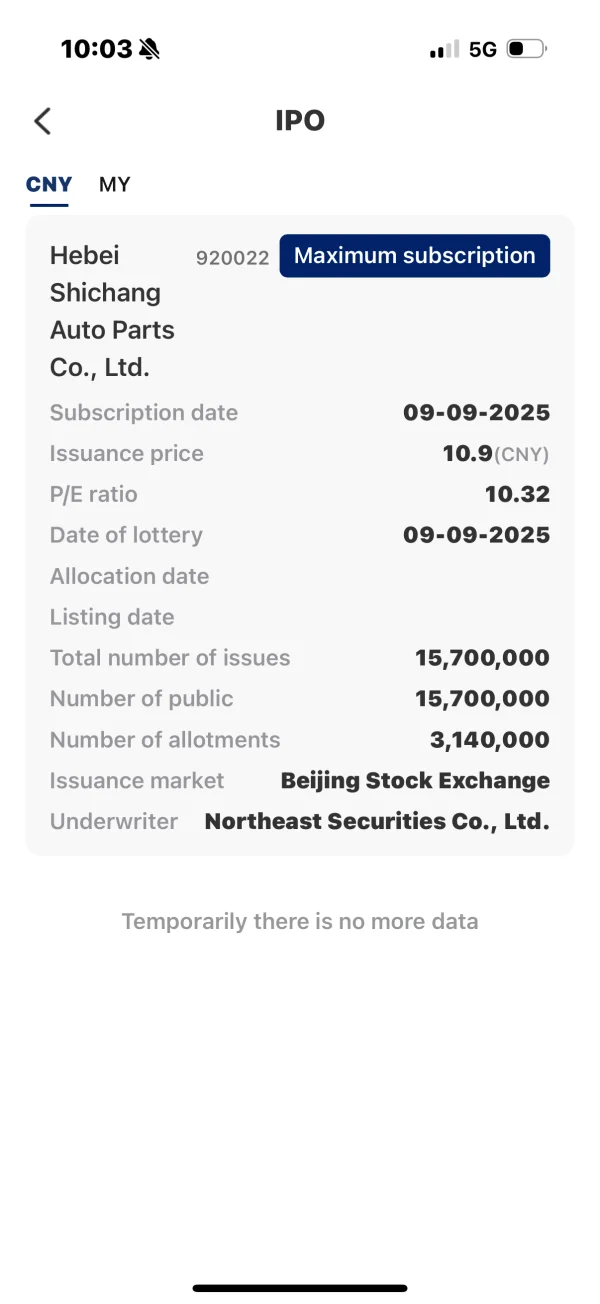

Traders can trade stocks, options and futures.

| Trading Products | Supported |

| Stocks | ✔ |

| Options | ✔ |

| Futures | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| ETFs | ❌ |

Account Type

CMB International did not provide a clear account type. However, for individual securities account opening, the following several methods can be referred to:

- Online account opening without witnessing (Not applicable to those opening accounts with the People's Republic of China Resident Identity Card): Use the mobile version of the IOS/Android “Yilong Global” APP for full online operation without witnessing. For details, please refer to the following web page: https://app.cmbi.info/appweb/knowledge/detail?id=395

- Offline account opening: You need to visit China Merchants Bank International in person, which is located on the 46th floor of Kwan Kwan Building, 3 Garden Road, Central, Hong Kong. Or you can open an account by mail (not applicable to those who open an account with a People's Republic of China resident identity card).

- If you are a customer of China Merchants Bank, please call 400-120-9555 (mainland) /(852)3761-8888 (Hong Kong) or email crm@cmbi.com.hk.

- Bank-securities transfer service: This service is a collaboration between the company and the Hong Kong Branch of China Merchants Bank and China Merchants Wing Lung Bank. It enables the mutual transfer of funds between customers' bank accounts and securities accounts. The funds deposited through this service will be directly transferred to the customers' securities accounts without the need for fax confirmation.

CMB Fees

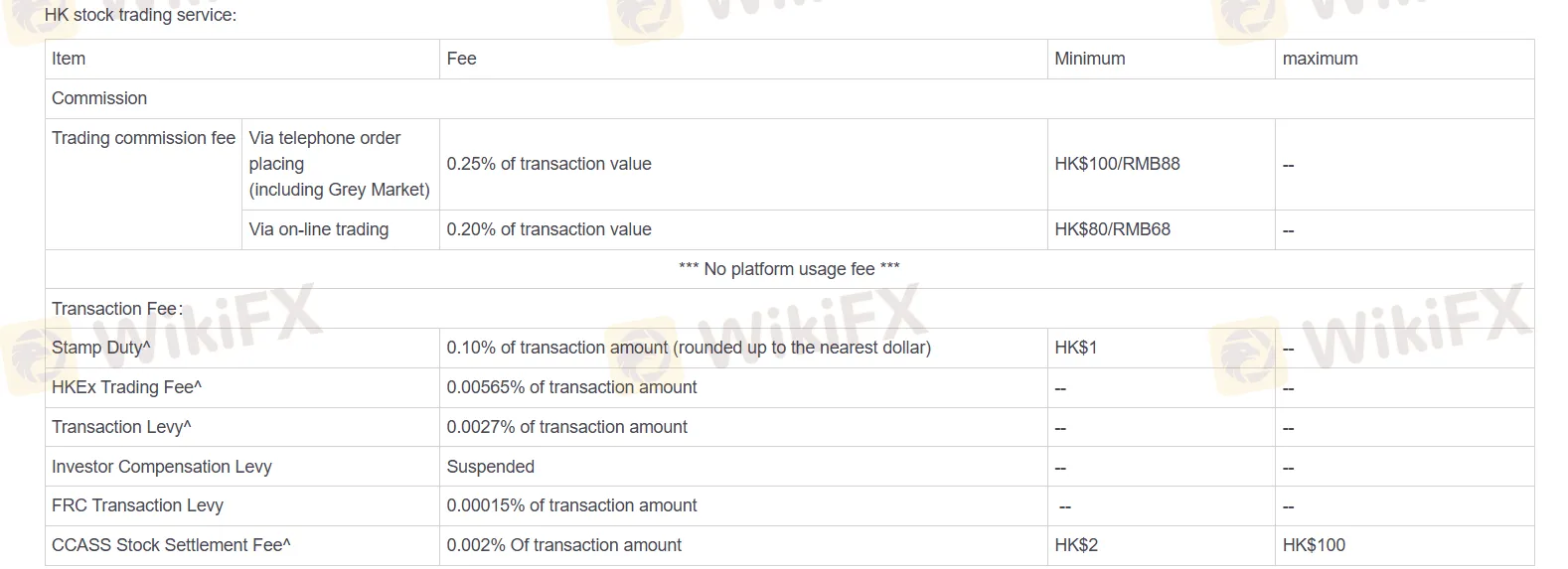

The transaction fees for stocks, options and futures vary. Here, we take the trading commission of Hong Kong stocks as an example. For more detailed information, you can refer to: https://www.cmbi.com.hk/en-US/commision#navs

| Fees | Amount | Minimum Charge | Maximum Charge |

| Commission | Telephone Orders (including grey market): 0.25% of transaction amount | HK$100/RMB88 | -- |

| Online Trading | 0.20% of transaction amount | HK$80/RMB68 | -- |

| Stamp Duty | 0.10% of transaction amount | HK$1 | -- |

| SEHK Trading Fee | 0.00565% of transaction amount | -- | -- |

| Trading Levy | 0.0027% of transaction amount | -- | -- |

| FRC Transaction Levy | 0.00015% of transaction amount | -- | -- |

| CCASS Share Settlement Fee | 0.002% of transaction amount (based on contract order) | $2 | $100 |

Trading Platform

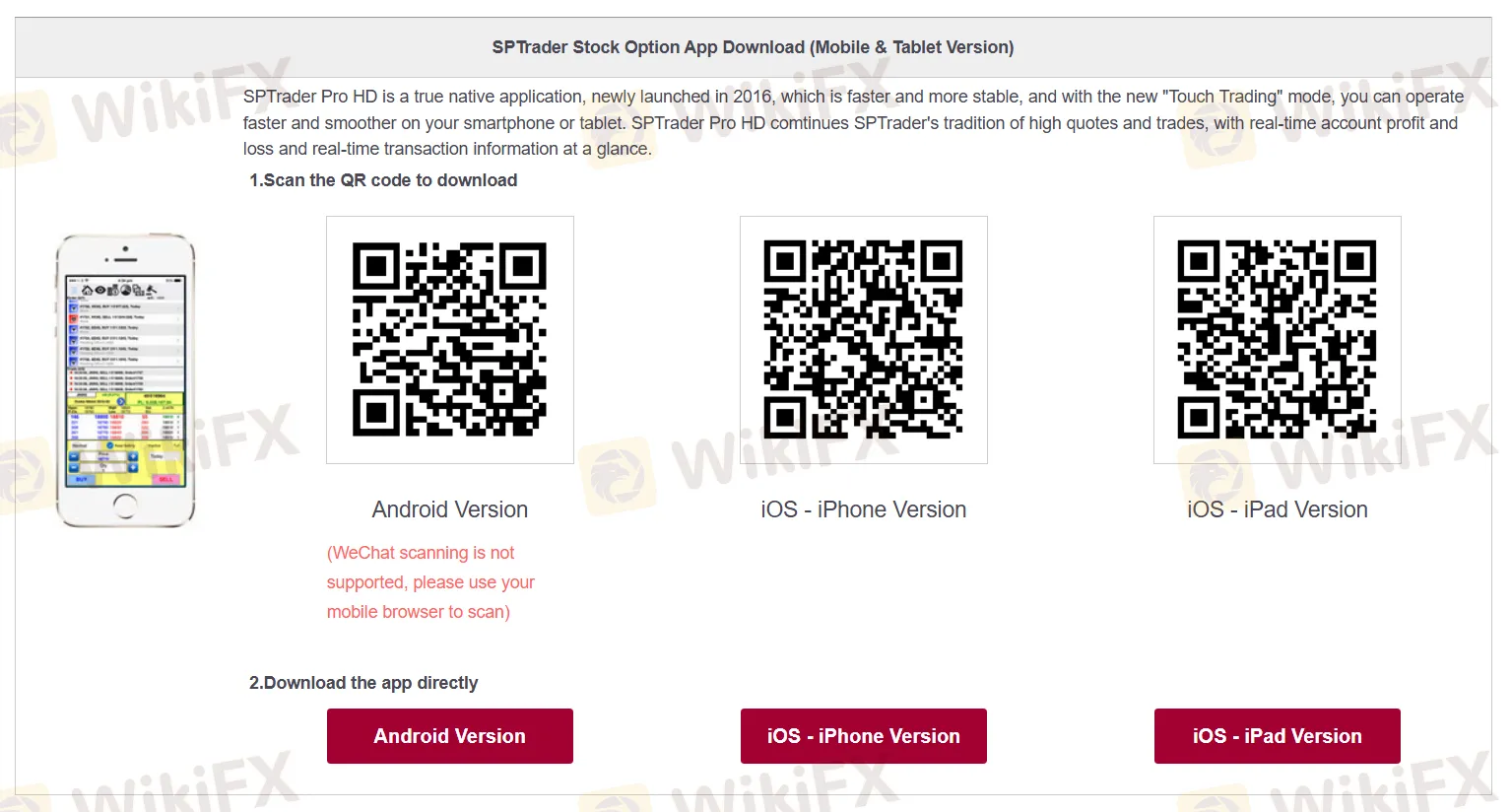

It offers 3 types of trading software, which can trade stocks, options and futures, and are respectively supported for use on desktops, mobile phones and tablets.

| Trading Platform | Supported | Available Devices |

| Yat Lung GloBal | ✔ | Mobile |

| SP Trader | ✔ | Desktop, Mobile, Tablet |

| Multicharts | ✔ | Desktop |

Deposit and Withdrawal

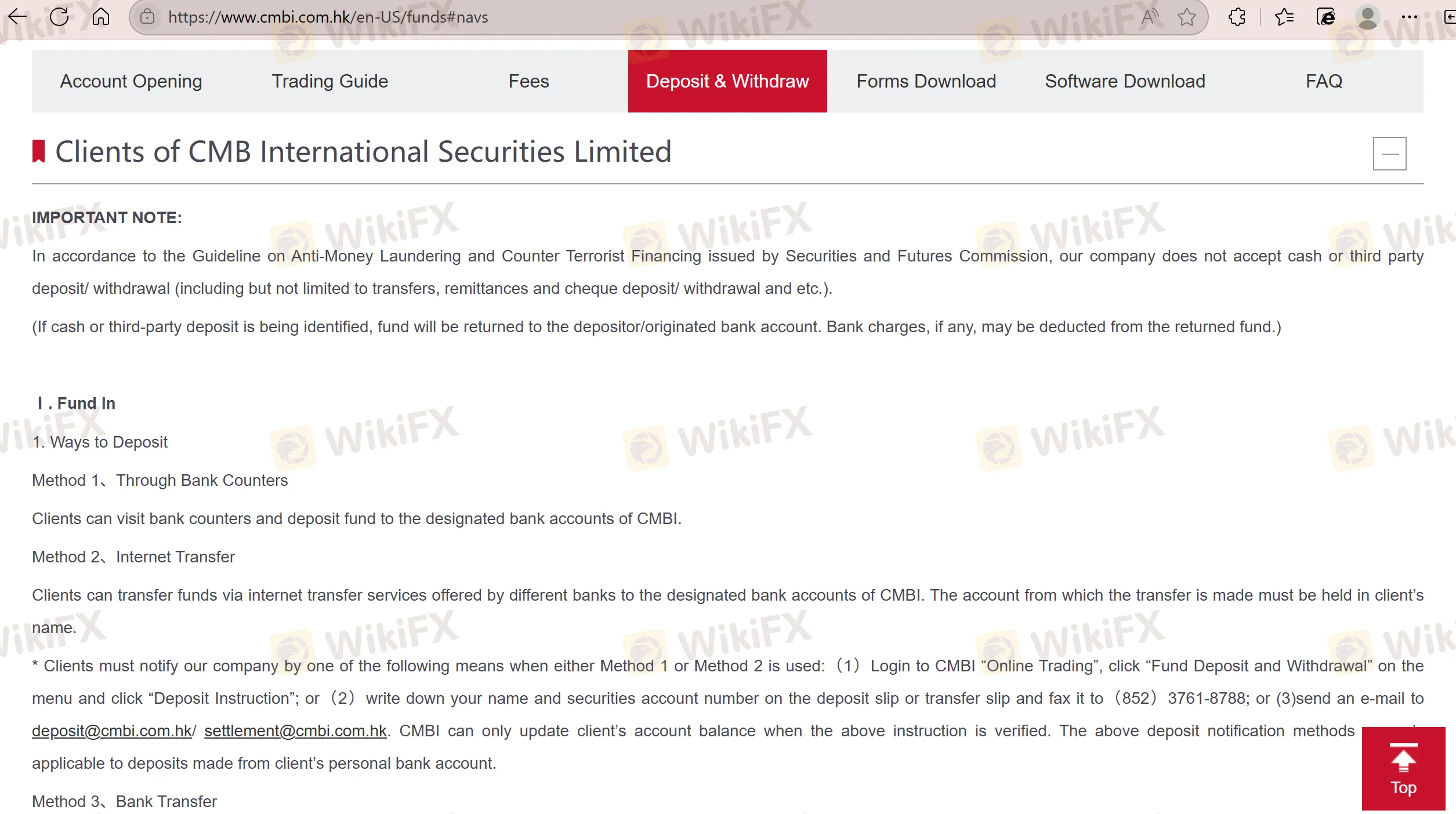

The deposit and withdrawal methods for stock trading are as follows:

Deposit

Through Bank Counters

Clients can visit bank counters and deposit funds to the designated bank accounts of CMBI.

Internet Transfer

Clients can transfer funds via internet transfer services offered by different banks to the designated bank accounts of CMBI. The account from which the transfer is made must be held in the clients name.

Clients must notify our company by one of the following means when either Method 1 or Method 2 is used: (1) Login to CMBI “Online Trading”, click “Fund Deposit and Withdrawal” on the menu and click “Deposit Instruction”; or (2) write down your name and securities account number on the deposit slip or transfer slip and fax it to (852) 3761-8788; or (3) send an e-mail to deposit@cmbi.com.hk/ settlement@cmbi.com.hk. CMBI can only update the clients account balance when the above instruction is verified.

Bank Transfer

This method is suitable only for clients who have successfully applied for such service. Simply visit the CMB Hong Kong Branch website, log in to “Home Banking Service” and transfer funds. Transfers made between 8:30 a.m. and 4:00 p.m. on any trading day will be immediately shown in the clients bank balance (no deposit notification needed) at the CMBI trade system. The update of bank balance will be processed in the next trading day when transfers are made beyond the aforementioned period.

Withdrawal

Fund Withdrawal Instruction Form

- by post to 45/F, Champion Tower, 3 Garden Road, Central, Hong Kong;

- by fax to (852) 3761-8788;

- by email to settlement@cmbi.com.hk

Please submit the completed “Fund Withdrawal Instruction Form” by any of the following methods:

Login to Internet Trading System (Withdrawal)

Select “Withdrawal Instruction” under “Fund Deposit and Withdrawal” on the website. This method is for clients who have successfully applied our internet trading service and submitted account information to CMBI.

Login to Internet Trading System (Transfer)

Use the “Fund Transfer” option under “Transfer” on the website. This method is for clients who have successfully applied the internet trading service and submitted account information to CMBI.

FX2489918960

Malaysia

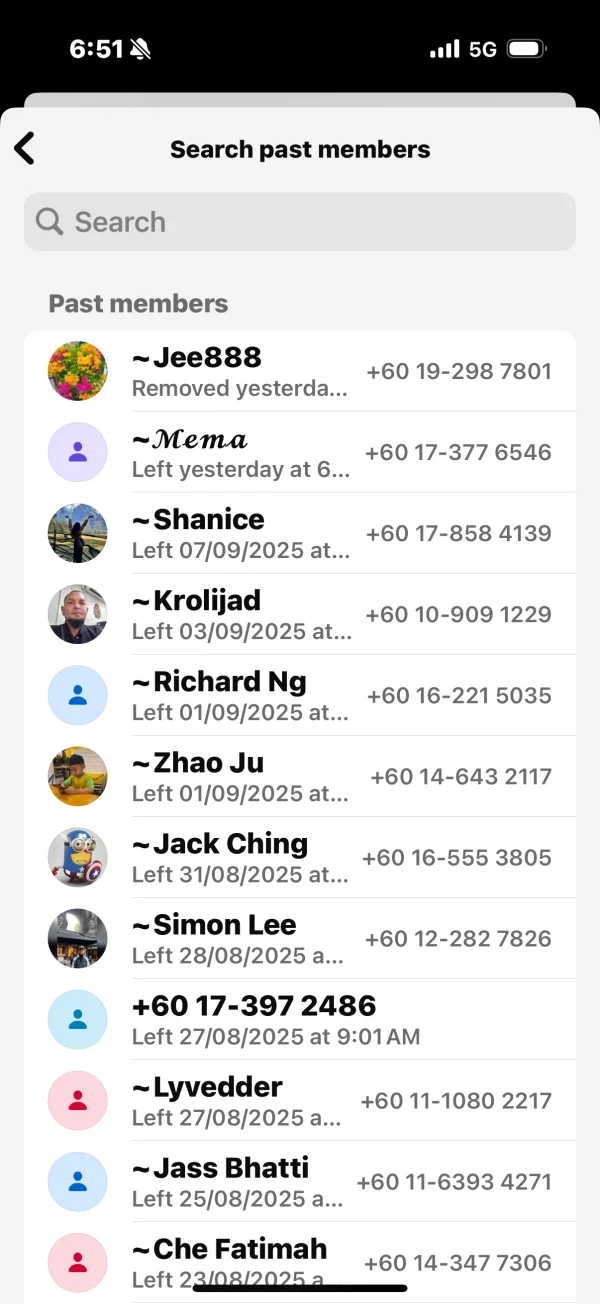

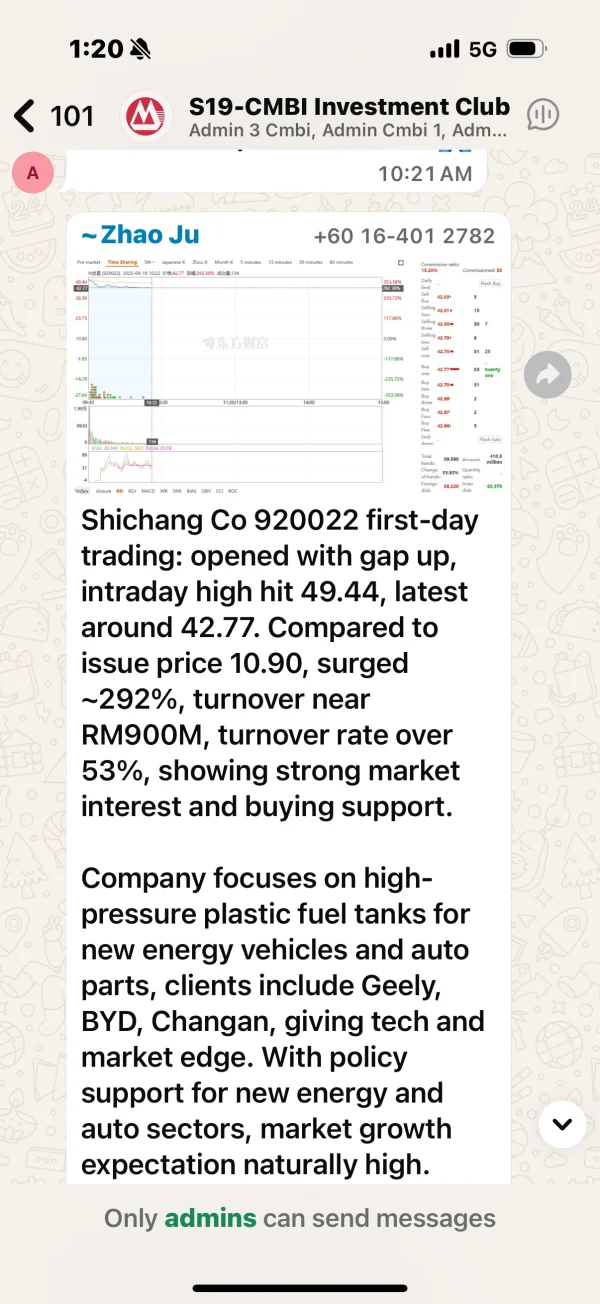

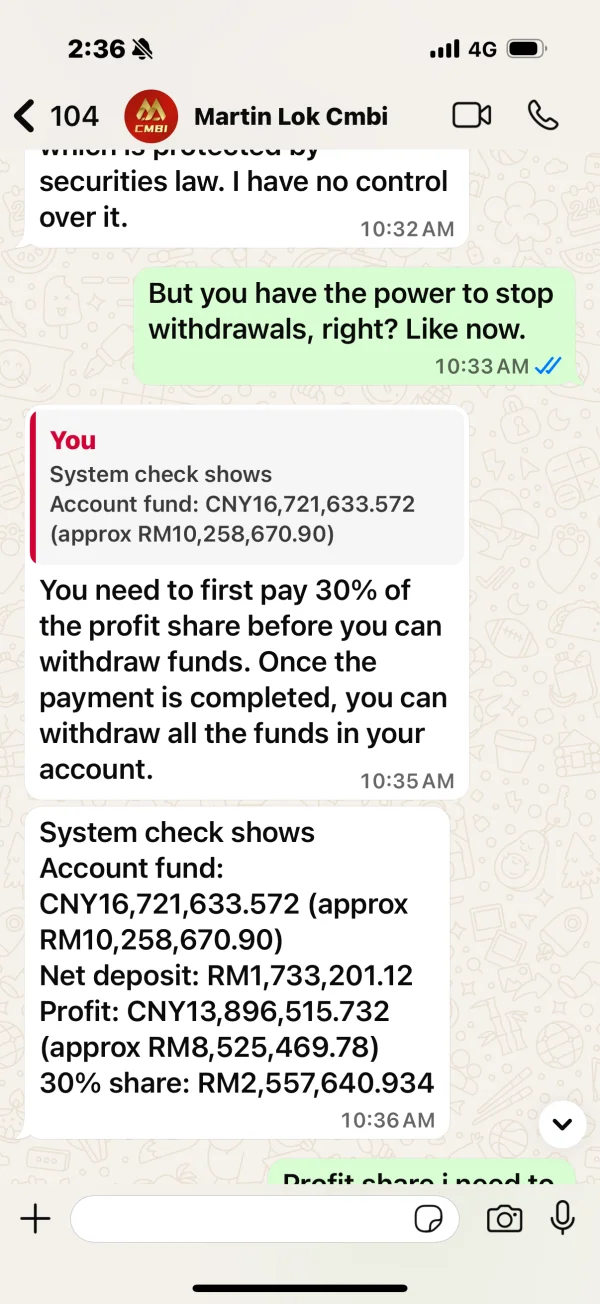

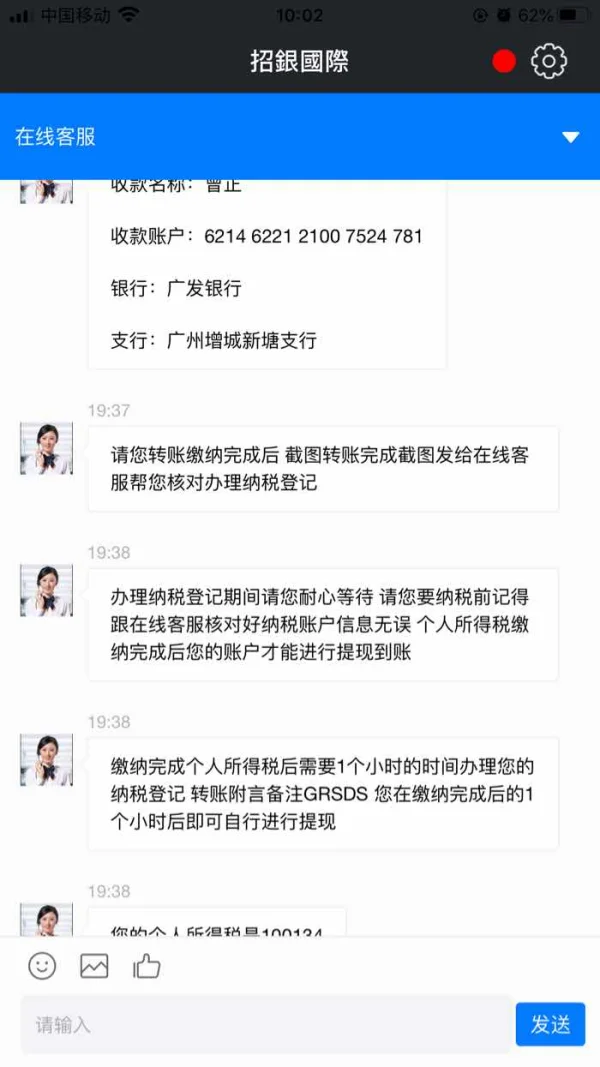

This company collaborates with various firms and banks in Hong Kong and China to manipulate the Chinese stock market. This fraudulent company then prevents withdrawals after trading.

Exposure

龙瑞

Hong Kong

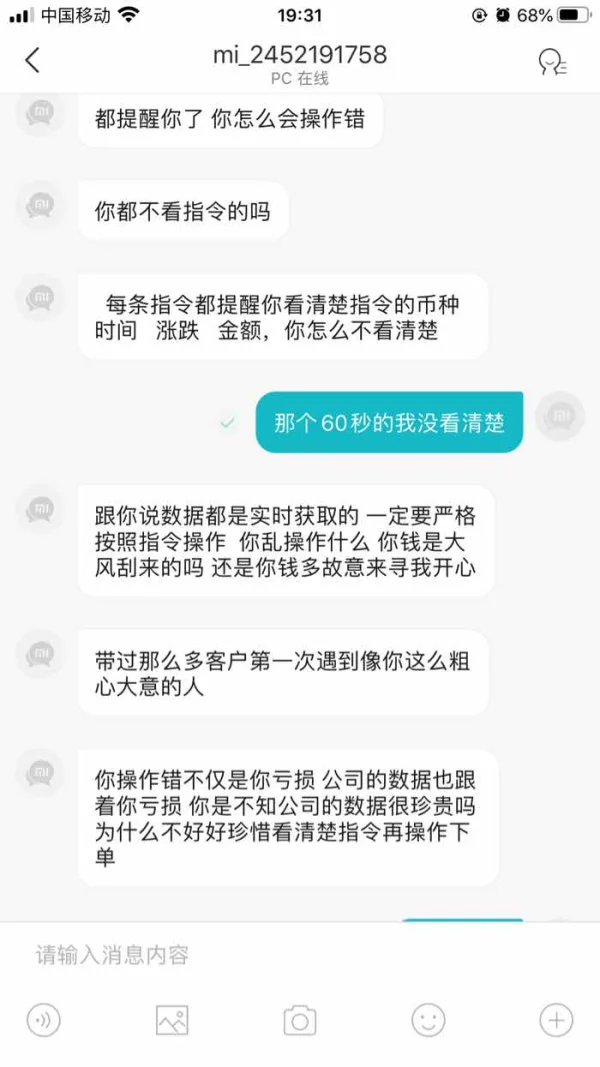

The so-called programmers guided u to invest with instructions. If u lose, they will ask u to deposit funds. After u profit, u should pay individual income tax to withdraw funds. The reality is ruthless

Exposure

龙瑞

Hong Kong

Ask u to pay money with varied excuses. But u can’t withdraw funds in the end.

Exposure

西风古道

Peru

CMB is one of the most legit finance companies I've come across. I've traded stocks and done some financial trading on their platform and the fees are pretty transparent. Plus, the trading environment is fair, no shady stuff going on. And the customer service reps are on point, always professional and know their stuff.

Positive

สมพง พระประแดง

Thailand

The broker said that there was bonus for transactions. While I could not witdhraw funds after trading for some time. They said that their staff had covid. So I've waited since last year

Exposure