Company Summary

| CAPITAL Review Summary | |

| Founded | 1999 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Trading Products | Securities, Futures, Options, Funds |

| Trading Platform | / |

| Customer Support | Phone: (852) 2530-9966 |

| FAX: (852) 2104-6006 | |

| Email: fund_dl@e-capital.com.hk | |

| Address: 3/F., FWD Financial Centre, 308 Des Voeux Road Central, Hong Kong | |

CAPITAL Information

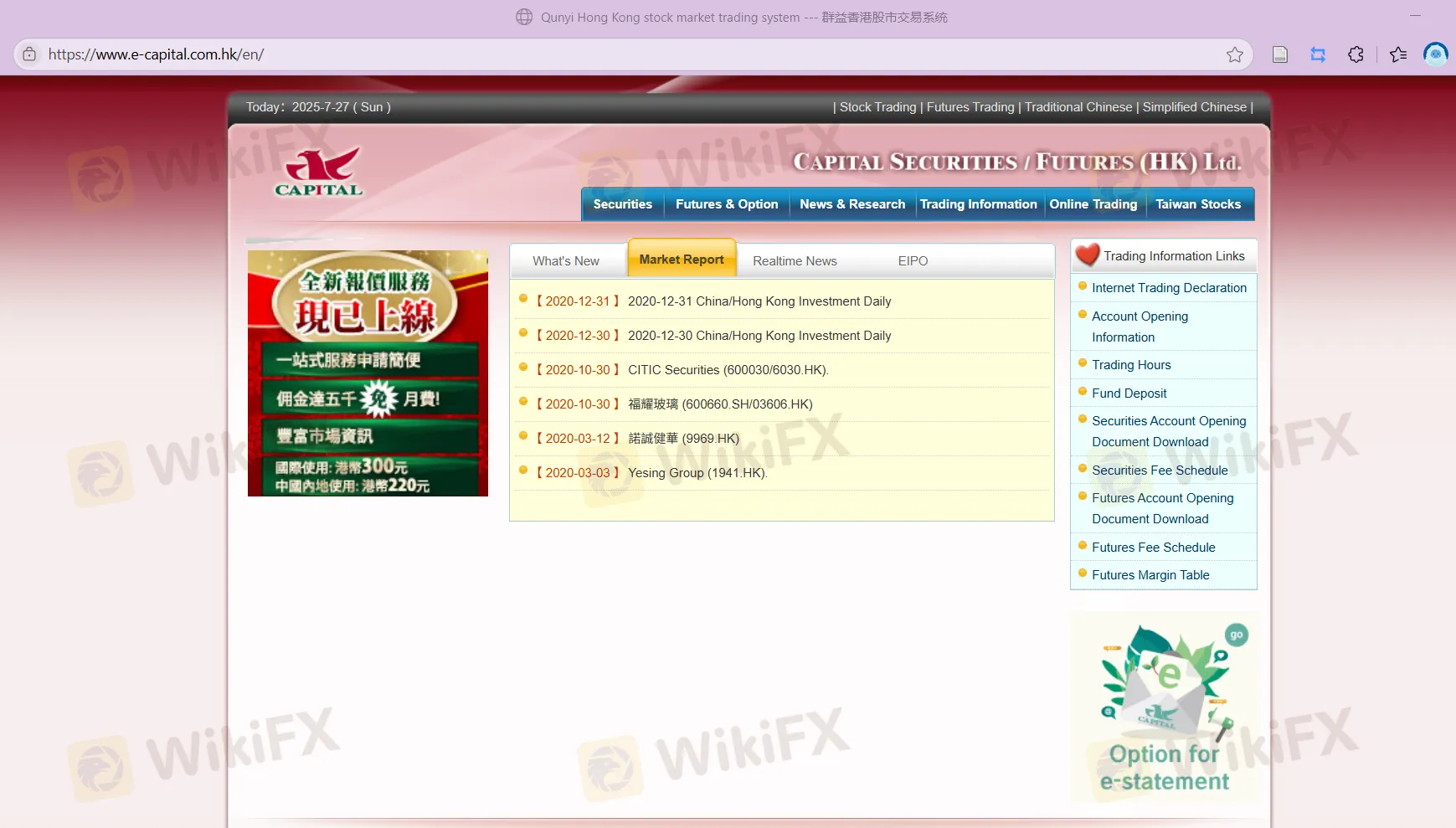

CAPITAL was established in 1999 and is registered in Hong Kong. It specializes in securities, futures, options, and fund trading.

It is regulated by Securities and Futures Commission of Hong Kong (SFC). Its subsidiaries, CSC Futures (HK) Limited and CSC Securities (HK) Limited, hold futures contract trading licenses (license numbers: AFD052 and ACC324), demonstrating their legal qualifications for futures trading.

However, information on account features and deposits and withdrawals is missing, so investors need to pay attention to its transparency issues.

Pros and Cons

| Pros | Cons |

| Long history | Unclear fee structure |

| Regulated by SFC | No info on trading platform |

| Various trading products |

Is CAPITAL Legit?

CAPITAL is regulatedby Securities and Futures Commission of Hong Kong (SFC). Its subsidiaries, CSC Futures (HK) Limited and CSC Securities (HK) Limited, hold futures contract trading licenses (License Numbers: AFD052 and ACC324), respectively, indicating that they are legally qualified to engage in futures contract trading.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| Securities and Futures Commission of Hong Kong (SFC) | Regulated | CSC Futures (HK) Limited | Dealing in futures contracts | AFD052 |

| Securities and Futures Commission of Hong Kong (SFC) | Regulated | CSC Securities (HK) Limited | Dealing in futures contracts | ACC324 |

What Can I Trade on CAPITAL?

CAPITAL focuses on trading securities, futures, options, and funds.

| Trading Products | Available |

| Securities | ✔ |

| Futures | ✔ |

| Options | ✔ |

| Funds | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| ETFs | ❌ |

Deposit and Withdrawal

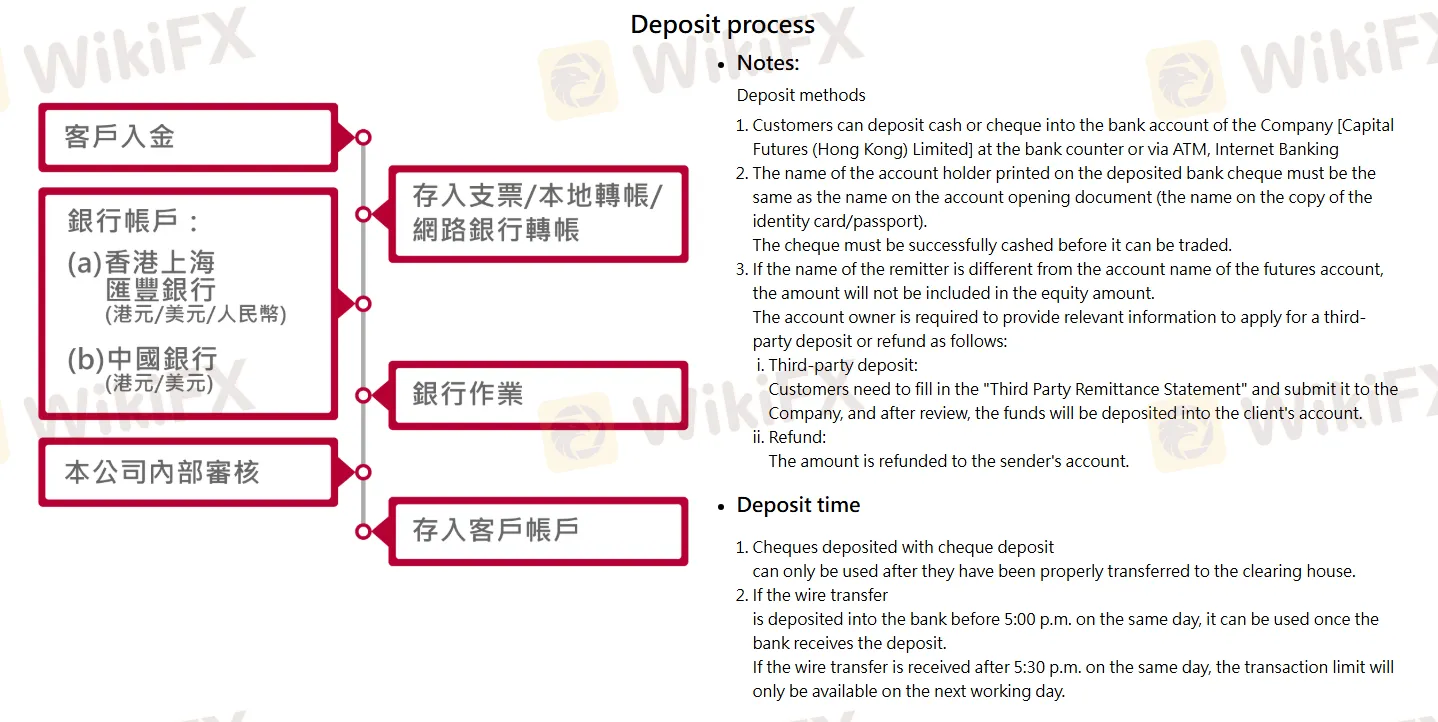

Deposits:

CAPITAL accepts payments via cash, check, or ATM/online bank transfer, offering HSBC and Bank of China as deposit channels, and supporting Hong Kong dollars, US dollars, and Chinese yuan.

CAPITAL also accepts third-party deposits, requiring relevant information for third-party deposit or refund requests.

Deposit processing time: If a wire transfer is received by the bank before 5:00 PM on the same day, funds are available for use upon receipt. If a wire transfer is received after 5:30 PM on the same day, funds are available for use on the next business day.

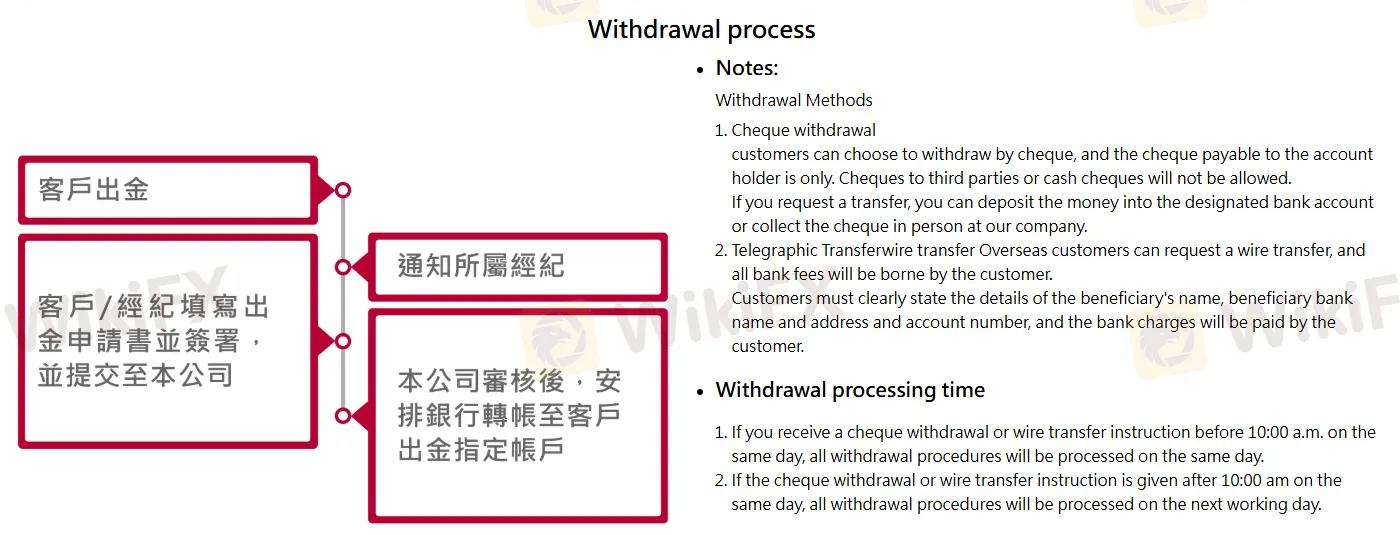

Withdrawals:

Check withdrawals and wire transfers. Check withdrawals do not support third-party withdrawals or cash checks.

Withdrawal processing time: If a check withdrawal or wire transfer instruction is received before 10:00 a.m., all withdrawal procedures will be processed on the same day. If a check withdrawal or wire transfer instruction is received after 10:00 a.m., it will be processed on the next business day.