Company Summary

| MEXEM Review Summary | |

| Founded | 2008 |

| Registered Country/Region | Cyprus |

| Regulation | CySEC, FCA (Revoked) |

| Trading Products | Stocks, Bonds, ETFs, Options, Futures, Warrants, Mutual Funds, Metals |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | Client Portal, TWS, MEXEM Lite, MEXEM APIs |

| Minimum Deposit | / |

| Customer Support | Contact form |

| Phone: +357-25030447 | |

| Email: info@mexem.com | |

MEXEM Information

MEXEM, founded on July 28, 2008, is a Cyprus-based broker regulated by CySEC. It provides access to diverse instruments like stocks, ETFs, and futures, and supports multiple trading platforms.

Pros and Cons

| Pros | Cons |

| Long operational history | Revoked FCA license |

| Regulated by CYSEC | Commission fees charged |

| Various trading products | Limited educational resources for beginners |

| Free initial withdrawal |

Is MEXEM Legit ?

MEXEM is currently regulated by the Cyprus Securities and Exchange Commission (CySEC) and was previously regulated by the UK Financial Conduct Authority (FCA), but its license has been revoked.

| Regulatory Authority | Regulated by | Regulatory Status | Licensed Entity | License Type | License Number |

| Financial Conduct Authority (FCA) | United Kingdom | Revoked | Mexem Ltd | European Authorized Representative (EEA) | 787270 |

| Cyprus Securities and Exchange Commission (CySEC) | Cyprus | Regulated | Mexem Ltd | Appointed Representative (AR) | 325/17 |

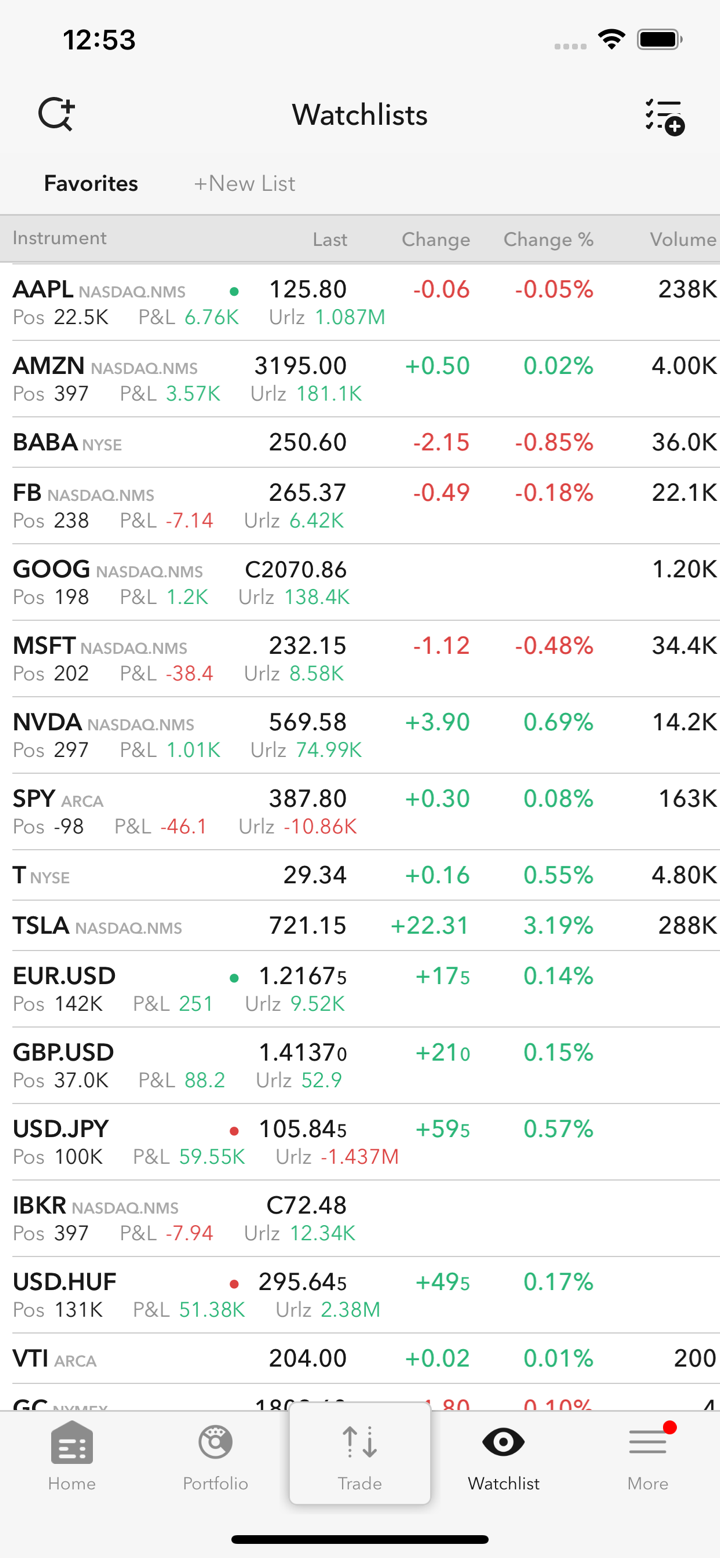

What Can I Trade on MEXEM?

MEXEM offers 8 types of trading instruments: stocks, bonds, ETFs, options, futures, warrants, mutual funds, and metals.

| Tradable Instruments | Supported |

| Stocks | ✔ |

| Bonds | ✔ |

| ETFs | ✔ |

| Options | ✔ |

| Futures | ✔ |

| Warrants | ✔ |

| Mutual funds | ✔ |

| Metals | ✔ |

| Forex | ❌ |

| Other Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

Account Type

Individual Account Types: Individual, Joint, Family Office, Friend & Family

Business and Professional Account Types: Small Business, Advisor, Funding Manager, Proprietary Trading Groups, Hedge & Mutual Fund, Compliance Officers

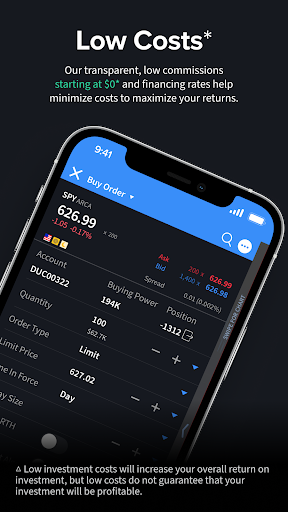

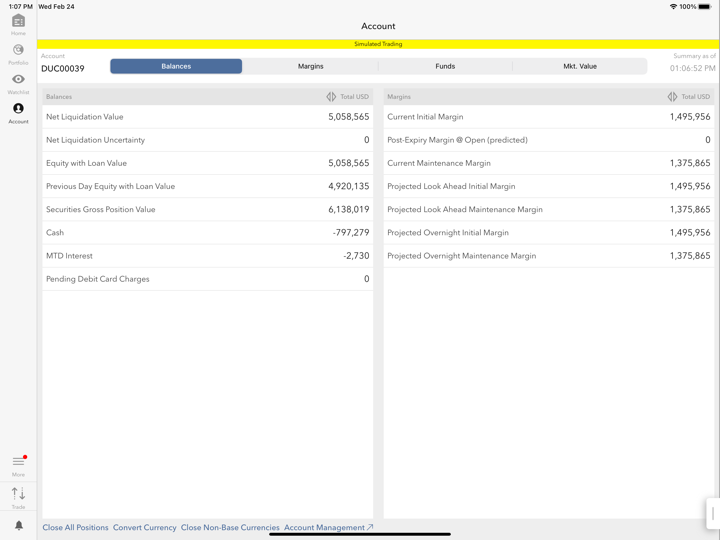

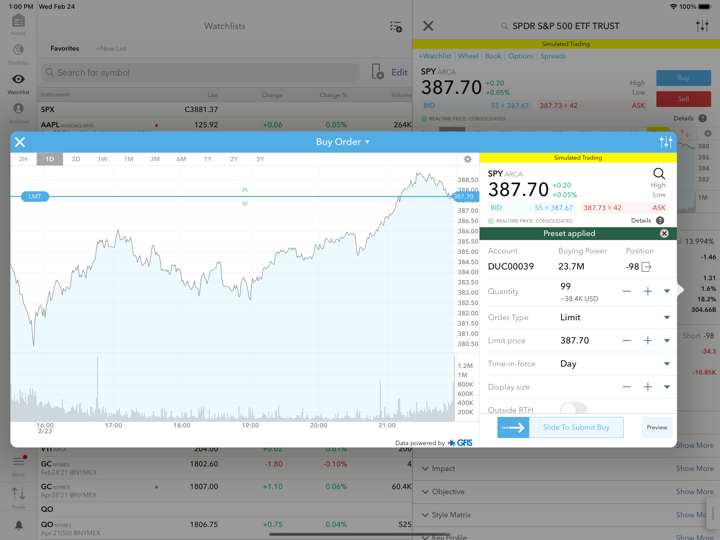

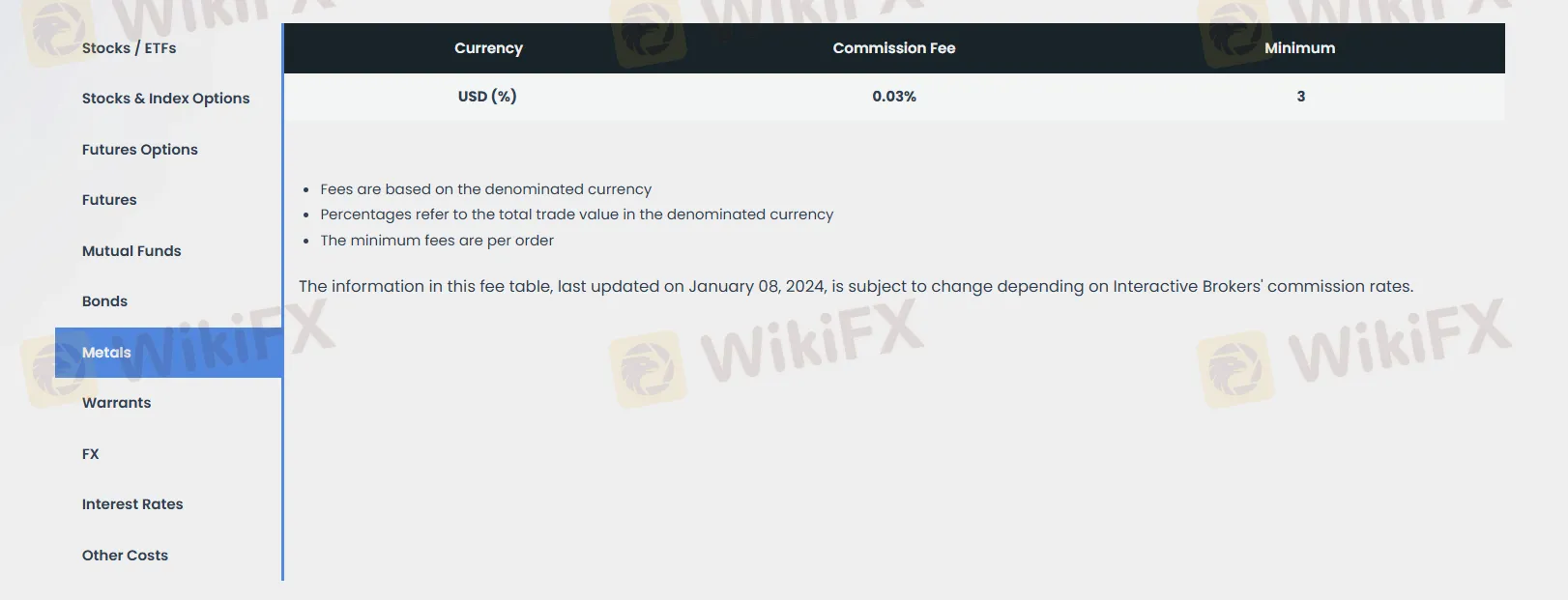

MEXEM Fees

MEXEMs fee structure varies by product. Below is a summary of the main commissions and minimum fees in USD:

| Trading Product | Commission Fee | Minimum Fee |

| Stocks and ETFs | $0.005 per share | $1 |

| Stocks & Index Options | 2 | $2 |

| Futures Options | 4 | $3.50 |

| Futures | 1 | $1 |

| Metals | 0.03% | $3 |

| Bonds | 0.15% | $8 |

| Forex (FX) | 0.005% | $5 |

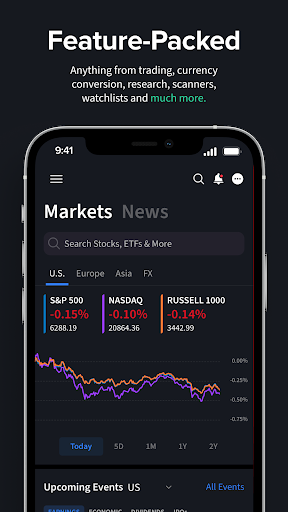

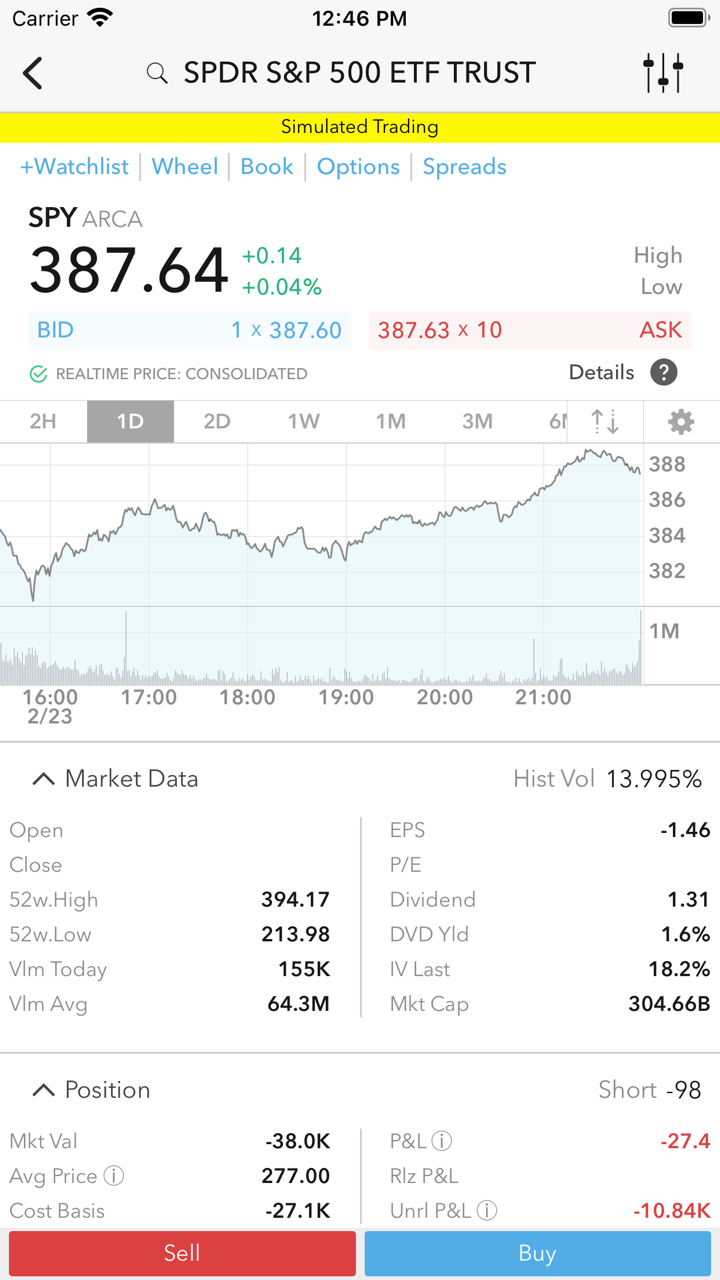

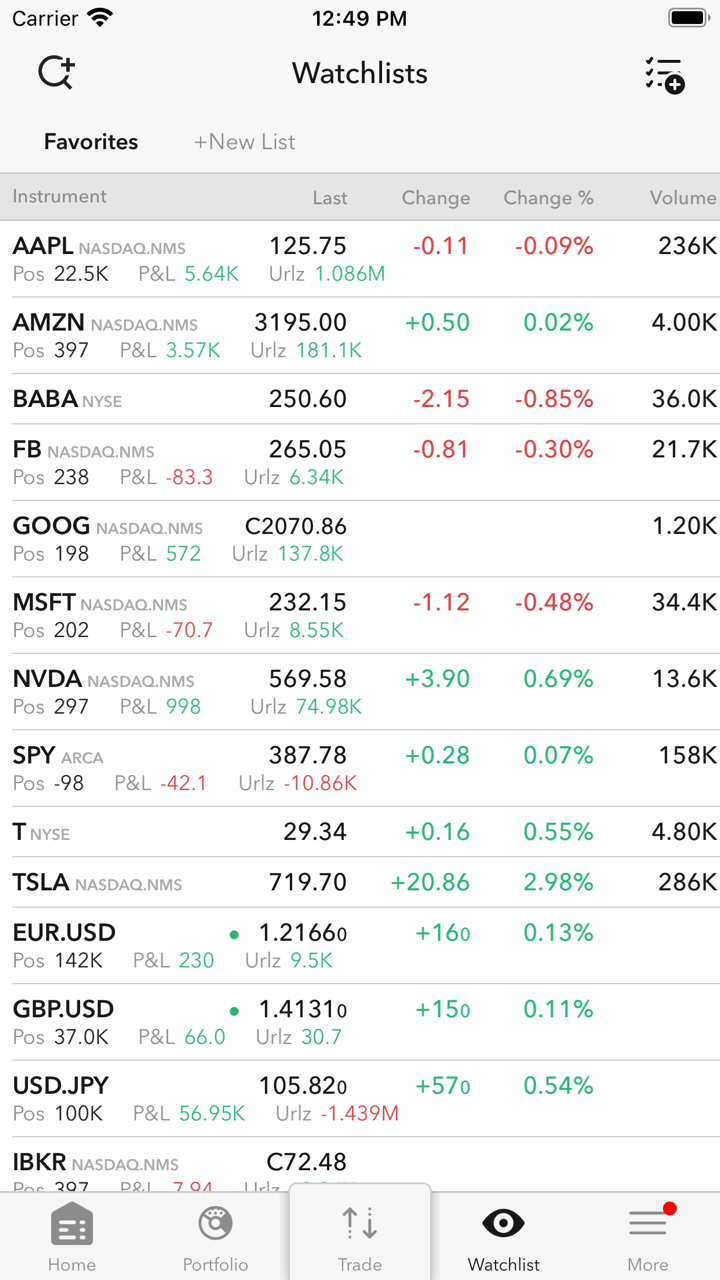

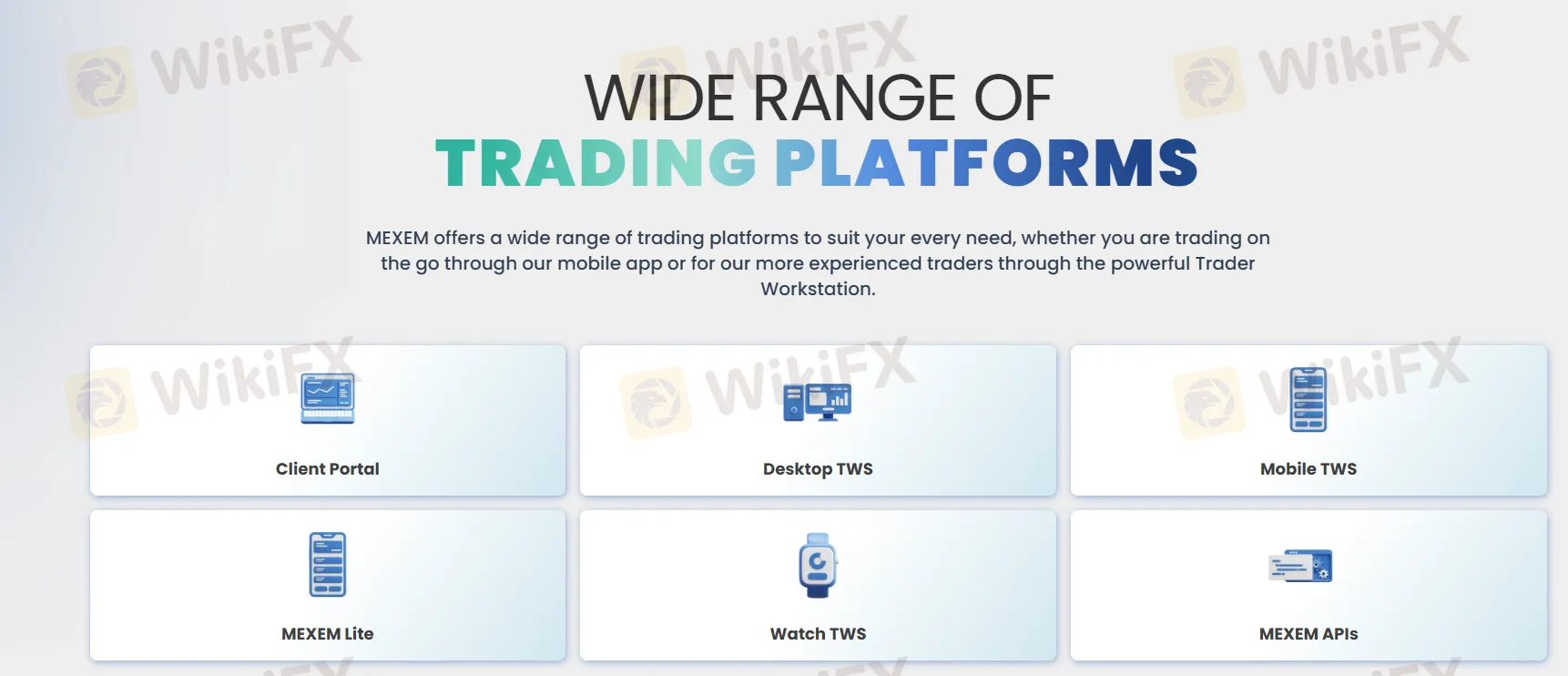

Trading Platform

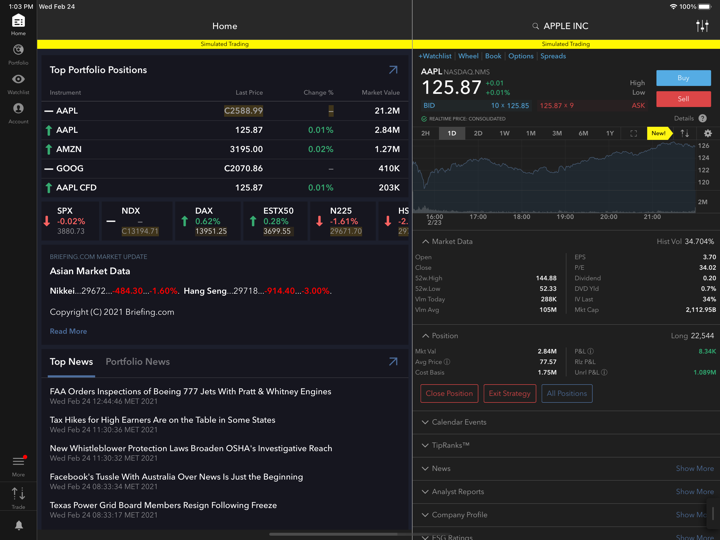

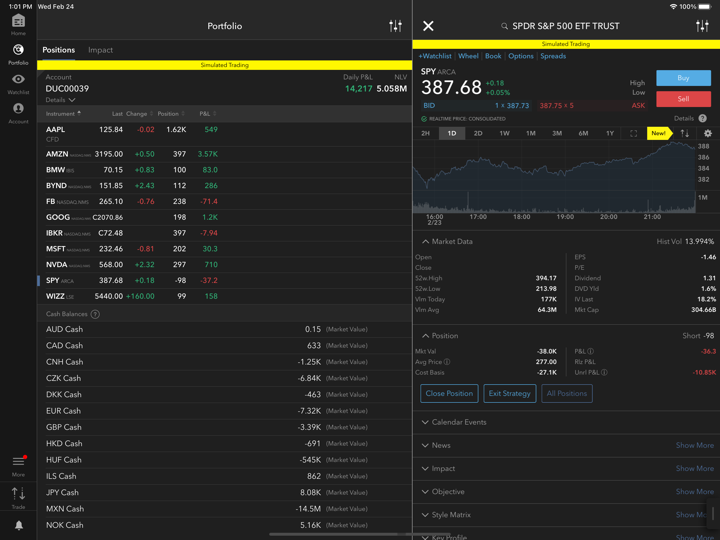

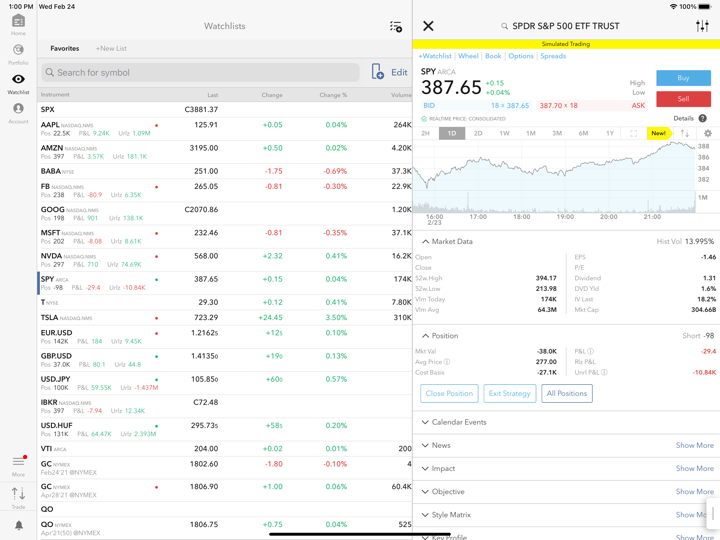

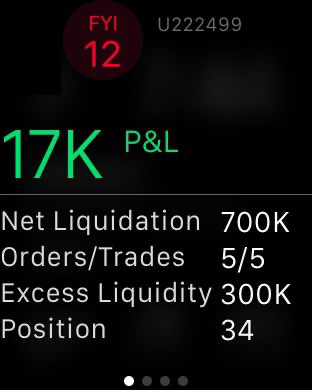

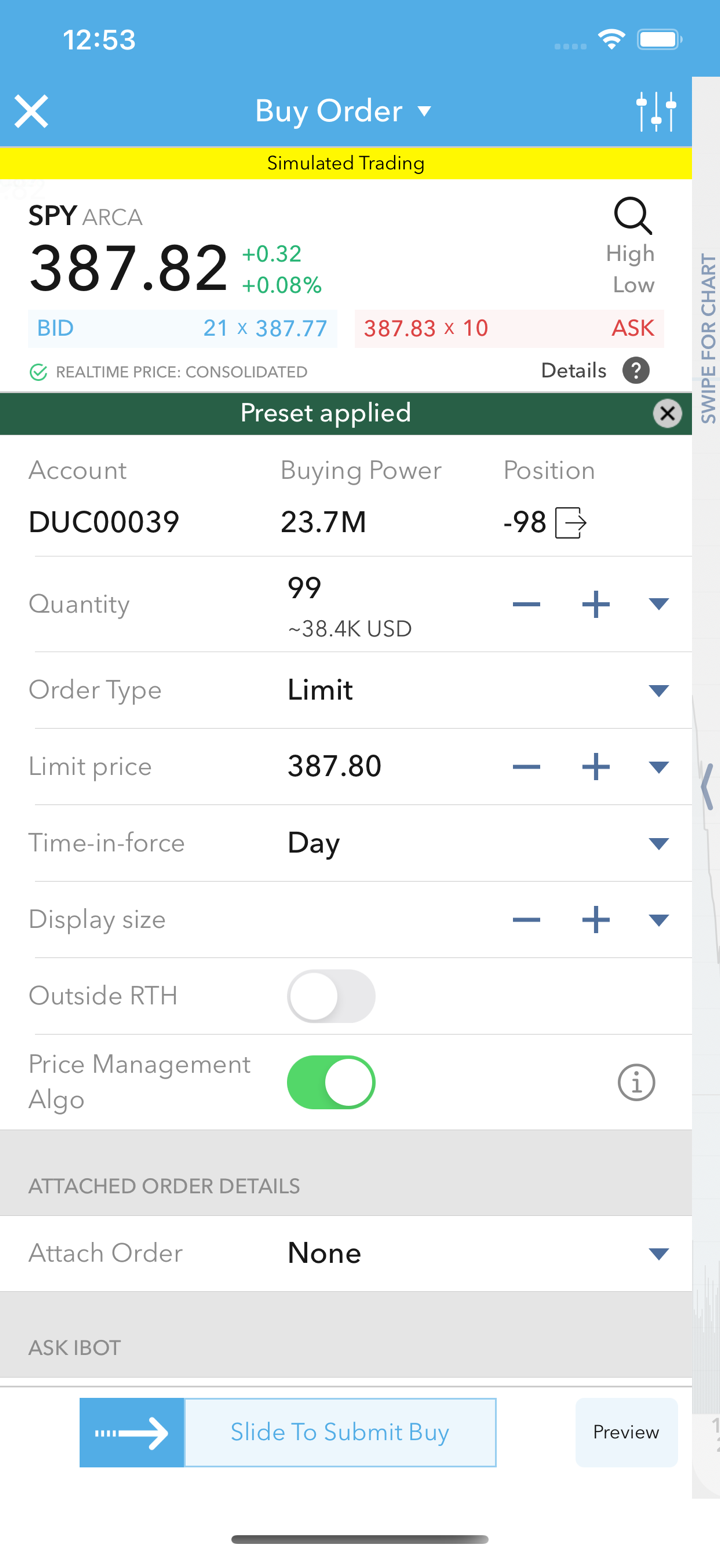

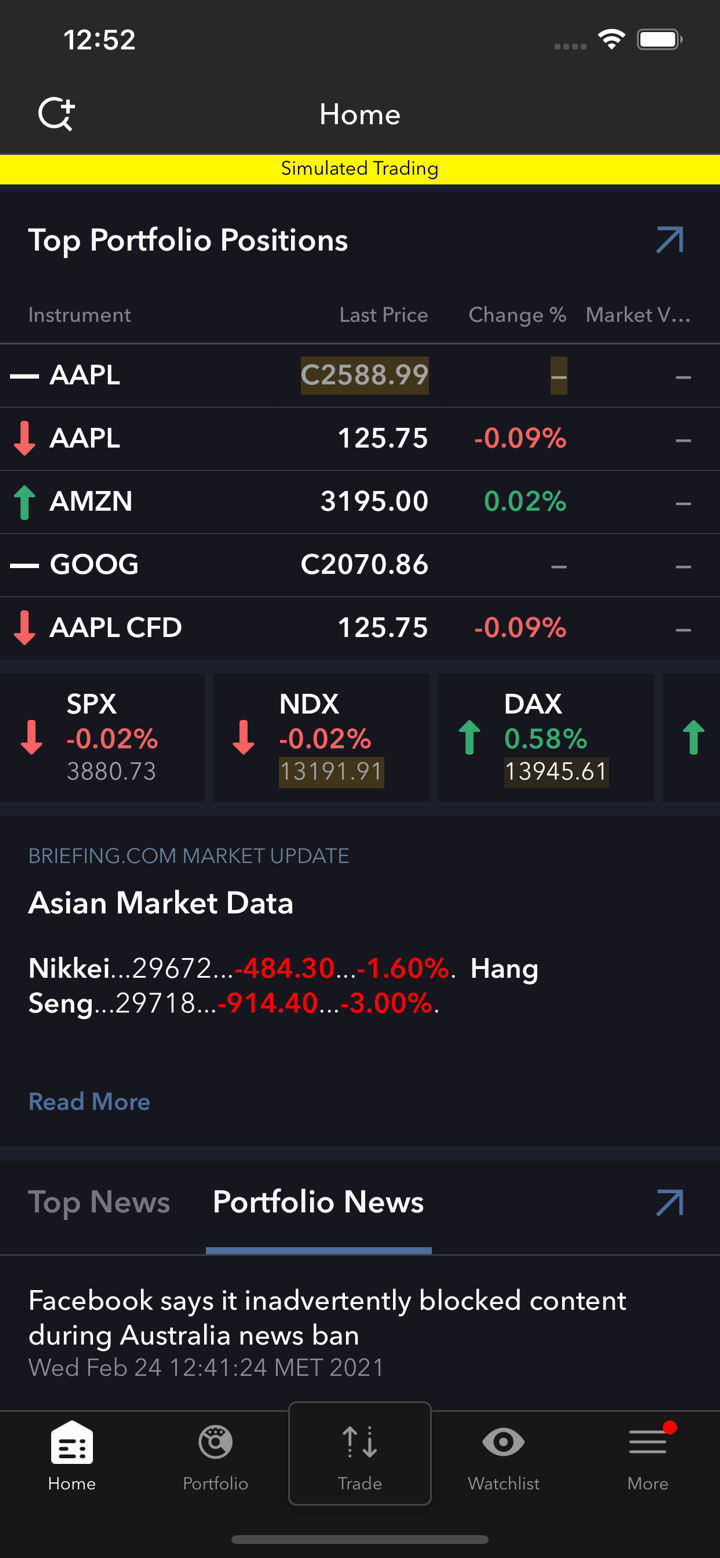

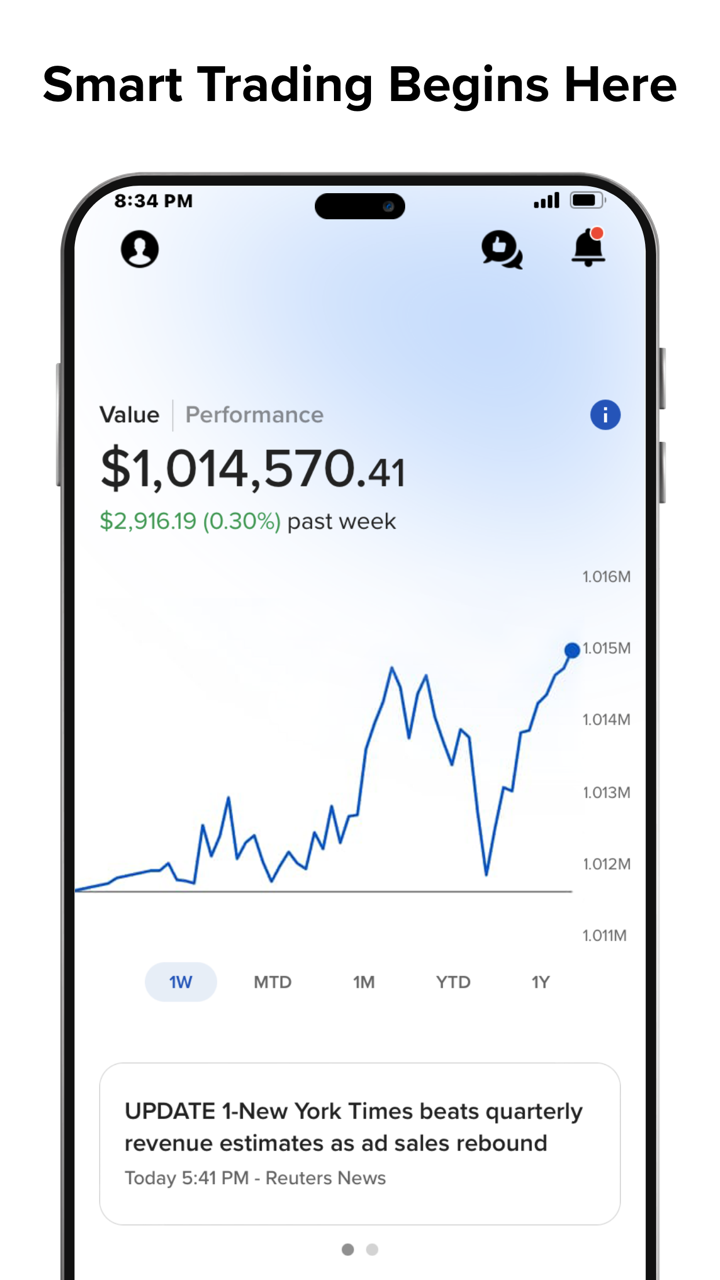

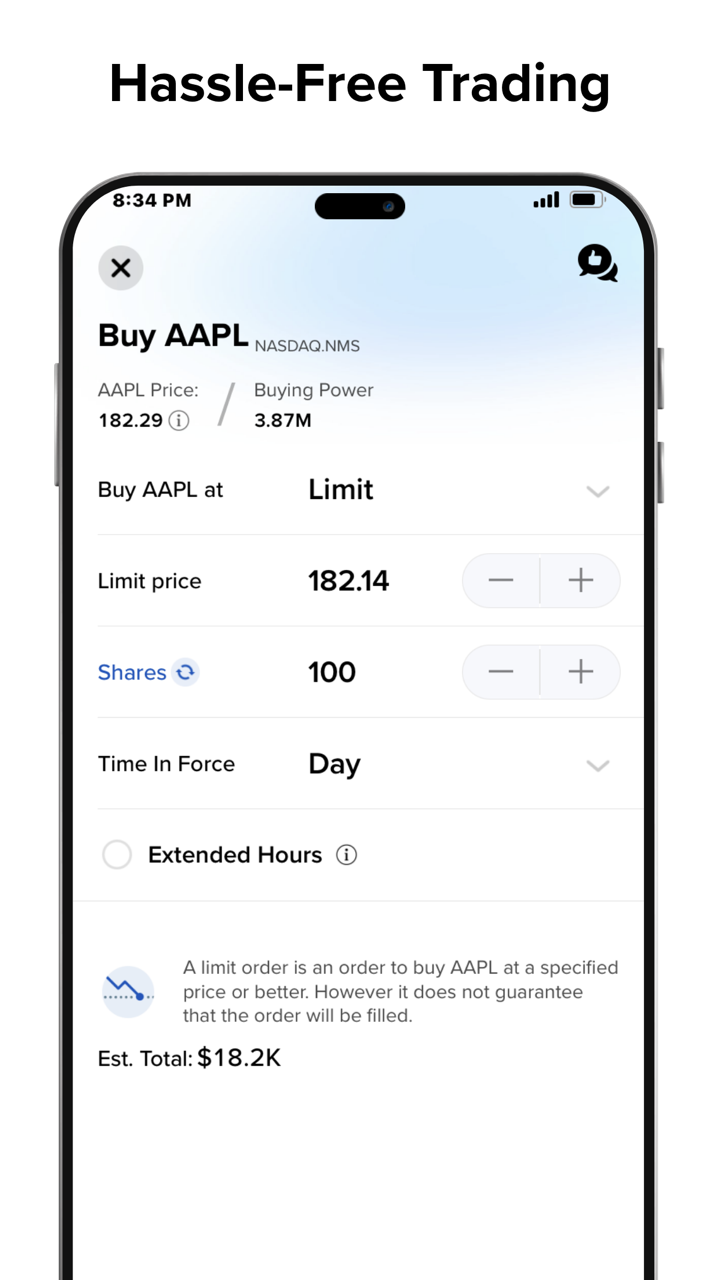

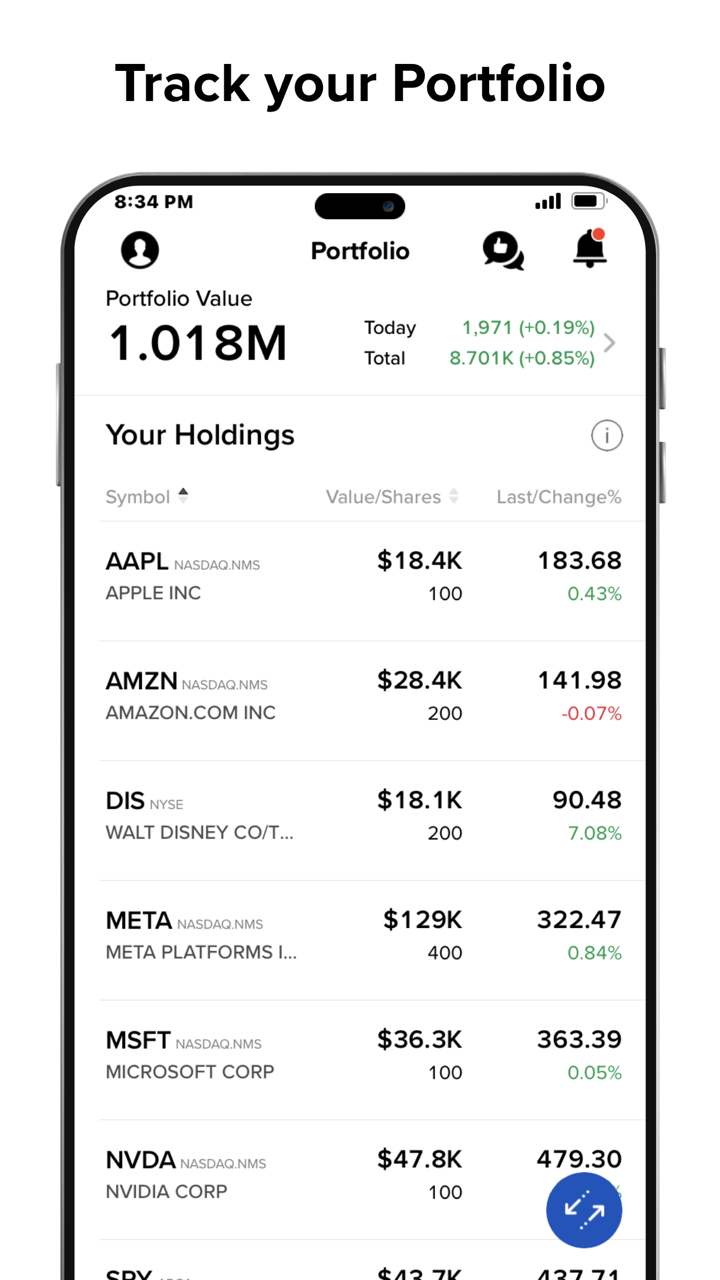

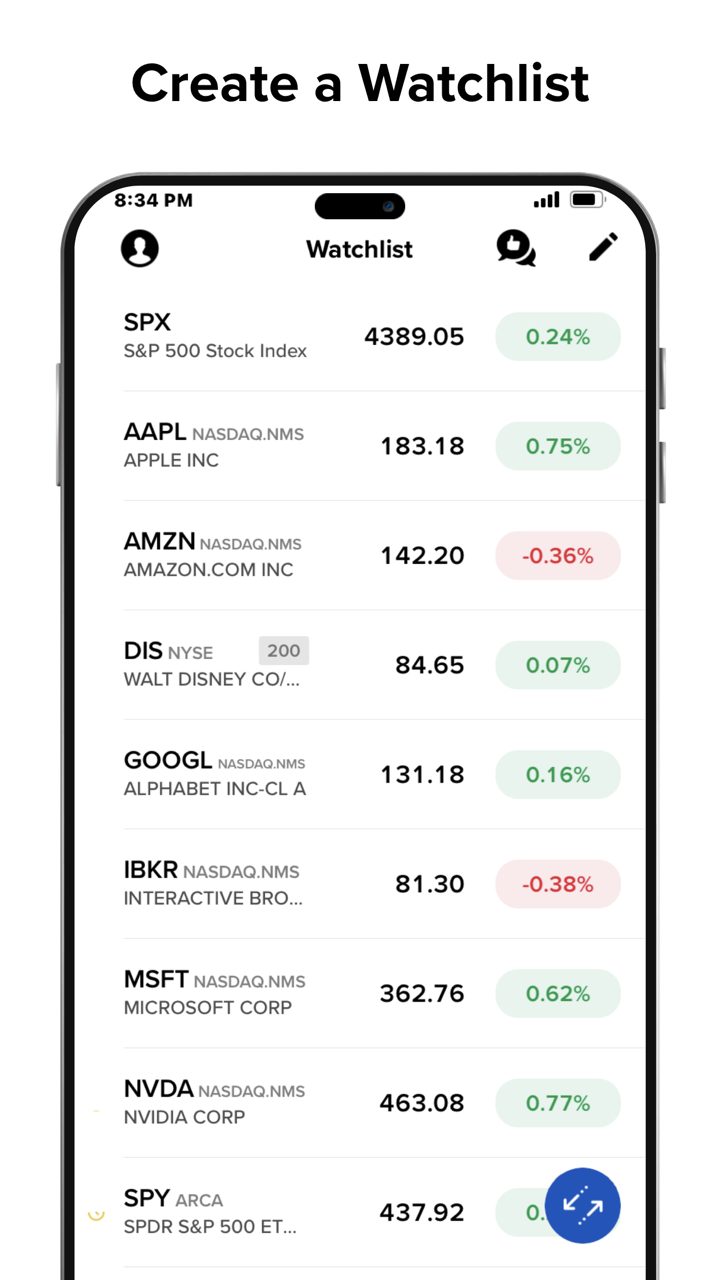

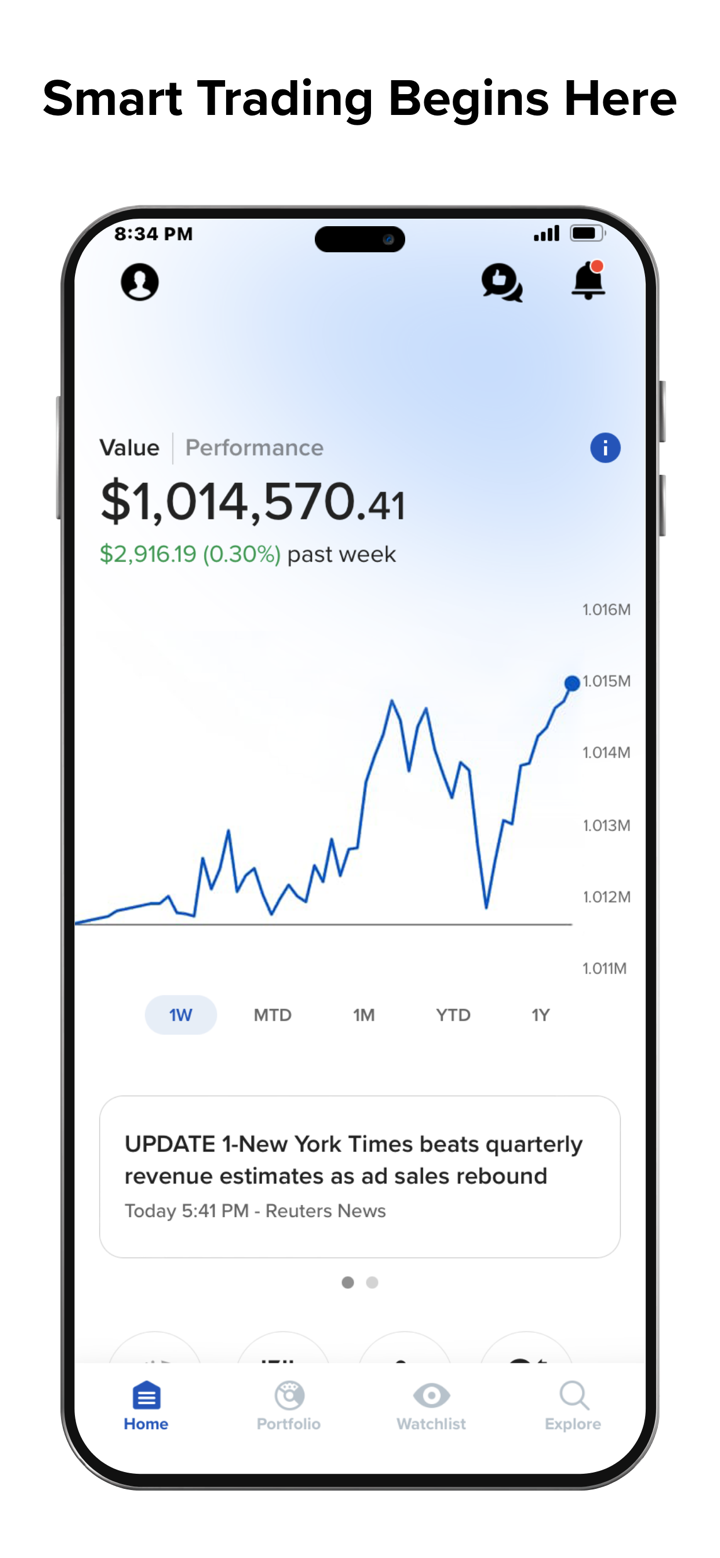

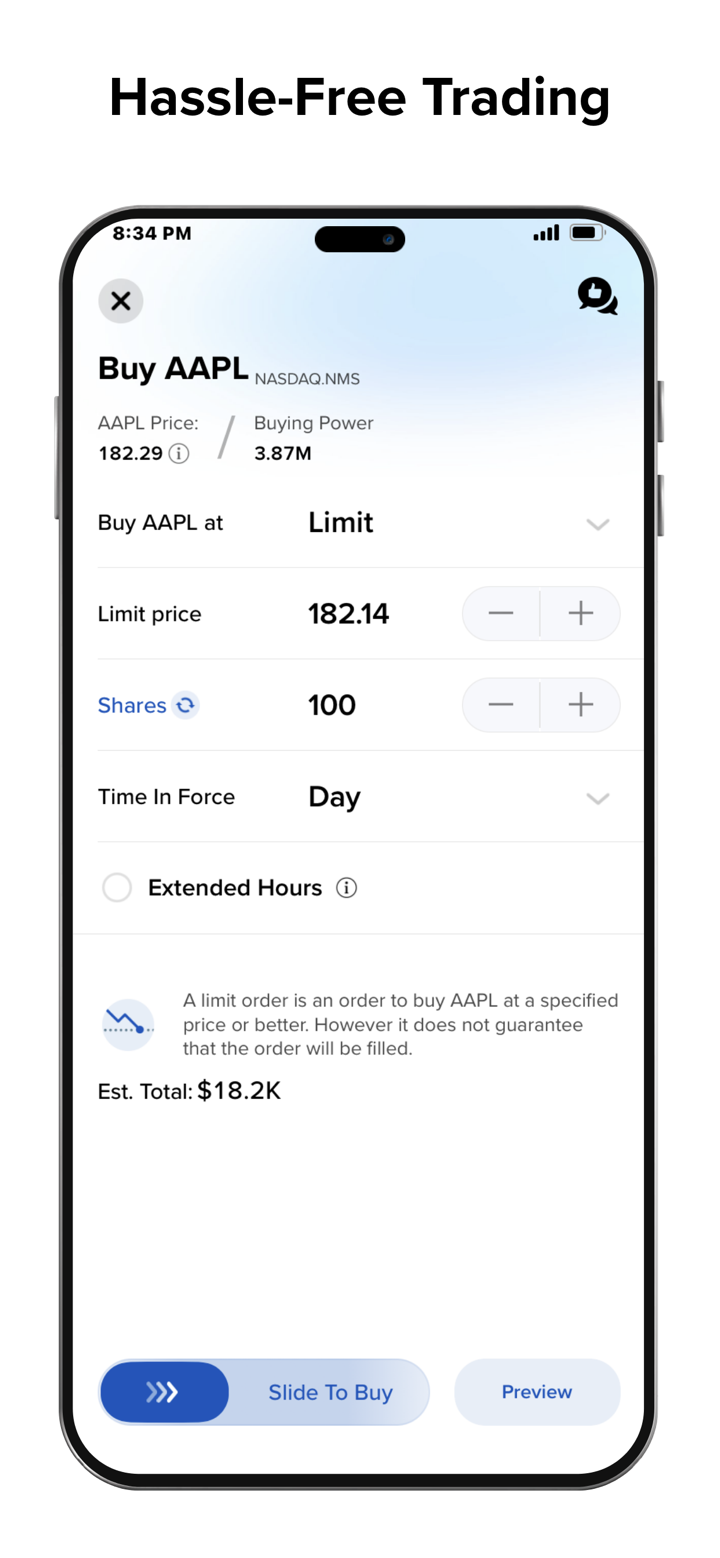

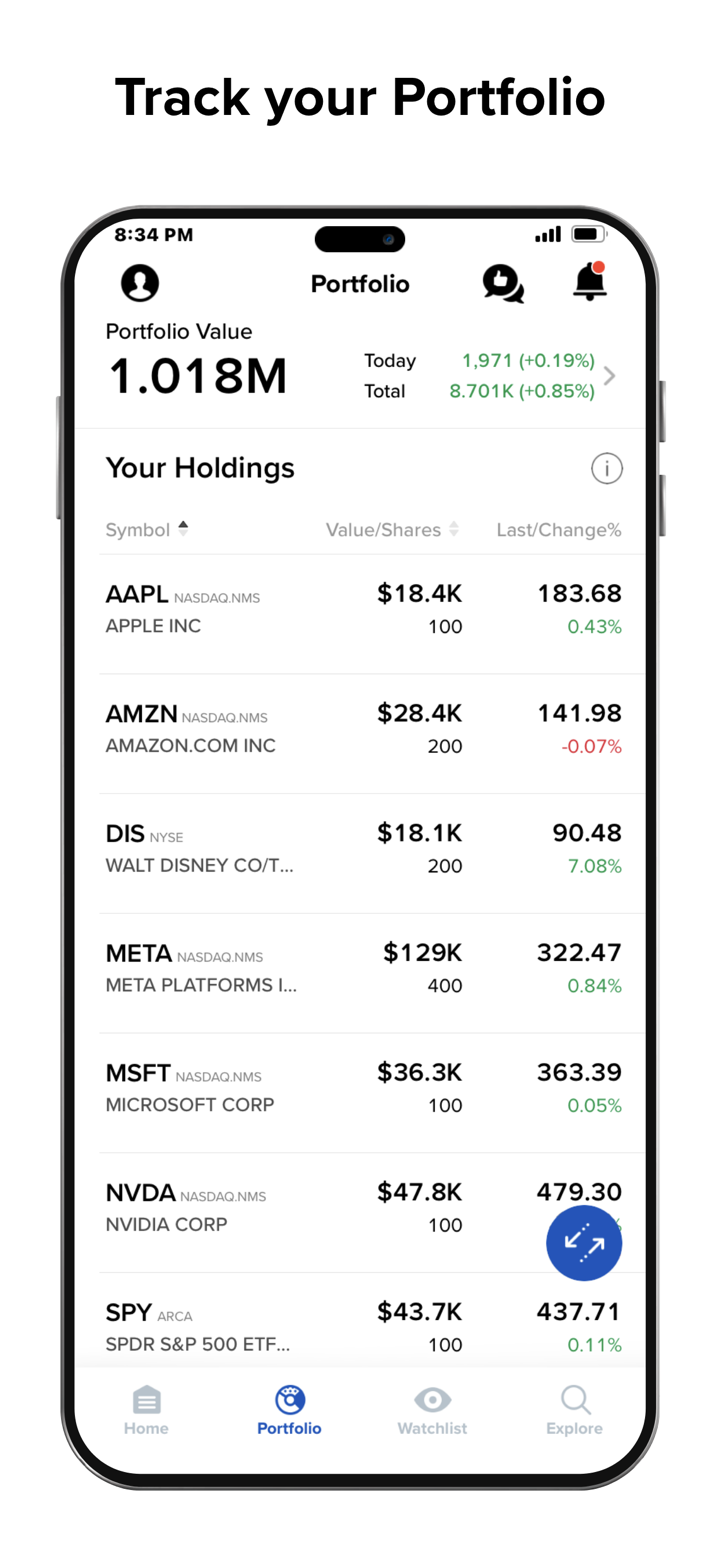

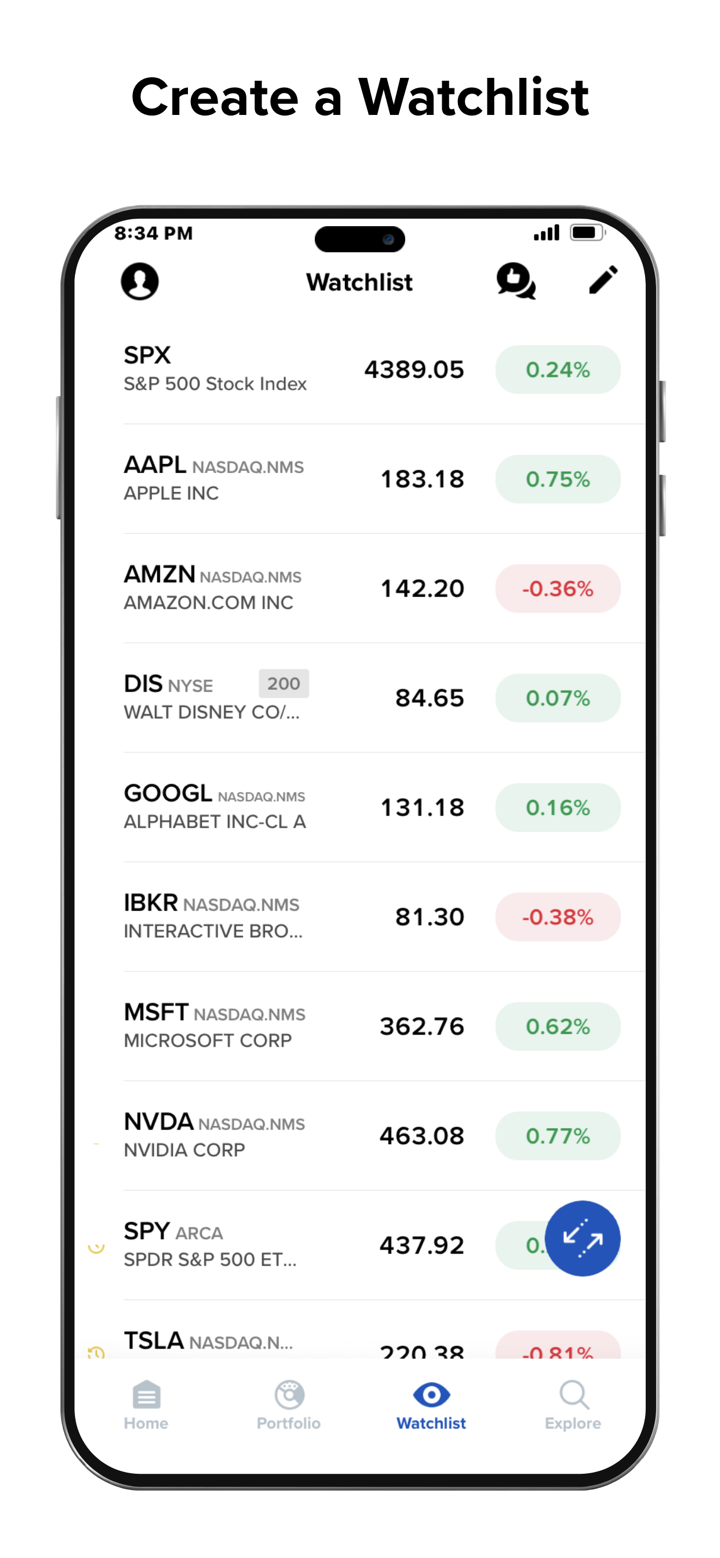

MEXEM offers four types of trading platforms.

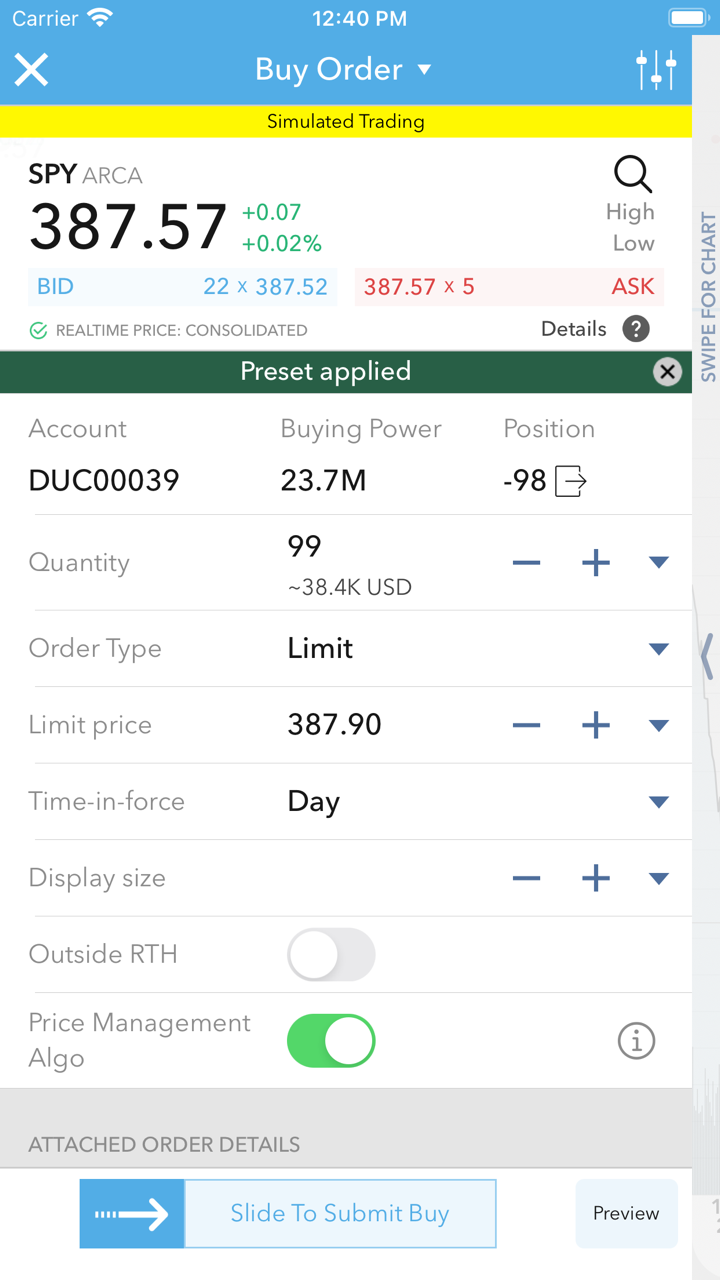

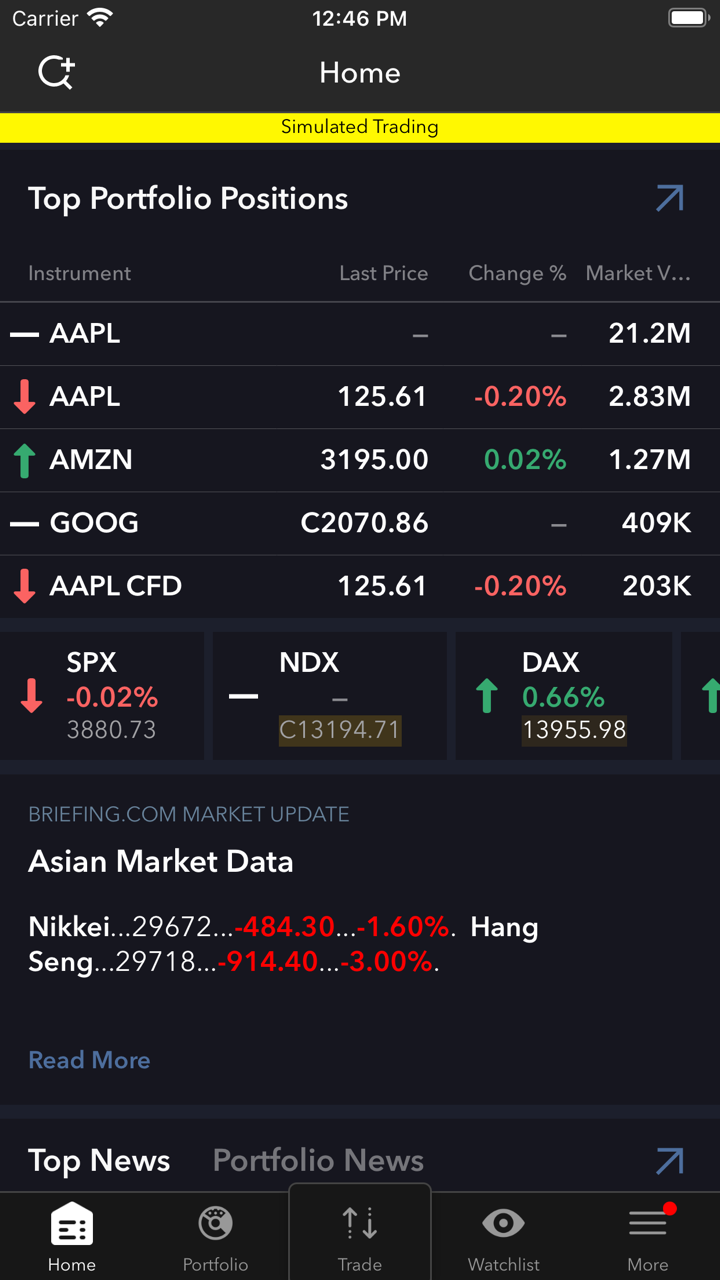

| Trading Platform | Supported | Available Devices |

| Client Portal | ✔ | Web |

| TWS | ✔ | PC, mobile, watch |

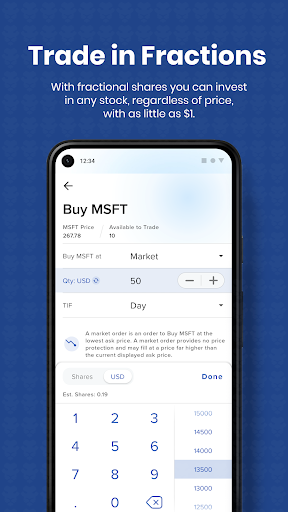

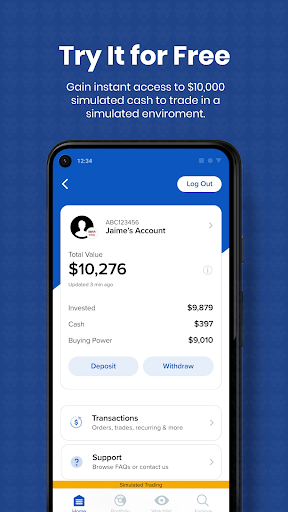

| MEXEM Lite | ✔ | iOS, Android |

| MEXEM APIs | ✔ | Custom, Third-party apps |

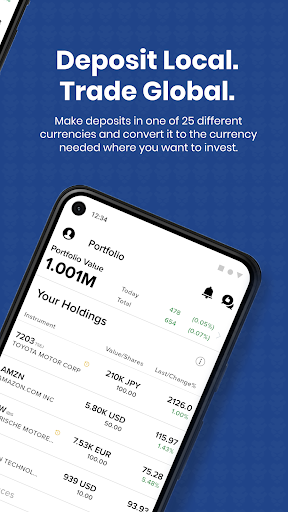

Deposit and Withdrawal

For withdrawals, MEXEM offers a free allowance for the first withdrawal. For example, SEPA and wire transfers in the Eurozone are free within 30 days of account activation; after that, they incur fees of €1 and €8 respectively. USD withdrawals are free for the first transaction, then $10 per transaction afterward. GBP withdrawals are also free for the first time, with a £7 fee for each subsequent withdrawal.