Cheat Sheet for Heikin Ashi

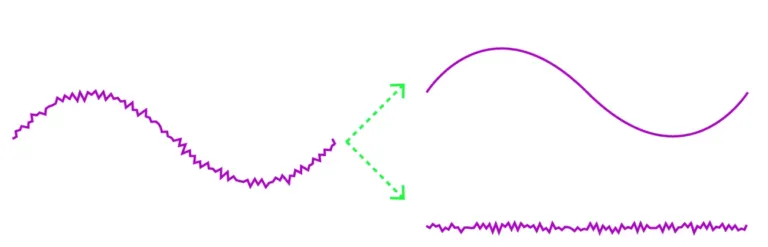

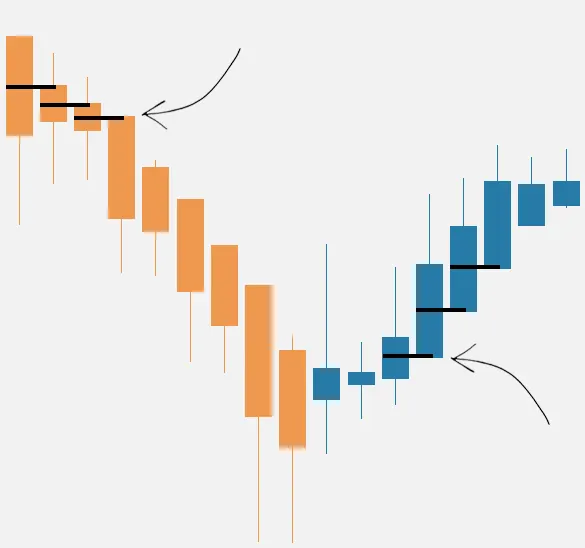

A candlestick chart, or Heikin Ashi, is a sort of price chart that uses candlesticks. Japanese candlesticks that have been modified. A Heikin Ashi chart filters out market noise and gives you a clearer picture of the trend.