Common Mistakes That New Traders Make When Using Japanese Candlesticks

Here are some common mistakes new traders make when using Japanese candlesticks.

Here are some common mistakes new traders make when using Japanese candlesticks.

Remember that candlesticks are meaningless unless you examine the market situation and what the price is showing you. As with every benchmark index or tool, just because candlesticks indicate a reversal or continuance does not mean it will occur.

Did you start clicking here? If so, stop reading immediately and take a Japanese candlestick lesson first! Once that's done, here's a one-page cheat sheet for single, dual, and triple Japanese candle formations. This cheat sheet will help you quickly determine the type of candlestick pattern you are looking at when trading.

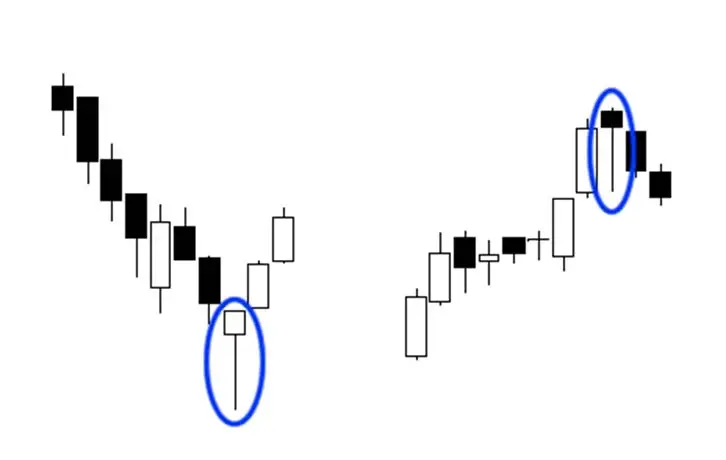

To recognize quadruple Japanese candlestick patterns, look for specific formations that include three candlesticks in total. These candlestick formations assist traders in predicting how the price will behave in the future. 3 candlestick patterns are reversion patterns, that demonstrate the conclusion of a trend and the beginning of a new trend in the reverse.

What could be better than a single candlestick pattern? DUAL candlestick designs! To recognize multiple Japanese candlestick patterns, search for certain formations that include TWO candlesticks in total.

What do marubozus, spinning tops, and dojis have in common? They're all Japanese candlesticks in their most basic form! Let's look at each of the many types of candlesticks and what they signify in terms of price activity.

let's move on to individual candlestick patterns. If these candles are displayed on the chart, they may indicate a potential market reversal. The four basic single Japanese candlestick patterns are:

Like humans, candlesticks have different body sizes. And when it comes to forex trading, there's nothing worse than looking at the candlestick itself!

While we discussed Japanese candlestick charting analysis briefly in the previous forex class, we'll now go over it in greater depth.

The peak reached before the price falls back is now resistance when it moves up and then retracts. As the price climbs back up, the lowest position hit before the climb is now considered support.

As the name implies, one approach for trading support and resistance levels is soon after the rebound. Many Forex retail traders make the mistake of placing an order at a bullish level and then sitting down and waiting for the transaction to be executed.

We may establish a "channel" by extending the trend line hypothesis and drawing a parallel line at the same angle as the uptrend or downturn.

In forex trading, trend lines are the most often used type of technical analysis. They're also one of the most obscure. They can be as exact as any other approach if drawn correctly. Most forex traders, unfortunately, draw them improperly or try to make the line represent the market instead of the other way around.

One of the most often used trading ideas is "support and resistance." Surprisingly, everyone appears to have their own opinion on how support and resistance should be measured.