Abstract:The Reserve bank of Australia left its cash rate at a record low of 0.1% on Tuesday and ended its A$275 billion ($194.40 billion) bond-buying campaign as expected.

However, traders were disappointed because the statement has pushed back on market wagers for an early rate rise.

The statement emphasised that ceasing bond purchases did “not imply” a near-term increase in interest rates and the Board was still prepared to be patient.

“As the Board has stated previously, it will not increase the cash rate until actual inflation is sustainably within the 2 to 3% target range,” RBA Governor Philip Lowe said in a brief statement. “While inflation has picked up, it is too early to conclude that it is sustainably within the target band.”

Key points

Rba says it also decided to cease further purchases under the bond purchase program, with the final purchases to take place on 10 February.

RBA says committed to maintaining highly supportive monetary conditions.

RBA says the RBA's central forecast is for gdp growth of around 4¼ per cent over 2022 and 2 per cent over 2023.

RBA says will not increase the cash rate until actual inflation is sustainably within the 2 to 3% target range.

RBA says board is prepared to be patient as it monitors how the various factors affecting inflation in Australia evolve.

RBA says the central forecast is for the unemployment rate to fall to below 4 per cent later in the year and to be around 3¾ per cent at the end of 2023.

RBA says while inflation has picked up, it is too early to conclude that it is sustainably within the target band

RBA says there are uncertainties about how persistent the pick-up in inflation will be as supply-side problems are resolved

RBA says likely to be some time yet before aggregate wages growth is at a rate consistent with inflation being sustainably at target

RBA says ceasing purchases under the bond purchase program does not imply a near-term increase in interest rates.

RBA says the board will consider the issue of the reinvestment of the proceeds of future bond maturities at its meeting in May.

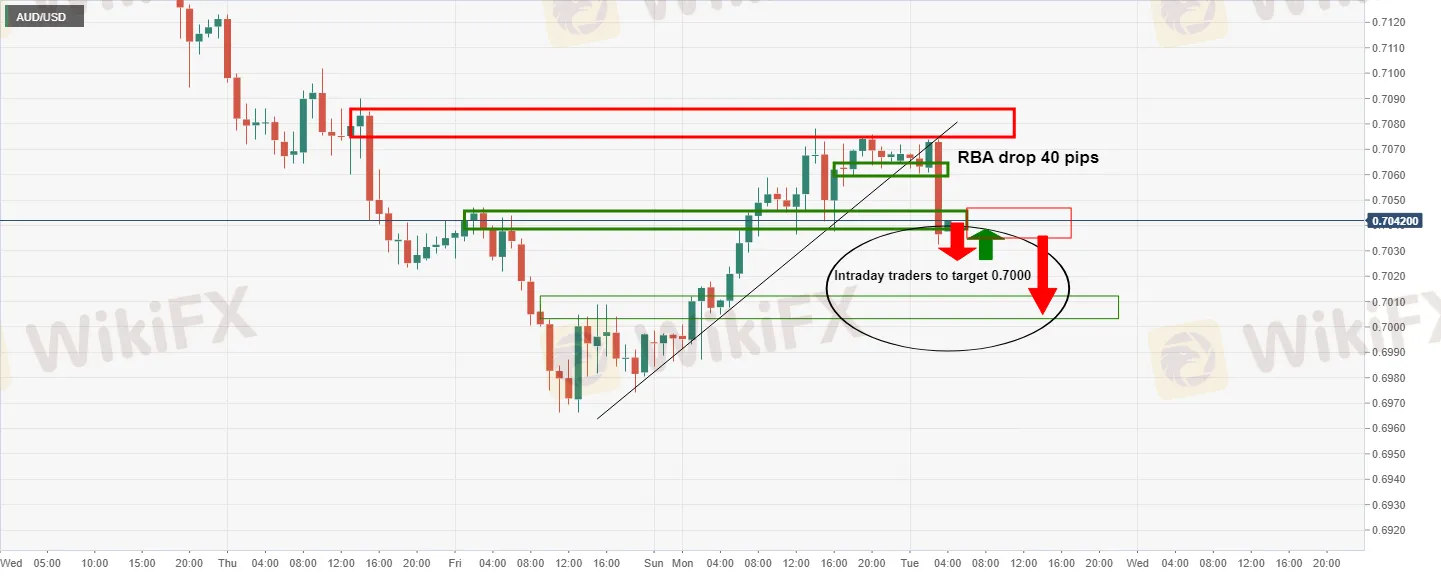

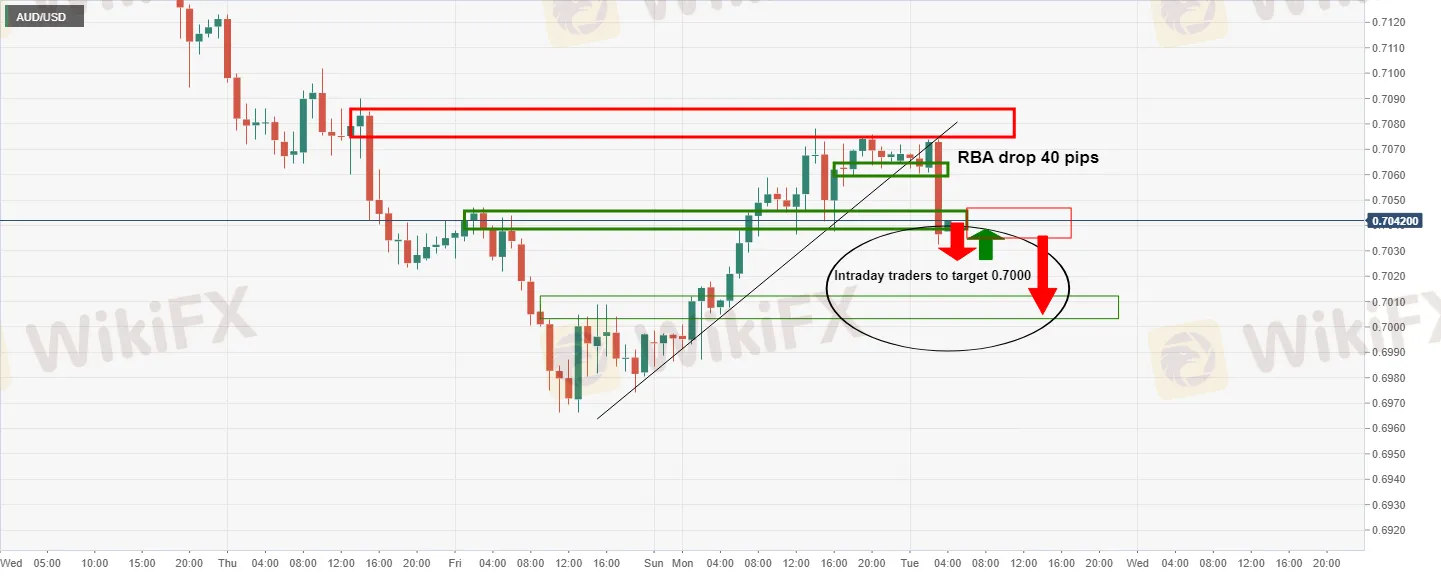

AUD/USD reaction