Abstract:There are basically two types of accounts in the forex market: institutional trading accounts and retail trading accounts. In this article, we will discuss institutional trading accounts. WikiFX has listed four solid brokers offering institutional trading accounts.

There are basically two types of accounts in the forex market: institutional trading accounts and retail trading accounts. In this article, we will discuss institutional trading accounts. WikiFX has listed four solid brokers offering institutional trading accounts.

What is an Institutional forex trading account?

Institutional trading accounts are not for individuals. Among the institutions, groups, and companies that use these accounts are banks, mutual funds, insurance companies, multinational corporations, pension funds, and hedge funds.

Comparing retail and institutional trading accounts, institutional trading accounts have additional advantages. Their systems can be connected to the real-time data of financial brokers via APIs. In such a completely in-house environment, they are able to execute trades quickly.

Brokers list: Institutional trading accounts

IG

A member of the FTSE 250 since 1974, IG Group is an established financial services provider. Its nearly 50-year experience in leading the market gives it a huge advantage over its competitors. The company has been recognized as a pioneer in its field, having created a whole new type of trading in the year it was founded. It offers more than 400 products and has offices in 20 countries across five continents, serving over 400,000 clients worldwide.

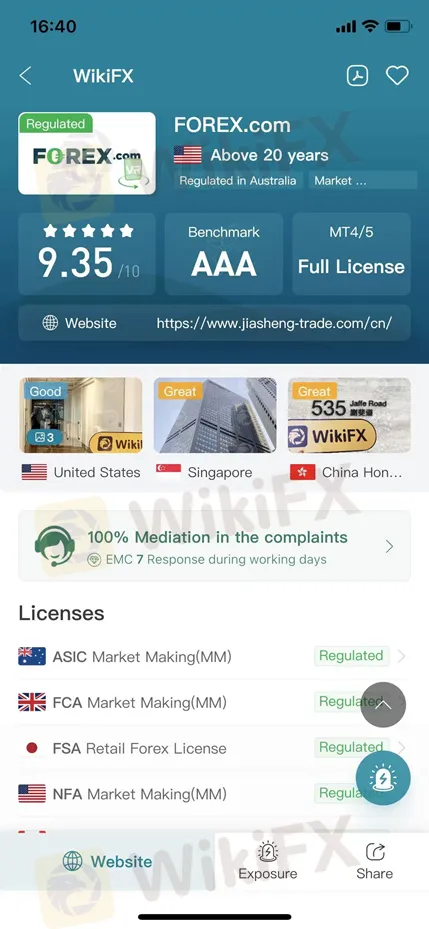

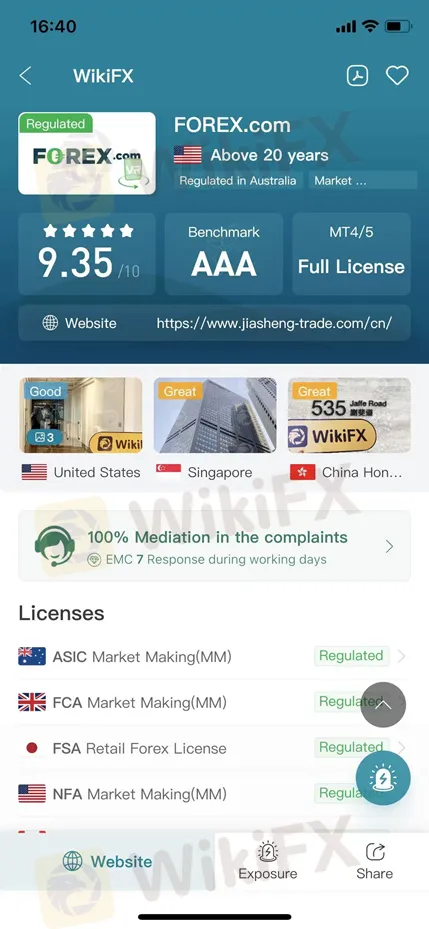

FOREX.com

FOREX.com is the leading global retail online trading brand of Gain Capital, owned by NASDAQ-listed StoneX Group Inc. Founded in 1999, this company has developed into a global leader in online trading and operates through its regulated subsidiaries in seven major financial jurisdictions around the world

AvaTrade

AvaTrade was established in 2006 in Dublin, the capital of Ireland, co-founded by professionals in the financial field and experts in the e-commerce field. By the end of 2016, AvaTrade had 16 directly-affiliated branches, with branches in five continents around the world, in addition to representative offices in more than 20 countries, and business covering more than 150 countries around the world.

IC Markets

IC Markets is a leading forex broker around the globe, offering various solutions for active traders, day traders, scalpers and more. IC Markets allows its clients access to a massive market with diversified types of trading instruments.