PU Prime Launches “The Grind” to Empower Traders

Discover PU Prime’s new campaign, “The Grind,” and learn how trading discipline builds long-term success. Watch and start your trading journey today!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

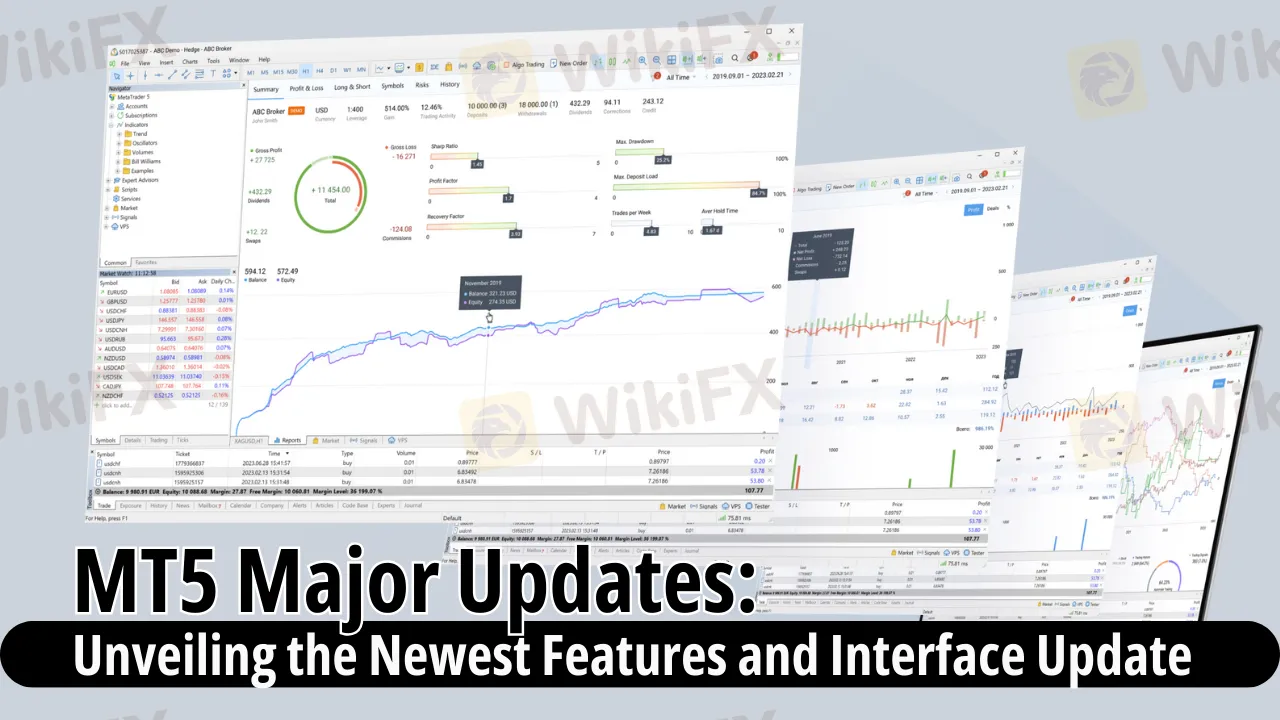

Abstract:Discover MT5 Major Updates, enhancing your trading experience. Dive into advanced Trading Analytics, enjoy seamless Integrated Payments directly in the platform, and experience a refreshed Interface Update. Simplified, secure, and efficient trading awaits!

MetaTrader 5 (MT5) has recently undergone significant updates, enhancing the trading experience for users. This article highlights the main changes and the benefits they bring.

Trading Analytics: A major change is the introduction of advanced trading statistics. Traders can now analyze their performance in a much improved and detailed manner. Whether you're just starting out or are a seasoned professional, MT5 now offers comprehensive insights into your trading activities. With just a click, users can access:

Summary Reports: Quick glance at account details, profits, losses, and more.

Profit/Loss Data: Insight into successful and less successful trades, divided by trading types like manual, copy, or algorithmic.

Order Reports: Overview of Buy and Sell orders over specific time frames.

Symbols: Analysis of trades based on the financial instruments involved.

Integrated Payments: Another crucial update is the built-in payment service. Gone are the days when traders had to navigate away from MT5 to top up their accounts. Now, with integrated payments, users can:

Deposit funds directly via the MT5 platform.

Avoid the hassle of remembering multiple passwords for different payment sites.

Add funds whenever needed, ensuring trading opportunities are never missed.

This new payment feature also promotes security as all personal data and transactions are safeguarded.

Interface Update: MT5 is getting a visual makeover! While the core look of the platform will remain recognizable, the updated interface aims to be more modern and user-friendly.

For now, the update has been rolled out for the desktop version compatible with Windows 10 or newer. However, MT5 promises that the web and mobile platforms will soon receive these enhancements.

Moreover, these features come at no additional cost! If you're an MT5 user, simply update to the latest version and enjoy these advanced features.

Lastly, to use the integrated payments, ensure your broker supports this feature. It's always a good idea to check with them beforehand.

To sum up, with these major updates, MT5 is poised to offer a smoother, more efficient, and insightful trading experience for all its users.

Install WikiFX to stay updated on the latest news in the Online Trading Market.

Download link: https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Discover PU Prime’s new campaign, “The Grind,” and learn how trading discipline builds long-term success. Watch and start your trading journey today!

IG boosts FCA compliance by integrating Adclear’s AI tools. Learn how automation accelerates marketing approvals and ensures regulatory accuracy.

Trust has always been a widely discussed topic in the forex industry. When genuine, rational voices are drowned out, market participants struggle to discern which information is trustworthy amid a sea of complex data. This difficulty in establishing trust has placed industry transparency at the forefront of attention.

The Indian Finance Minister Nirmala Sitharaman, while announcing the Union Budget 2026-27, proposed a sharp rise in the Securities Transaction Tax (STT) on Futures and Options as part of the government’s strategy to soothe the country’s overheated derivatives market. The move comes on the backdrop of regulators’ concerns over excessive speculation in F&O allowing retail traders to enter the market and lose capital. Whether the government will be able to curb excessive speculation in F&O through this move remains to be seen. The stock indices, however, were hit hard, with the BSE Sensex falling by 1500 points amid widespread selling on the STT hike. Let’s examine the potential impact of this hike on Indian F&O traders.