Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Vebson is listed as high risk on WikiFX, with exposure to unpaid withdrawal cases and misleading claims. Read this forex scam alert before you deposit a cent.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

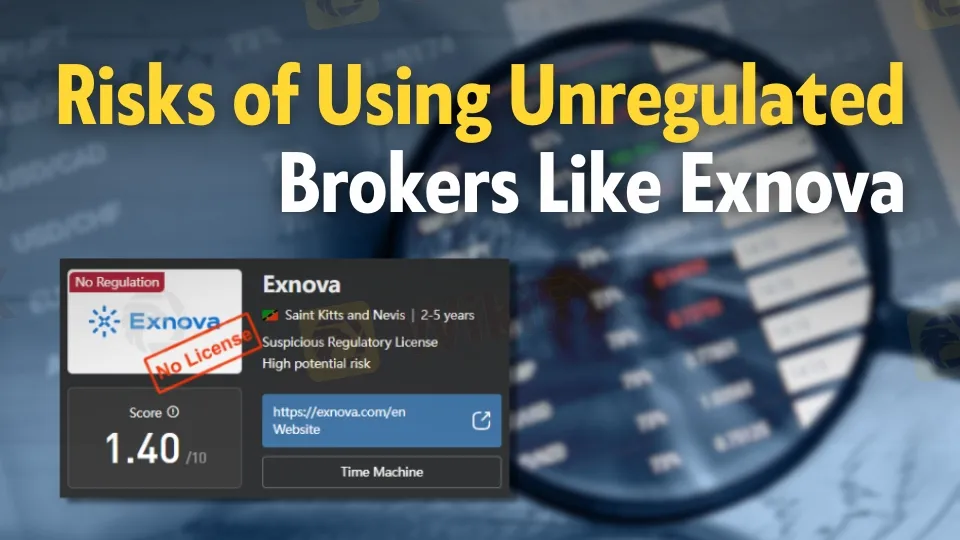

Abstract:Trading with unregulated brokers, such as Exnova, exposes traders to numerous risks, including fraud, withdrawal issues, and a lack of client protection. Learn about the dangers associated with these brokers and why it's crucial to choose a licensed, reliable platform.

In the fast-paced world of online trading, brokers are the bridge between investors and the financial markets. But not all brokers are created equal. Unregulated brokers, such as Exnova, bring a range of risks that can put your money and trading experience in jeopardy. This article uncovers the real dangers of using unregulated platforms, with a close look at Exnova, and explains why every investor should be cautious.

Brokers without proper regulation operate outside the watchful eye of financial authorities. This lack of oversight opens the door to many problems, including:

Exnova, being unregulated, has been reported to engage in several of these practices, making it a risky option for anyone seeking fairness and transparency.

One of the biggest warning signs with Exnova is trouble withdrawing funds. Users have reported:

These issues not only cause financial stress but also destroy trust in the broker. The inability to access your funds is a serious risk that can lead to major losses.

Regulated brokers must follow strict rules to protect clients, such as:

Exnova, as an unregulated broker, does not offer these safeguards. This means:

The lack of client protection is a major reason why trading with unregulated brokers is so dangerous.

Keeping your funds safe should be your top priority, but Exnovas business model raises big concerns:

This creates a high-risk situation where your money can be lost, stolen, or frozen without warning.

Trading with unlicensed brokers like Exnova exposes you to serious legal and financial dangers:

Choosing an unlicensed broker is like trading without any safety net, making you more vulnerable to fraud and loss.

Trading with unregulated brokers like Exnova brings serious risks that can damage your finances. From fraud and withdrawal problems to the lack of client protection and fund safety, the dangers are real and significant. The legal and financial fallout from dealing with unlicensed brokers can be devastating. For a safe and transparent trading experience, always choose brokers regulated by respected authorities. Protect your investments by picking brokers who follow strict rules, offer client safeguards, and are fully transparent—qualities that unregulated brokers like Exnova simply do not provide. Always do thorough research before trusting any trading platform with your money. Your financial security depends on it.

Exnova faces many complaints about withdrawals, account blocks, and no regulation. Dont risk your money—check the full review before trading.

Visit here: https://www.wikifx.com/en/dealer/1569136234.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Vebson is listed as high risk on WikiFX, with exposure to unpaid withdrawal cases and misleading claims. Read this forex scam alert before you deposit a cent.

Exposed: Amaraa Capital is a forex scam. Protect your funds—read this detailed scam alert now and avoid risky forex investments.

HIJA MARKETS is unregulated and unsafe. This scam alert exposes the risks of forex trading & investment—read now to protect your funds today.

When you look up things like "Is Vida Markets Legit" or "Vida Markets Scam", you're asking an important question that affects your capital's safety. You need a clear, fact-based answer to figure out if this company can be trusted with your capital or if it might be risky. This article gives you a complete check on whether Vida Markets is legitimate. We won't just repeat its advertising claims or random opinions. Instead, we'll do a deep investigation using facts we can prove, including whether it is properly regulated, its business history, real complaints from users, and reports from people who checked its offices. Our goal is to give you the facts clearly so you can make a smart and safe choice.