Abstract:TriumphFX is under scrutiny with multiple regulatory warnings and fraud investigations worldwide. Stay informed on its license status and avoid potential scams.

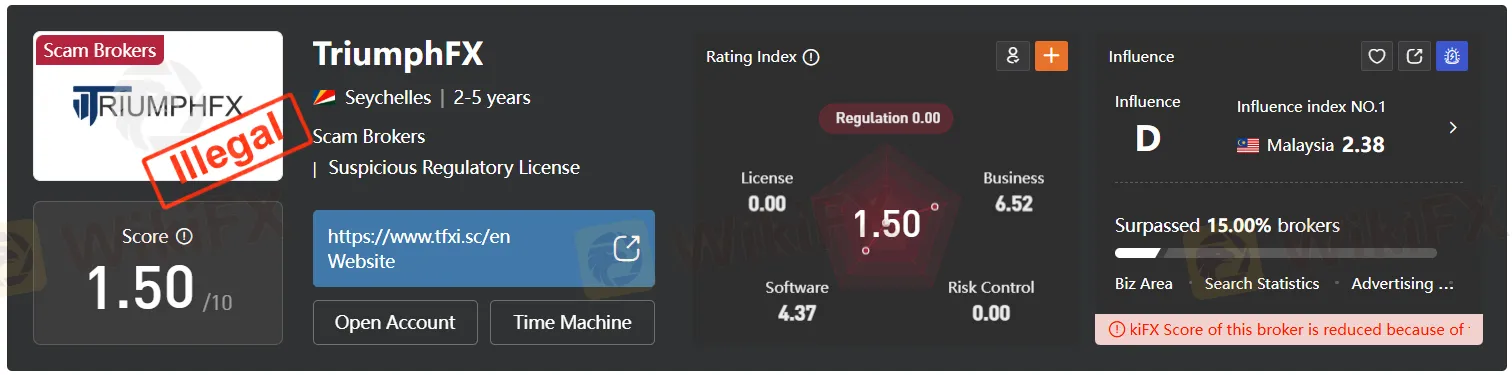

TriumphFX, known for its forex and CFD services, is operated by Triumph Int. (Cyprus) Ltd and Triumph Int. (SC) Ltd has landed in hot water with regulators around the world. Even though it held a license from the Cyprus Securities and Exchange Commission (CySEC) before the revocation, the companys activities and leadership have been repeatedly questioned, sparking a wave of cautionary warnings for potential investors.

Regulatory Trouble Spanning the Globe

The regulatory rollercoaster started rolling in December 2023 when CySEC took the extraordinary step of suspending voting rights for TriumphFX‘s sole indirect shareholder, Chong Chun Hseung. Along with this, the firm’s executive directors, Christoforos Christoforou and Joel Prakash Benedict, were handed a two-year ban on any management roles. These actions will stay in place until TriumphFX gets itself off investor alert lists in places like Singapore and Malaysia.

But the red flags didnt start or end there:

- Singapores Monetary Authority (MAS) added TriumphFX to its Investor Alert List back in August 2021, warning that the brokerage might be misleading people into thinking it was licensed locally.

- Malaysias Securities Commission joined in even earlier, blacklisting TriumphFX in 2020 for unauthorized activities tied to capital markets.

- New Zealand‘s Financial Markets Authority (FMA) and Australia’s ASIC have both issued bulletins, warning that TriumphFX is not a registered or licensed provider in their countries, and advising extreme caution for would-be investors.

This global pushback has cast doubt over TriumphFXs compliance claims, raising serious questions about its credibility as a regulated broker.

Investors Burned—and the Authorities Take Notice

Things escalated in Malaysia, where 72 police reports from frustrated investors revealed collective losses exceeding $5.3 million. Authorities didn‘t stop at the original operation—investigators also unearthed a TriumphFX clone scam, which enticed with quick profits but left victims with nothing but regret. Malaysia’s fraud investigators are now knee-deep in multiple ongoing cases, seeking accountability for the widespread financial losses.

Although TriumphFX continues to advertise itself as a licensed, regulated brokerage, a flood of negative reviews and complaints tells a different story. Customers routinely voice disappointment over management issues, poor communication, lengthy withdrawal processes, and a general lack of transparency—a pattern that raises further alarms about the firms practices.

The Companys Shaky Regulatory Foundation

TriumphFX currently holds licenses in Cyprus and the Seychelles. However, its track record is anything but reassuring. The company formerly operated under a license from the Vanuatu Financial Services Commission (VFSC) but lost that privilege after its license was revoked—a detail that adds to doubts about its reliability and intentions.

Multiple regulatory warnings from varied jurisdictions underline the importance of skepticism. Ongoing investigations in several countries only amplify concerns, signaling that authorities aren‘t yet convinced of TriumphFX’s trustworthiness or regulatory compliance.

What Savvy Investors Should Do

When it comes to choosing an online broker, doing your homework isn‘t just wise—it’s necessary. TriumphFX‘s regulatory headaches and mounting customer complaints make it a high-risk choice for anyone thinking about investing. Here’s what every investor should keep in mind:

- Scrutinize license credentials. Never take a brokers word for it—confirm licenses through official channels, and note any red flags such as negative press, lack of registration, or regulatory investigations.

- Read customer feedback. A steady stream of complaints or unresolved withdrawal issues is a major warning sign.

- Prioritize transparency and oversight. Reliable brokers are transparent about their regulations, fees, and ownership, and they communicate clearly with clients.

Choosing a broker with a spotless regulatory reputation can help you avoid headaches and financial loss. As TriumphFX faces growing international scrutiny, investors would be wise to consider safer alternatives and to stay informed by monitoring official warnings and real user experiences.

Safeguard your investments by staying diligent, skeptical, and proactive—because your financial security is too important to leave to chance.

You may also check other traders' negative experiences with TruimphFX by accessing its broker's page: https://www.wikifx.com/en/dealer/2785101112.html