Abstract:Looking for safe, CMA-licensed forex brokers in Keny0 2025? See the latest regulated brokers, what CMA oversight means, and how to verify any broker fast.

Introduction

Trust is everything in forex. In Kenya, the Capital Markets Authority (CMA) licenses and supervises online forex brokers 2025, setting rules for authorization, conduct, capital adequacy, client fund protection, and ongoing disclosures to safeguard traders and market integrity. Choosing a CMA-regulated broker means operating under Kenyan law with local oversight, clear redress channels, and verifiable credentials on the public registry.

The CMA Advantage: Why Local Regulation Matters

- The CMA is Kenyas statutory markets regulator under the Capital Markets Act, mandated to license, monitor, and enforce compliance across market intermediaries, including online forex brokers.

- The regulator routinely issues public notices and enforcement actions against unlicensed platforms, underscoring why verification on the CMA Licensees portal is essential before funding an account.

- CMA rules define licensing categories (such as non-dealing online forex brokers and money managers), minimum capital, segregation of client funds, disclosures, and marketing standards—providing structured protections under local law.

Current CMA-Licensed Online Forex Brokers in Kenya

Below is the latest roster commonly listed in the CMAs Licensees directory under Online Forex Trading categories, including license numbers and local details as presented on the public registry. Always re-check the CMA site before opening an account, as statuses can change.

- Pepperstone Markets Kenya Limited: International broker with a CMA-licensed local entity (License No.128), recognized for competitive pricing and platform breadth.

- Exness KE Limited: CMA-licensed (License No.162), often noted for flexible account options and local funding.

- Admirals KE Limited: CMA-licensed (License No.178), part of a globally regulated group offering MT4/MT5 and multi-asset CFDs.

- Windsor Markets Kenya Limited: CMA-licensed (License No.156) with a broad CFD product line.

- Scope Markets (SCFM Limited): CMA-licensed (License No.123), offering MT5 and tiered accounts.

- FP Markets Limited: CMA-licensed (License No.193), known for ECN-style pricing in global reviews.

- IC Markets (KE) Limited: CMA-licensed (License No.199), aligning a global brand with local oversight.

- Trademax Global Markets (KE) Pty Limited: CMA-licensed (License No.219), adding regulated choice in Kenya.

The CMA licensees' portal is the authoritative source to confirm licenses, names, and categories in real time. The following concise notes reflect widely referenced industry perspectives, alongside CMA licensing confirmation via the public registry:

Note: “Best broker” lists vary by methodology. Corroborate marketing claims with the CMA registry and evaluate fees, platforms, execution quality, and support firsthand.

How to Verify a Brokers CMA License

- Visit the CMA Licensees portal and search under the Online Forex categories to confirm the exact legal name, license number, and status.

- Cross-check the brokers website for matching legal entity details and Kenyan contact information, ensuring consistency with CMA records.

- Review CMA notices and alerts for enforcement updates and warnings on unlicensed activities.

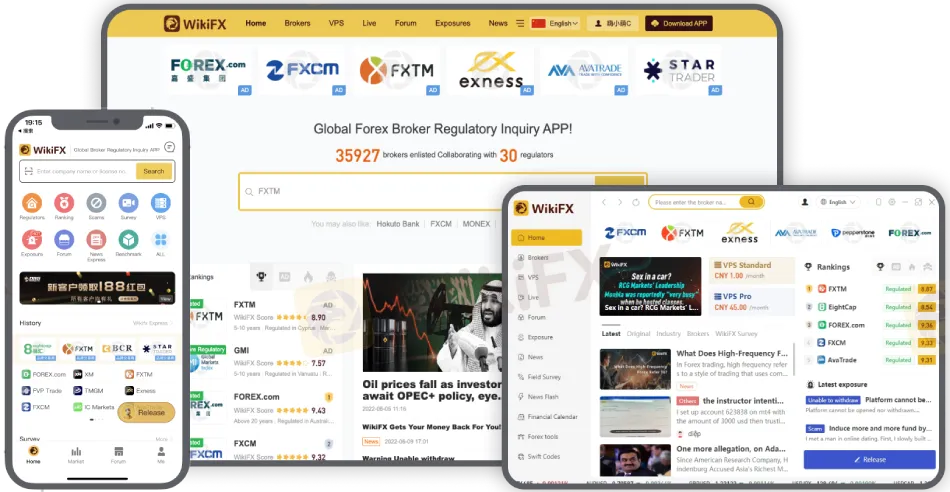

- Use the WikiFX apps main feature—broker verification—to look up any forex broker and view its stated regulatory status, license details, risk alerts, and clone warnings, helping flag fake, expired, or revoked authorizations before moving funds.

What CMA Oversight Typically Covers

- Licensing categories (non-dealing brokers and money managers), local incorporation/branch requirements, and minimum capital thresholds to operate in Kenyas online forex market.

- Segregation of client funds, AML/KYC obligations, disclosures, and fair marketing rules, plus ongoing reporting to the regulator.

- The CMA issues investor alerts and can impose penalties or cease-and-desist orders to protect the public from unlicensed activity.

Choosing Among CMA-Licensed Brokers

- Compare trading costs (spreads and commissions), platforms (MT4/MT5/proprietary), execution quality, instrument range, and local funding methods such as M-Pesa.

- Consider customer service quality and local support hours, alongside education resources and risk disclosures aligned with CMA guidance.

- Confirm that the live account is opened with the CMA-licensed Kenyan entity named on the regulators portal.

Practical Tips to Start Safely

- Begin with a demo to test execution, spreads, and platform stability during Kenyan market hours.

- Verify deposit/withdrawal timelines with small test transactions via preferred local payment rails.

- Read the brokers order execution policy and product disclosure statements to understand costs and risks.

- Enable 2FA and use strong, unique passwords; avoid public Wi‑Fi for account access or payments.

Conclusion

Kenyan traders benefit from a growing slate of CMA-licensed forex brokers 2025 operating under a clear local framework designed for fair dealing and investor protection. Start by verifying licenses on the CMA registry, use tools like WikiFX for additional checks, then compare pricing, platforms, and support to choose a broker that fits personal trading needs—always prioritizing exact legal details that match the Authoritys records.

Don't miss out on the latest updates and events from the regulated brokers. Scan the QR code below to download and install the WikiFX app on your smartphone.