Abstract:Headway Broker faces mounting allegations of withdrawal manipulation, spread fraud, and account closure tactics despite FSCA regulation.

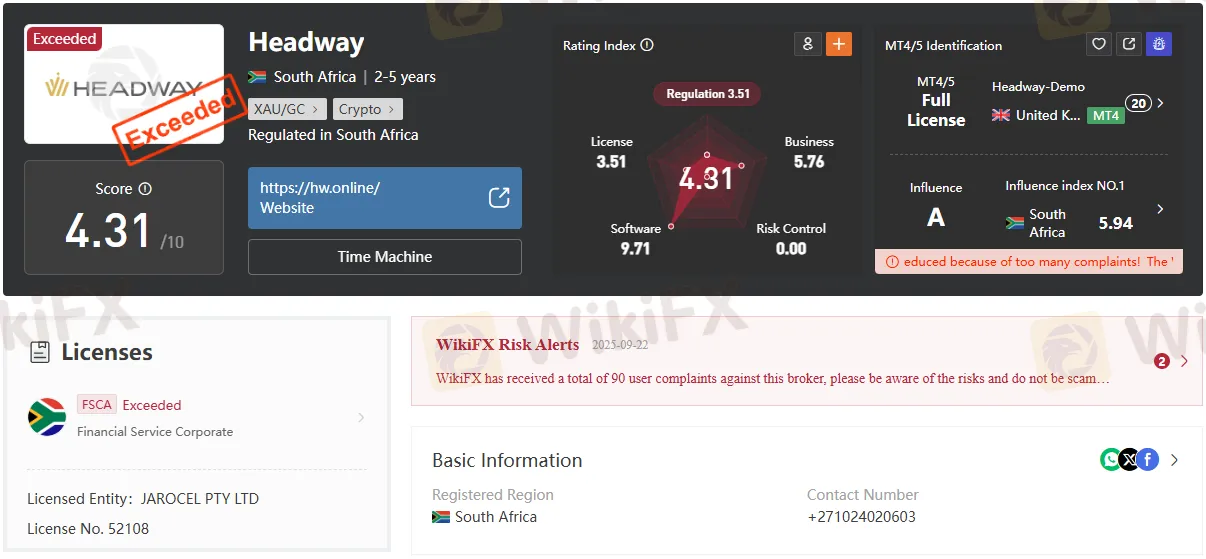

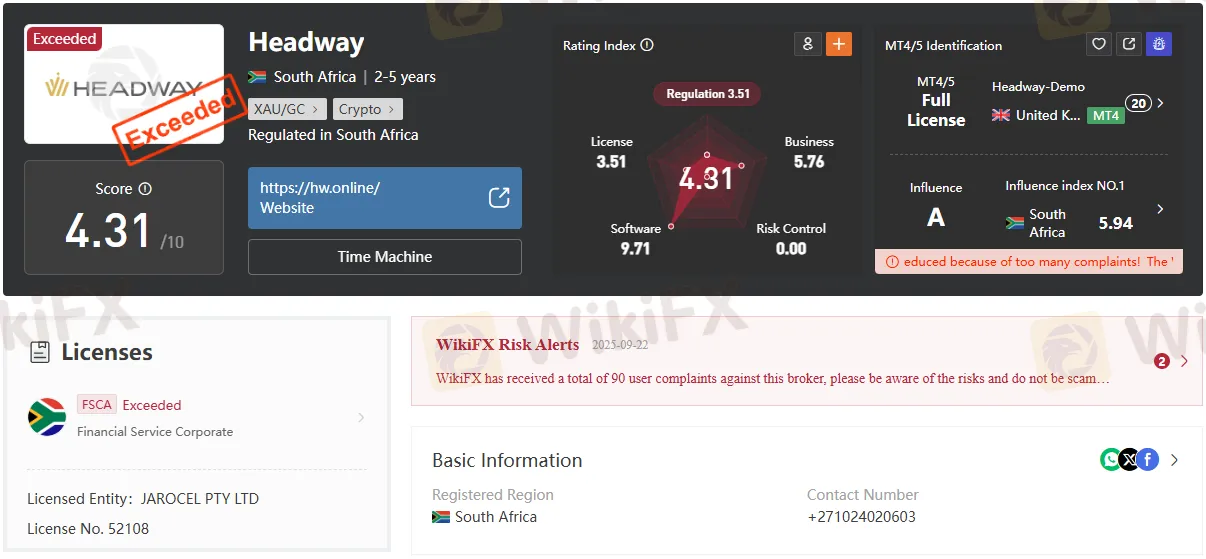

Headway, a South African forex broker licensed under FSCA number 52108, faces mounting accusations of withdrawal manipulation, spread fraud, and account closure tactics despite maintaining regulatory authorization. Investigation documents reveal systematic patterns of customer complaints spanning multiple jurisdictions, challenging the broker's regulatory standing and operational integrity.

FSCA License Status Under Review

Headway operates under JAROCEL PTY LTD with a Financial Sector Conduct Authority license 52108, established in 2022. The regulatory framework provides Tier 2 oversight through South Africa's financial watchdog, yet customer protection mechanisms remain limited without compensation fund provisions. Current documentation indicates the license status shows an “Exceeded” marking, raising questions about compliance boundaries and operational scope.

Regulatory oversight through FSCA theoretically ensures segregation of client funds and negative balance protection protocols. However, verification processes and enforcement mechanisms demonstrate gaps when addressing systematic withdrawal delays and account manipulation allegations reported by international clients.

Withdrawal Obstruction Patterns

Multiple verified accounts detail systematic withdrawal blocking across different regions and timeframes. Malaysian trader FX4205959506 reported endless delays following promises of 3-5 business day processing, with customer service citing “data anomalies” requiring additional documentation. Similar patterns emerge from Iraqi customers facing repeated rejection despite using identical deposit methods for withdrawal requests.

Documented cases reveal withdrawal approval processes extending beyond stated timeframes, with customer service representatives providing inconsistent explanations ranging from technical reviews to compliance holds. Thai trader FX3356244193 experienced platform freezing during profitable trades, followed by a complete account lockout preventing both trading and withdrawal access.

Spread Manipulation Allegations

Indonesian trader FX7186156320 documented EUR/USD spread inflation from normal 1.8 points to 15 points during Federal Reserve announcements, resulting in RM4,500 fee deductions on 100,000 ringgit principal. This contradicts the advertised “ECN account spreads as low as 0.5 points” marketing claims, suggesting deliberate spread widening during high-volatility periods.

Slippage complaints reveal consistent patterns beyond normal market conditions. Saudi Arabian trader Sani Salim reported GBP/JPY slippage exceeding 30 pips during stable market conditions, indicating potential execution manipulation rather than legitimate market movement. These practices align with known forex manipulation tactics documented in global financial scandals.

Bonus Removal Tactics

Headway's promotional structure demonstrates predatory unlocking requirements through excessive trading volume demands. Malaysian customer FX3295060534 faced 300x bonus-plus-principal trading requirements, translating to 225 lots over an estimated two-year completion period based on average trading patterns. Withdrawal attempts trigger 50% penalty charges, effectively confiscating deposited principal despite profit generation.

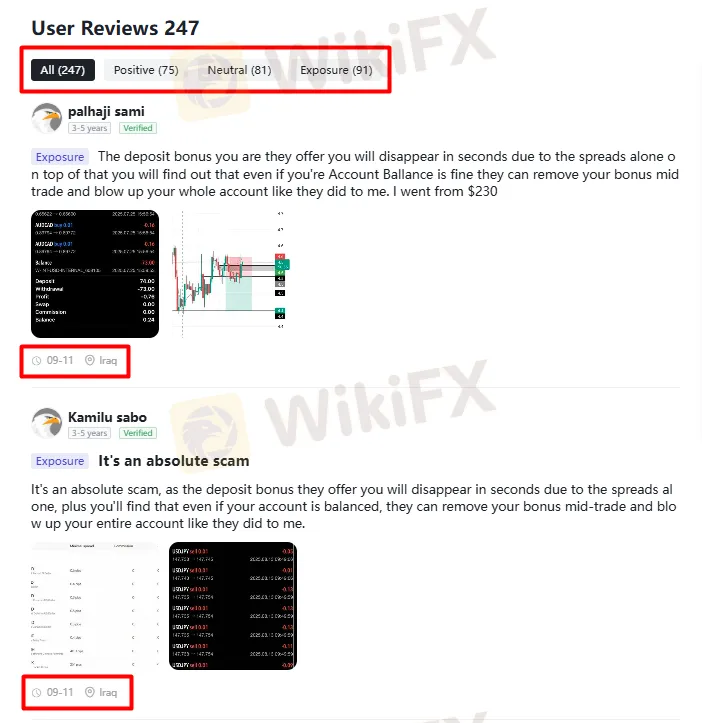

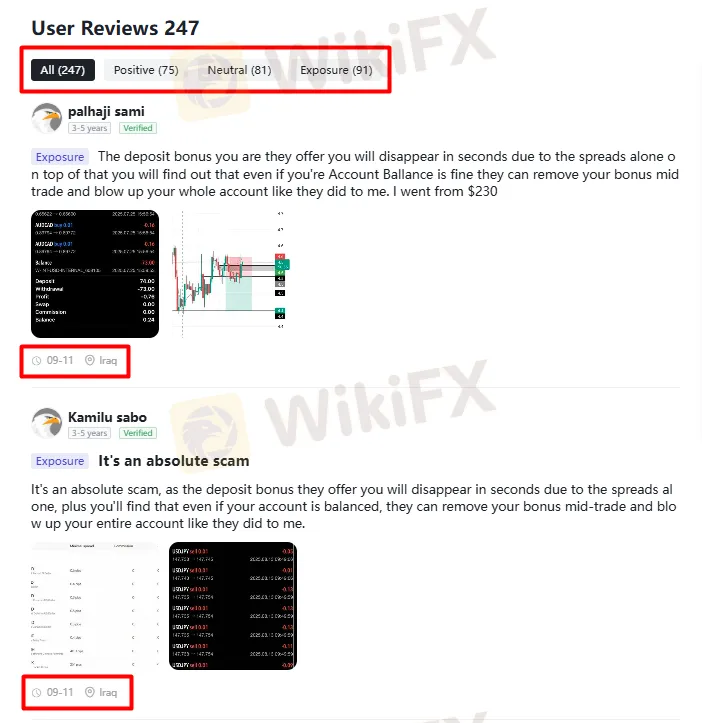

Multiple accounts confirm mid-trade bonus removal during profitable positions, causing margin call liquidation of entire account balances. Iraqi traders Palhaji Sami and Kamilu Sabo both reported identical bonus disappearance patterns during spread-widening events, suggesting coordinated manipulation timing.

Account Closure Justifications

Customer complaints reveal arbitrary account termination based on unsubstantiated multi-account allegations. Saudi Arabian trader Etsu Mana spent three hours disputing false five-account claims before experiencing complete fund confiscation, including initial capital. These closures coincide with profit generation, suggesting systematic targeting of successful trading activity.

Account freezing tactics extend to false negative balance claims despite positive account status. Trader Dan Makama faced zero account drainage following disputed negative balance assertions, accompanied by unprofessional customer service interactions refusing resolution attempts. Such practices indicate systematic fund appropriation disguised as policy enforcement.

Regulatory Verification Concerns

FSCA license verification reveals operational discrepancies between regulatory permissions and actual service delivery. While maintaining technical compliance through segregated accounts and negative balance protection, enforcement gaps allow systematic customer detriment without regulatory intervention. The exceeded license status requires clarification regarding operational boundaries and customer protection scope.

Independent review platforms document escalating complaint volumes reaching 90 verified cases with exposure ratings exceeding neutral feedback by significant margins. This complaint trajectory contradicts regulatory oversight effectiveness and raises questions about FSCA monitoring capabilities for international client protection.