Abstract:Regulatory compliance, transparency, and trustworthiness should always come first when we choose a forex broker. Unfortunately, many traders fall victim to unregulated brokers or poorly monitored platforms that put their funds at risk. In this article, we’ll highlight several brokers with low WikiFX scores and serious complaints from traders worldwide. If you’re looking for a safe trading environment, you should be extremely cautious with the following names.

When choosing a forex broker, regulatory compliance, transparency, and trustworthiness should always come first. Unfortunately, many traders fall victim to unregulated brokers or poorly monitored platforms that put their funds at risk. In this article, we‘ll highlight several brokers with low WikiFX scores and serious complaints from traders worldwide. If you’re looking for a safe trading environment, you should be extremely cautious with the following names.

Brokers That May Endanger Your Funds

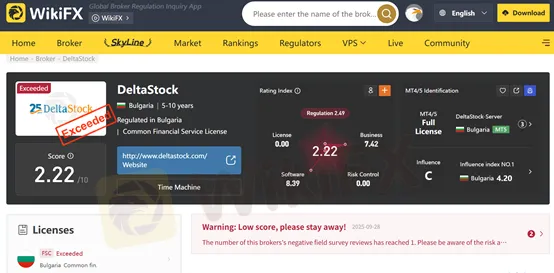

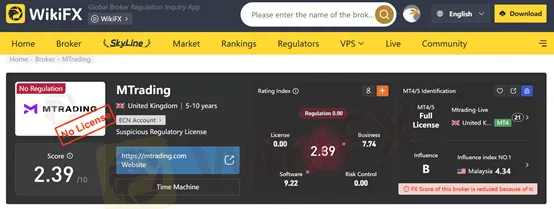

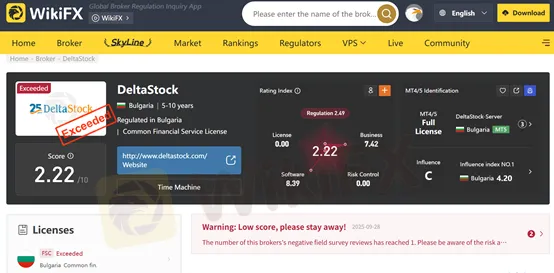

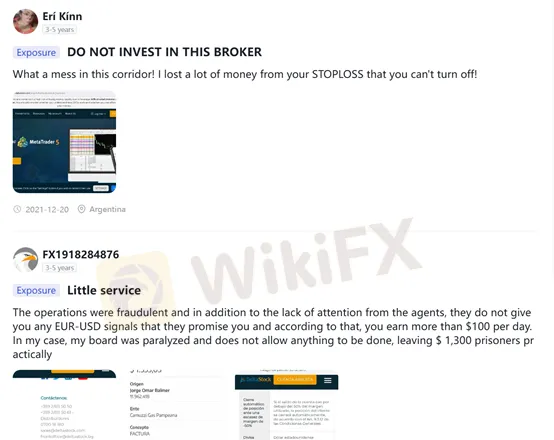

DeltaStock – WikiFX Score: 2.22/10

- Founded: 1998

- Headquarters: Bulgaria

- Regulation: Financial Supervision Commission (FSC), status “Exceeded”

DeltaStock has been around for over two decades, but that doesn‘t necessarily make it safe. WikiFX’s on-field investigation found no physical office in Bulgaria, raising a major red flag about its legitimacy. Furthermore, reports on social media suggest that this broker may be freezing investors funds. Traders should think twice before depositing money here.

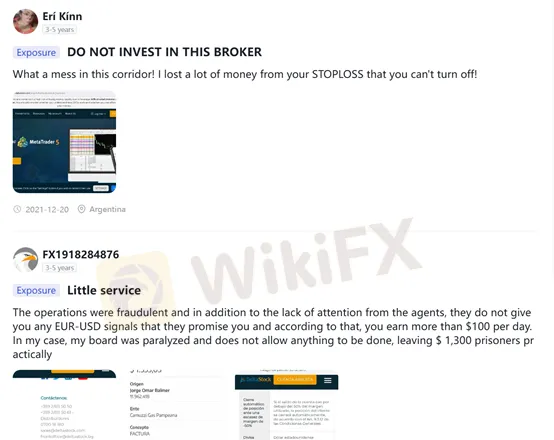

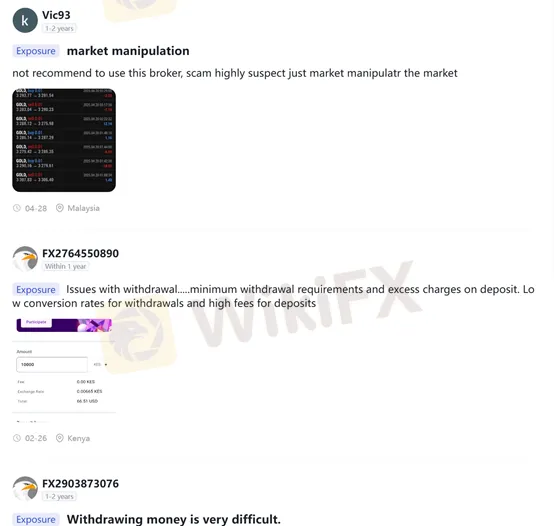

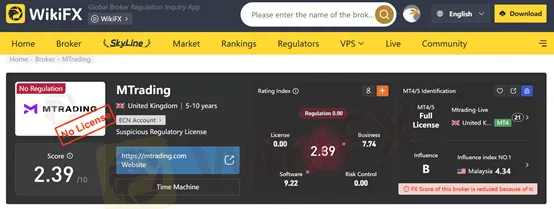

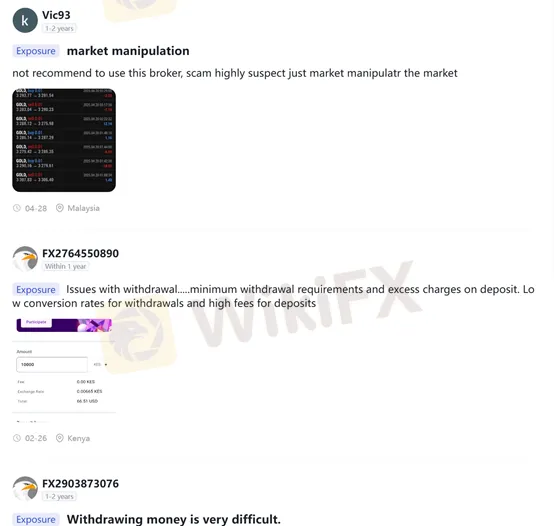

MTrading – WikiFX Score: 2.39/10

- Founded: 2012

- Headquarters: Saint Vincent and the Grenadines

- Regulation: Claims FCA (UK) via MONETRIX LTD (License No. 16198039)

While MTrading promotes its FCA-linked license, its offshore base in SVG is concerning. WikiFX has received multiple complaints from traders in Southeast Asia and Africa, alleging unfair practices. The combination of offshore registration and a history of complaints makes this broker a high-risk choice for traders.

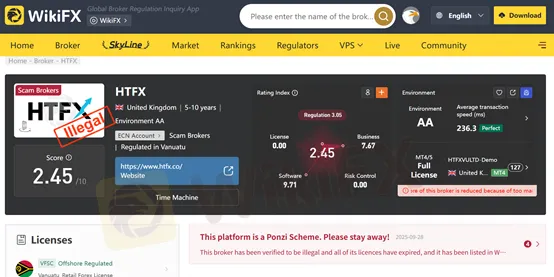

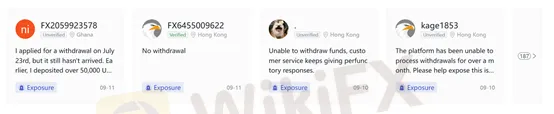

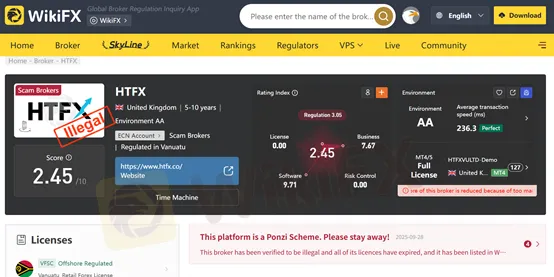

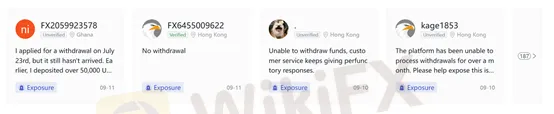

HTFX – WikiFX Score: 2.45/10

- Founded: 2018

- Headquarters: Vanuatu

- Regulation: FCA, CySEC, VFSC (offshore)

HTFX offers a wide range of account types and instruments, but the broker has been hit with over 170 complaints recently. Many victims allege that HTFX engages in fraudulentactivities, preventing withdrawals and manipulating trades. The large number of complaints strongly suggests this broker should be approached with extreme caution.

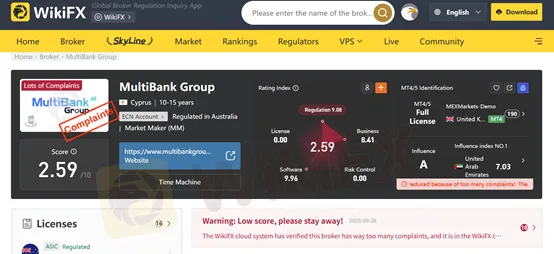

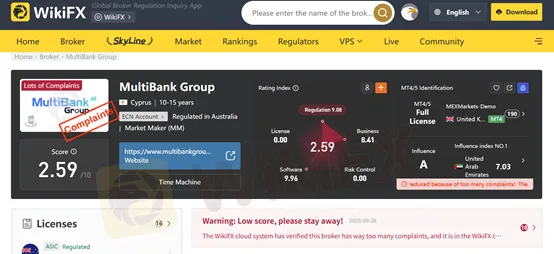

MultiBank Group – WikiFX Score: 2.59/10

- Founded: 2005

- Headquarters: USA (California), with offices across Asia-Pacific

- Products: Forex, metals, shares, indices, commodities, crypto

MultiBank Group markets itself as a global trading giant, but WikiFX has published multiple investigative reports raising concerns about its legitimacy. Traders have filed numerous complaints regarding withdrawal issues and potential scams. For more details, see our coverage on forex scams.

Despite its international presence, the risk factor remains high.

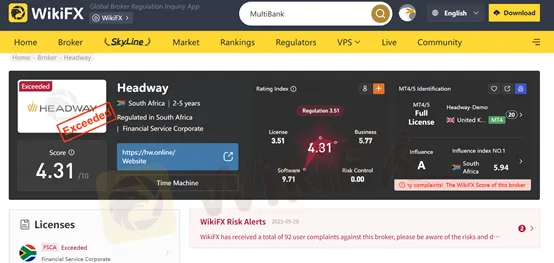

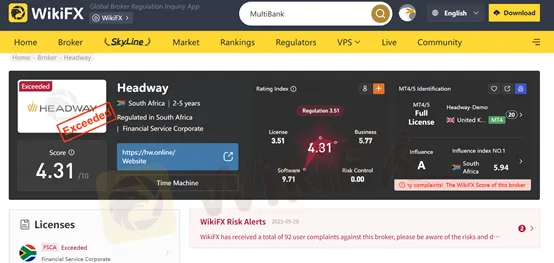

Headway – WikiFX Score: 4.31/10

- Trading Platforms: MT4, MT5

- Instruments: Forex, stocks, indices, energies, metals, crypto

At first glance, Headway looks like a user-friendly broker. However, it operates without regulatory oversight. More than 90 complaints have been received by WikiFX, primarily about withdrawal failures and poor customer service. Without proper licensing, traders have little to no protection if problems occur.

Comparison Table of Risky Brokers

Safe Alternatives: Trusted Brokers with High WikiFX Scores

While the above brokers raise serious red flags, there are reliable alternatives that have strong regulatory oversight and positive reputations among traders. Here are some safer options:

- IG Group – FCA-regulated, long-established broker with a wide range of products and professional-grade platforms.

- Saxo Bank – A fully regulated broker under the Danish FSA, known for transparency and high-quality research.

- CMC Markets – FCA-regulated broker offering advanced trading tools and strong customer protection.

- Exness – A global broker regulated by multiple authorities, with transparent pricing and quick withdrawals.

If youre a beginner, you might also want to read our guide on how to choose a forex broker.

Final Thoughts: Protect Your Funds Before Its Too Late

Your funds deserve a safe and regulated trading environment. Dont fall victim to brokers that could endanger your investments. The brokers listed above may appear legitimate on the surface, but low WikiFX ratings, lack of transparency, and a history of complaints are strong warning signs.

We suggest you:

- Verify licenses directly with financial regulators.

- Research broker reviews and complaint histories.

- Avoid depositing large sums into suspicious or offshore entities.