简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

IG Broker Analysis Report

Abstract:This comprehensive analysis report examines IG through systematic review of authentic user experiences, providing traders and investors with an objective assessment based on real-world feedback rather than promotional materials.

In an increasingly complex forex trading landscape, selecting a reliable broker requires more than marketing claims—it demands rigorous, data-driven evaluation. This comprehensive analysis report examines IG through systematic review of authentic user experiences, providing traders and investors with an objective assessment based on real-world feedback rather than promotional materials.

Our methodology centers on quantitative analysis of 213 verified user reviews collected from multiple independent review platforms. These sources, designated as Platform A, B, and C to maintain analytical objectivity, represent diverse trader demographics and experience levels. By aggregating feedback across multiple channels, we minimize platform-specific bias and capture a more representative picture of IG's actual service delivery and client satisfaction levels.

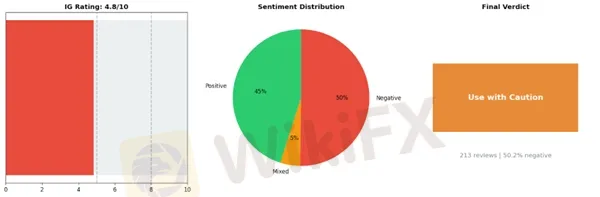

The analysis employs a standardized evaluation framework that converts qualitative user feedback into quantifiable metrics. Each review undergoes systematic assessment across multiple performance dimensions, including platform reliability, customer service responsiveness, fee transparency, withdrawal processes, and overall user satisfaction. This approach has yielded an overall rating of 4.85 out of 10 for IG, with a negative sentiment rate of 50.23%—figures that warrant the “Use with Caution” designation assigned to this broker.

This report is structured to provide traders with actionable intelligence for informed decision-making. Readers will gain insight into specific strengths and weaknesses identified through user feedback, common complaint patterns, and areas where IG demonstrates consistent performance—both positive and negative. The analysis examines critical operational aspects including execution quality, spread competitiveness, platform stability, regulatory compliance perception, and customer support effectiveness.

We recognize that no single metric tells the complete story. Therefore, this report presents granular breakdowns of review data, allowing readers to weigh factors according to their individual trading priorities. Whether you're a high-frequency trader concerned with execution speed, a beginner evaluating educational resources, or an experienced investor assessing fund security, this analysis provides the empirical foundation necessary for objective broker evaluation.The following sections detail our findings, supported by statistical evidence and representative user experiences that illuminate IG's operational reality beyond marketing narratives.

Key Caution Areas for IG Traders: A Critical Assessment

While IG maintains its position as an established forex broker, recent user feedback reveals several concerning patterns that warrant careful consideration before committing funds. Analysis of customer experiences highlights five primary issues that prospective traders should evaluate thoroughly.

Customer Support Deficiencies

The most frequently reported concern involves IG's customer service responsiveness, accounting for 54 documented complaints. Traders describe prolonged resolution times and inadequate solutions to critical account issues. This becomes particularly problematic when time-sensitive trading matters arise, as delayed support can directly impact financial outcomes. One experienced trader's assessment is telling:

“💬 Phillipe Leyland: ”My initial impression was positive, but that did not last long. IG Trading has great potential. But this is coupled with some serious flaws.“”

For active traders who require immediate assistance during volatile market conditions, this support infrastructure raises legitimate concerns about operational reliability when it matters most.

Withdrawal Processing Concerns

Perhaps more alarming are the 42 reports of withdrawal delays and rejections. Access to funds represents a fundamental broker obligation, and any friction in this process should trigger heightened scrutiny. Multiple accounts describe withdrawal requests taking weeks rather than days, with some traders reporting funds being held in administrative limbo. The frustration is evident in user experiences:

“💬 Mr Keelan singh: ”I've spent > 5 hours writing, calling, chasing and jumping through ludicrous hoops with IG to try and get a sizeable amount of ISA cash transferred from them to another provider... IG are essentially holding my money hostage, refusing to let it go, but of course dressing that up with excuses of procedure and process.“”

While regulatory compliance may explain some delays, the pattern suggests systematic processing issues that could leave traders without timely access to their capital.

Execution Quality and Slippage

Twenty-nine reports of execution issues and slippage present tactical concerns for traders employing precise entry and exit strategies. Slippage during volatile periods is industry-wide, but consistent execution problems can erode trading edge and profitability. Scalpers and day traders face particular vulnerability, as even minor execution delays can transform profitable setups into losses.

Fund Security Apprehensions

The 19 complaints categorized under fund safety issues deserve serious attention. While IG operates under FCA regulation, which provides client fund protection, user experiences describe instances of misdirected transfers and account number discrepancies:

“💬 Dixon: ”On the report, the beneficiary account number was not the same as my bank account number that IG has on file. My bank confirmed it did indeed receive the amount but due to an incorrect beneficiary account number, the bank bounced the funds back.“”

Such administrative errors, though potentially resolvable, introduce unnecessary risk into what should be straightforward transactions.

Fee Transparency Problems

Seventeen complaints about opaque fees and hidden charges round out the concern profile. Recent reports indicate substantial increases in overnight funding costs that caught established clients off-guard:

“💬 Jav: ”Since late December 2025, IG's overnight funding charges have increased to a level that is genuinely shocking for retail traders. What used to be a manageable cost has turned into a daily deduction that can wipe...“”

Position traders and swing traders maintaining overnight exposure face particular vulnerability to these escalating costs, which can significantly impact net profitability.

Risk Assessment by Trader Profile

High-frequency traders should carefully evaluate execution reliability before committing significant volume. Those requiring responsive support during active trading hours may find service levels inadequate. Traders planning to maintain substantial account balances should thoroughly test withdrawal processes with smaller amounts first. Anyone holding positions overnight must calculate the true cost impact of current funding rates on their strategy viability.

While IG's regulatory standing and platform capabilities merit recognition, these documented issues suggest proceeding with measured caution and maintaining alternative broker relationships where feasible.

Positive Aspects of IG That Require Careful Consideration

IG has established itself as a recognizable name in the forex and CFD trading space, with users consistently highlighting several strengths that deserve acknowledgment—though potential clients should approach these benefits with informed caution.

Regulatory Standing and Long-Term Reliability

One of IG's most frequently praised attributes is its regulatory oversight and established market presence. Users appreciate the platform's FCA and ASIC regulation, with one long-term client noting:

“💬 FX2958852652: ”The IG platform is regulated by strict authorities such as the UK FCA and the Australian ASIC. It has a well-established fund segregation system and high security. I have been using it for a long time without encountering any financial risks.“”

This regulatory framework provides a degree of confidence that newer or less-established brokers cannot match. However, traders should remember that regulation doesn't eliminate trading risk itself—only the risk of broker misconduct. The same regulatory protections exist at multiple competing brokers, so this shouldn't be the sole deciding factor.

Platform Accessibility and Interface Design

Users consistently mention IG's intuitive interface and ease of use, particularly for executing basic trades. The integration with third-party tools like ProRealTime and the mobile app functionality receive positive mentions:

“💬 Simon: ”Buying and selling shares couldn't be any easier or any cheaper than with IG. Easy initial funding of ac, good trading interface with additional information to hand through the app sub menus.“”

While this accessibility benefits beginners, the simplicity of executing trades can be a double-edged sword. Easy trade execution doesn't equate to profitable trading, and novice traders may find themselves overtrading or taking positions without adequate analysis simply because the platform makes it so straightforward.

Customer Support: A Mixed Picture

Customer support receives mention as both a strength and weakness. When users do connect with support staff, they often report helpful and knowledgeable assistance:

“💬 Ben: ”Just one smooth transaction with prompt and decisive replies from the IG Team, particularly Sharief, Ashish, Sandile, Justyna, and Jose.“”

However, the same data reveals significant wait times and difficulty accessing support channels, particularly during busy periods. Traders who require immediate assistance during volatile market conditions may find these delays problematic. The reality is that responsive support exists—but accessing it may require patience that urgent trading situations don't afford.

IG: Strengths vs Issues

Top Strengths:

1. Responsive Customer Support — 77 mentions

2. Good Reputation Safe — 26 mentions

3. User Friendly Interface — 24 mentions

Top Issues:

1. Slow Support No Solutions — 54 mentions

2. Withdrawal Delays Rejection — 42 mentions

3. Execution Issues Slippage — 29 mentions

Who Might Benefit?

IG appears best suited for experienced traders who value regulatory oversight and don't require frequent customer support intervention. Those who appreciate platform stability and can independently navigate most issues will likely find value here. However, active traders should carefully examine overnight funding costs, which recent reviews suggest have increased substantially, and beginners shouldn't mistake ease of use for a guarantee of trading success.

The platform's strengths are genuine but come with important caveats that require careful personal evaluation.

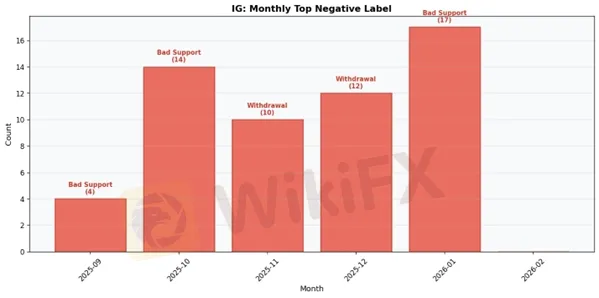

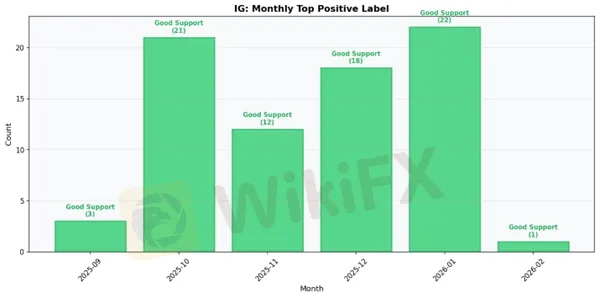

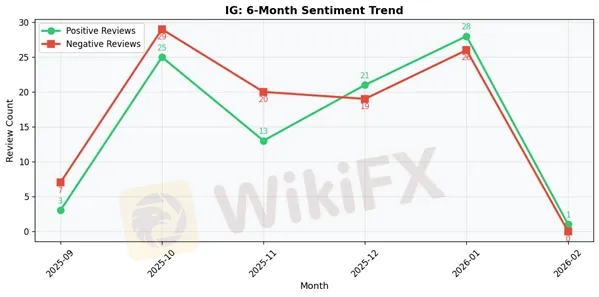

IG: 6-Month Review Trend Data

2025-09:

• Total Reviews: 10

• Positive: 3 | Negative: 7

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Slow Support No Solutions

2025-10:

• Total Reviews: 57

• Positive: 25 | Negative: 29

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Slow Support No Solutions

2025-11:

• Total Reviews: 36

• Positive: 13 | Negative: 20

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Withdrawal Delays Rejection

2025-12:

• Total Reviews: 42

• Positive: 21 | Negative: 19

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Withdrawal Delays Rejection

2026-01:

• Total Reviews: 55

• Positive: 28 | Negative: 26

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Slow Support No Solutions

2026-02:

• Total Reviews: 1

• Positive: 1 | Negative: 0

• Top Positive Label: Responsive Customer Support

• Top Negative Label: N/A

IG Final Conclusion

IG presents a contradictory profile that warrants serious consideration before opening an account, earning a below-average rating of 4.85/10 with over half of the 213 reviewed traders reporting negative experiences. The data reveals a broker struggling with fundamental operational issues despite having some redeeming qualities. While IG demonstrates responsive customer support, maintains a generally good reputation for safety, and offers a user-friendly interface, these strengths are significantly overshadowed by critical weaknesses. The 50.23% negative rate indicates that approximately one in two traders encounters substantial problems with this broker. Most concerning are the persistent reports of withdrawal delays and rejections, execution issues with noticeable slippage, and support interactions that fail to resolve underlying problems despite being responsive in timing.

For beginners, IG's user-friendly interface might initially appear attractive, but the high incidence of withdrawal complications and execution problems creates an unsuitable learning environment. New traders require reliability and transparency above all else, and the documented issues suggest IG may create more frustration than educational value during the critical early trading phase. Beginners should strongly consider alternative brokers with better operational track records.

Experienced traders who understand risk management and have diversified broker relationships might use IG selectively, but should maintain heightened vigilance regarding withdrawal procedures and execution quality. The execution issues and slippage reports suggest that IG's infrastructure may not consistently deliver the performance that seasoned traders require for their strategies to remain profitable. Any experienced trader considering IG should start with minimal capital and thoroughly test withdrawal processes before committing significant funds.

High-volume traders should exercise extreme caution or avoid IG entirely. The combination of execution issues, slippage concerns, and withdrawal complications becomes exponentially more problematic when dealing with larger positions and frequent transactions. The operational inconsistencies documented in user reviews suggest IG's systems may not adequately support the demands of professional-level trading activity.

Regarding specific trading styles, scalpers should definitely look elsewhere, as execution quality and slippage are absolutely critical for this strategy's viability. Swing traders and position traders might find IG marginally more acceptable since they're less affected by minor execution discrepancies, though withdrawal concerns remain relevant regardless of trading timeframe.

The “Use with Caution” system conclusion accurately reflects IG's current standing. Any trader choosing to proceed should implement strict risk controls: limit initial deposits, document all interactions, test withdrawal processes with small amounts first, and maintain detailed records of execution quality. The broker's positive aspects cannot compensate for the fundamental operational concerns that affect the majority of its user base. IG may have built a recognizable brand, but a 4.85 rating and 50% negative feedback rate demonstrate that brand recognition means little when half your clients report problematic experiences with core services.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

Pinnacle Pips Forex Fraud Exposed

Grand Capital Review 2026: Is this Broker Safe?

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Currency Calculator