Informasi Dasar

Hong Kong

Hong KongSkor

Hong Kong

|

10-15 tahun

|

Hong Kong

|

10-15 tahun

| https://stock.pingan.com.hk/en/index

Website

Peringkat indeks

Pengaruh

C

Indeks pengaruh NO.1

Hong Kong 4.90

Hong Kong 4.90 Lisensi

LisensiInti tunggal

1G

40G

1M*ADSL

Hong Kong

Hong KongPing An Securities (Hong Kong) Hong Kong Terverifikasi: Kantor Operasional Dikonfirmasi

Tim inspeksi lapangan mengunjungi broker forex Ping An Securities (Hong Kong) di alamat bisnis yang ditampilkan secara publik di Hong Kong, China sesuai rencana. Nama perusahaan broker dan informasi lainnya dapat dilihat di lokasi tersebut, menunjukkan bahwa broker memiliki tempat usaha yang sah. Investor disarankan untuk membuat pilihan mereka setelah pertimbangan komprehensif.

Hong Kong

Hong KongKunjungan ke PingAn Kantor HK Ditemukan

Kunjungan surveyor mengkonfirmasi bahwa alamat asli dari broker berlisensi HK PingAn sama dengan alamat lisensinya. Pialang memegang lisensi bursa berjangka dan lisensi keuangan biasa yang dikeluarkan oleh SFC. Diperlukan pertimbangan terkait dengan investasi.

Hong Kong

Hong KongPing An Securities (Hong Kong) Hong Kong Terverifikasi: Kantor Operasional Dikonfirmasi

Tim inspeksi lapangan mengunjungi broker forex Ping An Securities (Hong Kong) di alamat bisnis yang ditampilkan secara publik di Hong Kong, China sesuai rencana. Nama perusahaan broker dan informasi lainnya dapat dilihat di lokasi tersebut, menunjukkan bahwa broker memiliki tempat usaha yang sah. Investor disarankan untuk membuat pilihan mereka setelah pertimbangan komprehensif.

Hong Kong

Hong KongKunjungan ke PingAn Kantor HK Ditemukan

Kunjungan surveyor mengkonfirmasi bahwa alamat asli dari broker berlisensi HK PingAn sama dengan alamat lisensinya. Pialang memegang lisensi bursa berjangka dan lisensi keuangan biasa yang dikeluarkan oleh SFC. Diperlukan pertimbangan terkait dengan investasi.

Hong Kong

Hong Kong pingan.com.hk

pingan.com.hk Hong Kong

Hong Kong

| PACSHK Ringkasan Ulasan | |

| Didirikan | 2006 |

| Negara/Daerah Terdaftar | Hong Kong |

| Regulasi | SFC |

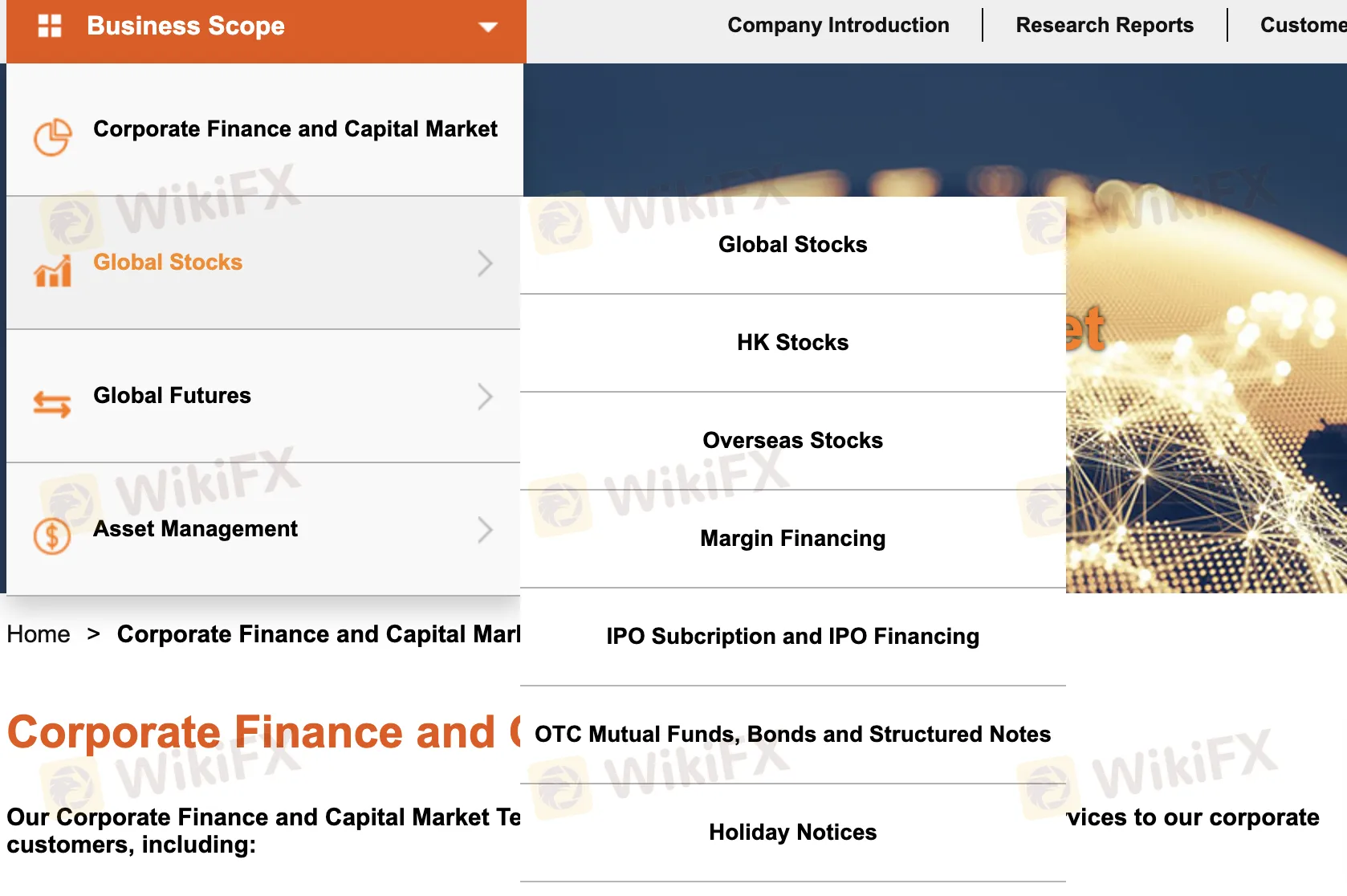

| Produk dan Layanan | Keuangan Korporat & Pasar Modal, Saham Global, Futures Global, Manajemen Aset |

| Akun Demo | ❌ |

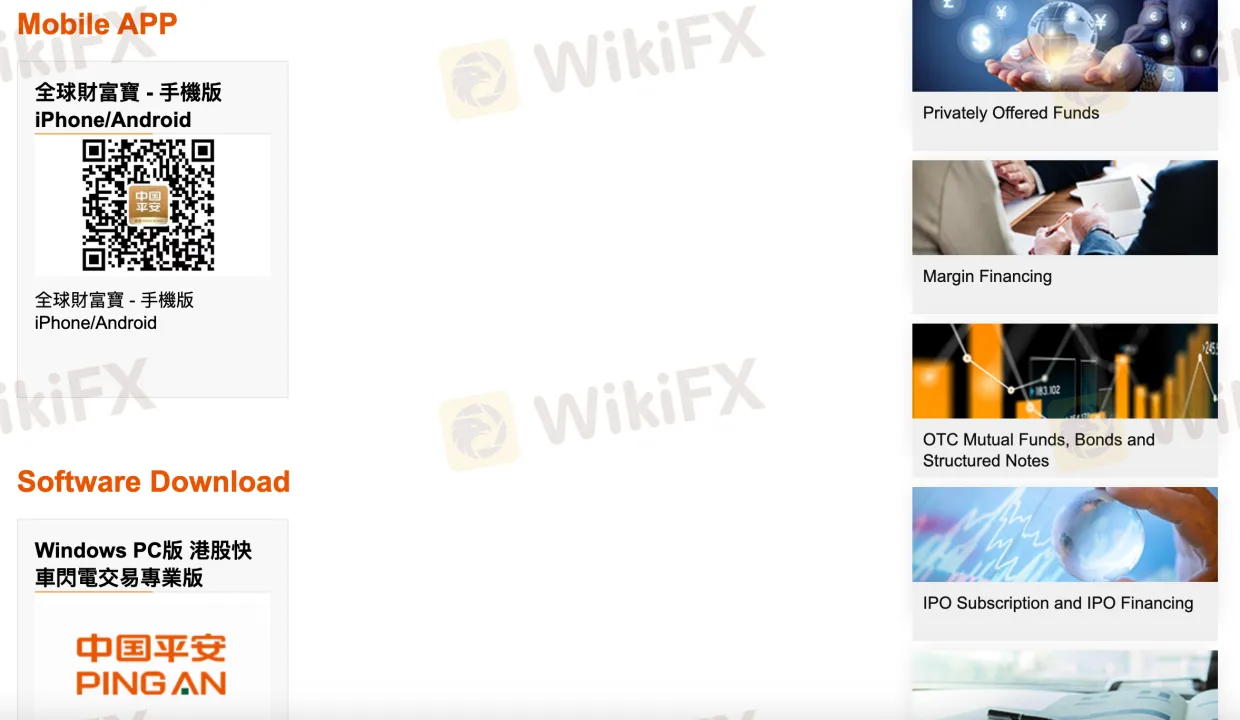

| Platform Perdagangan | 全球財富寶 Mobile App, 港股快車閃電交易專業版 (Windows) |

| Dukungan Pelanggan | Telepon (HK): +852 3762 9688 |

| Telepon (CN): +86 400 841 1061 | |

| Email: cs.pacshk@pingan.com | |

| Fax: +852 3762 9668 | |

Spesialis dalam perdagangan futures dan layanan investasi, Ping An of China Securities (Hong Kong) Company Limited (“PACSHK”) adalah anak perusahaan sepenuhnya milik Ping An Securities Company Limited (Kantor pusat Shenzhen didirikan pada Agustus 1991). Ini adalah lembaga keuangan yang berlisensi dan diatur di bawah SFC Hong Kong. Platform-platform propertinya dan proses pembukaan akun fisik termasuk pembiayaan margin, akses dana pribadi, dan solusi IPO.

| Pro | Kontra |

| Diatur oleh SFC di Hong Kong | Tidak ada akun demo atau akun Islami |

| Akses ke dana pribadi dan alat investasi terstruktur | Terbatas pada pembukaan akun secara langsung |

| Platform perdagangan Mobile dan PC tersedia | Tidak mendukung perdagangan Mac atau berbasis browser |

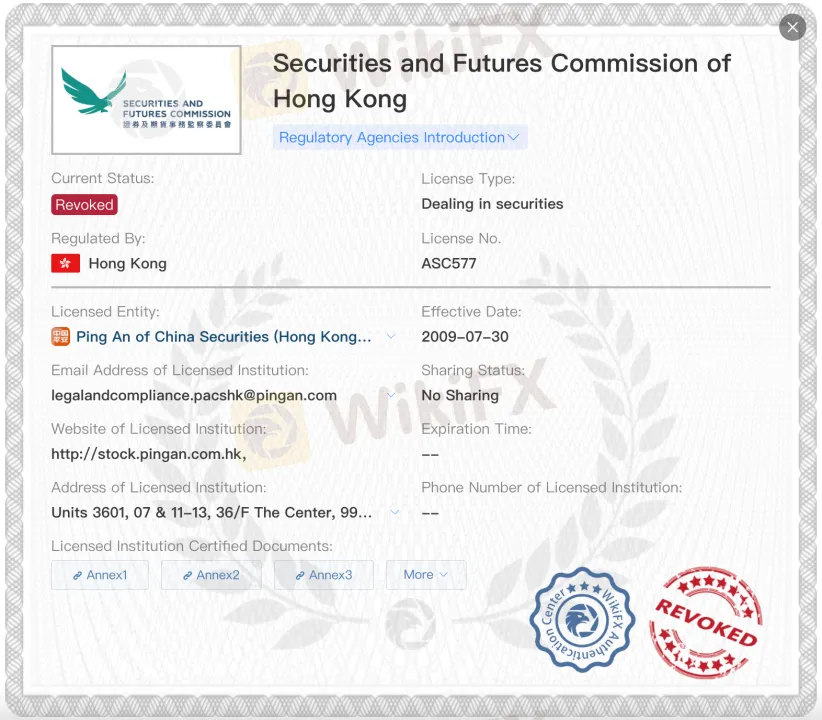

Ya, PACSHK diatur. Komisi Sekuritas dan Futures Hong Kong (SFC) telah memberikannya Lisensi No. AXR954 untuk Bertransaksi dalam Kontrak Futures sejak 30-03-2012.

Namun, Lisensi Perdagangan Sekuritas Ping An of China (Hong Kong) (Lisensi No. ASC577) telah dicabut. Perbedaan ini penting saat mengonfirmasi layanan atau bisnis grup Ping An.

PACSHK menawarkan berbagai produk dan layanan keuangan termasuk solusi keuangan korporat, perdagangan sekuritas global, futures dan opsi, serta manajemen aset.

| Kategori | Produk/Layanan yang Ditawarkan |

| Keuangan Korporat & Pasar Modal | Sponsor dan penjaminan IPO |

| Penerbitan obligasi dan saham preferen | |

| Penerbitan obligasi konversi | |

| Penempatan pasar sekunder | |

| Penasihat keuangan M&A | |

| Penempatan pribadi | |

| Saham Global | Saham Hong Kong (Saham HK) |

| Saham Global/Luar Negeri | |

| Pembiayaan margin | |

| Langganan dan Pembiayaan IPO | |

| Dana Investasi OTC | |

| Obligasi OTC | |

| Catatan Struktural OTC | |

| Futures Global | Futures dan Opsi Hong Kong |

| Futures Global | |

| Manajemen Aset | Dana yang Ditawarkan Secara Privat |

PACSHK menyediakan dua jenis akun trading live: Akun Korporat dan Akun Individu/Gabungan. Tidak menyediakan akun Islami (bebas swap) atau akun demo. Pembukaan akun dilakukan secara langsung; setiap jenis akun disesuaikan untuk berbagai kelompok investor tergantung pada persyaratan personal atau institusi.

| Jenis Akun | Deskripsi | Cocok Untuk |

| Individu/Gabungan | Untuk investor pribadi atau gabungan yang membuka akun secara langsung | Investor ritel atau pribadi |

| Korporat | Untuk perusahaan atau investor institusi | Usaha atau entitas korporat |

| Akun Demo | Tidak tersedia | — |

| Akun Islami | Tidak tersedia | — |

| Platform Trading | Didukung | Perangkat Tersedia | Cocok untuk Jenis Trader Apa |

| Aplikasi Mobile 全球財富寶 | ✅ | iOS, Android (Smartphone) | Trader yang fokus pada perangkat mobile yang mencari kenyamanan |

| Versi Windows PC 港股快車閃電交易專業版 | ✅️ | Windows PC | Trader profesional yang memerlukan alat desktop |

| Versi Mac | ❌ | — | Tidak didukung |

| Platform Berbasis Web | ❌ | — | Tidak didukung |

PACSHK tidak mengenakan biaya untuk penarikan atau deposit. Semua transfer harus dilakukan ke/dari rekening bank terdaftar; tidak mengizinkan deposit pihak ketiga atau tunai.

Pilihan Deposit

| Metode Deposit | Min. Deposit | Biaya | Waktu Pemrosesan |

| BOC Sub-Account (khusus klien) | Tidak disebutkan | Gratis | 1–2 hari kerja |

| Akun HSBC / Standard Chartered / BOC | Tidak disebutkan | Gratis | 1–2 hari kerja |

Pilihan Penarikan

| Metode Penarikan | Min. Penarikan | Biaya | Waktu Pemrosesan |

| Ke rekening bank terdaftar | Tidak disebutkan | Gratis | 1–2 hari kerja |

| Ke rekening bank non-terdaftar (melalui formulir) | Tidak disebutkan | Gratis | 1–3 hari kerja |

PACSHK is a safe platform to use for trading, particularly for futures and asset management services, as it is regulated by the Securities and Futures Commission (SFC) of Hong Kong. Being under the oversight of the SFC provides a layer of protection for investors, as the SFC enforces strict standards for financial institutions in Hong Kong. This regulation ensures transparency, accountability, and proper risk management within PACSHK’s operations. However, the revocation of its Securities Dealing License is an important factor to consider. While PACSHK continues to be regulated for futures trading, investors should be cautious when considering investments in securities, as they no longer have the same level of protection for those products. For users accessing PACSHK login or trading on the PACSHK platform, it’s important to understand the regulatory status and to only engage in futures and asset management products that fall under the SFC’s regulatory umbrella.

PACSHK’s regulation under the SFC provides several key advantages to investors. First and foremost, the SFC is one of the most respected financial regulators in the world, particularly in Asia, where Hong Kong serves as a major financial hub. Being regulated by such an authority assures investors that PACSHK follows high standards of financial reporting, risk management, and investor protection. For traders accessing the PACSHK platform or using PACSHK login, this regulation ensures that the platform operates within a framework that emphasizes transparency and accountability. The firm must maintain proper capital reserves, conduct regular audits, and follow the rules that govern the futures market, ensuring that investors are dealing with a legally compliant and ethical entity. Furthermore, the SFC’s oversight adds a layer of trust for institutional investors and high-net-worth individuals who rely on regulated environments to safeguard their substantial investments. This regulatory framework provides peace of mind for those engaging with PACSHK’s futures trading services and asset management options. However, as noted previously, this regulation does not extend to securities trading due to the revocation of PACSHK's securities dealing license.

PACSHK, or Ping An of China Securities (Hong Kong), is indeed a regulated financial institution in Hong Kong. The firm holds an active license from the Securities and Futures Commission (SFC), which is one of the most prestigious financial regulators in Asia. PACSHK has been granted License No. AXR954 for dealing in futures contracts, and this regulation ensures that the firm adheres to strict financial standards set by the SFC. However, it is crucial to note that PACSHK's Securities Dealing License (License No. ASC577) has been revoked. This distinction is important for investors because it means that while PACSHK is still allowed to operate in futures trading, it no longer holds the necessary license to deal with securities. This revocation reduces the platform's ability to legally offer a full range of investment products, such as stock trading or securities-based investment services. For investors using PACSHK login or engaging in PACSHK platform services, it’s essential to consider that while the firm is regulated for futures and asset management services, the absence of the securities dealing license means that any investments or trades involving stocks or securities might not be fully protected under the same regulatory oversight. This brings up a few red flags, especially for those seeking a broader range of financial services within a regulated environment. The firm’s reputation is still largely intact, but potential clients must understand the full scope of PACSHK’s regulatory limitations. Those looking to trade futures or engage with asset management services may find the platform trustworthy, but retail investors or those interested in securities trading should be cautious.

PACSHK’s regulatory status under the SFC means that the platform operates in accordance with Hong Kong’s stringent financial regulations, providing a safe environment for trading futures contracts and accessing asset management services. For investors, this means that their funds are safeguarded according to Hong Kong’s financial laws, and PACSHK must meet specific standards of transparency and fair practices. However, the revocation of its Securities Dealing License means that investments in securities, such as stocks and bonds, may not be as secure as those involving futures. Investors should be aware that their trading in securities is no longer covered under SFC oversight for those products. While PACSHK remains a trusted platform for futures trading, those accessing the PACSHK login for securities investments should consider these risks carefully.

Silakan masukan...

TOP

TOP

Chrome

Plugin Chrome

Pertanyaan Regulasi Pialang Forex Global

Jelajahi situs web broker forex dan kenali broker resmi dan penipu secara akurat

Pasang sekarang