회사 소개

| Currency Solutions 리뷰 요약 | |

| 설립 연도 | 2003 |

| 등록 국가/지역 | 영국 |

| 규제 | FCA: 스트레이트 스루 프로세싱 (STP) (규제됨), 결제 라이선스 (초과됨) |

| 서비스 | 외환 (FX) 및 국제 결제 서비스 |

| 데모 계정 | ❌ |

| 레버리지 | / |

| 스프레드 | / |

| 거래 플랫폼 | / |

| 최소 입금액 | / |

| 고객 지원 | 전화: +44 2077400000 |

| X, Linkedin, Instagram | |

| 주소: 4th Floor Hobbs Court, 2 Jacob Street, London, SE1 2BG | |

2003년 영국에서 설립된 Currency Solutions은 외환 (FX) 및 국제 결제 서비스를 제공하며 170가지 이상의 통화 쌍에 액세스할 수 있습니다. 이 회사는 스트레이트 스루 프로세싱 (STP)을 위해 재무행정감독청 (FCA)로부터 승인 및 규제를 받았습니다. 그러나 결제 라이선스 (번호 512130)가 초과되었습니다. 또한, 거래 플랫폼, 스프레드, 레버리지, 최소 입금액에 대한 정보가 쉽게 이용할 수 없으며 현재 데모 계정을 제공하지 않습니다.

장단점

| 장점 | 단점 |

| FCA 규제 | 라이선스 초과 |

| 거래 수수료에 대한 제한된 정보 | |

| 데모 계정 없음 | |

| 거래 플랫폼에 대한 정보 부족 |

Currency Solutions은(는) 합법적인가요?

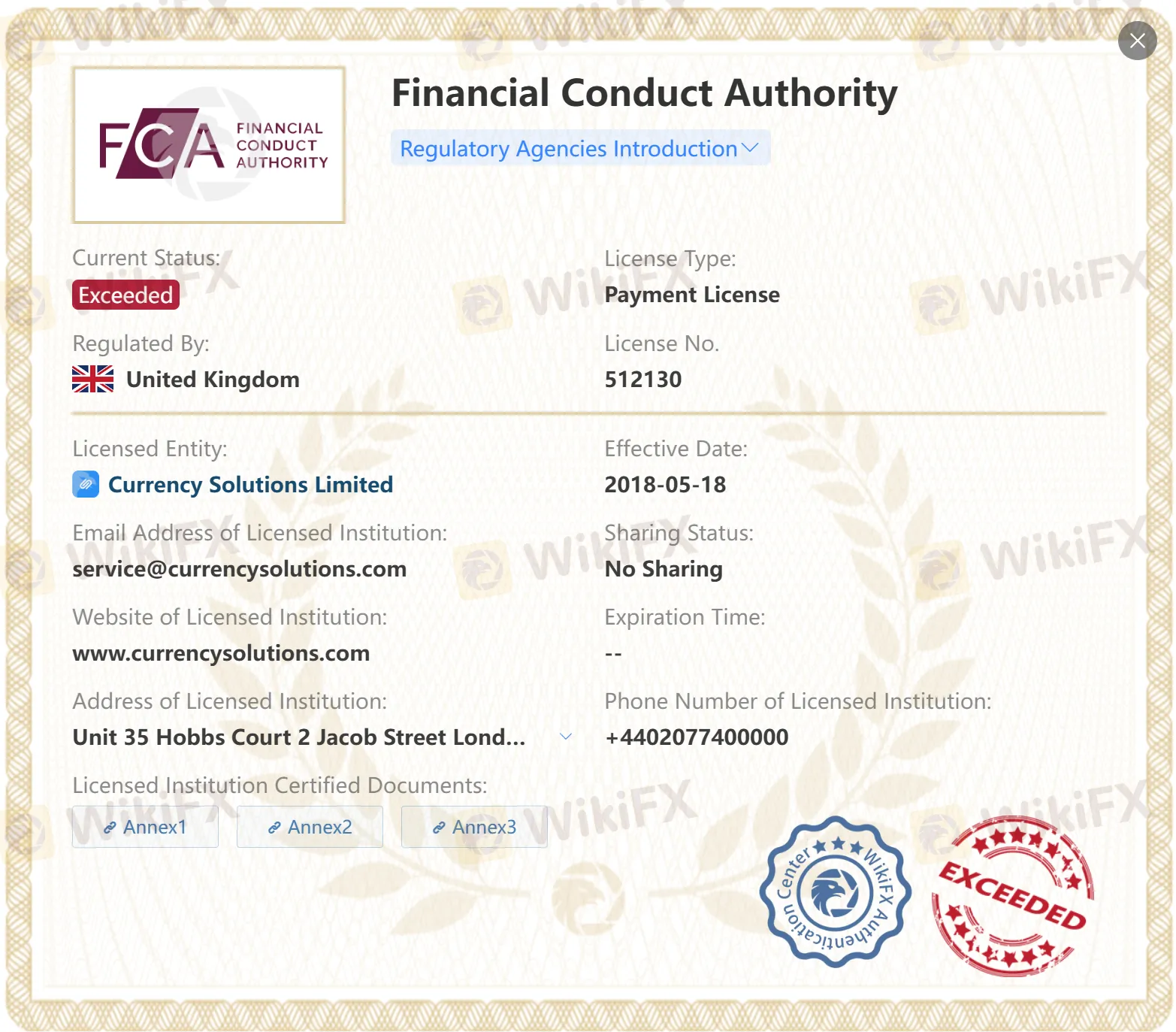

Currency Solutions 현재 FCA 아래에서 두 개의 라이선스를 보유하고 있습니다. 하나는 Straight Through Processing (STP) 라이선스로, 규제되고 있습니다. 다른 하나는 Payment License로, 초과되었습니다.

| 규제 국가 | 규제 기관 | 규제 업체 | 현재 상태 | 라이선스 유형 | 라이선스 번호 |

| 금융행정청 (FCA) | Currency Solutions 리미티드 | 규제됨 | Straight Through Processing (STP) | 602082 |

| 금융행정청 (FCA) | Currency Solutions 리미티드 | 초과됨 | Payment License | 512130 |

서비스

Currency Solutions은 170가지 이상의 통화쌍, 외환거래(FX) 및 국제 송금 서비스를 제공합니다.

입출금

Currency Solutions은 Visa 및 Mastercard 직불카드 및 은행 송금을 통한 결제 방법을 지원합니다.