Company Summary

| Currency Solutions Review Summary | |

| Founded | 2003 |

| Registered Country/Region | United Kingdom |

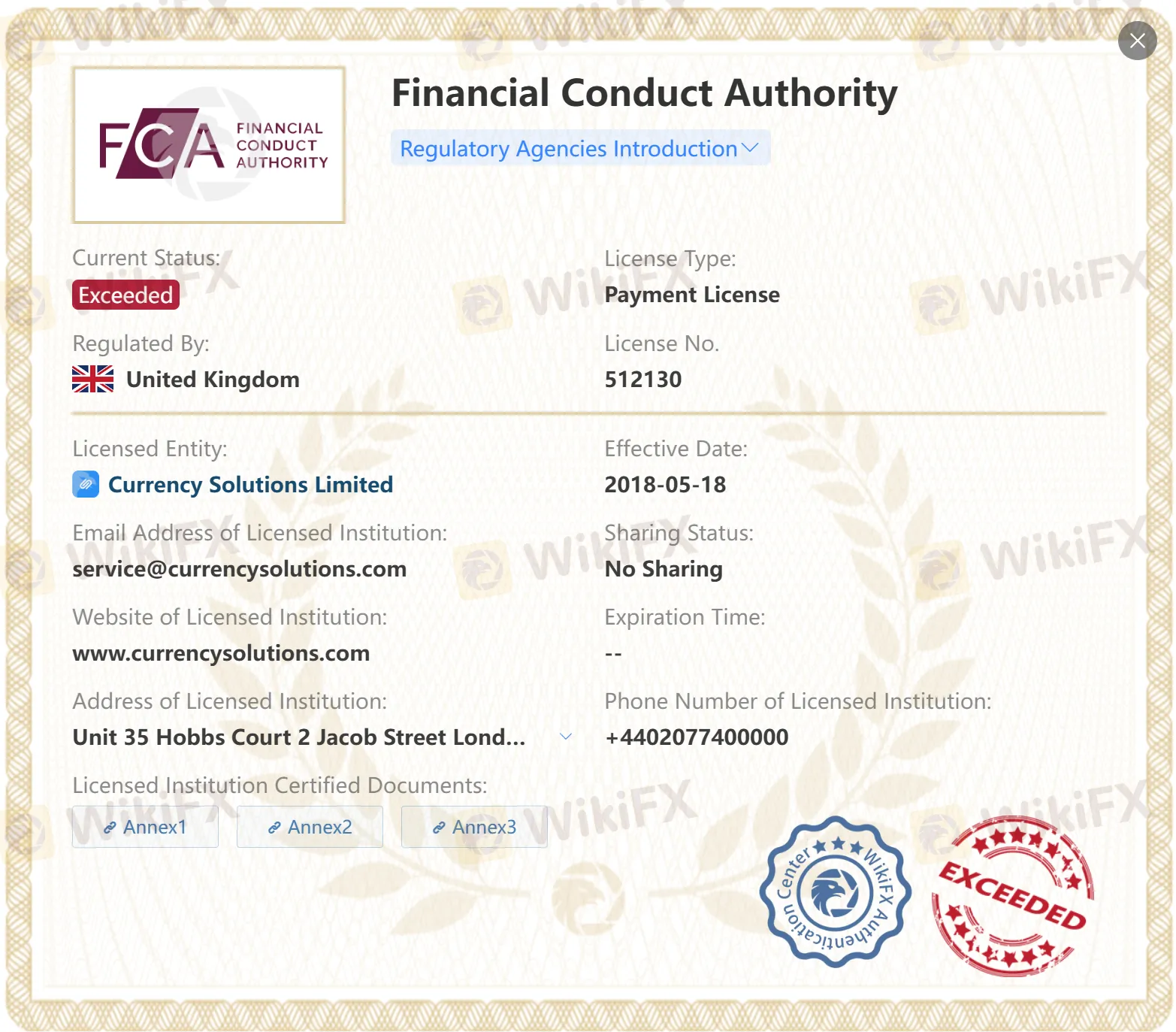

| Regulation | FCA: Straight Through Processing (STP) (regulated), Payment License (exceeded) |

| Services | Foreign exchange (FX) and international payment services |

| Demo Account | ❌ |

| Leverage | / |

| Spread | / |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Phone: +44 2077400000 |

| X, Linkedin, Instagram | |

| Address: 4th Floor Hobbs Court, 2 Jacob Street, London, SE1 2BG | |

Founded in the UK in 2003, Currency Solutions offers foreign exchange (FX) and international payment services, providing access to over 170 currency pairs. The firm is authorized and regulated by the Financial Conduct Authority (FCA) for Straight Through Processing (STP). However, their Payment License (number 512130) has been exceeded. Moreover, information regarding trading platforms, spreads, leverage, and minimum deposit is not readily available, and they do not currently offer demo accounts.

Pros and Cons

| Pros | Cons |

| Regulated by FCA | Exceeded license |

| Limited info on trading fees | |

| No demo accounts | |

| Lack of info on trading platforms |

Is Currency Solutions Legit?

Currency Solutions currently holds two licenses under the FCA. One is a Straight Through Processing (STP) license, which is regulated. The other is a Payment License, which has been exceeded.

| Regulated Country | Regulated Authority | Regulated Entity | Current Status | License Type | License Number |

| Financial Conduct Authority (FCA) | Currency Solutions Limited | Regulated | Straight Through Processing (STP) | 602082 |

| Financial Conduct Authority (FCA) | Currency Solutions Limited | Exceeded | Payment License | 512130 |

Services

Currency Solutions offers more than 170 currency pairs, foreign exchange (FX) and international payment services.

Deposit and Withdrawal

Currency Solutions supports payment methods through Visa and Mastercard debit cards, as well as bank transfer.