公司简介

| Currency Solutions 评论摘要 | |

| 成立时间 | 2003 |

| 注册国家/地区 | 英国 |

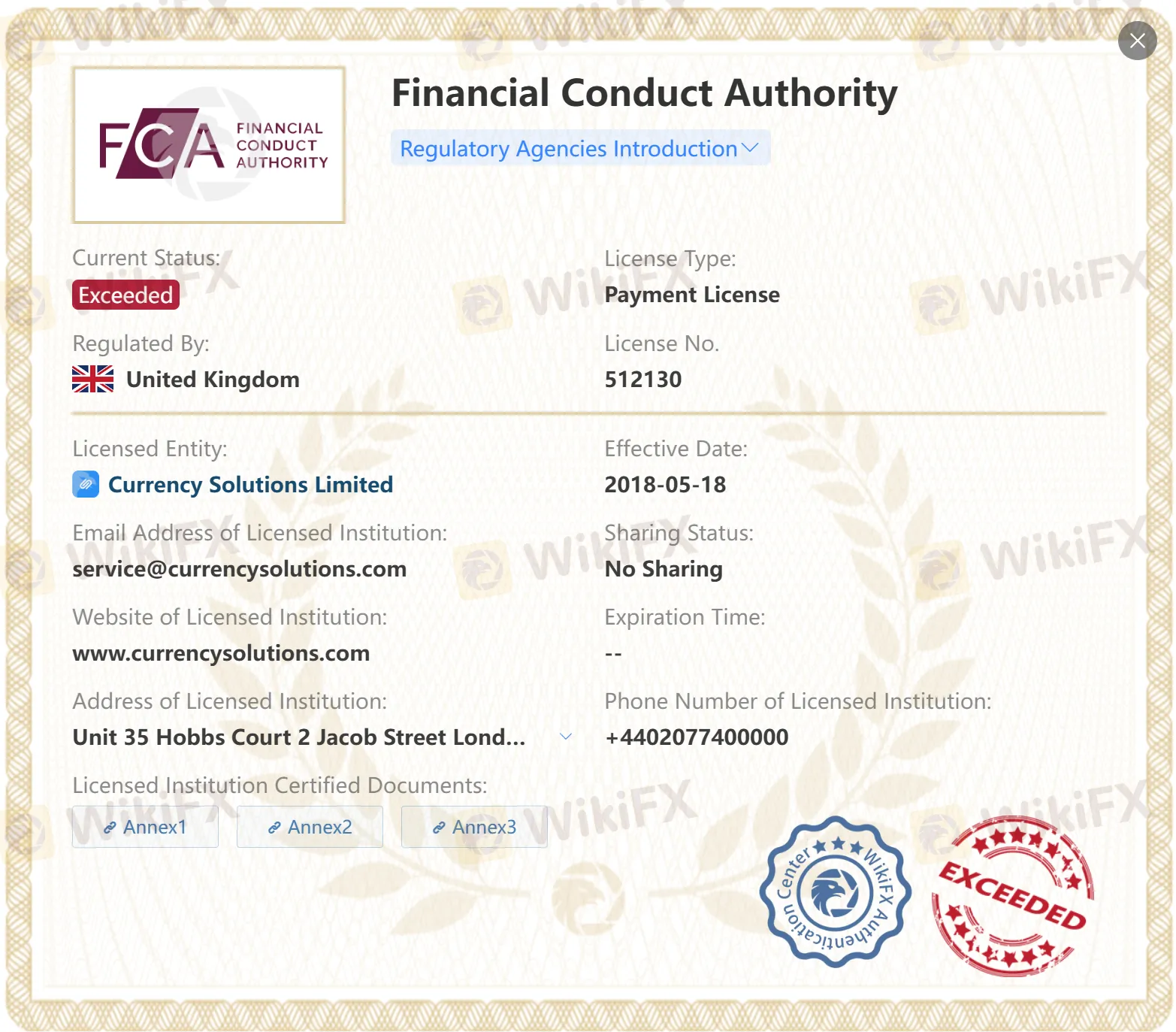

| 监管 | FCA: 直通处理(STP)(受监管),支付许可证(已超出) |

| 服务 | 外汇 交易所(FX)和国际支付服务 |

| 模拟账户 | ❌ |

| 杠杆 | / |

| 点差 | / |

| 交易平台 | / |

| 最低存款 | / |

| 客户支持 | 电话:+44 2077400000 |

| X,Linkedin,Instagram | |

| 地址:伦敦Jacob Street 2号Hobbs Court 4楼,邮编SE1 2BG | |

Currency Solutions成立于2003年,总部位于英国,提供外汇 交易所(FX)和国际支付服务,可访问超过170种货币对。该公司经授权并受英国金融市场行为监管局(FCA)监管直通处理(STP)。然而,他们的支付许可证(编号512130)已超出。此外,有关交易平台、点差、杠杆和最低存款的信息并不容易获得,目前他们也不提供模拟 账户。

优点和缺点

| 优点 | 缺点 |

| 受FCA监管 | 超出许可证 |

| 交易 手续费信息有限 | |

| 无模拟 账户 | |

| 交易平台信息缺乏 |

Currency Solutions 是否合法?

Currency Solutions目前持有FCA颁发的两个许可证。一个是直通处理(STP)许可证,受到监管。另一个是支付许可证,已超出。

| 受监管国家 | 监管机构 | 受监管实体 | 当前状态 | 许可证类型 | 许可证号码 |

| 金融行为监管局(FCA) | Currency Solutions有限公司 | 受监管 | 直通处理(STP) | 602082 |

| 金融行为监管局(FCA) | Currency Solutions有限公司 | 超出 | 支付许可证 | 512130 |

服务

Currency Solutions提供超过170种货币对、外汇(FX)和国际支付服务。

存款和取款

Currency Solutions支持通过Visa和Mastercard借记卡以及银行转账进行支付。