회사 소개

| HUNGSING 리뷰 요약 | |

| 설립 연도 | 1999 |

| 등록 국가/지역 | 홍콩 |

| 규제 | SFC (초과, 취소) |

| 서비스 | 부채 금융, 투자 상품, 자산 관리, IPO 신청 등 |

| 데모 계정 | ❌ |

| 거래 플랫폼 | 홍쉼증권 (웹 및 모바일 버전) |

| 최소 입금액 | / |

| 고객 지원 | 문의 양식 |

| 전화: (852) 3589 1623 | |

| 이메일: settlement@hungsing.org | |

| 영업 시간: 월요일부터 금요일 오전 9:00부터 오후 6:00까지 토요일, 일요일 및 공휴일 휴무 | |

| 홍콩 성완, 콘나프트로드 센트럴 200번지 선탁센터 서쪽 타워 25층 2505호 주소: | |

HUNGSING은 1999년에 설립된 홍콩에 등록된 금융 회사입니다. 부채 금융, 투자 상품, 자산 관리 및 IPO 신청과 같은 다양한 서비스를 제공합니다. 회사는 웹 및 모바일 버전에서 이용할 수 있는 홍쉼증권 플랫폼을 제공합니다. 그러나 증권 거래 라이선스는 SFC(증권 선물 위원회)에 의해 초과되었으며 선물 계약 거래 라이선스는 취소되었습니다.

장단점

| 장점 | 단점 |

| 다양한 서비스 | 초과 및 취소된 라이선스 |

| 다양한 고객 지원 채널 | 계정에 대한 정보 제한 |

| 거래 수수료에 대한 정보 제한 | |

| 데모 계정 없음 |

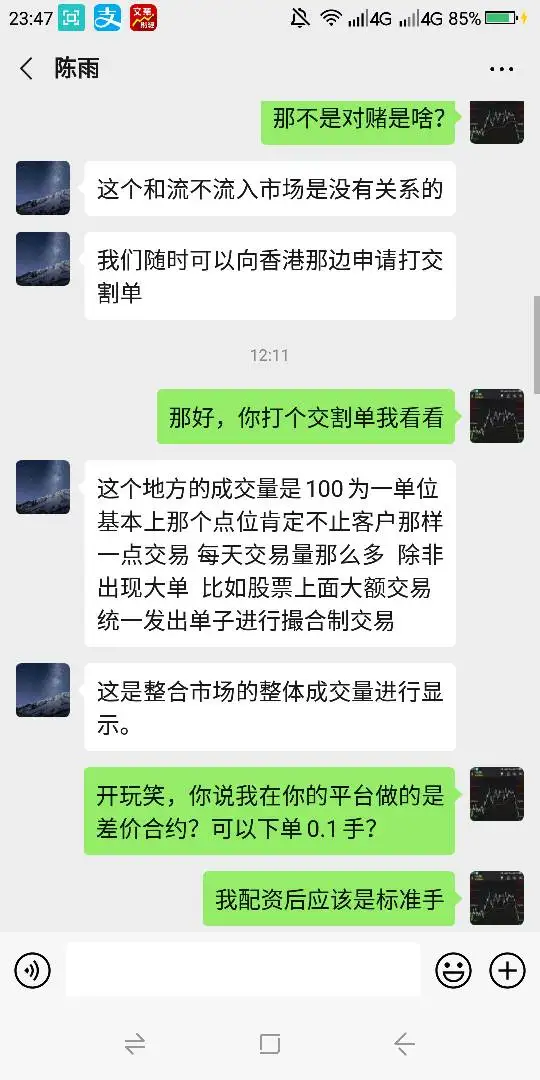

HUNGSING은 신뢰할 만한가요?

현재, HUNGSING은 증가된 라이선스만 증권 및 선물 위원회 (SFC)로부터 선물 계약 거래에 대한 라이선스를 소유하고 있습니다. 그의 증권 거래 라이선스는 취소되었습니다. 귀하께서는 다른 규제된 회사에서 서비스를 받는 것이 좋습니다.

| 규제 국가 | 규제 기관 | 규제 기관 | 현재 상태 | 라이선스 유형 | 라이선스 번호 |

| 증권 및 선물 위원회 (SFC) | 홍싱 선물 리미티드 | 취소됨 | 선물 계약 거래 | AFC168 |

| 증권 및 선물 위원회 (SFC) | 홍싱 증권 리미티드 | 초과됨 | 증권 거래 | ABS697 |

HUNGSING은 고객에게 부채 금융, 투자 상품, 자산 관리, IPO 구독 등과 같은 다양한 금융 서비스를 제공합니다.

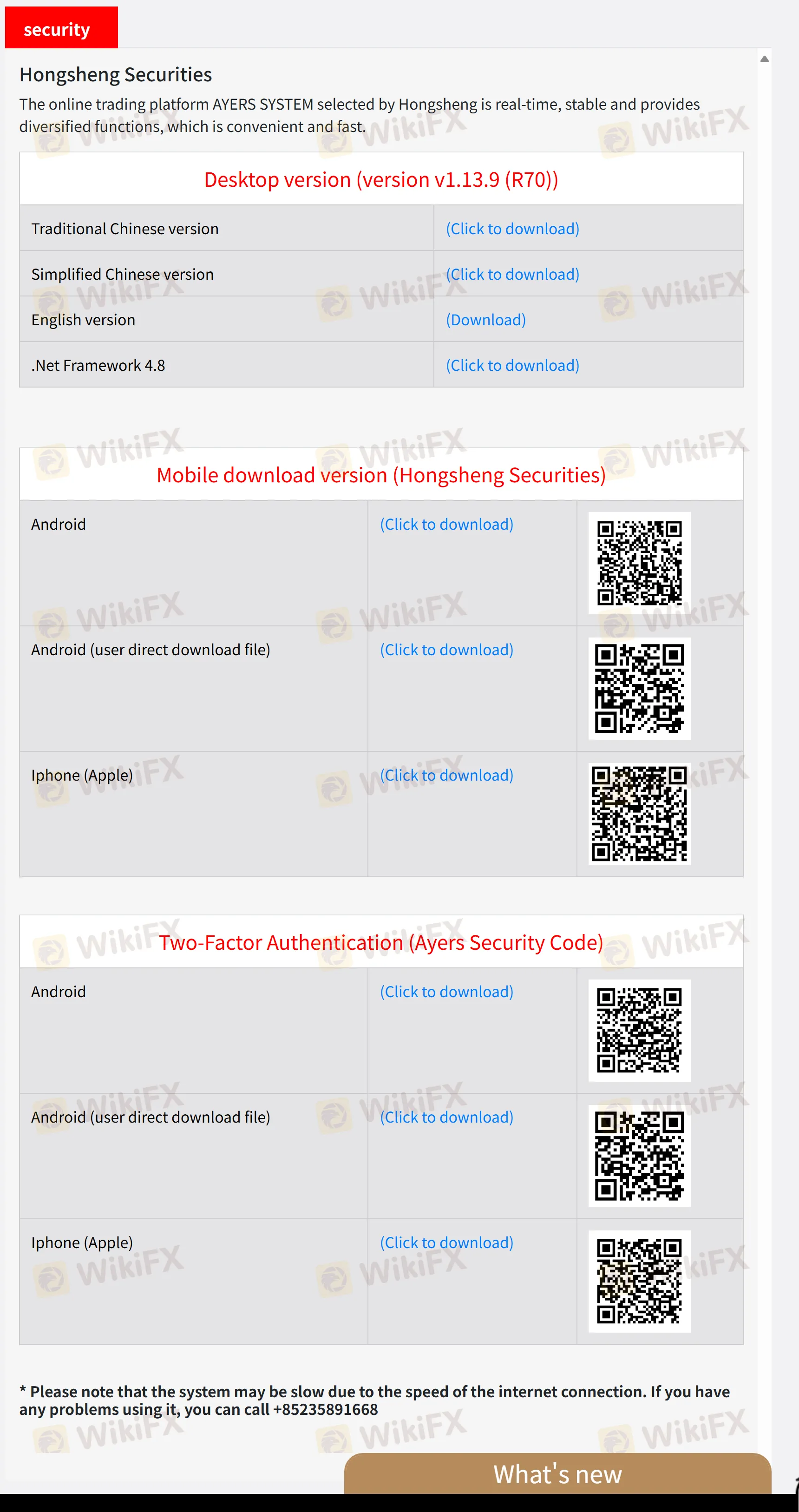

거래 플랫폼

| 거래 플랫폼 | 지원됨 | 사용 가능한 장치 |

| 홍성 증권 | ✔ | 웹, 모바일 |