公司简介

| 鸿升金融 评论摘要 | |

| 成立时间 | 1999 |

| 注册国家/地区 | 香港 |

| 监管 | SFC(超出,被吊销) |

| 服务 | 债务融资、投资产品、资产管理、IPO认购等 |

| 模拟账户 | ❌ |

| 交易平台 | 鸿盛证券(网页版和移动版) |

| 最低存款 | / |

| 客户支持 | 联系表单 |

| 电话:(852) 3589 1623 | |

| 电子邮件:settlement@hungsing.org | |

| 办公时间:周一至周五上午9:00至下午6:00周六、周日和公共假期休息 | |

| 香港上环干诺道中200号信德中心西座25楼2505室地址: | |

鸿升金融 是一家成立于1999年并注册在香港的金融公司。该公司提供各种服务:债务融资、投资产品、资产管理和IPO认购。该公司提供鸿盛证券平台,可在网页版和移动版上使用。然而,其证券交易牌照已被超出,期货合同交易牌照已被证券期货事务监察委员会(SFC)吊销。

优缺点

| 优点 | 缺点 |

| 多样化服务 | 超出和被吊销的许可证 |

| 多种客户支持渠道 | 关于账户的信息有限 |

| 关于交易手续费的信息有限 | |

| 没有模拟账户 |

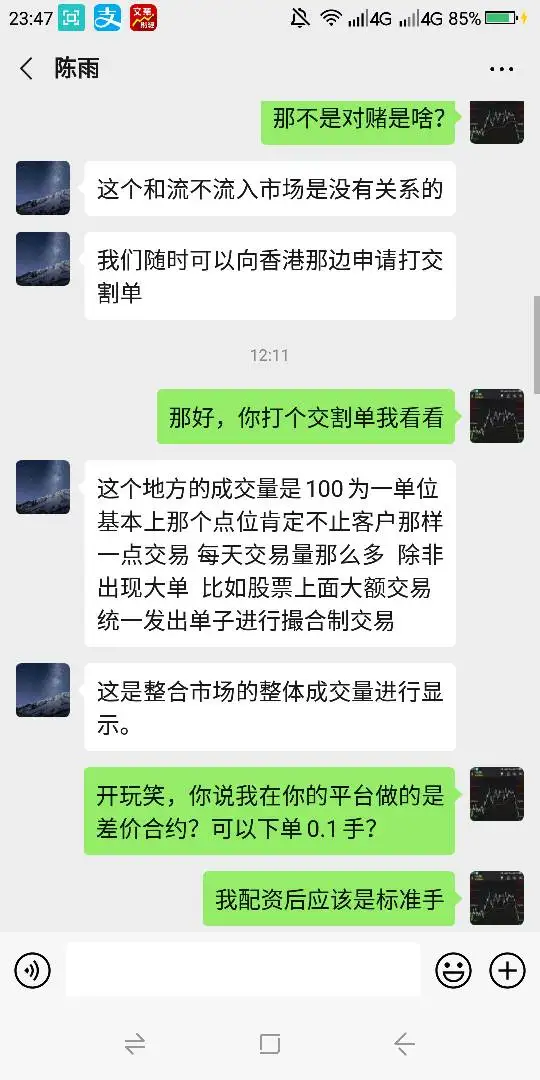

鸿升金融 是否合法?

目前,鸿升金融 仅持有证券及期货事务监察委员会(SFC)颁发的期货合约交易许可证,其证券交易许可证已被吊销。我们建议您寻求其他受监管公司的服务。

| 受监管国家 | 监管机构 | 受监管实体 | 当前状态 | 许可证类型 | 许可证号码 |

| 证券及期货事务监察委员会(SFC) | 鸿星期货有限公司 | 吊销 | 期货合约交易 | AFC168 |

| 证券及期货事务监察委员会(SFC) | 鸿星证券有限公司 | 超出 | 证券交易 | ABS697 |

鸿升金融 为客户提供多样化的金融服务,如债务融资、投资产品、资产管理、IPO认购等。

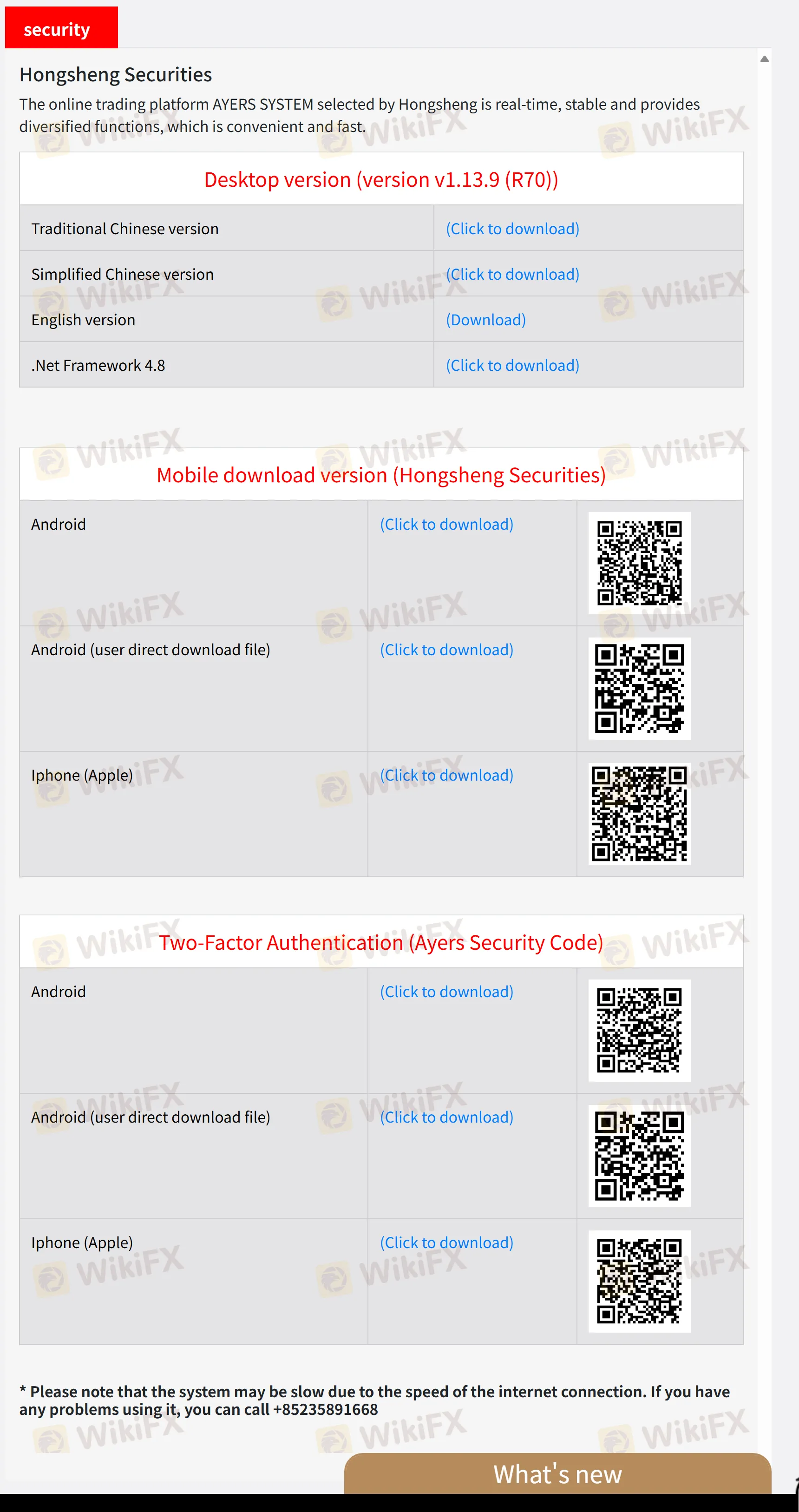

交易平台

| 交易平台 | 支持 | 可用设备 |

| 鸿盛证券 | ✔ | Web,移动设备 |