公司简介

| 方正中期期货评论摘要 | |

| 成立时间 | 2007-11-28 |

| 注册国家/地区 | 中国 |

| 监管 | 受监管 |

| 市场工具 | 农产品、商品、期货和期权 |

| 模拟 | ✅ |

| 交易平台 | Quick Period V2和V3、博易云、文华WH6等 |

| 客户支持 | 电话:010-85881183 |

| 传真:010-85881338 | |

| 400-880-2277 | |

| 95571 (4) | |

方正中期期货 信息

CIFCO期货创始人,简称CIFCO期货,提供期货交易、资产管理和财富管理等全方位服务。CIFCO期货提供丰富多样的交易工具,涵盖商品、金融期货、期权等。基于CTP的Quick Period V2和V3等多个交易平台,可以满足不同交易者的需求。

优点和缺点

| 优点 | 缺点 |

| 受监管 | 复杂的费用结构 |

| 多样的交易工具 | 高风险性质的交易(期货交易) |

| 多样的交易平台(基于CTP的Quick Period V2和V3平台) |

方正中期期货 是否合法?

是的,CIFCO期货是一家合法的期货交易公司。它受中国金融期货交易所监管,许可证号为0167。

方正中期期货 可以交易什么?

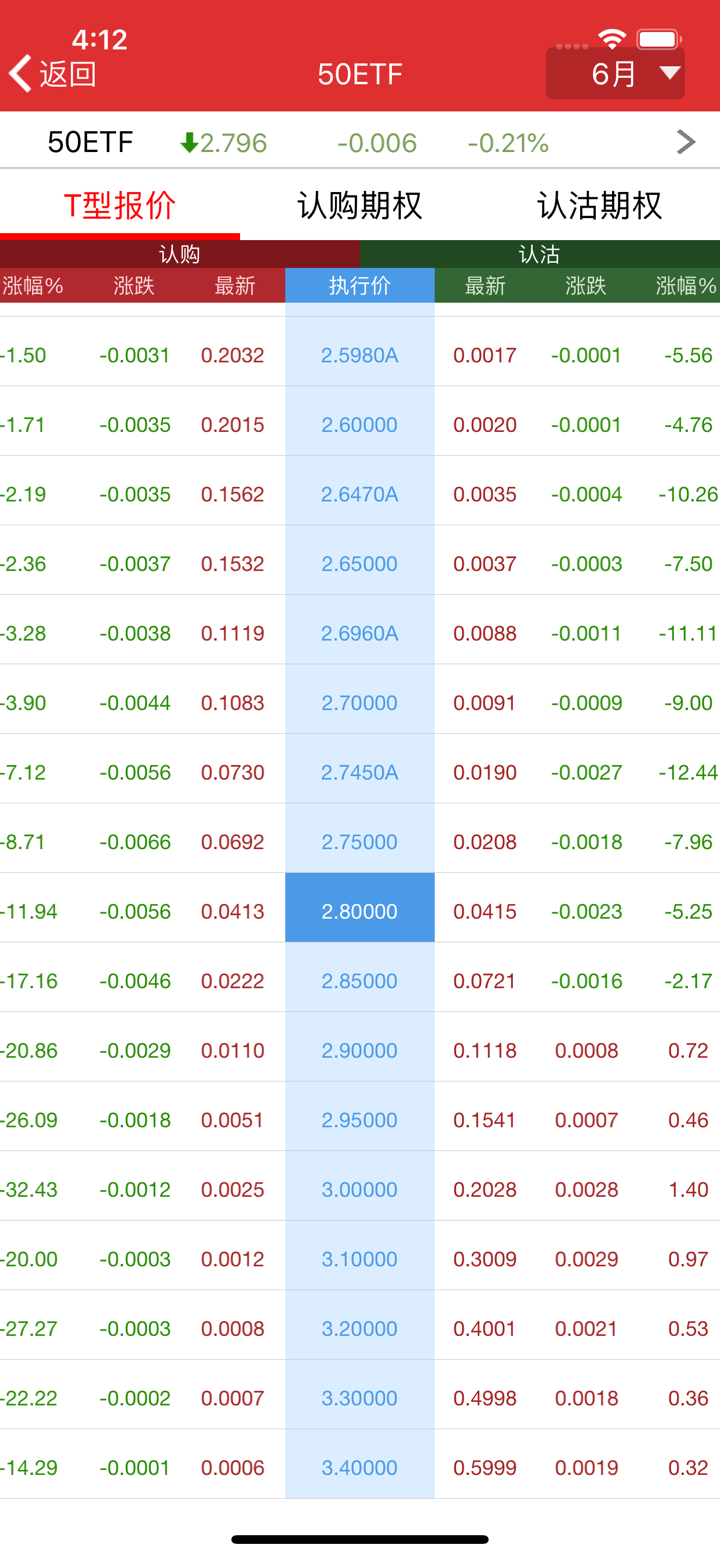

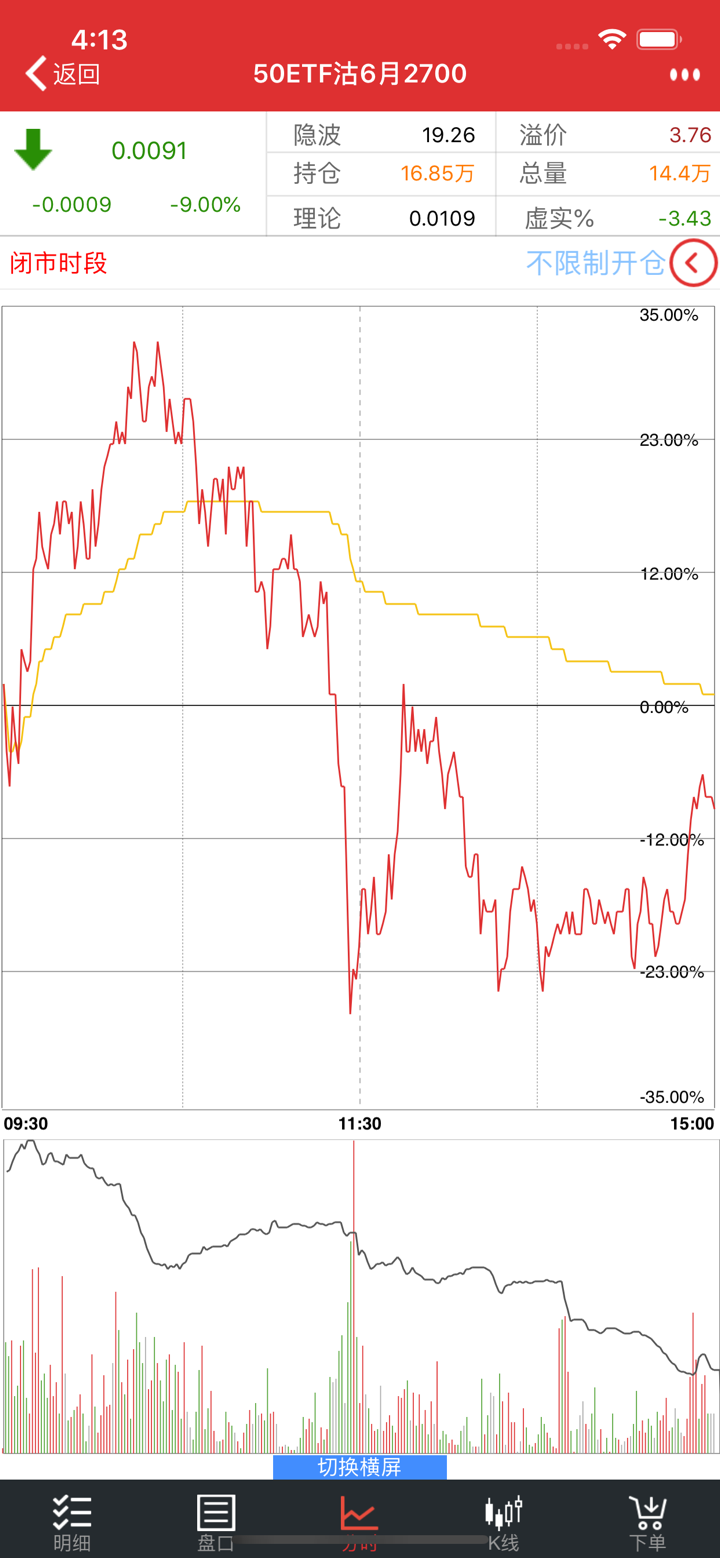

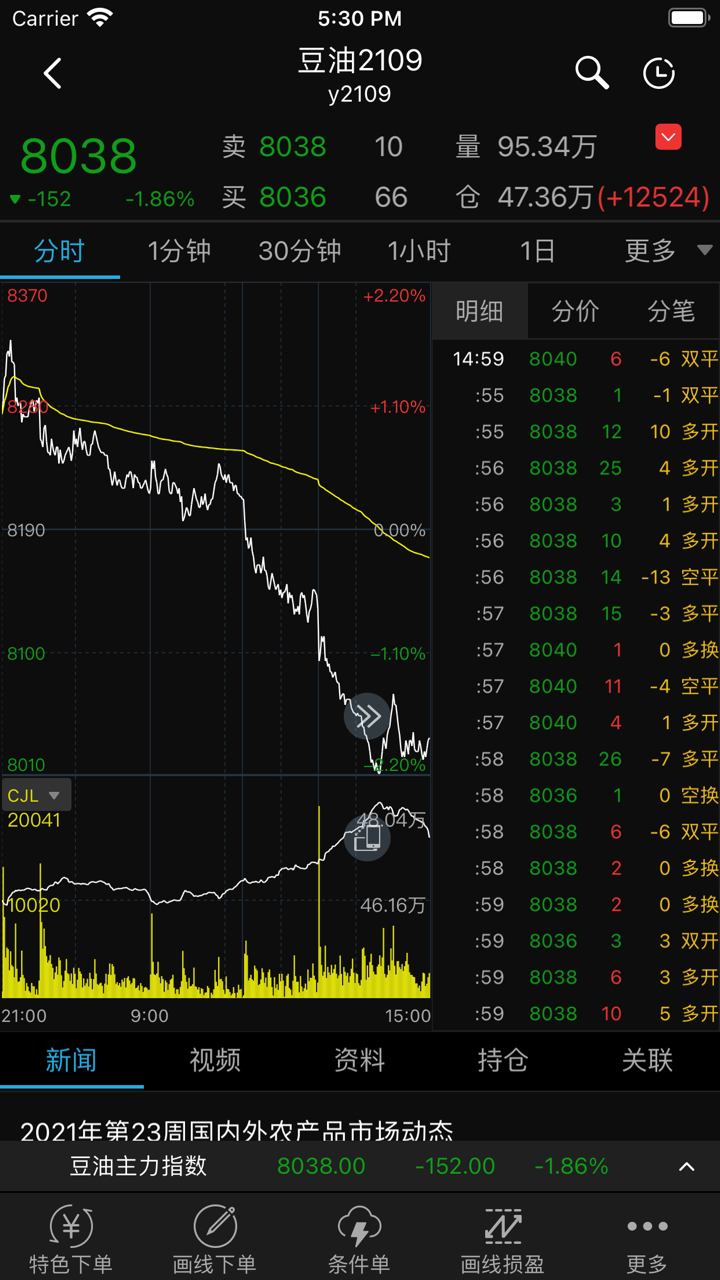

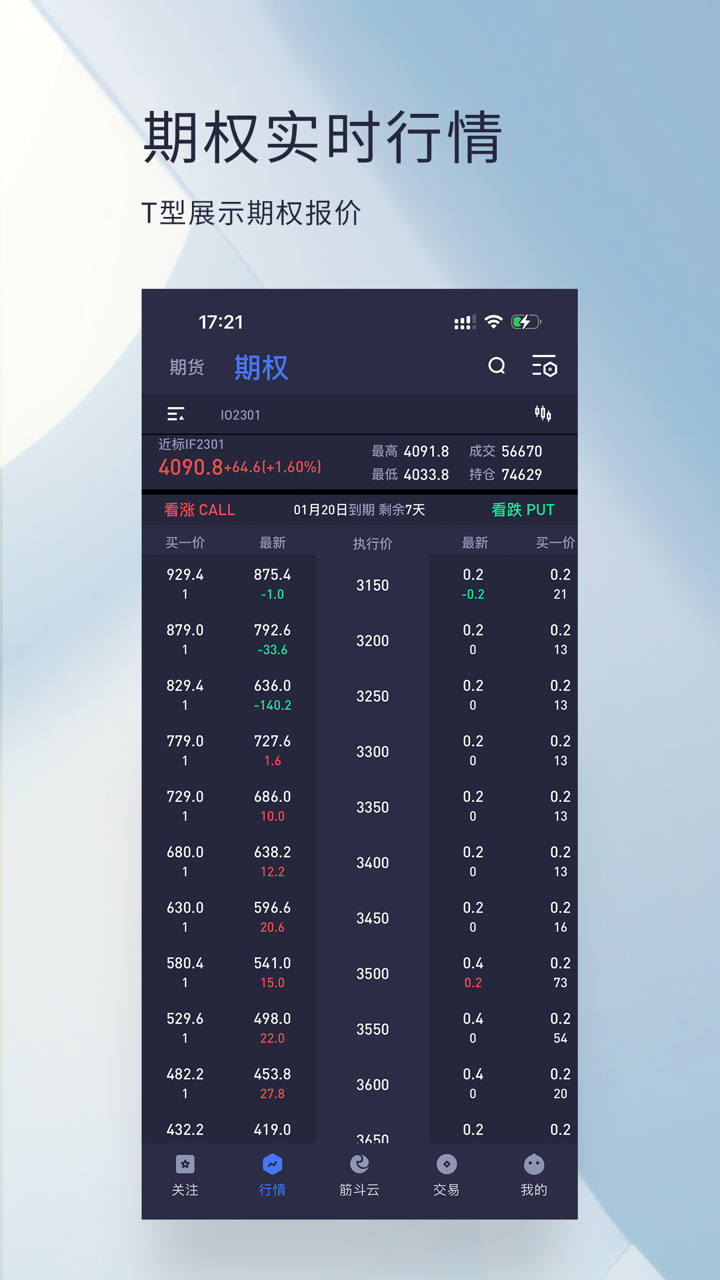

在CIFCO期货,投资者可以交易各种金融工具。这包括金属(如黄金、白银)、能源产品(如原油)和农产品(如小麦、大豆)等商品。它还提供股指期货、利率期货等金融期货。此外,还提供期权交易。

| 可交易工具 | 支持 |

| 农产品 | ✔ |

| 商品 | ✔ |

| 期货 | ✔ |

| 期权 | ✔ |

方正中期期货 费用

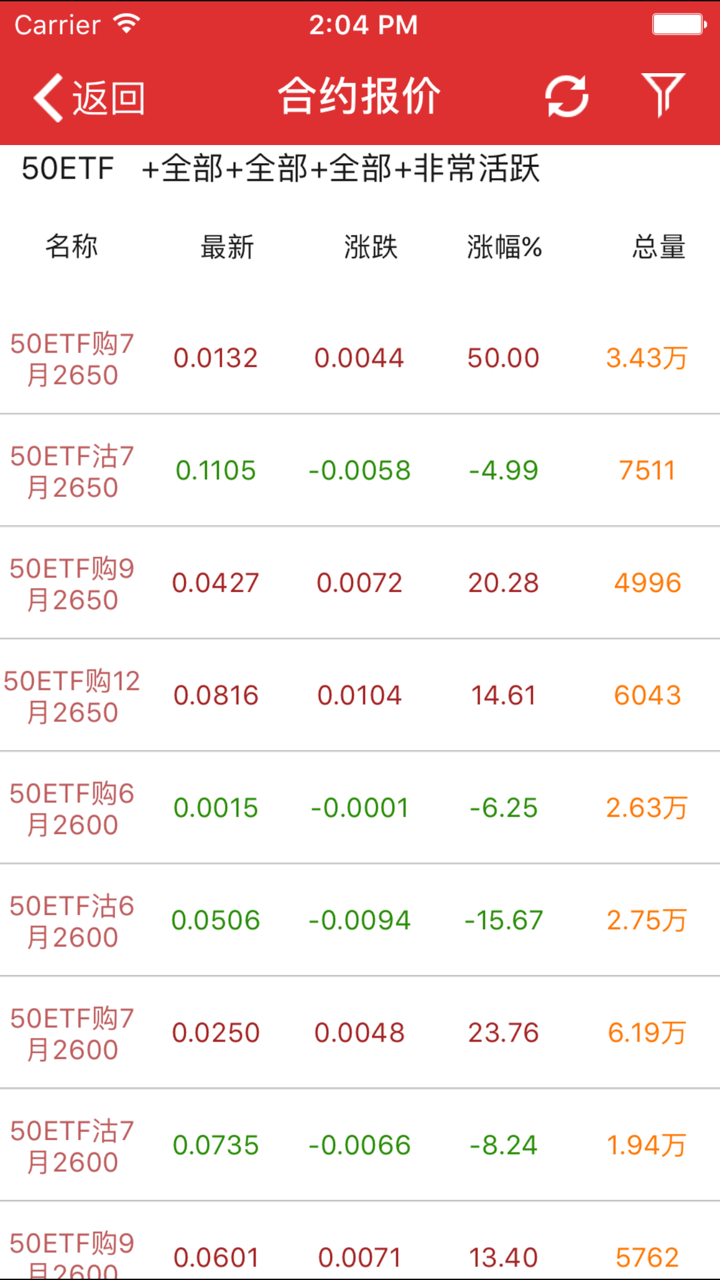

CIFCO期货的费用根据交易产品而异。例如,对于股票期权,上海和深圳证券交易所上的ETF交易费用按交易金额的0.03%收取。如果交易金额较低,则最低费用为5元。ETF期权的交易费用为每份合约10元。

交易平台

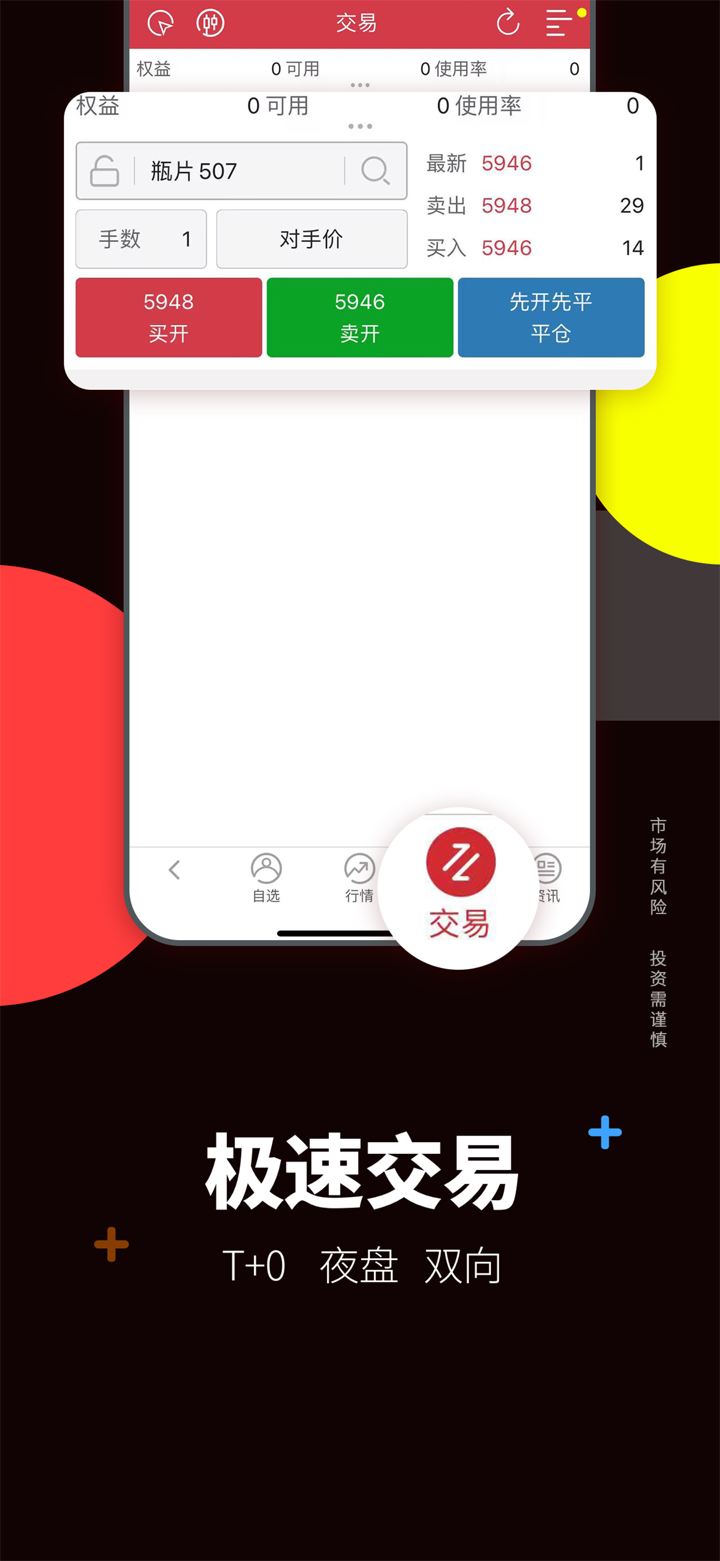

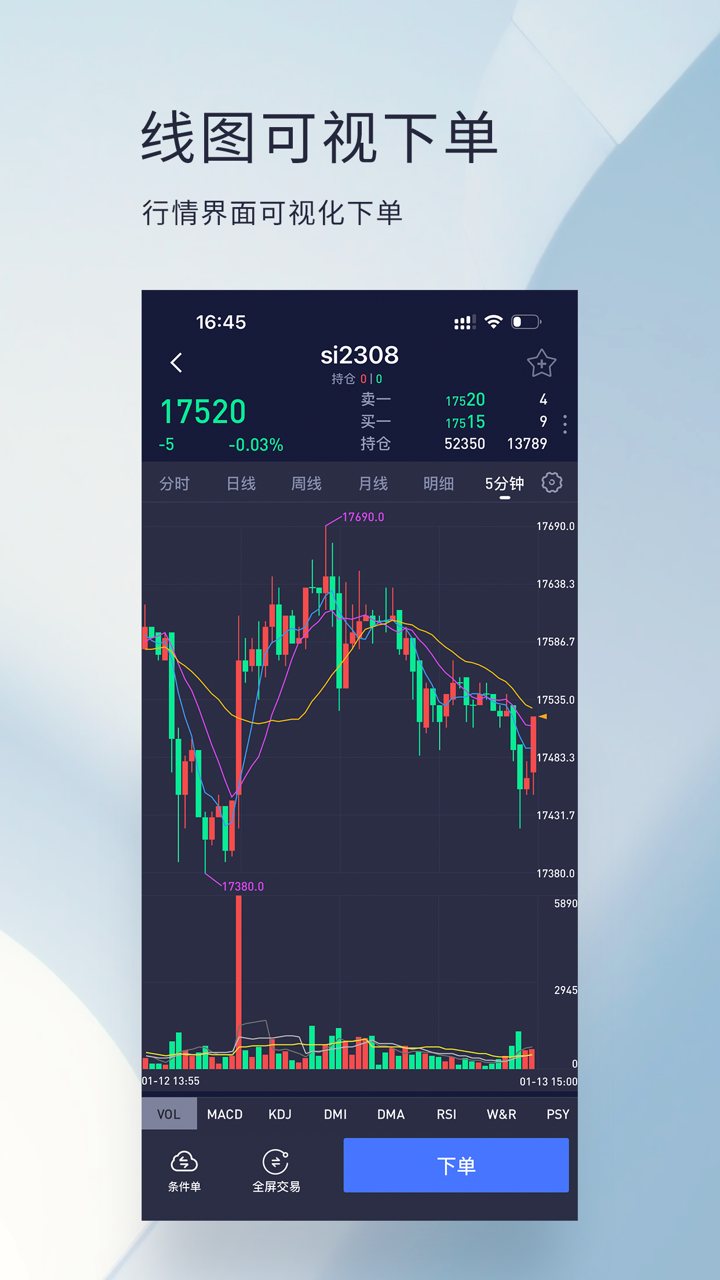

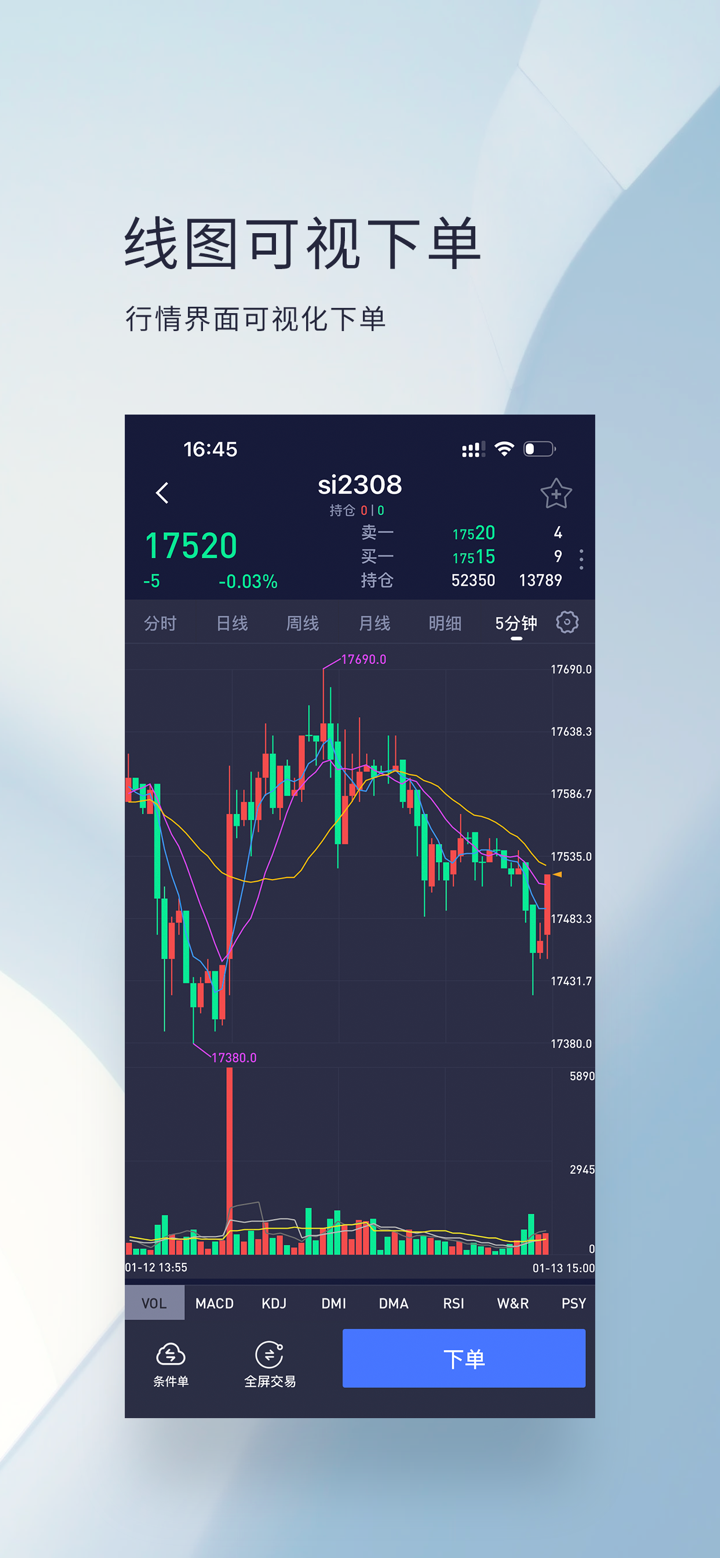

创始人CIFCO Futures提供多种交易平台。基于CTP的平台,如Quick Period V2和V3,在交易者中非常受欢迎。Quick Period V2为不同类型的交易者提供不同的下单方法,具有自定义套利、持仓滚动和大宗订单拆分等功能。Quick Period V3支持多窗口和多屏设置,并提供高级下单方法。

其他平台,如博易云,支持实时商品期权交易,并提供市场分析工具。另一方面,文华WH6具有三键下单和画线下单等功能。

存款和取款

方正中期期货的存款金额没有限制。交易者可以通过各种方式,如银行转账,将资金存入他们的账户。

白银期货转账的每日累计提款限额为500万元。每笔交易的最高金额为500万元,每日最大提款次数为5次。提款时间为交易日的9:05至15:30。